The Upside Case For Pipelines – Part 2

As we noted last week, the world doesn’t need another anodyne “2022 Outlook”. So we’ve put together a set of upside scenarios that are plausible but not consensus.

Last week we published The Upside Case For Pipelines – Part 1. This examined factors unrelated to commodity prices that could provide the sector a boost. This blog post considers what might boost oil and gas prices, which would likely provide a lift to the sector.

They fall into four categories – cyclical, geopolitical, Covid and the energy transition.

1) Cyclical factors that are bullish

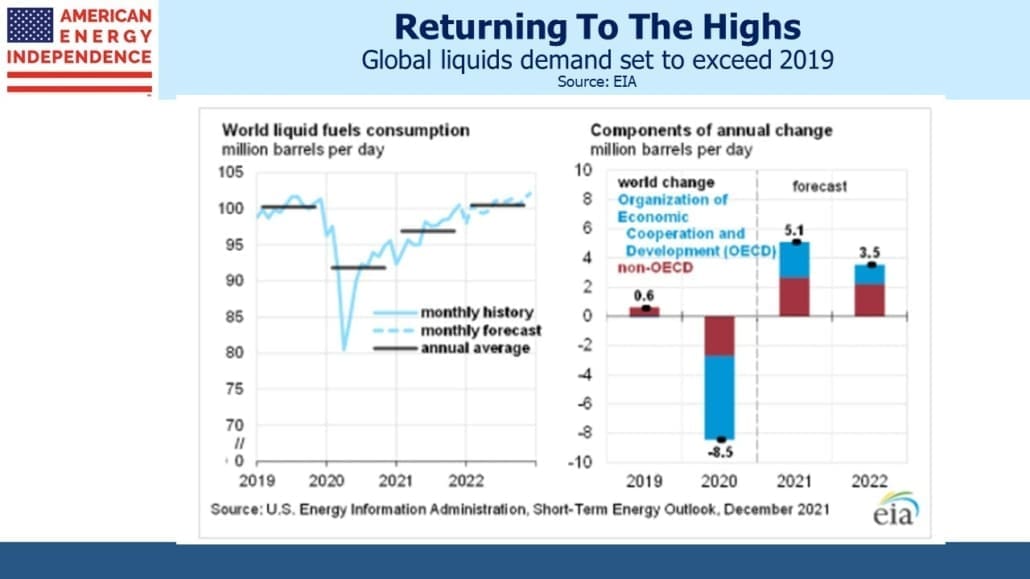

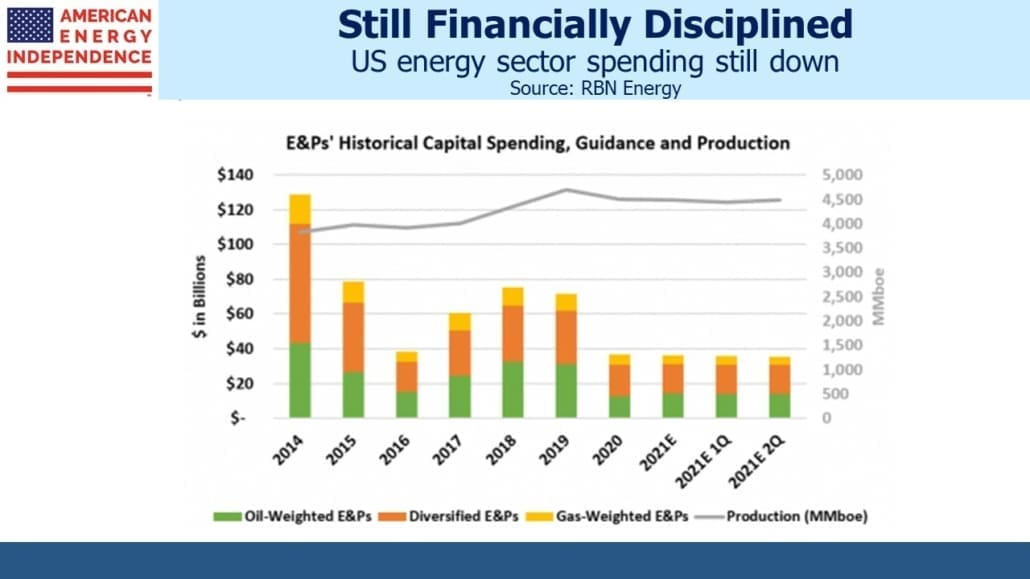

Reduced growth capex has become a positive habit for the energy industry. Depletion of oil and gas wells is 2-4% of production – meaning that the industry needs to invest in that much new supply just to stay even. Crude oil demand has obviously been volatile over the past couple of years, but looks likely to reach new record levels over the next couple of years, driven by growth in emerging economies. The industry seems poorly positioned to meet this extra demand.

Capex is down 2/3rds from its 2014 peak, and the industry shows little inclination to boost it in spite of high prices and entreaties from the Administration. RBN Energy expanded on this theme in September (see Where Has All The Capex Gone? E&P Investment Down Despite Rising Prices And Cash Flows).

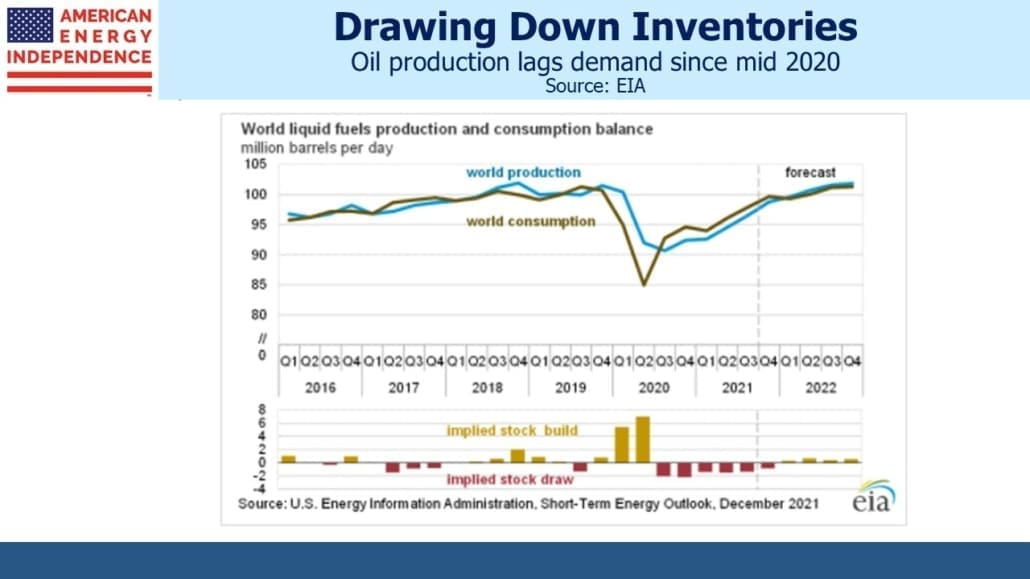

Global oil inventories have been drawing down since early last year, leaving little excess available. Moreover, OPEC countries are producing well within their stated capacity, which leads some to suspect that their actual maximum production capability is less.

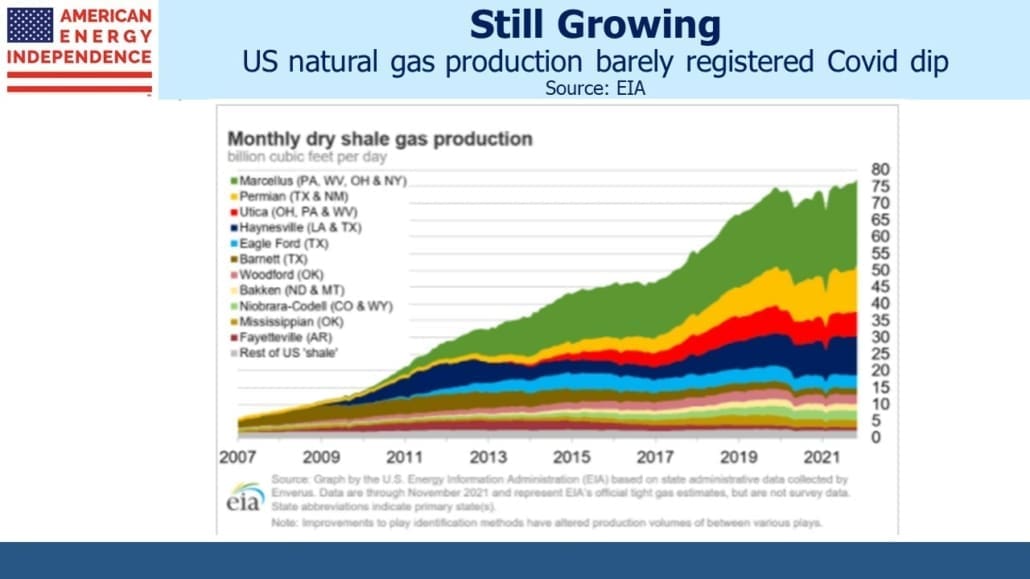

The story is similar with natural gas, except that global demand is more clearly rising. Because transportation costs are relatively high, regional prices vary substantially. TTF futures, the European natural gas futures benchmark, are priced at the equivalent of $26 per Thousand Cubic Feet (MCF) for January 2023, lower than the $29 equivalent price of the front month January 2022. US prices are one seventh of this, so the prospects for continued growth in shipments of US Liquified Natural Gas (LNG) to Europe and Asia look good.

Against this positive backdrop for prices, it’s worth remembering that oil services companies shrank payrolls in response to the drop in capex, so even if spending did ramp up it would take time for the industry to rehire and retrain.

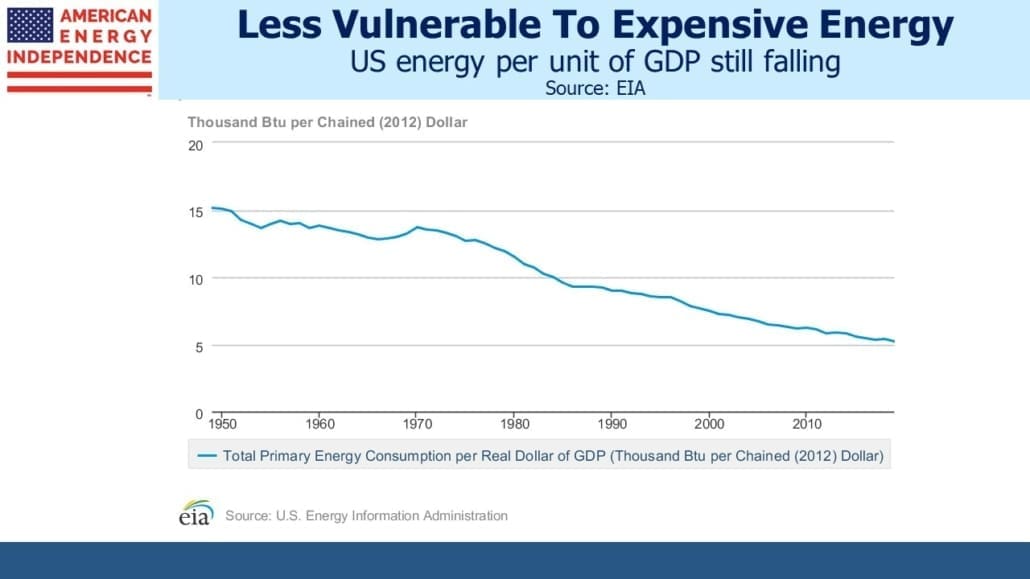

Lastly, economies around the world have been improving their energy efficiency. The US is no exception. Adjusted for inflation, it takes 60% less energy per $ of GDP output than was the case in the 1970s. Therefore, energy prices have a smaller impact on the economy today, making it better able to withstand higher energy prices than in the past.

2) Geopolitical factors that might surprise

The middle east remains one of the less stable regions of the world. A fifth of the world’s crude and an increasing amount of natural gas pass through the Strait of Hormuz. Although it’s unlikely Iran could ever cause more than a temporary disruption to supplies, the threat remains, along with the possibility of conflict breaking out elsewhere. The world has very little spare capacity, so is vulnerable to surprises here. A failure in the Iran negotiations over nuclear weapons would keep Iranian oil mostly off the world market.

Russia’s growing military threat to Ukraine is another flashpoint where armed conflict could disrupt supplies of Russian natural gas to western Europe. Nordstream 2, the controversial natural gas pipeline from Russia to Germany, is completed but not yet operational pending German and EU regulatory approval. Conflict in Ukraine might delay its start indefinitely – likely a factor behind the elevated price of January ‘23 TTF natural gas futures noted above.

3) Covid loses its ability to disrupt

The Omicron variant is highly infectious and milder than preceding variants. It is causing far fewer hospitalizations and research shows why it’s causing less severe illness (see Studies Suggest Why Omicron Is Less Severe: It Spares the Lungs).

Economic disruption from Covid has come mostly from the mitigation steps countries have taken to curb its spread. In the near term, Omicron’s fast rate of spread is likely to drive global supply disruptions in a more synchronized matter. Former FDA Commissioner Dr Scott Gottlieb has become a widely followed resource on covid, and he expects in 2022 we will “…go from a pandemic into a more endemic phase,” as countries learn to live with Covid without noticeable disruption.

As the world opens up, energy demand will increase especially in Asia where many borders have remained partially or fully closed. International air travel remains the one weak point in liquids consumption, and a rebound could push crude prices higher. We’ve already seen prices reach $80 recently without these sources of extra demand.

4) Energy transition

So far there’s little sign that renewables are reducing the world’s demand for oil, gas and coal. Higher prices for fossil fuels remain inevitable if consumers are to switch to other forms of energy. The failure of COP26 in Glasgow may lead to renewed unilateral efforts by policymakers to reduce emissions. Curbing coal remains the obvious target – consumption limits or wider use of carbon taxes would drive demand for natural gas as the closest substitute, and to a lesser extent crude oil.

New Year’s Day brought an encouraging report that the EU will classify nuclear power and, in certain cases, natural gas as “green” energy. The requirements for natural gas include that it’s being used to replace coal, and that its emissions are no higher than 270g per Kilowatt Hour (KWh). Natural gas emits 180g per KWh, so even allowing for conversion losses this ought to be an achievable benchmark.

Assuming the news report is comfirmed, EU endorsement of natural gas as part of the energy transition solution is a long term very postive development for the natural gas industry. It will likely add momentum to emerging economies and perhaps even the US to adopt a similar approach. It should be supportive of natural gas demand and correspondingly negative for coal.

The energy crisis of 2021, which exposed some countries’ overly hasty embrace of renewables, showed that traditional sources of energy are vulnerable to sudden price jumps.

Any of the factors above or some in combination could drive oil and gas prices higher, potentially much higher, which would support already improving sentiment in the energy sector.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Excellent. It’s a shame that thee facts are not obvious to the authors of the algorithms that run 70% of stock market trades.

The new EU classification of natural gas as a “green” energy source could prove to be a huge positive for pipeline companies. The first trading day of 2022 certainly suggested it.

Very good article but ”Omicron is causing far fewer hospitalizations” is not accurate. Due to it being highly contagious (more people getting it), there are more mid-serious Omicron patients needing hospital beds. “Hospitalizations are nonetheless rising in the U.S., because Omicron is so contagious that it has led to an explosion of cases.” Today’s NYTimes.

Since Omicron is so contagious, even for the vaccinated and boosted, (my brother, a vaccinated and boosted doctor, has it right now) it may cause a slowdown in economic output due to the massive amount of the population being sick, but it will be temporary. What happens if another highly contagious variant shows up in 6 months? Idk.