Energy – The Only Bright Spot In 2022

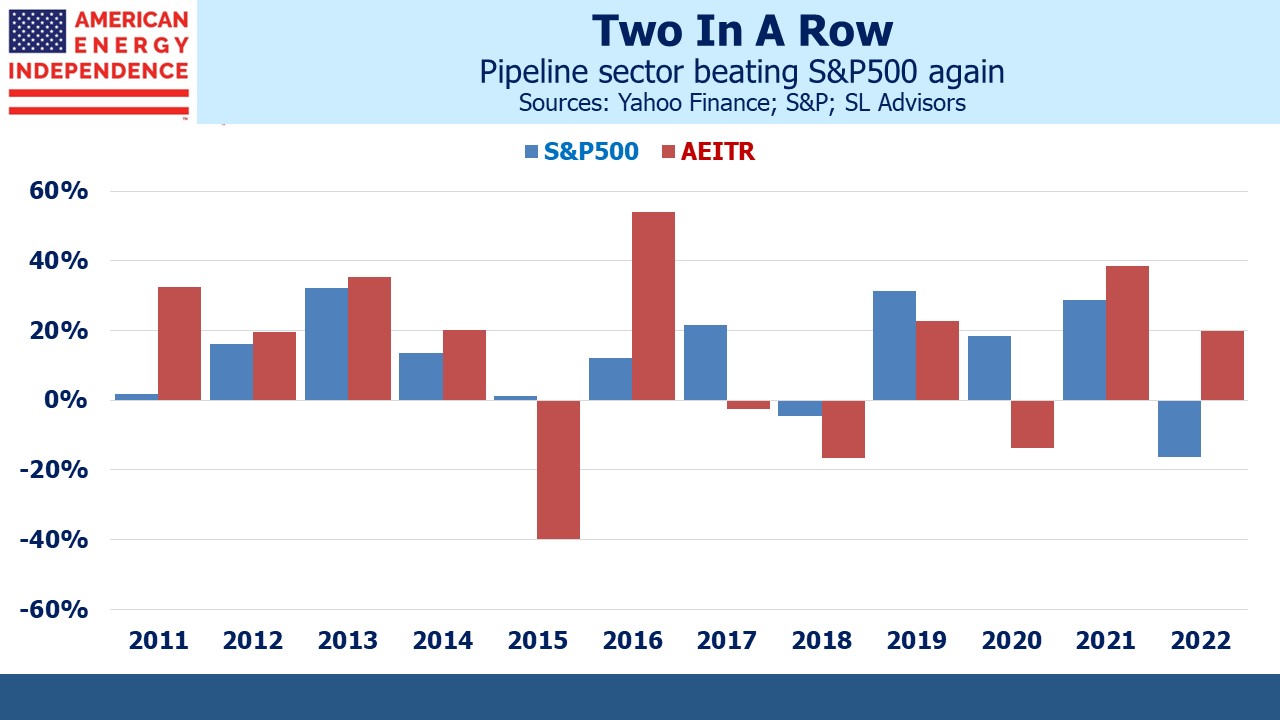

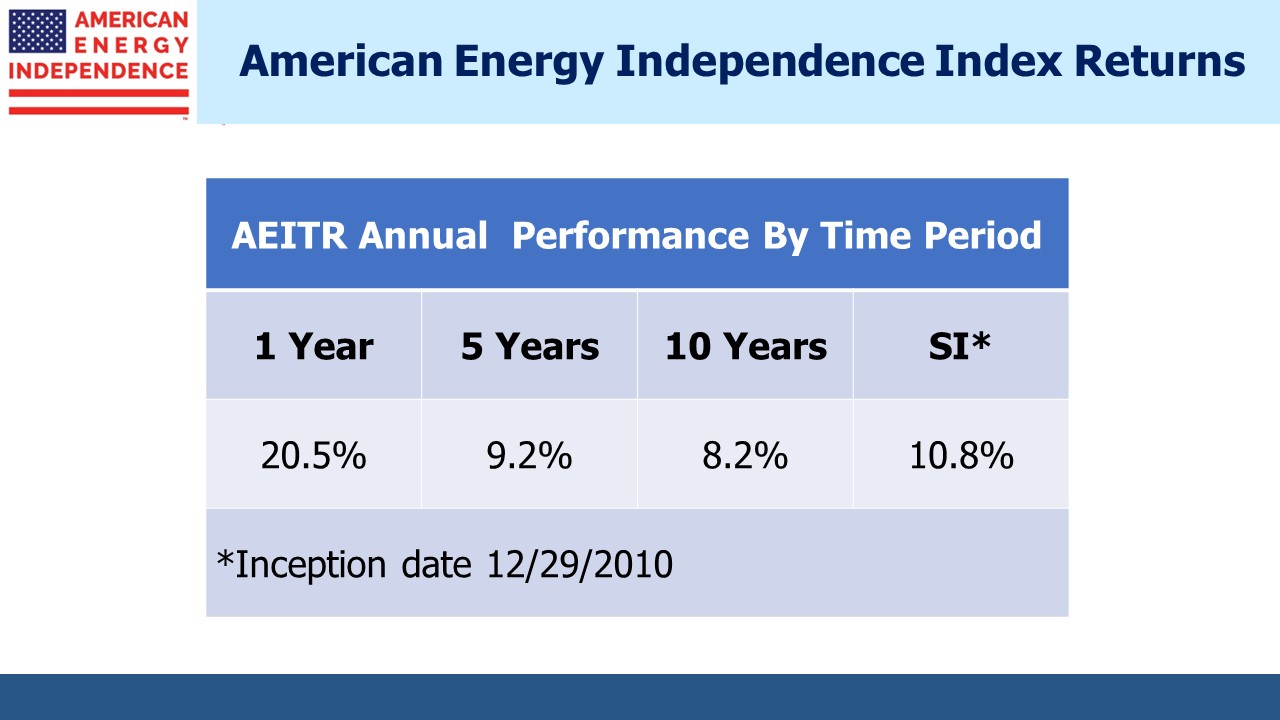

The energy sector is closing out a strong year weakly. This shouldn’t detract from the fundamentals, which remain strong. The American Energy Independence Index (AEITR) is 36% ahead of the S&P500 YTD after finishing 10% ahead last year. That almost two-year period of outperformance is the best since the index’s inception date in 2010. Battle-hardened pipeline investors might fear a correction next year. It’s worth remembering what’s going right.

MLPs have outperformed the broader pipeline sector by 7% this year, recapturing a small portion of the past five years’ underperformance. Unfortunately, investors in the Alerian MLP ETF (AMLP) will miss out on over half of that because of a tax error (see AMLP Trips Up On Tax Complexity). Some MLPs are attractively priced, including Energy Transfer and Enterprise Products Partners, which both yield close to 8%.

However, there aren’t enough MLPs to make up a diversified portfolio — one way to own the few that are worth the time is through a RIC-compliant fund that limits MLPs to less than 25% of assets. That avoids the tax drag faced by AMLP and other MLP-dedicated funds while still benefiting from the yield and shielding the investor from any K1s.

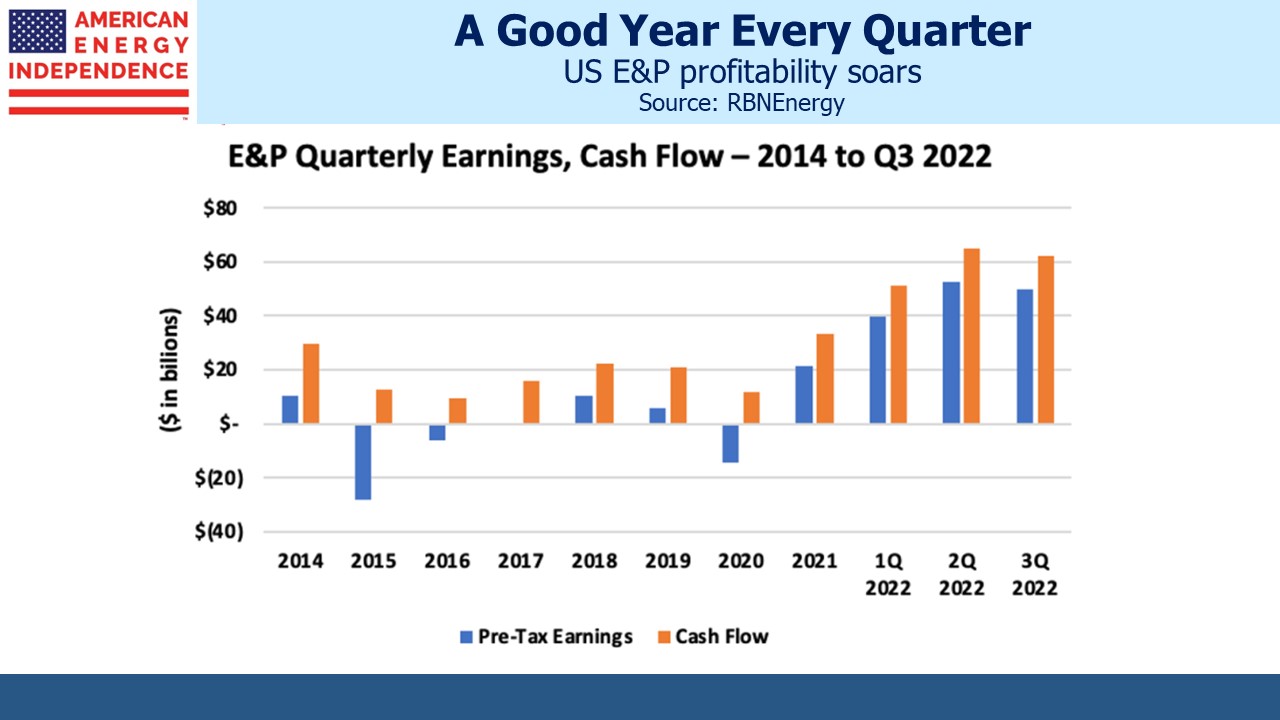

US E&P companies are generating record amounts of cash. Examine the chart above carefully, because it shows each of this year’s quarterly pre-tax earnings and cash flow figures beating each of the full year results going back to 2014. E&P companies are having a great year every quarter! These are the pipeline sector’s customers. Profitability in the upstream segment is supportive for midstream, as this year’s results have shown.

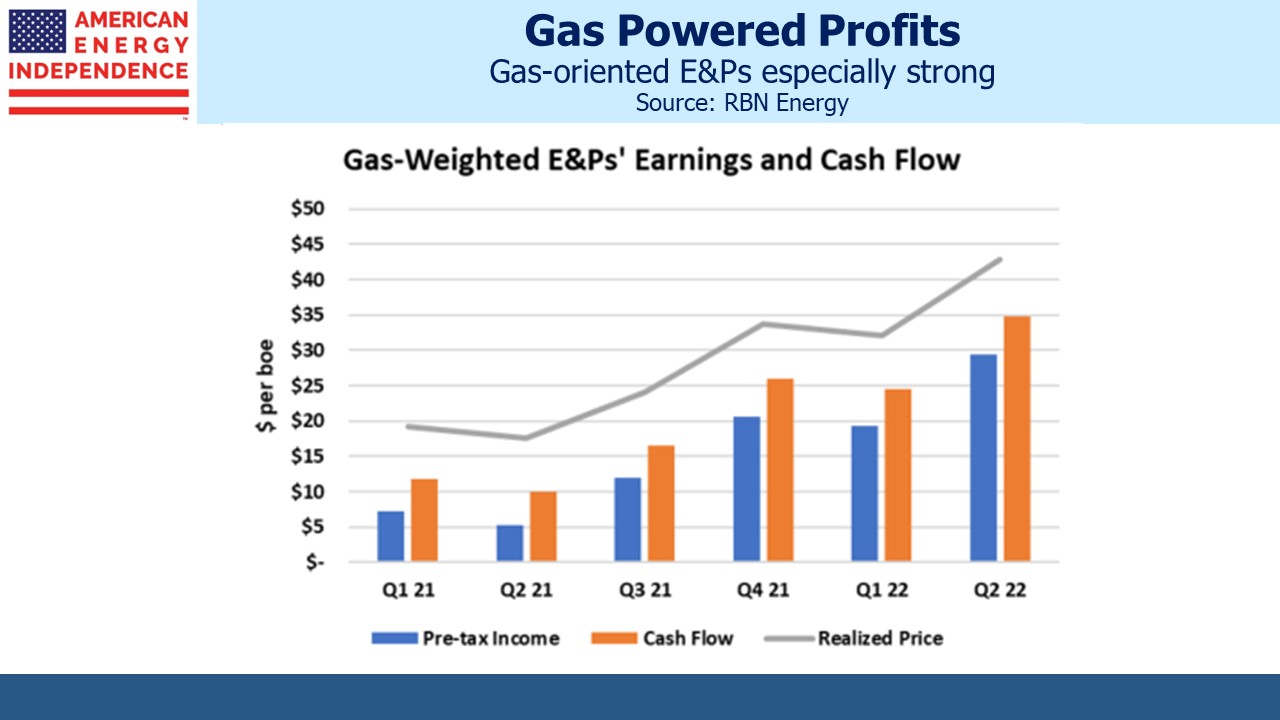

The chart showing gas-weighted E&Ps profitability converts into barrels of oil equivalent and shows that margin expansion is a big driver of profitability.

Factset projects S&P energy sector earnings growth of 150% this year, but that’s a broader universe than E&Ps and is dominated by majors such as Exxon Mobil and Chevron. Capital discipline continues for the most part – analysts expect TC Energy to sell some assets to fund its growing capex budget – but investor returns continue to dominate decision making.

Even though the White House’s chief energy adviser Amos Hochstein has accused investors of being “un-American” in not sharing the Administration ephemeral desire for increased output, investment returns are likely to reinforce capital parsimony.

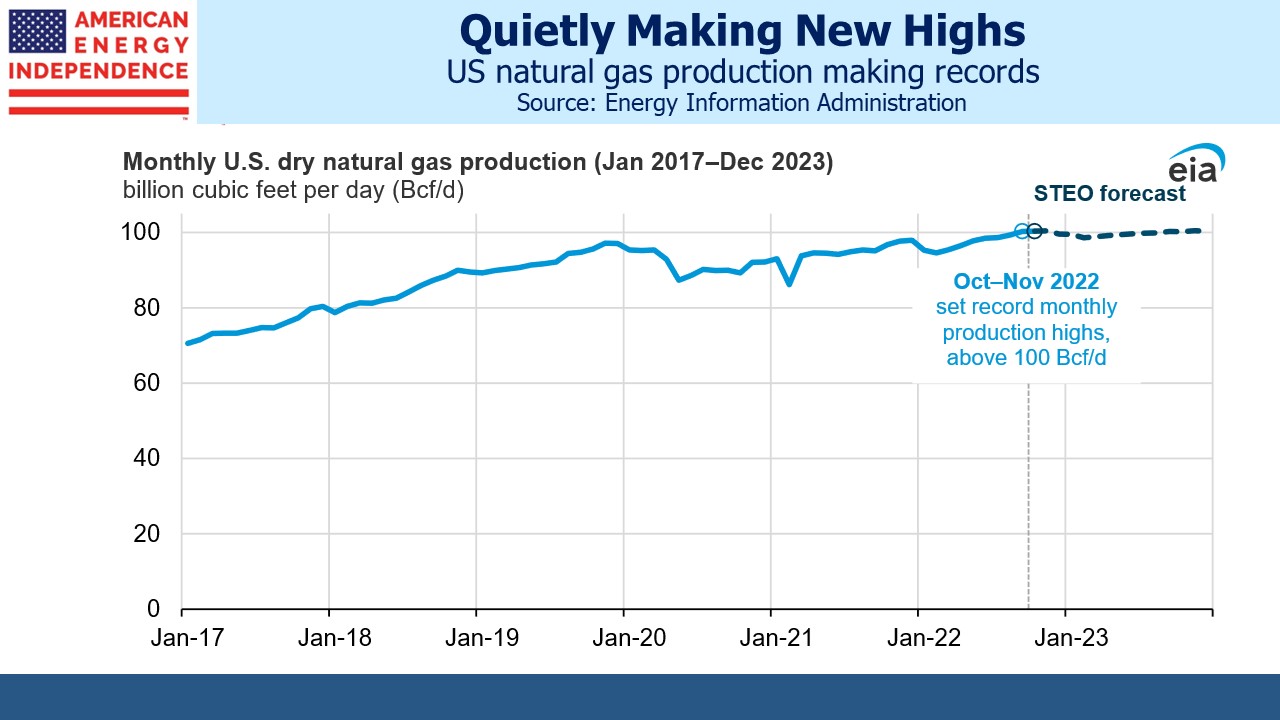

Domestic production of natural gas continues to set new records, and because it’s not a transportation fuel the pandemic had much less impact than it did for crude oil. The Energy Information Administration (EIA) is expecting record output next year.

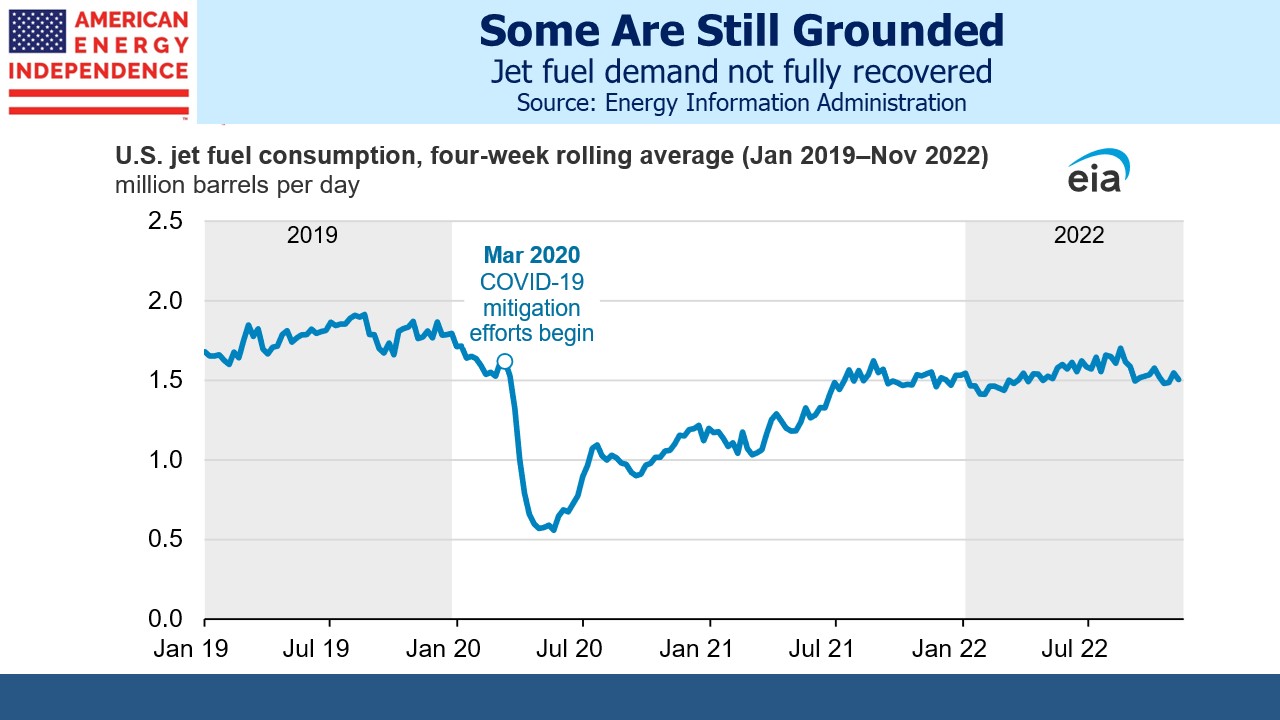

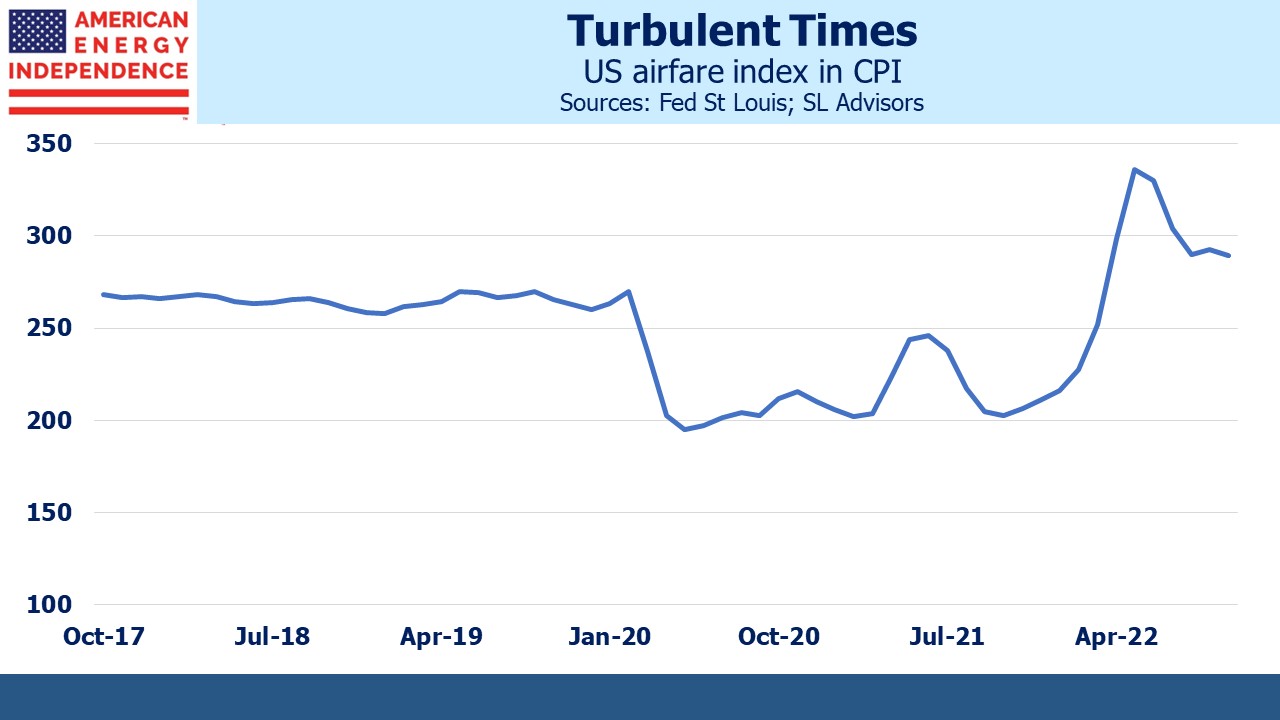

By contrast, jet fuel demand has still not fully recovered. Airfares in the CPI are up 43% over the past year, although they’re down 16% since the high in May.

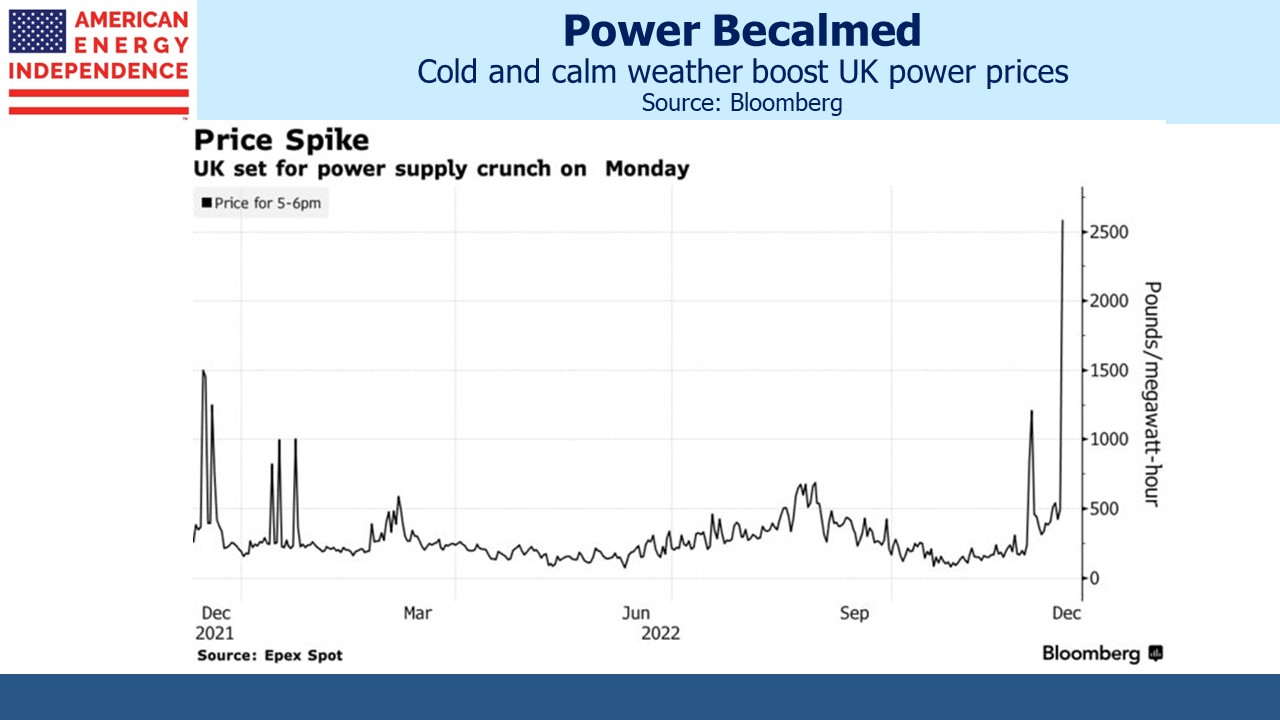

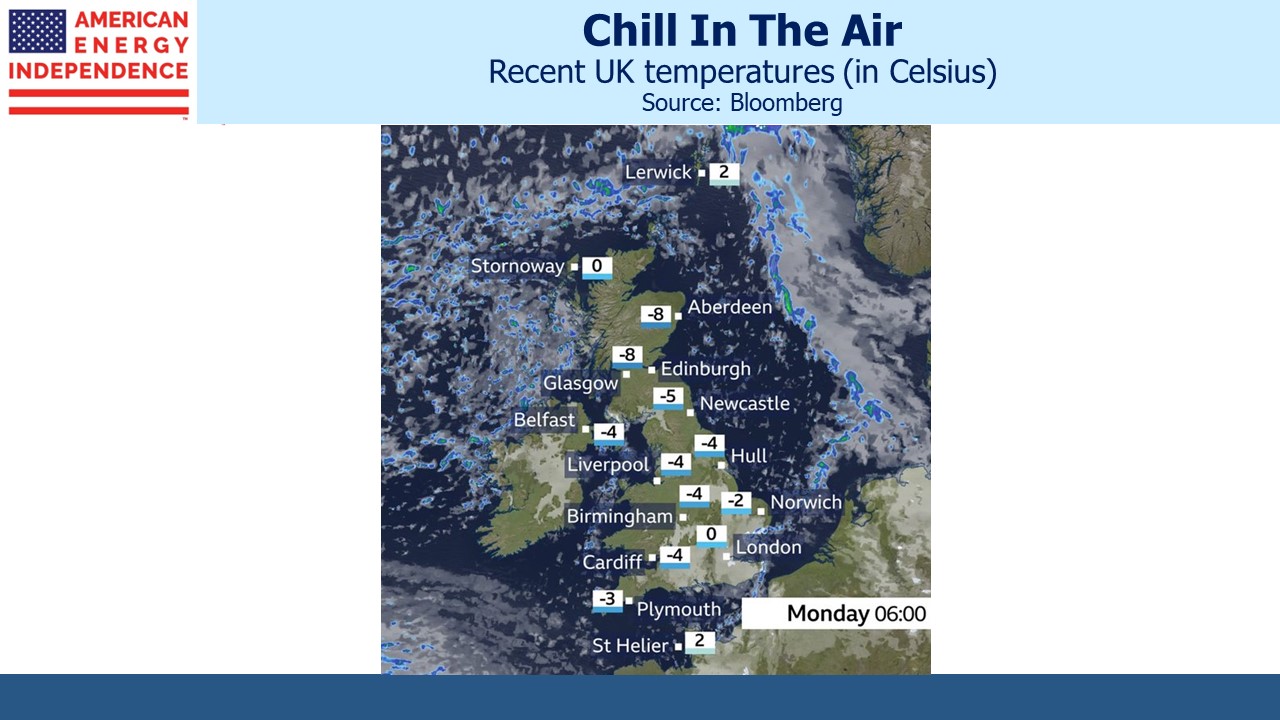

Countries with weather-dependent electricity such as the United Kingdom are enduring unusually cold and calm weather, which is reducing windmill output. London saw snow, which only happens about once a decade. UK wholesale power prices have spiked, but that will mostly be absorbed by the government since for now there are caps on consumer heating bills.

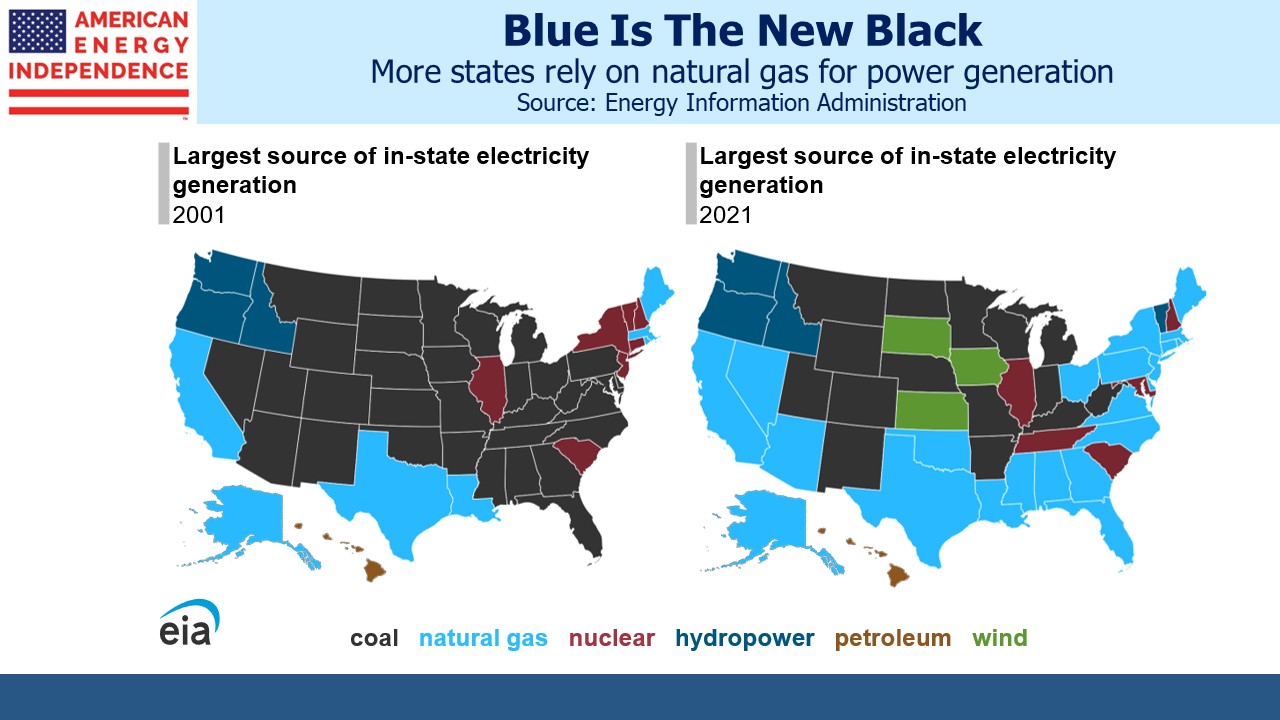

The EIA produced an interesting pair of maps showing each state’s largest source of in-state power generation. The shift from coal to gas is easily seen, but there are three states (South Dakota, Iowa and Kansas) for whom wind power is number one. Personally, I don’t want to live in a state that relies on intermittent energy that takes up vast amounts of space, but some people are fine with it.

Asian demand for crude oil continues to grow. Morgan Stanley reported year-on-year increases of 10.2% in India and 12% in China – this being especially surprising given the widespread lockdowns that have been in place in China. There remains a strong underlying growth trend. Meanwhile Russian exports to Europe are down 80% on a year ago. It’s clear where those shipments unwanted by European buyers will be going.

There was an interesting report that linked the Keystone pipeline’s third spill in five years with increased operating pressure. US crude oil pipelines are limited to operating at a “yield strength” of 72% of maximum. In 2017 Transcanada, who owns and operates the Keystone, obtained approval to go to 80%. They will dispute circumstantial evidence that points to this increased pressure as the cause. Regulators are reviewing the data. Following the leak into the Kansas Mill Creek, the segment from Steele City, KS to the Cushing, OK storage terminal is closed.

Recent sector weakness belies strong underlying volume growth and increasing cash flow. Pipeline investors will have plenty to celebrate this Christmas.

We have three funds that seek to profit from this environment: