Looking Back on 2022

Readers know not to expect bearish views on energy from this blog. A year ago, we offered ten reasons why we thought the outlook was positive (see The Upside Case For Pipelines – Part 1 and Part 2). We were right about the direction but not all our reasons played out. Below is a report card:

1) Investors become convinced financial discipline will continue Grade: A

Growth capex has remained well contained for the most part. The two big Canadians continue to have outsized investment programs, and together make up almost half of the industry’s total even though they’re just over a quarter by market cap. They both have large business segments within Canada that enjoy highly predictable returns, and as a result both trade at a premium (EV/EBITDA) to the market. Wells Fargo expects growth capex to drop from 41% of free cash flow last year to 35% by 2027. Assuming the trend continues, the market is likely to reward the sector.

2) Pragmatism guides the energy transition Grade: B

California and parts of New England continue to pursue self-destructive policies that in effect accommodate continued emissions growth in Asia ex-Japan while enduring higher costs and less reliability. Most other regions of the US are adopting a more balanced approach. Solar and wind were 12% of US power generation in 2021, and 4.7% of total primary energy consumption. There’s much more to energy than generating electricity. The EIA expects solar and wind to reach 16% of power generation in 2023. Thanks to approaches that vary by state, the US energy transition is less disruptive than the European model.

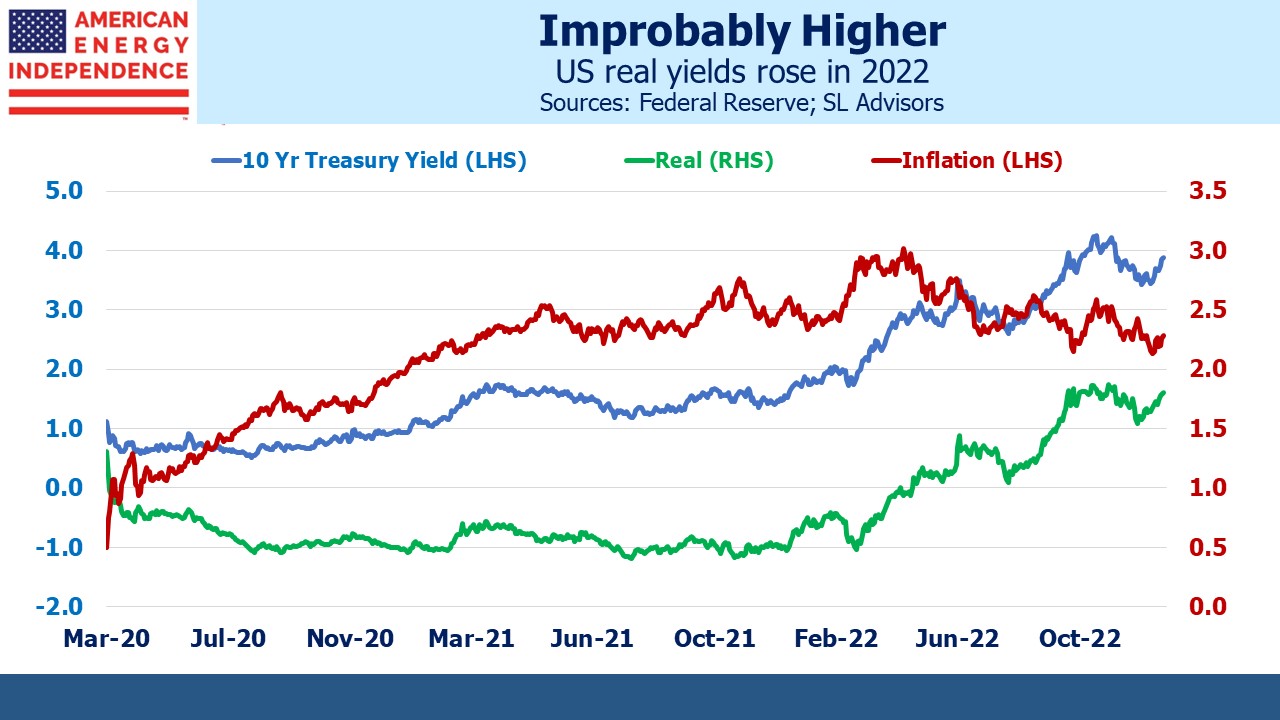

3) Real yields continue to fall Grade: F

Surprisingly (to us), real yields on ten-year treasury notes have risen by 2.5% this year, from –1% to +1.5%. We had felt negative real yields would drive more investors into income-generating assets, including midstream energy infrastructure. Tightening financial conditions were a headwind for almost all sectors, but not energy. Excessive government indebtedness is likely to limit the economy’s tolerance for high interest rates. Real yields will at some point resume their long-term decline.

4) Inflation surprises to the upside Grade: A

The Fed got this spectacularly wrong. A year ago they expected 2022 inflation, as measured by their favored Personal Consumption Expenditures (PCE) index, to run at 2.6%. They’re now at 5.6%. Private forecasters were also mostly wrong. In April JPMorgan was forecasting 2022 CPI of 5.5%, but now they’re at 7.4%. For 2023 the Fed is forecasting 3.1% (PCE) and JPMorgan 2.8% (CPI). This outcome would represent victory for the Fed. Inflation will fall, but the risk to these forecasts remains to the upside.

5) Republican mid-term gains squash any anti-energy sector legislation Grade: C

Poor candidate selection led to muted Republican gains and failure to regain control of the Senate. Regulatory reform that Joe Manchin thought he’d won in exchange for supporting the Inflation Reduction Act has still not passed. The Mountain Valley Pipeline, built but unused, would be the most tangible beneficiary but renewables advocates should recognize that construction of high voltage power lines will also suffer from the current regulatory uncertainty confronting many types of infrastructure construction. Nonetheless, Democrat policies favor energy investors by discouraging capex, thereby boosting cash flow. Hug your local climate protester and drive them to an event.

6) Sector fund flows turn positive Grade: C

Flows into midstream energy infrastructure funds were negative for the sixth straight year, albeit better than 2021 at $1.1BN through November 2022 vs $1.7BN (same period 2021) according to JPMorgan. Wells Fargo estimates 2022 buybacks at $4.8BN, so sales by retail investors are being easily absorbed by the companies themselves. 2023 buybacks are forecast at $5BN. The sector’s increasing cashflow remains a positive flow of funds story.

7) Cyclical factors that are bullish Grade: A

Goldman’s Jeff Currie believes the ESG movement is distorting the normal capex cycle of the energy sector because high commodity prices are not spurring the type of investment in new production that might otherwise be expected. The result is an extended cyclical upswing, benefiting investors if not consumers.

8) Geopolitical factors that might surprise Grade: A

World events that shock usually hurt equity markets. Energy is different, in that conflict often raises prices and makes energy security more valuable. We had no insight about Russia’s invasion of Ukraine, but US LNG exports are an unsurprising winner. For the first half of 2022 the US was the world’s biggest LNG exporter.

9) Covid loses its ability to disrupt Grade: B

The world finally moved on, except for China where rolling citywide lockdowns reduced growth and demand for oil. China’s recent pivot to dump virtually all restrictions will allow the economy to rebound.

10) Energy transition Grade: A

2022 showed the importance of “dispatchable” energy, meaning energy that’s there when you need it as opposed to when the weather permits. Western Europe didn’t scramble to buy more windmills as Russian natural gas flows petered out. They bought more LNG, especially from the US, and consumed more coal. Policymakers are increasingly accepting that solar panels and windmills aren’t the complete solution. Moreover, traditional energy companies are turning out to be vital to reducing greenhouse gas emissions. The Inflation Reduction Act has boosted investment in carbon capture projects. NextDecade is signing contracts to export LNG for which emissions generated during processing have been captured. The energy transition has gone from threatening the energy sector to providing opportunities.

Midstream energy infrastructure had a great year in spite of a few misses on our report card. Fundamentals that were good a year ago remain so. With free cash flow almost 2X dividends, buybacks increasing, and capex still constrained, 5-6% yields still look appealing.

We have three funds that seek to profit from this environment: