Why Energy Transfer Cut Their Distribution

Energy Transfer’s (ET) 50% distribution cut announced late on Monday surprised most observers. Given the comfortable 1.4-1.5X DCF coverage this year and next, many felt that there was little pressure to reduce it. However, the persistently high yield (18% before the announcement), reflected widespread investor skepticism around its sustainability. Debt:EBITDA of 5X is higher than the prevailing 4-4.5X standard for investment grade names in the sector.

The company’s press release provided no additional color, and the 3Q20 earnings call will be next Wednesday, when election results will dominate the news.

Distribution cuts are rarely well received. Income-seeking investors who used to be the core investor base for pipelines have endured them for years. Few could be shocked by one more. The payout on the Alerian MLP ETF (AMLP) is 50% below its peak of February 2016. Since ET is a 10.1% position in its index, the Alerian MLP Infrastructure Index (AMZI), AMLP is likely to cut a little more. MLP-dedicated funds run by Invesco are also significant ET holders, highlighting the problems such funds face with a shrinking pool of investable names (see Why MLP Fund Investors Should Care When They Change).

Selling on Tuesday following the announcement likely reflected disappointment from investors who had believed the DCF coverage meant it was secure.

The problem was that too few investors believed the distribution would be maintained, and this became a self-fulfilling prophecy. The high yield meant it was a waste of money to keep paying it. The stock is too cheap to be used as an acquisition currency. Retiring CEO Kelcy Warren’s substantial income from the distribution was one of the arguments for its continuation, but he can probably get by on less.

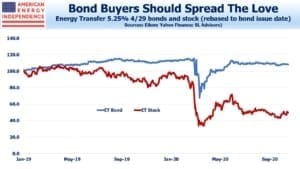

A few weeks ago we contrasted the negative view of ET held by equity investors with the relative equanimity shown by their bond yields (see The Divergent Views About Energy Transfer). As the chart shows, strong differences of opinion about ET persist across the capital markets. A ten year bond issued by ET in January last year trades above par, after falling sharply earlier this year. By contrast, ET’s stock price remains at just half the level it was when the bonds were issued.

This is a theme with investment grade pipeline stocks. Enterprise Products Partners (EPD) is another example of a company whose bonds reflect a much more positive outlook than does their stock (see Stocks Are Still A Better Bet Than Bonds).

Pipeline stocks have long abandoned any connection with Miller-Modigliani and the Capital Asset Pricing Model (CAPM). Theoretically, investors should be indifferent to leverage or dividends for example, but in practice they are not. Once the reactive selling from those who liked the former 18% yield is finished, investors will see a company with more financial flexibility. They could use some of the cash freed up by the distribution cut to repay debt, although their bonds are expensive. Or they could initiate a stock buyback, directly confronting their low valuation.

We’ll need to wait until next Wednesday to learn more. ET has often been criticized for exploiting its investors where possible. The convertible preferreds they issued to management in 2016 following the ill-fated pursuit of Williams Companies (WMB) permanently cost them trust in the marketplace, and is a reason for their continued depressed stock price (see Energy Transfer’s Weak Governance Costs Them). Newly promoted co-CEOs Mackie McCrea and Tom Long have an opportunity to demonstrate good faith with investors.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!