Energy – The Only Bright Spot In 2022

/

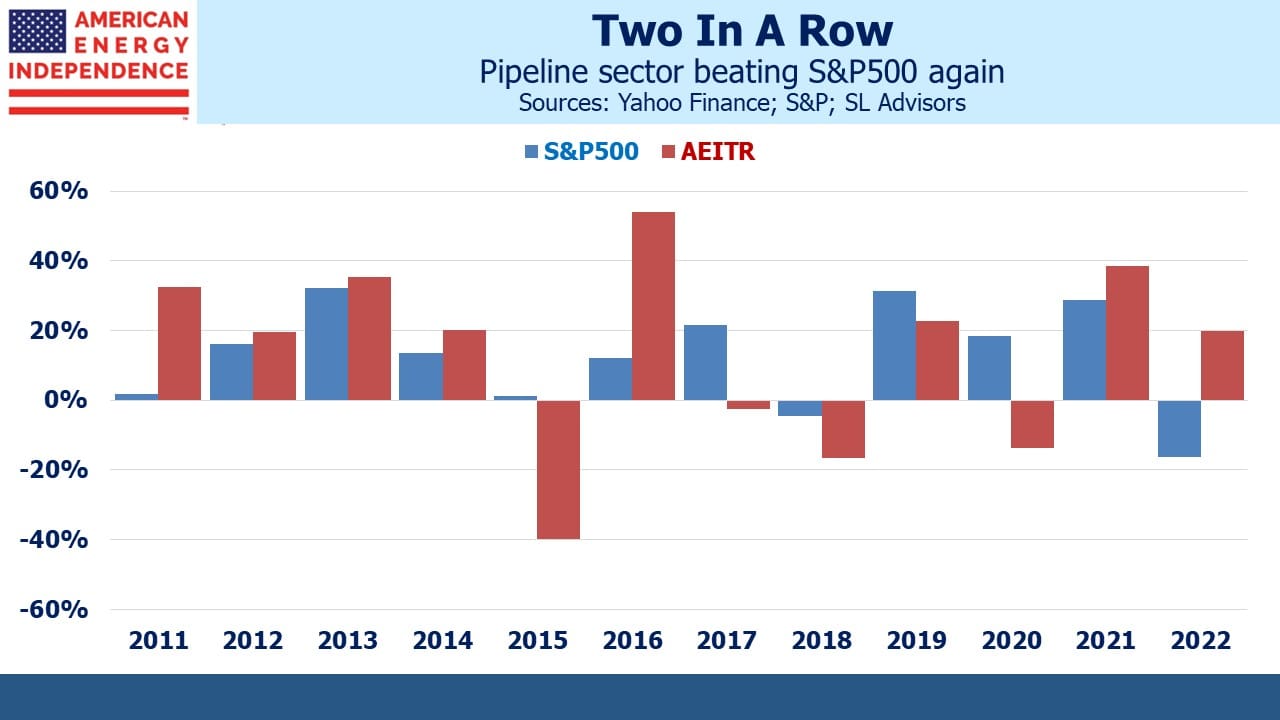

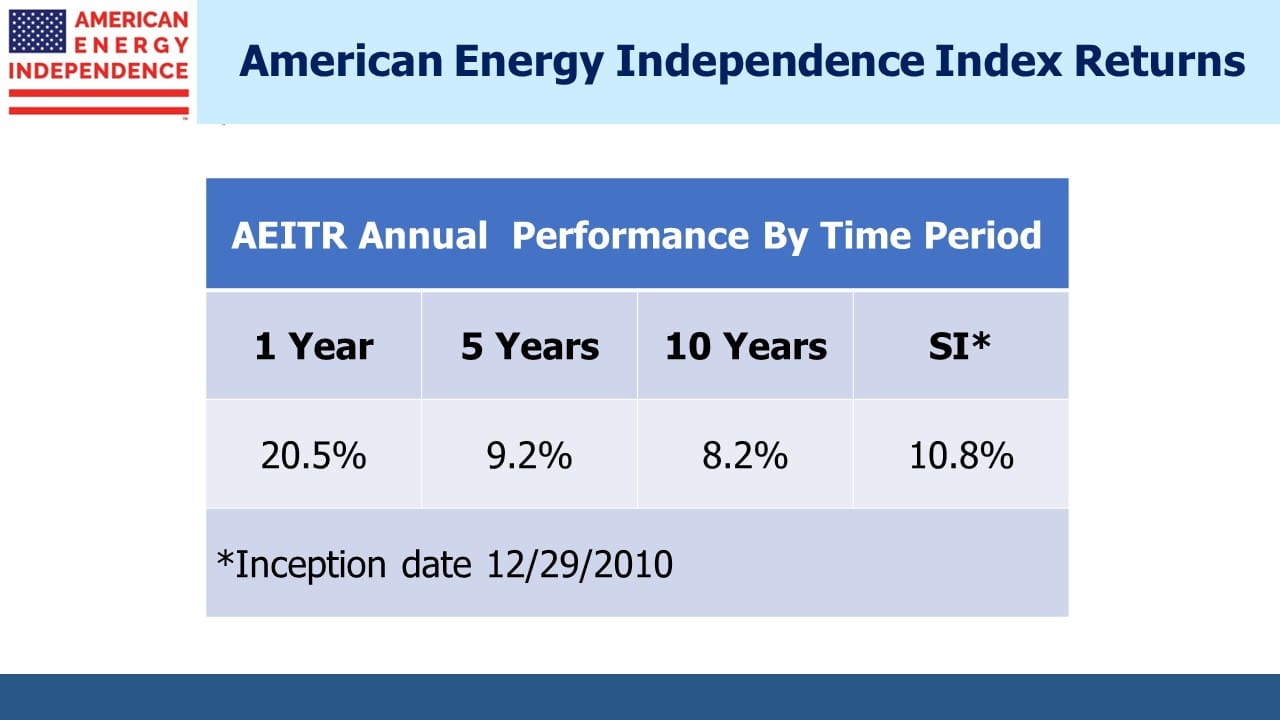

The energy sector is closing out a strong year weakly. This shouldn’t detract from the fundamentals, which remain strong. The American Energy Independence Index (AEITR) is 36% ahead of the S&P500 YTD after finishing 10% ahead last year. That almost two-year period of outperformance is the best since the index’s inception date in 2010. Battle-hardened pipeline investors might fear a correction next year. It’s worth remembering what’s going right.

MLPs have outperformed the broader pipeline sector by 7% this year, recapturing a small portion of the past five years’ underperformance. Unfortunately, investors in the Alerian MLP ETF (AMLP) will miss out on over half of that because of a tax error (see AMLP Trips Up On Tax Complexity). Some MLPs are attractively priced, including Energy Transfer and Enterprise Products Partners, which both yield close to 8%.

However, there aren’t enough MLPs to make up a diversified portfolio — one way to own the few that are worth the time is through a RIC-compliant fund that limits MLPs to less than 25% of assets. That avoids the tax drag faced by AMLP and other MLP-dedicated funds while still benefiting from the yield and shielding the investor from any K1s.

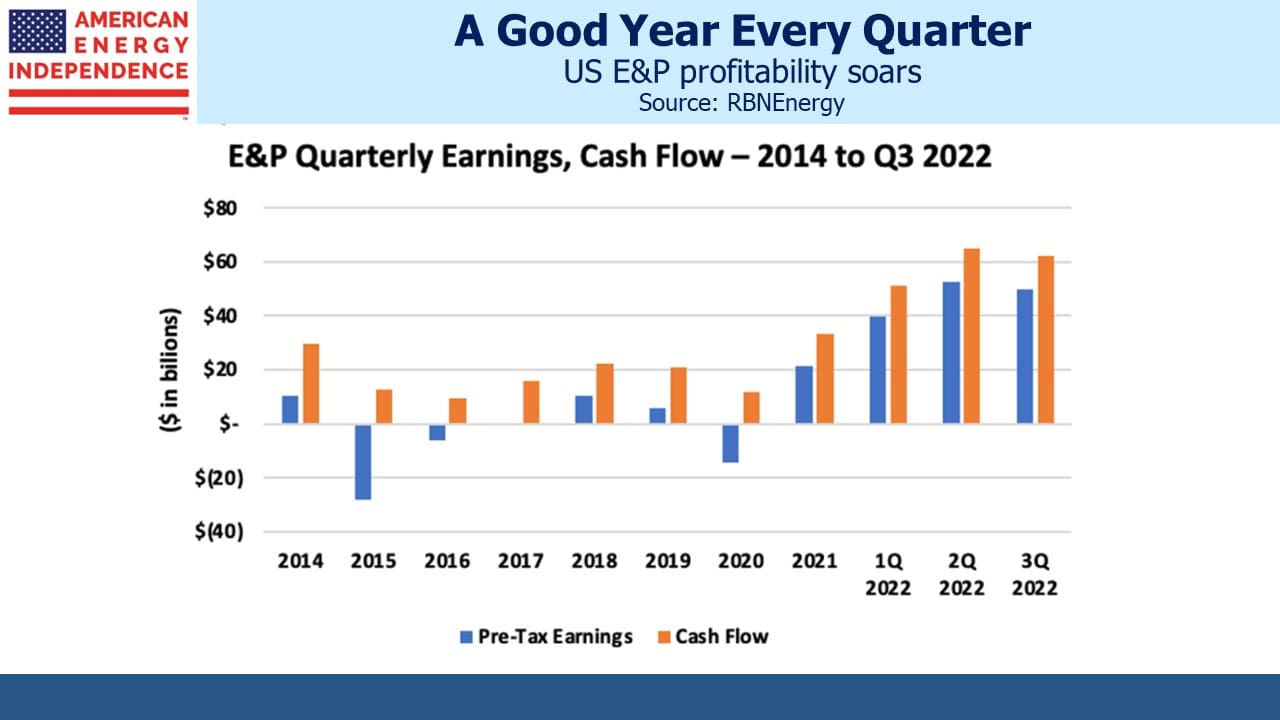

US E&P companies are generating record amounts of cash. Examine the chart above carefully, because it shows each of this year’s quarterly pre-tax earnings and cash flow figures beating each of the full year results going back to 2014. E&P companies are having a great year every quarter! These are the pipeline sector’s customers. Profitability in the upstream segment is supportive for midstream, as this year’s results have shown.

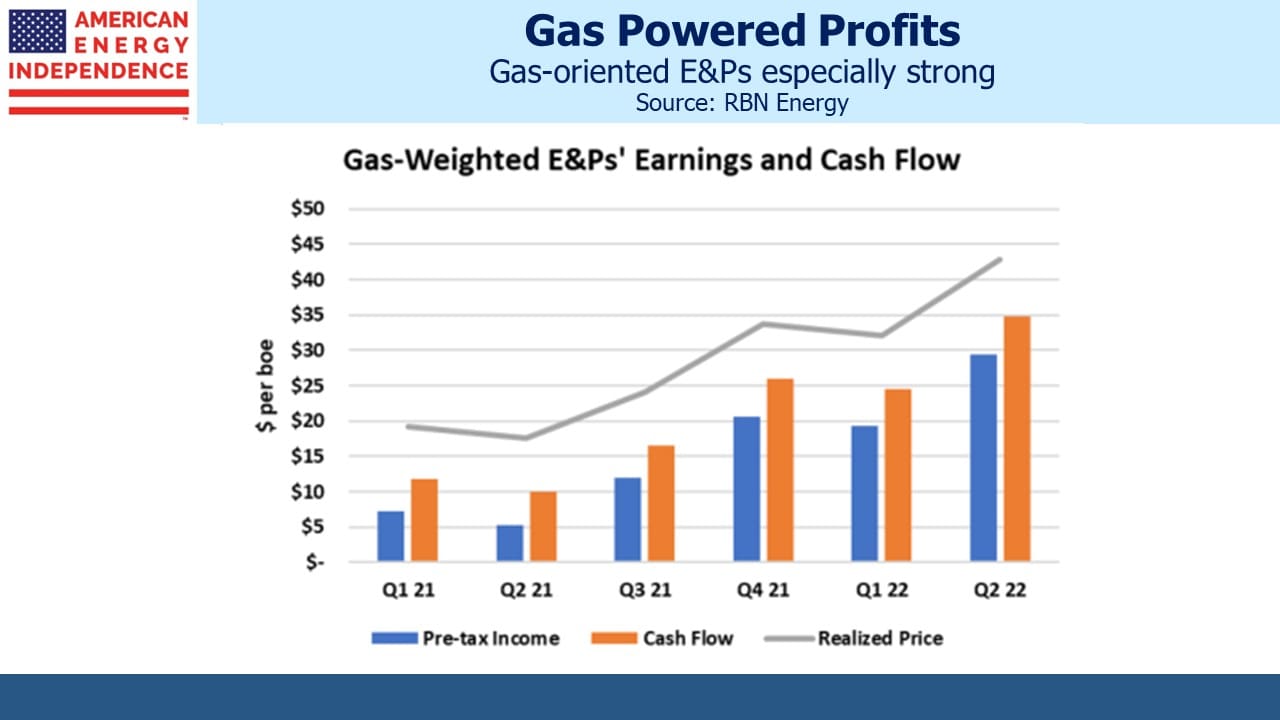

The chart showing gas-weighted E&Ps profitability converts into barrels of oil equivalent and shows that margin expansion is a big driver of profitability.

Factset projects S&P energy sector earnings growth of 150% this year, but that’s a broader universe than E&Ps and is dominated by majors such as Exxon Mobil and Chevron. Capital discipline continues for the most part – analysts expect TC Energy to sell some assets to fund its growing capex budget – but investor returns continue to dominate decision making.

Even though the White House’s chief energy adviser Amos Hochstein has accused investors of being “un-American” in not sharing the Administration ephemeral desire for increased output, investment returns are likely to reinforce capital parsimony.

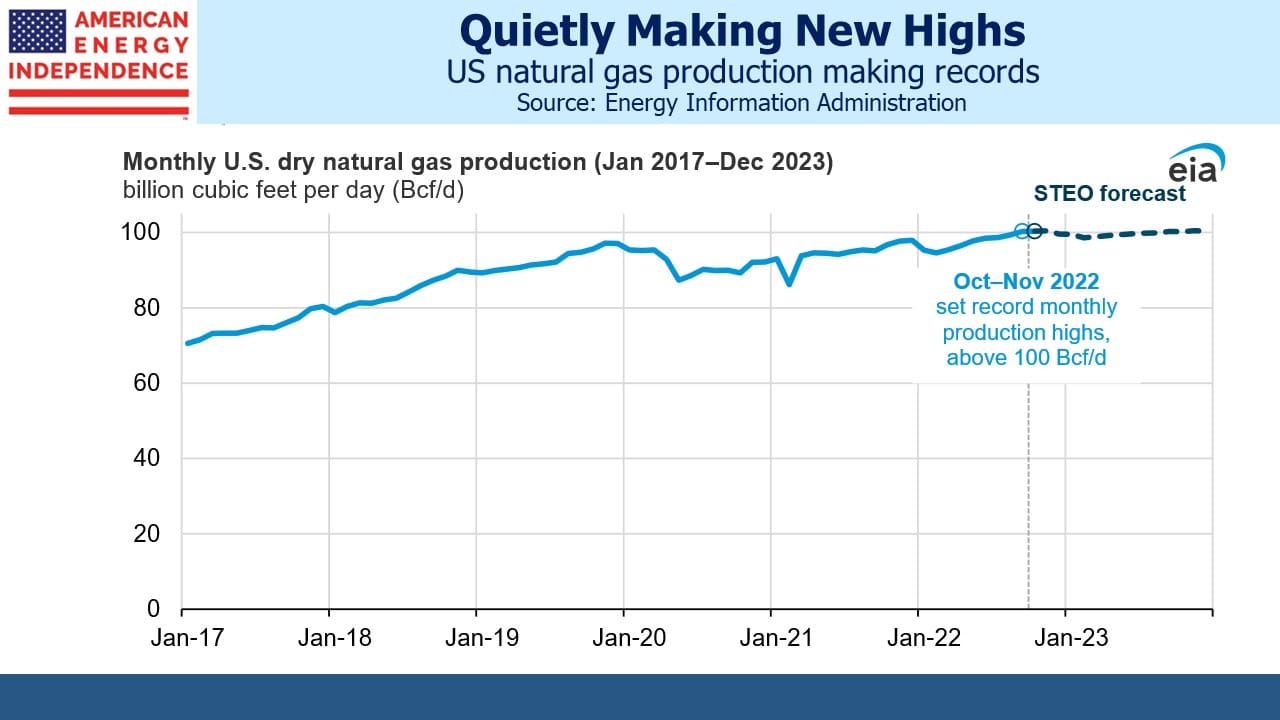

Domestic production of natural gas continues to set new records, and because it’s not a transportation fuel the pandemic had much less impact than it did for crude oil. The Energy Information Administration (EIA) is expecting record output next year.

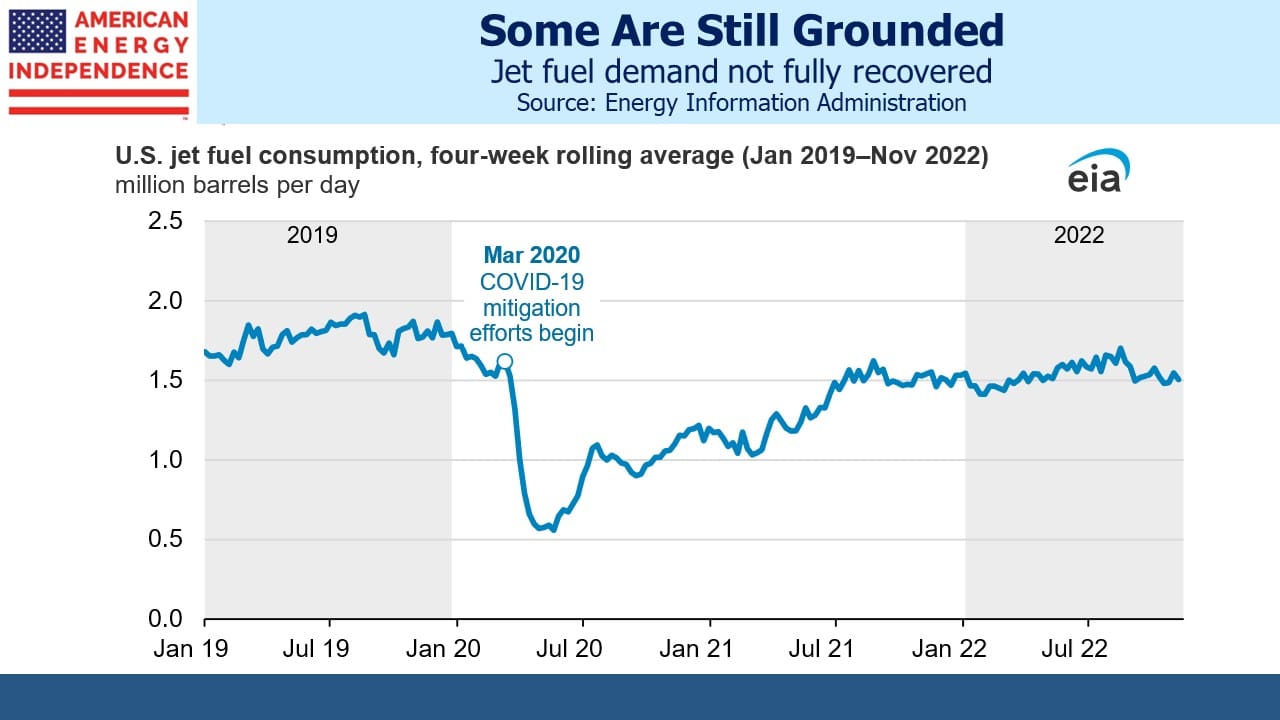

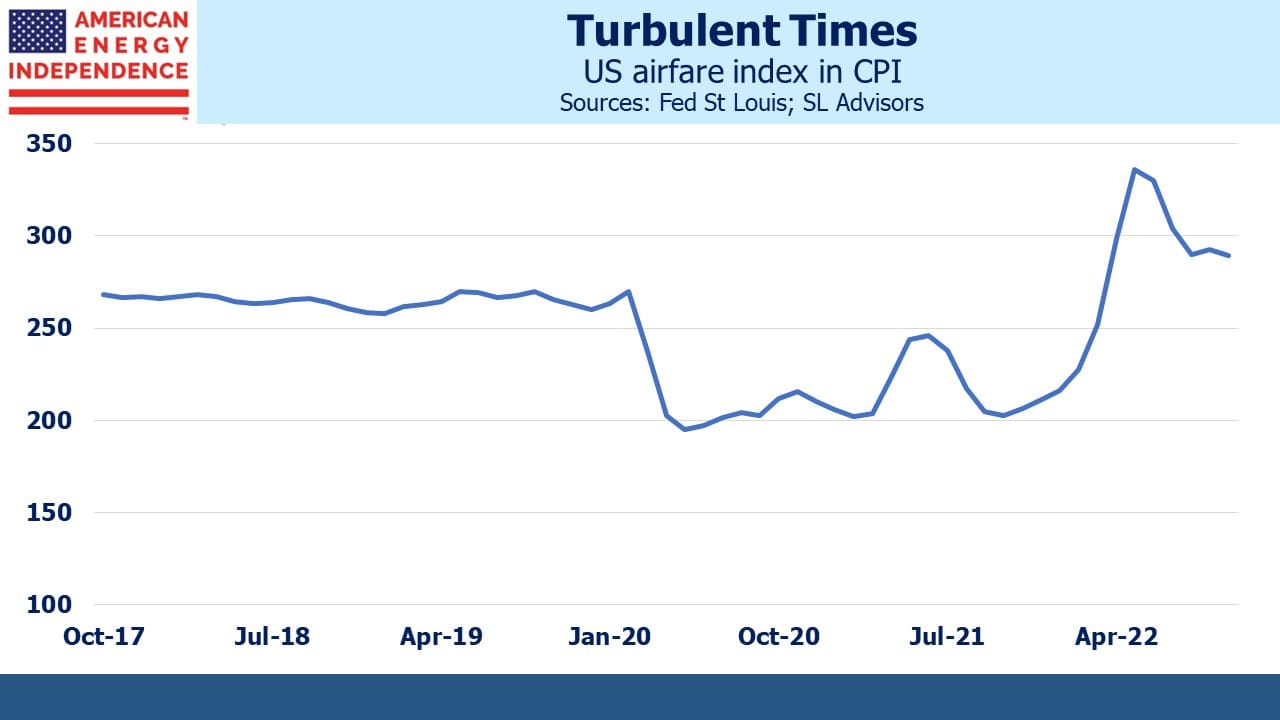

By contrast, jet fuel demand has still not fully recovered. Airfares in the CPI are up 43% over the past year, although they’re down 16% since the high in May.

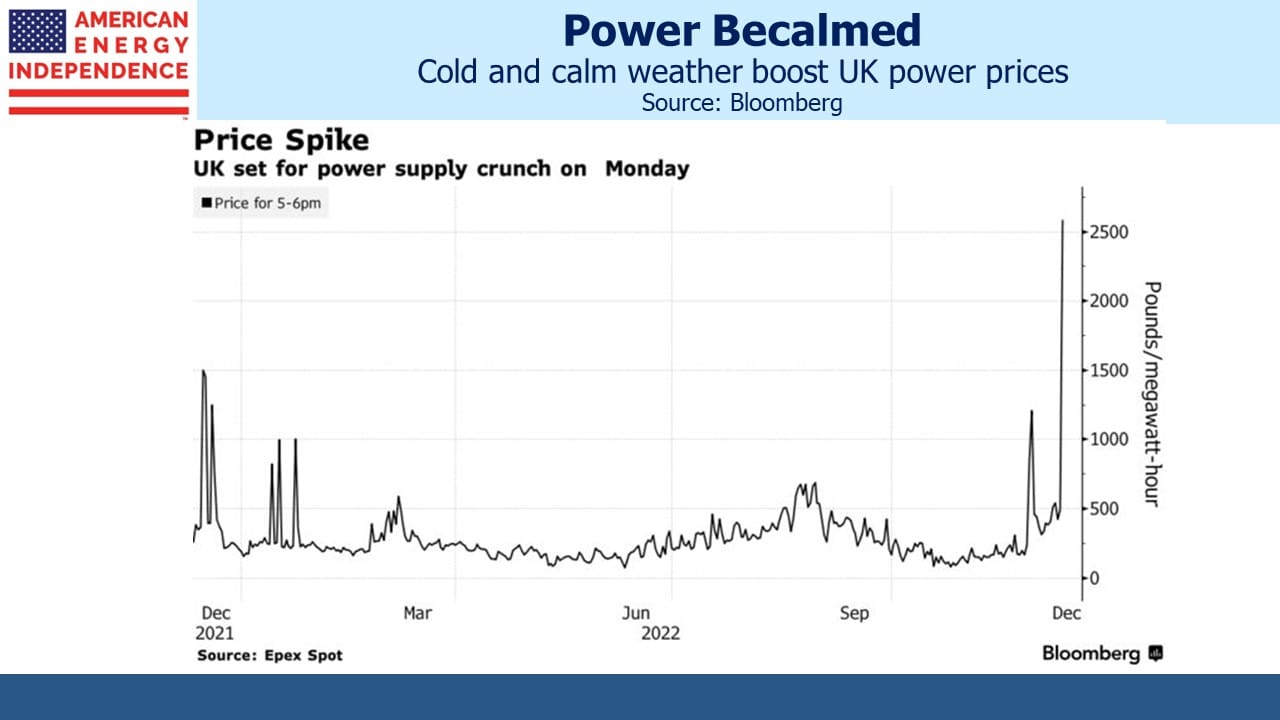

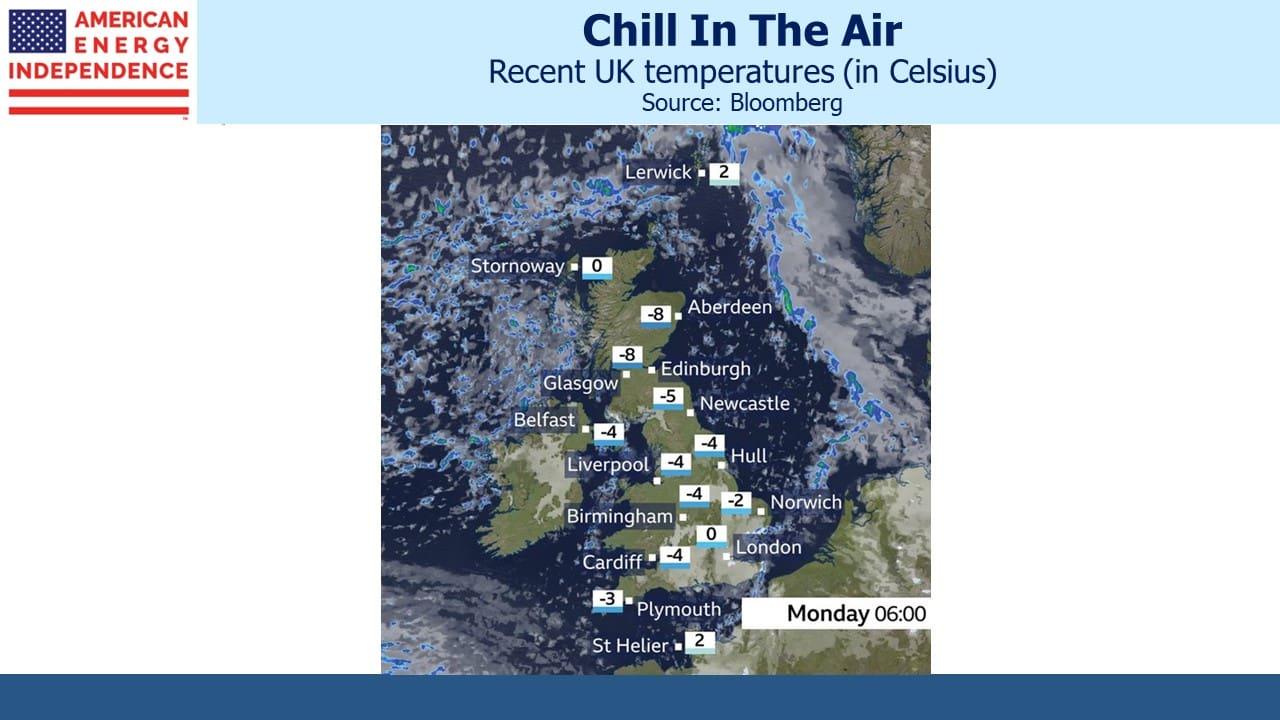

Countries with weather-dependent electricity such as the United Kingdom are enduring unusually cold and calm weather, which is reducing windmill output. London saw snow, which only happens about once a decade. UK wholesale power prices have spiked, but that will mostly be absorbed by the government since for now there are caps on consumer heating bills.

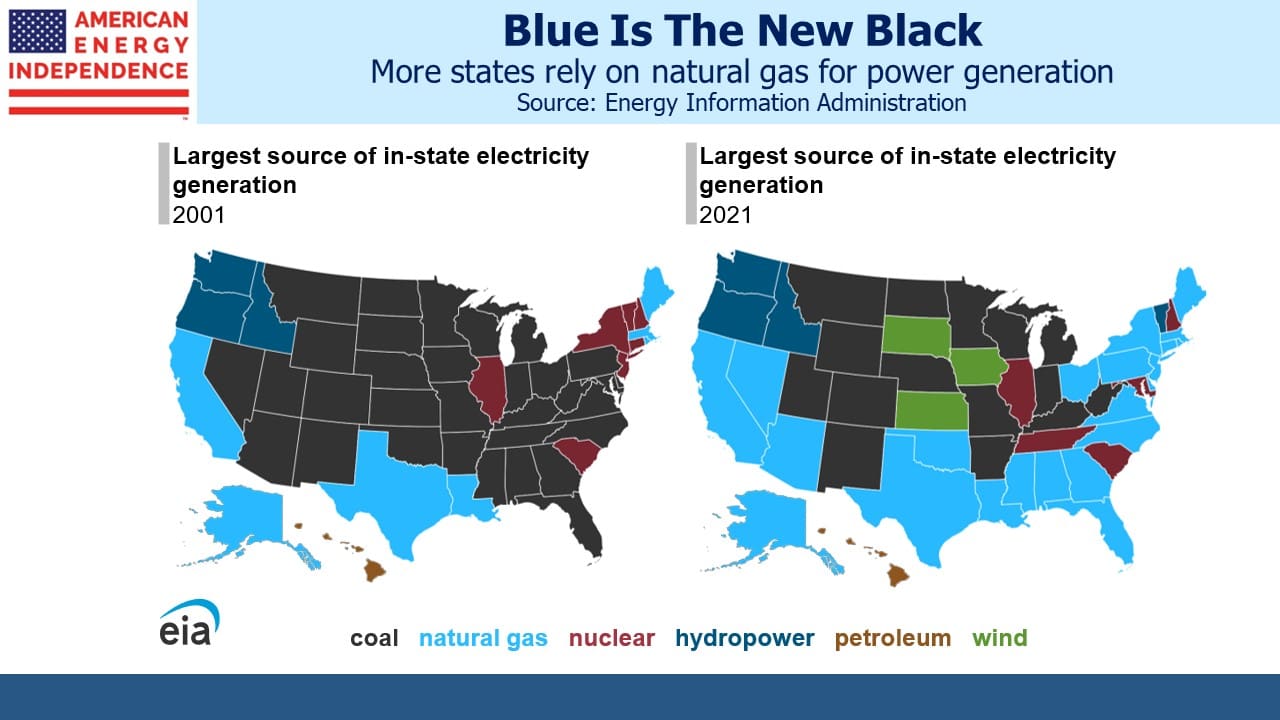

The EIA produced an interesting pair of maps showing each state’s largest source of in-state power generation. The shift from coal to gas is easily seen, but there are three states (South Dakota, Iowa and Kansas) for whom wind power is number one. Personally, I don’t want to live in a state that relies on intermittent energy that takes up vast amounts of space, but some people are fine with it.

Asian demand for crude oil continues to grow. Morgan Stanley reported year-on-year increases of 10.2% in India and 12% in China – this being especially surprising given the widespread lockdowns that have been in place in China. There remains a strong underlying growth trend. Meanwhile Russian exports to Europe are down 80% on a year ago. It’s clear where those shipments unwanted by European buyers will be going.

There was an interesting report that linked the Keystone pipeline’s third spill in five years with increased operating pressure. US crude oil pipelines are limited to operating at a “yield strength” of 72% of maximum. In 2017 Transcanada, who owns and operates the Keystone, obtained approval to go to 80%. They will dispute circumstantial evidence that points to this increased pressure as the cause. Regulators are reviewing the data. Following the leak into the Kansas Mill Creek, the segment from Steele City, KS to the Cushing, OK storage terminal is closed.

Recent sector weakness belies strong underlying volume growth and increasing cash flow. Pipeline investors will have plenty to celebrate this Christmas.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Other MLPs you might include in your discussion are MPLX and CEQP.