Why MLP Fund Investors Should Care When They Change

MLPs have been losing relevance to the midstream energy infrastructure sector for years. The Shale Revolution caused them to evolve from reliable generators of income to growth-seeking enterprises. As upstream companies plowed money into drilling, pipeline companies felt compelled to add new infrastructure to service them. The capital spending spigot had already been ratcheted down since 2018, with investors rebelling against the culture of always building. The hit to demand from Covid accelerated a trend already in pace.

MLPs represent around a third of the pipeline business. This has left MLP-dedicated funds increasingly challenged to find enough names to build out a portfolio. It’s a dilemma we’ve forecast for a long time (see The Uncertain Future of MLP-Dedicated Funds, April 2018). Such funds, most notably the Alerian MLP ETF (AMLP), were already burdened with an inefficient structure (see Uncle Sam Helps You Short AMLP, July 2018).

The MainStay Cushing MLP Premier Fund (CSHAX) has decided to bite the bullet and abandon their anachronistic structure. In recent weeks they’ve been quietly informing clients that they plan to limit MLPs to 25%, because of the “significant contraction” of MLPs. It’s taken them longer than it should, but they’ve accepted that the MLP business has changed. Serial distribution cuts imposed on income seeking investors have lost those investors to the sector for good.

CSHAX is around $500MM in AUM. Bringing their MLP holdings below 25% will require them to shed 75% of their portfolio, around $375MM, over period of months. MLP funds have seen around $6BN of outflows in the past year, and this has weighed on prices. Even so, the CSHAX repositioning should be manageable.

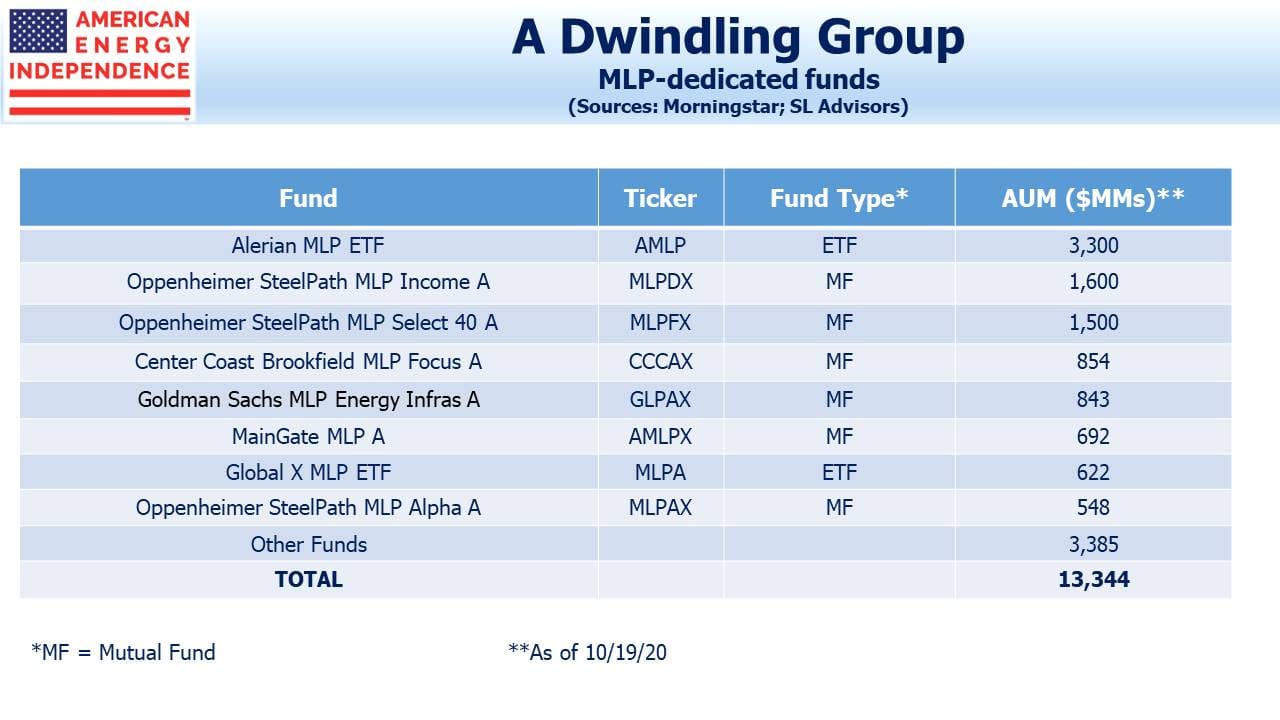

But what if other MLP funds reach the same conclusion? The Invesco Steelpath family of MLP funds is over $3.5BN. Center Coast and Goldman each have another $800MM. And AMLP is $3.3BN. There’s over $13BN invested in flawed, MLP-dedicated funds.

MainStay Cushing’s move is logical, but nobody will want to be the last one jumping. They’re not the first either. Some smaller closed end funds have combined and become RIC-compliant by limiting MLPs to 25%. The Kayne Anderson MLP/Midstream Investment Company recently became the Kayne Anderson Energy Infrastructure Fund (still KYN). Dropping MLPs is a developing trend.

It should induce investors in all MLP-dedicated funds to ponder their fund’s future. If bigger funds follow MainStay Cushing, the MLP sector could find itself having to absorb an indigestible amount of sales. Alerian calculates the market cap of MLPs at $139BN, but it’s only $72BN when adjusted for float. For example, the Duncan family’s 32% ownership of Enterprise Products Partners (EPD) doesn’t provide any liquidity. The remaining MLP-dedicated funds are almost 20% of the market.

MLPs are cheap by any reasonable measure. We’ve noted the yawning gap between EPD’s debt and equity yields (see Stocks Are Still A Better Bet Than Bonds). Bond and stock investors are poles apart in their assessment of the sector. But the risk investors in MLP-dedicated funds face is that portfolio shifts by competitor funds depress MLP prices, driving down their own fund’s NAV.

The near–term future of MLP-dedicated funds is unclear. But the time for such vehicles has passed, and it seems inevitable that funds invested in midstream infrastructure will limit MLPs to 25%. You just don’t want to be in the last fund to decide to make the shift.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

MLPs still provide the most tax effective way of investing in the midstream infrastructure industry, so long as the Democrats don’t win the election and eliminate the stepped up basis.