The Slow Death Of 60/40

/

On the weekend the WSJ highlighted contrasting views of the 60/40 portfolio between Goldman Sachs and Blackrock. The classic asset allocation had its worst year in nominal terms since the 2008-9 Great Financial Crisis (GFC) and adjusted for inflation the worst since the Great Depression.

It shouldn’t be a surprise. Bond yields have been too low to justify the discerning investor’s capital for many years – a point I made in my 2013 book Bonds Are Not Forever: The Crisis Facing Fixed Income Investors.

The Federal Reserve owns $7.3BN in treasury bonds and Mortgage-Backed Securities (MBS). These holdings are a result of Quantitative Easing (QE), which Ben Bernanke first unleashed in response to the GFC. At the time this was a controversial move that many (including me) thought would be inflationary. Bernanke understood better than anyone how the monetary system would respond. It was a unique moment and QE should have been a one-off.

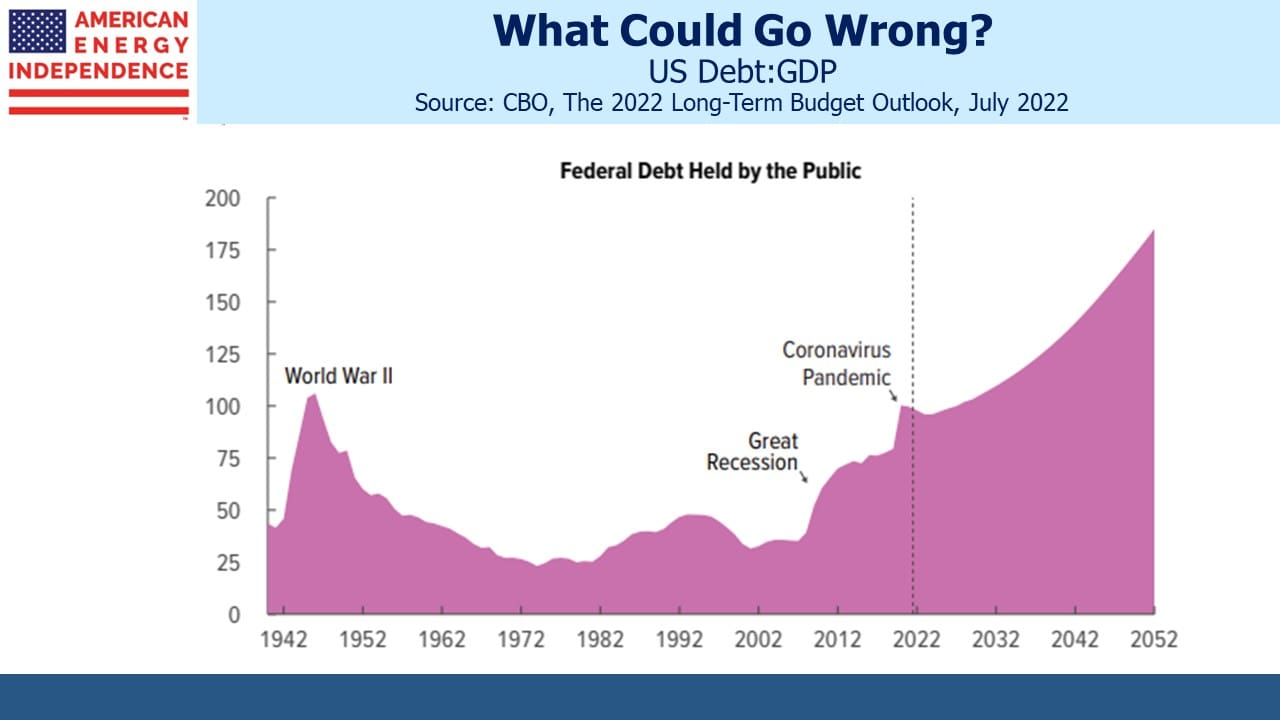

But in 2020 Jay Powell took it to a new level before the prior QE holdings had run off. Now one must conclude that any economic downturn will be met with Fed balance sheet expansion. The current lethargic pace of balance sheet reduction will likely be reversed with the next recession. This partial debt monetization is becoming permanent. It’s a consequence of too much debt.

Japan is the biggest foreign holder of US treasuries with $1.1TN. China is second at $0.9TN. Along with the Fed, for these investors a return ON capital is unimportant – they want a return OF capital. The old fear that China might dump their holdings is irrelevant with QE. Selling a $1TN of bonds would be destabilizing, but who now doubts the Fed would step in and take the other side?

Inflexible investment mandates that require fixed income allocations regardless of return prospects are another source of excess demand for bonds.

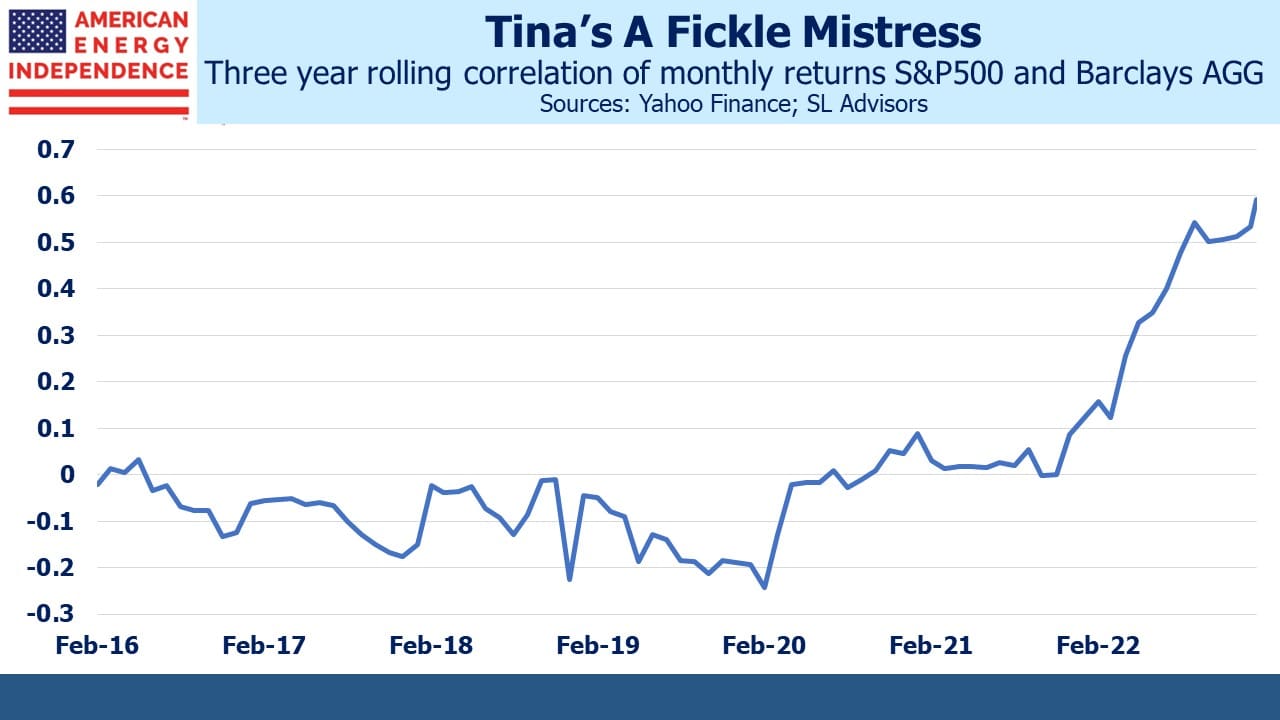

The result is that return-oriented bond investors are competing with substantial capital disinterested in a return. Bonds had some good years following the publication of my book warning investors to take their capital elsewhere. The adjustment away from fixed income is slow. But last year was a wake-up call. Paltry yields left diversification as the only justification for owning bonds. But their correlation with stocks has been rising sharply. The ascendancy of TINA (There Is No Alternative) caused this. The tyranny of pygmy interest rates and consequent shift to equity risk increased the stock market’s vulnerability to rising rates.

Over the past decade the Barclays Agg returned just 1.3% pa, versus 12.2% for the S&P500.

Today’s higher yields suggest a better decade ahead. But much depends on inflation. At 3.5% the ten year treasury note offers just 1.5% above the Fed’s long term inflation target of 2%. This is below the real return of the past hundred years. And it relies on inflation quickly returning to 2% and remaining there.

Inflation expectations are encouraging. Like many banks, JPMorgan expects falling inflation this year and is forecasting CPI of 2.8% in 4Q23. Ten-year TIPs yield 1.3%, implying a 2.2% embedded inflation rate in the bond market. The University of Michigan consumer survey regularly confirms this benign outlook.

The broad consensus on price stability isn’t easily ignored. It’s possible that return-insensitive buyers noted above are distorting the message unconstrained bond yields might offer. But Wall Street analyst and household views are harder to explain away. Nonetheless, having endured two years’ of high inflation a cautious investor should assume something above 2% in the future if only to compensate for the risk that these forecasts are wrong. A saver assuming her annual living expenses will increase at 3% into retirement will quickly find equities offer the only hope of keeping up.

60/40 was finished years ago. I haven’t owned a bond in probably two decades. There’s no point. Neither do any of our SMA clients. Instead they hold cash as a diversifier. 90-day treasury bills averaged 0.8% over the past decade, 0.5% less than the return on the Barclays AGG over that time but with no risk. Cash is a risk enabler. It supports increased exposure to equities which is the only chance savers have to maintain purchasing power. Bonds offer risk with an inadequate return.

Yields are still too low. The Congressional Budget Office forecasts sharply rising Debt:GDP over the next thirty years. US taxpayers are benefiting from investor inertia, since long term yields aren’t commensurate with the debt outlook.

In BlackRock vs. Goldman in the Fight Over 60/40, the WSJ finds Blackrock believes it outmoded while Goldman defends the indefensible. However, Goldman’s asset management business asked Is the 60/40 Dead? in October 2021 and warned “investors should at the very least recalibrate expectations.” Even within Goldman Sachs, reasonable people can disagree.

For more on how a combination of stocks and cash can replace fixed income, see The Continued Sorry Math Of Bonds, which we published around the same time. Adding midstream energy infrastructure to the equity portion of the stocks/cash barbell will, in our opinion, further boost its performance.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!