Inflation vs Regional Bank Crisis

This Friday’s inflation update will include the monthly Personal Consumption Expenditures (PCE) deflator and the Q1 Employment Cost Index (ECI). The Fed prefers the PCE because its weights are dynamic. When apples rise in price relative to oranges, CPI assumes no change in behavior, whereas some substitution towards oranges is to be expected. PCE picks this up.

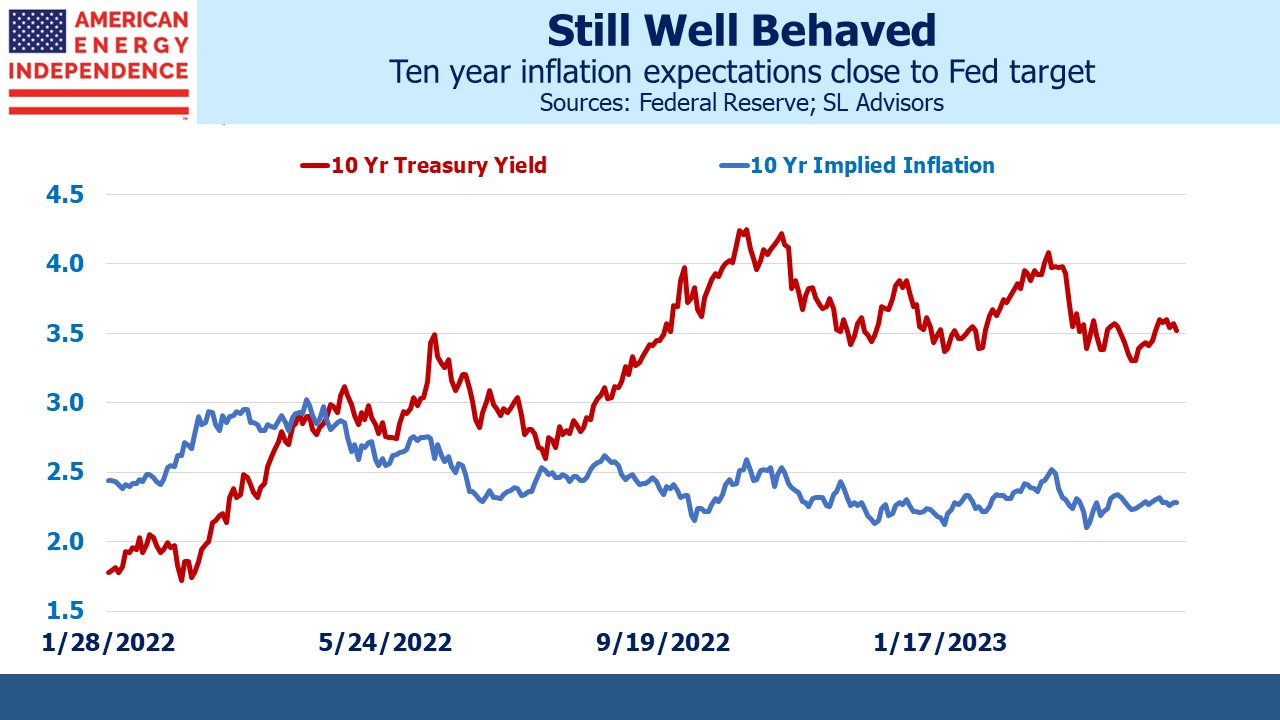

Long term inflation expectations are remarkably low. The difference between treasury yields and TIPs is one measure of what investors expect consumer prices to do. By this measure, 2.3% inflation over the next decade is the market forecast. Since the next twelve months will be higher, expected inflation for the subsequent nine years is close to 2%. This is based on the CPI, since that’s the underlying index for TIPs. Since PCE inflation typically runs 0.2-0.3% below CPI, the Fed could declare victory anytime by noting benign expectations.

A few months ago (see Can Pay Raises Keep Up With Inflation?) we pondered the seasonal adjustment factors to the ECI. Most workers get annual pay raises around year-end. The seasonal adjustment factors will already pick this up. However, elevated inflation means higher annual raises than normal, so the seasonal adjustment factors may be inadequate.

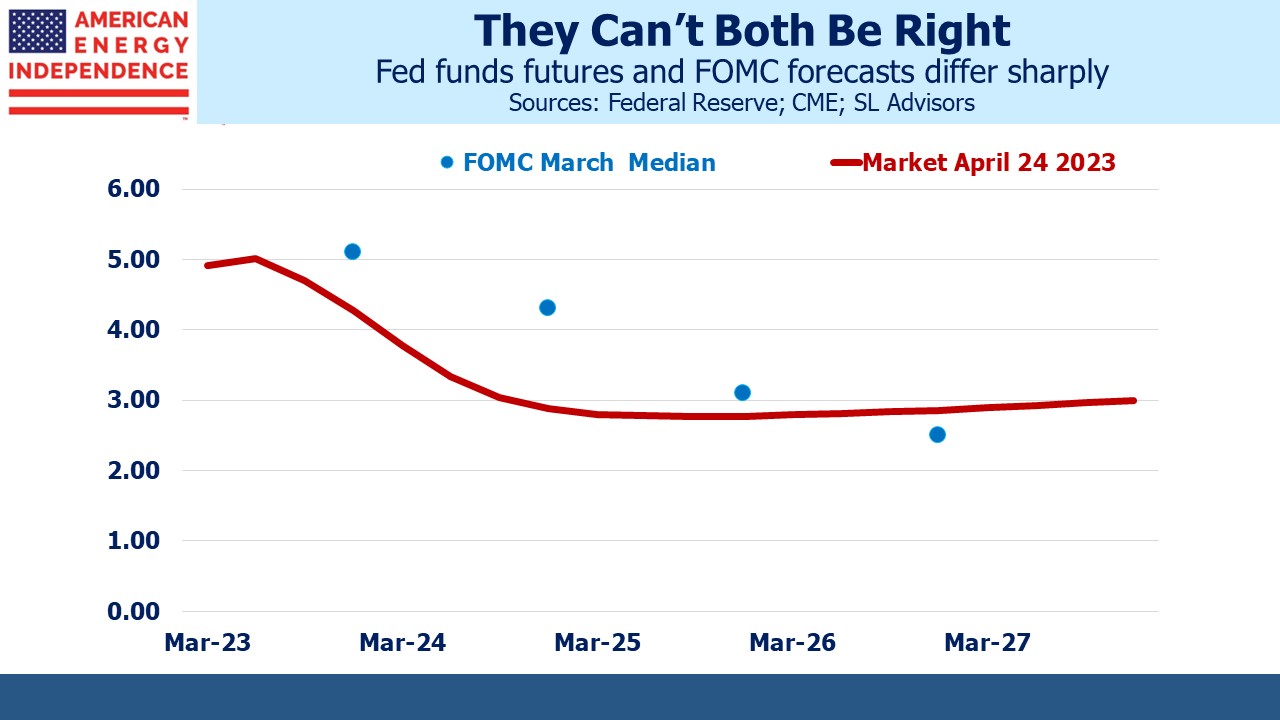

JPMorgan is forecasting 1.1% for the Q1 ECI, up slightly from Q4 which was 1.0% after three successive declines. Interest rate futures continue to forecast that the Fed will be cutting rates by the end of the summer. The FOMC projection materials envisage a Fed Funds rate 1% higher than the market by the end of next year. Current market pricing is inadequate for a disappointment on inflation.

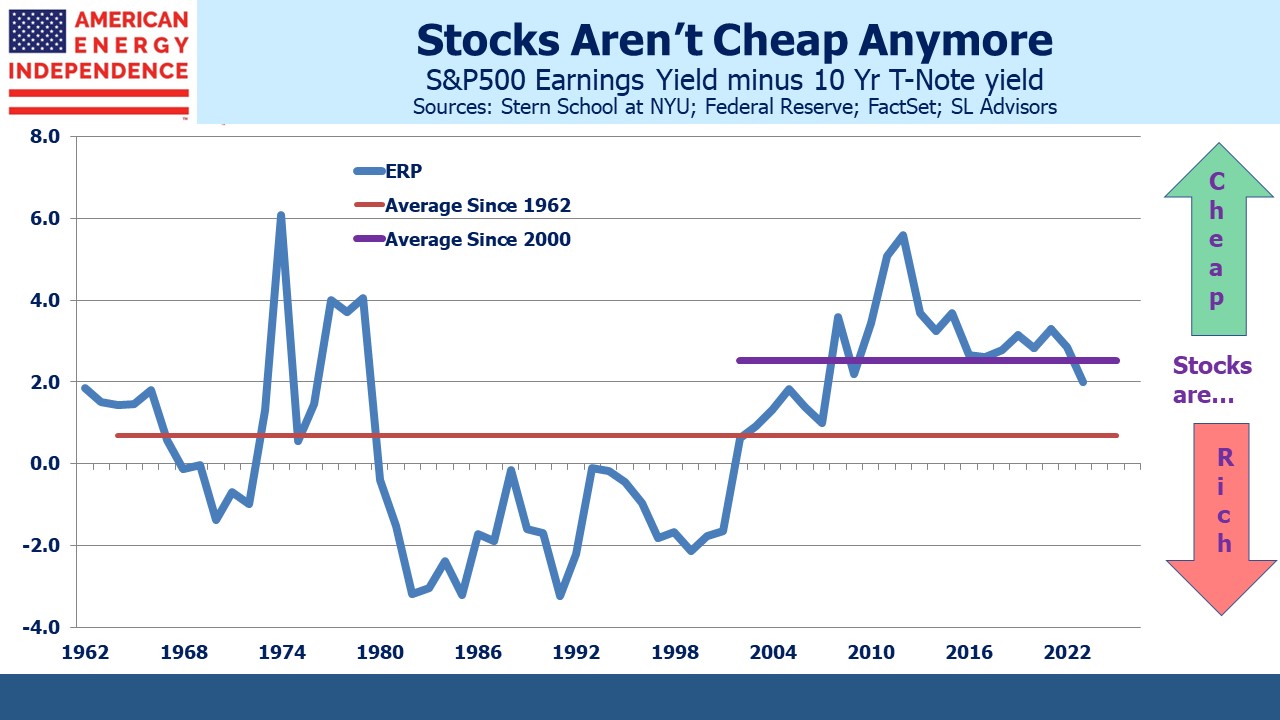

The Equity Risk Premium (ERP), defined here as the 2023 earnings yield minus ten year treasuries, sits below its 20+ year average. This measure shows stocks to be expensive. They’d need to drop at least 10% to put the ERP at neutral. This leaves the market vulnerable to higher yields.

Alternatively, the ERP could move higher to its long run average by yields falling. The ten year treasury would need to drop to 2.9%. Yields have been implausibly low for many years, so they could fall further. It’s not a bet we’d make.

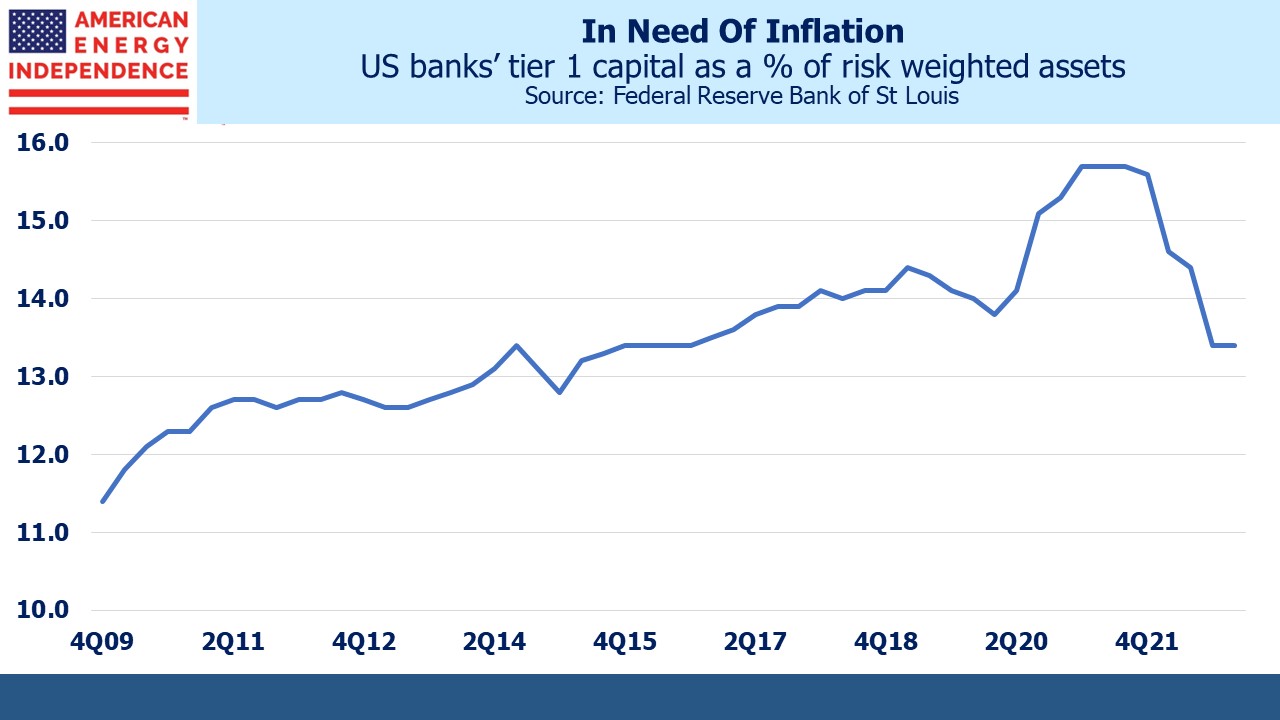

The regional banking crisis and Silicon Valley Bank’s abrupt collapse caused a sharp revision in the rate outlook. Having worked in banking for much of my career, I can well imagine the anticipation of regulatory scrutiny that will cause all but the biggest (ie systemically important) banks to review their interest rate risk and reliance on large, non-FDIC guaranteed deposits. Simply the knowledge that interest rate risk will draw more questions than in the past will make many banks more cautious about extending fixed rate loans.

The sharp drop in Tier 1 capital as a percent of risk-weighted assets is another consideration that is likely to cause tighter terms on new exposure.

There are also signs that depositors are not being quite so tolerant of banks underpaying on deposits.

First Republic is the latest bank having to issue reassurances that they have ample liquidity – once you have to respond to such fears it’s usually too late.

The market expects banks’ reduced risk appetites and competition for deposits to hurt the economy. The Fed believes the broader economic risks are minor. Such differences are usually resolved at the costs of the FOMC’s forecasting reputation, but that already looks fully priced in to the futures market.

Bonds had begun to offer at least a modest return, but the recent drop in long term yields is moving the asset class closer to the returnless risk state that has prevailed for years.

Stocks aren’t cheap vs bonds, and while that implies fixed income is attractive, the Fed still owns $8TN of government debt from Quantitative Easing, so is distorting yields.

Behavioral finance teaches that investors often make mistakes due to overconfidence. It’s a human trait, and one more common in men than women I regret to say, that opinions about how many jellybeans are in a jar, sports outcomes and the year-end level of the stock market are held with greater conviction than they should be. Humility around one’s market forecast would seem especially important during current circumstances.

Earnings season is upon us, and we expect that it will reaffirm the solid position of midstream energy infrastructure companies. With dividend yields of 5%+, two times covered by free cash flow, improving leverage of 3.5X Debt:EBITDA and still low growth capex for most names, the prospects for this sector look more assured than for many others.

We have three funds that seek to profit from this environment: