Chesapeake and Southwestern Are Betting On Higher US NatGas

Chesapeake (CHK) and Southwestern (SWN) are the latest energy companies to be contemplating a merger. Chesapeake was founded by Aubrey McLendon, whose belief in higher natural gas prices combined with his ample risk appetite led the company into financial difficulties during a period of low prices. In 2016 he was indicted by a federal grand jury on charges of conspiring “to rig bids on oil and natural gas leases”. The following day McLendon died alone in a fiery car crash. Chesapeake ultimately filed for bankruptcy in 2020 and emerged with reduced debt the following year.

The US natural gas story is about growing LNG exports. By combining, CHK and SWN would be America’s biggest natgas producer.

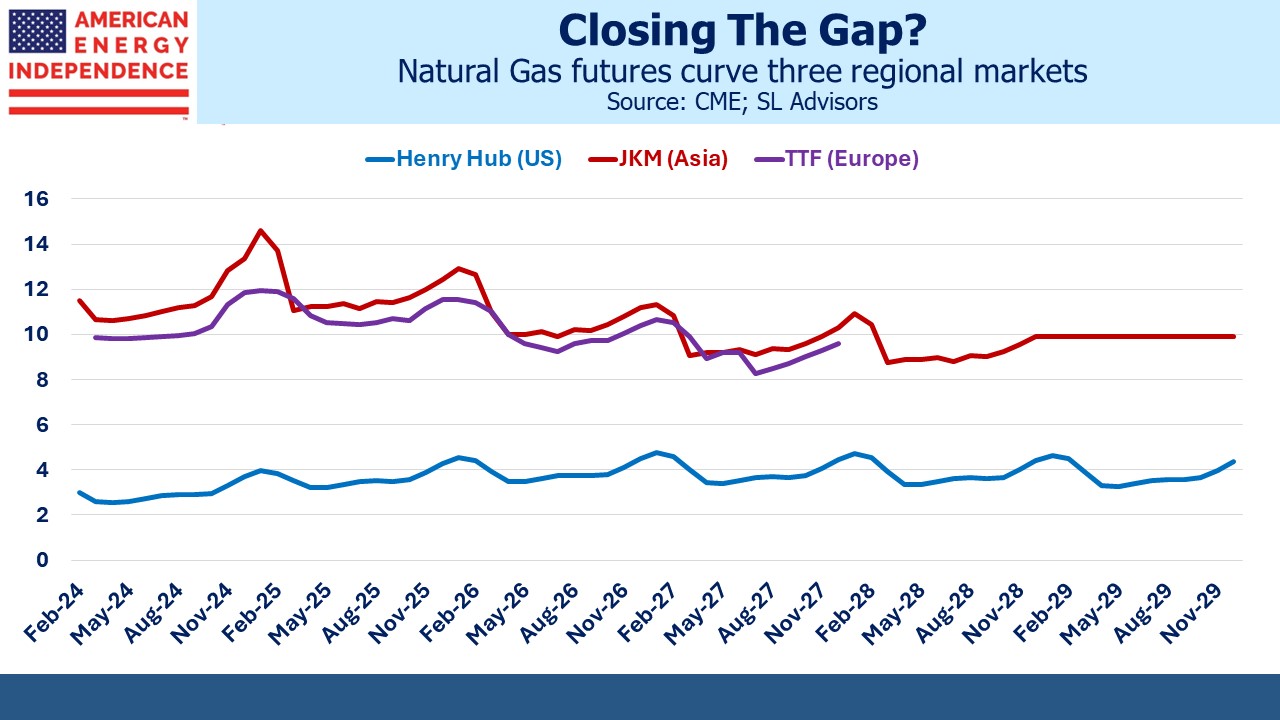

The opportunity can be seen in the futures curves for three regional benchmarks. Because natural gas is difficult and expensive to transport across the ocean, huge price discrepancies can persist for years until liquefaction and regassification infrastructure can be built in the appropriate places to allow for increased trade.

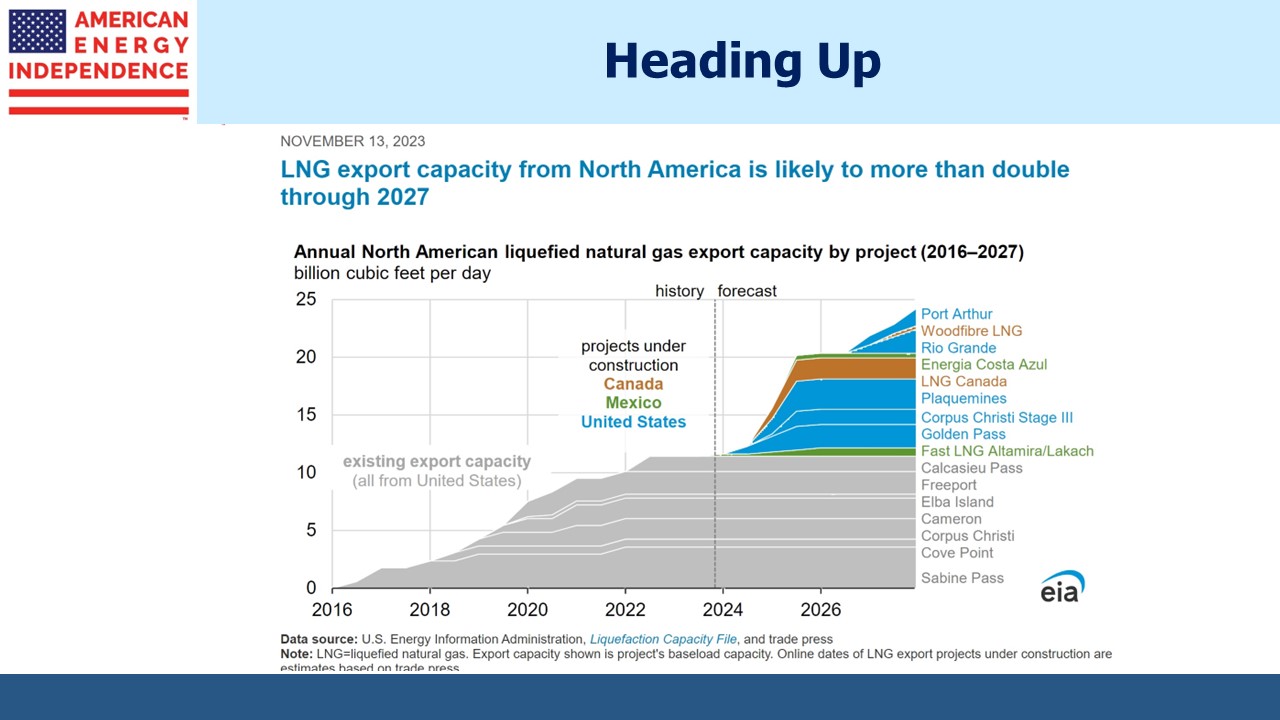

US natgas is very cheap, at under $3 per Million BTUs (MMBTUs). 13 Billion Cubic Feet per Day (BCF/D) is our export capacity, because that’s how much can be chilled and loaded onto specialized LNG tankers. But the discrepancy is so wide that it’s driving the construction of additional capacity.

The US Energy Information Administration (EIA) expects North American LNG export capacity to double by 2027. Given the several years construction takes, this is more than simply an economic forecast. Many projects have already reached Final Investment Decision (FID), meaning financing is lined up and they will be built. By adding in probable projects to those that have already reached FID, Wells Fargo sees 17 BCF/D of new US capacity by 2027 and 24 BCF/D by 2030, for 38 BCF/D of total US export capacity.

Perhaps the most tangible and certainly the most spectacular ESG disaster is Germany’s now shredded belief that they could rely on Russian gas while they transitioned to windpower. The WSJ quoted Bill Ackman thus: “Well-intentioned movements like ESG can have catastrophic consequences for the world. Europe’s loss of energy independence was a contributing factor in Putin having the confidence to invade Ukraine.”

The bet that a CHK/SWN tie-up is making is that the price differential between US natgas and other regional benchmarks will narrow. Asia has represented around 70% of global LNG trade in recent years. But Europe is becoming a bigger player, thanks to a misguided reliance on Russian gas and overly optimistic assumptions on renewables. European and Asian prices are $10-15 per MMBTUs higher than US, It costs around $2 per MMBTU to ship LNG from the US to Asia. Add in a $3 fee charged for liquefaction, and that still leaves a substantial price difference to support increased global trade.

The long term price curves for natgas futures suggest that increasing US LNG exports won’t be that impactful. This seems wrong. If US exports reach 25% or more of domestic production by 2030, as seems likely, domestic prices will rise. The market is not pricing in any narrowing of the differentials between the Asian/European benchmarks which are where the buyers are, and the US which is bringing more availability online.

Some may doubt Europe’s long term appetite for natural gas. It is the region most committed to reducing CO2 emissions, although much of their recent success on this has come from ruinously high energy prices forcing industrial output lower. German companies are relocating manufacturing out of Europe, including to the US.

But European energy companies aren’t behaving as if global LNG gas demand will disappear. Shell recently signed a twenty year contract to buy Canadian-sourced LNG from a new export facility in British Columbia. The Ksi Lisims project isn’t expected to be operational until 2030. And while Asia is geographically the obvious destination for these exports, if the European premium sustains it won’t be hard for Shell to redirect their purchased LNG to other buyers.

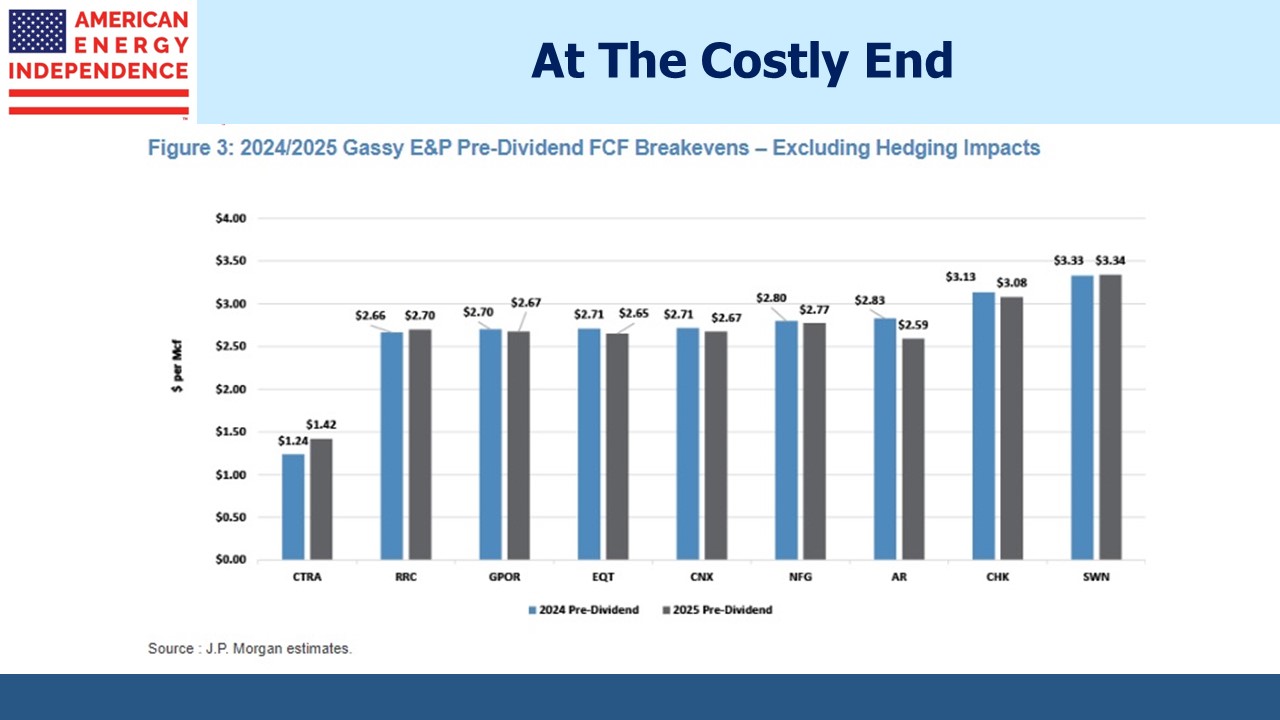

CHK and SWN are motivated by the likely upward pressure on US natgas prices growing LNG exports will cause. They’re probably also aware that as relatively high-cost producers, they are vulnerable to some more efficiently run competitors.

The bet on higher natgas prices looks like a sound one. If completed, the CHK/SWN merger will represent a pureplay bet on growing US LNG exports, something that’s also good for the midstream energy infrastructure companies that make it possible.

Join us for a webinar today, Wednesday January 10 at 4pm eastern. Click here to register.

We have three have funds that seek to profit from this environment: