Exxon’s Contrarian Bet

On Wednesday Exxon Mobil (XOM) declared a quarterly dividend of 82 cents a share. Although this means 2020 will be the first year since 1982 that they haven’t raised it, the bigger question is whether they can sustain it.

We noted recently how energy investors could fare better under a Democrat administration (see Why Exxon Mobil Investors Might Like Biden). A White House looking for ways to combat climate change should cause energy executives to hunker down, constraining their desire to drill for oil and build new infrastructure. A pipeline owner should find this a welcome prospect, as less cash spent on new projects means more for buybacks, debt reduction and dividend hikes. XOM is positioning itself for such a scenario – they plan to increase oil and gas production from 4 million Barrels of Oil Equivalent per Day (MMBOED) currently to over 5 MMBOED by 2025. This bet is predicated on rising global demand driven by emerging economies combined with falling investment in new supply, as energy companies prepare for peak oil and the energy transition.

There’s something appealingly pragmatic about XOM’s positioning. Although growth in renewables gets all the attention, the world still relies on fossil fuels for more than 80% of its energy. In the U.S., the biggest increase in power generation in the first half of the year came from natural gas, not renewables. Most credible long-term energy forecasts show that the world will be using more of every type of energy, because developing countries want to raise living standards. The energy outlook embedded in XOM’s production plans is probably not consistent with the Paris Climate Accord. If you want to bet that the world will manage to live with a warmer climate, rather than achieve the reductions laid out by the UN’s Intergovernmental Panel on Climate Change, XOM might be a way to express that view.

If they’re wrong, that 82 cent dividend won’t last. Analysts estimate they need crude prices of at least $55 per barrel in order to generate enough cash to cover planned growth capex and pay their dividend. For now, they’re funding it with increased debt.

Given the energy sector’s sorry history of overinvesting in recent years, maintaining high dividends does impose greater financial discipline. It raises the required return on new spending, making dilutive projects less likely. Although financial theory teaches that dividends shouldn’t matter, investors increasingly recognize the protection against otherwise poor capital allocation decisions. That’s likely part of the reason XOM rose on Thursday, because it maintained a dividend that’s currently financed partly with debt.

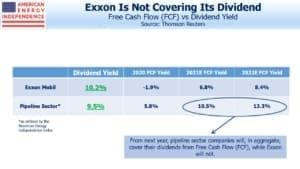

Pipeline investors often must consider the viability of a company’s payout policy. The Alerian MLP ETF, AMLP, has cut by 50% since 2014. Although Energy Transfer (ET) just did the same early last week, the pipeline sector is entering a period of sharply rising Free Cash Flow (FCF). The trend towards reduced spending on new projects was well underway before Covid hit this year.

Energy has been chronically out of favor, so XOM and the American Energy Independence Index have tracked one another lower. Although the pipeline sector and XOM are both forecast to experience growing FCF, pipeline dividends will be comfortably covered by FCF while XOM’s will not, at least with current crude oil pricing. XOM offers a way to bet on higher crude. By contrast, pipeline stocks look cheap regardless.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Next Wednesday, November 4th at 1pm EST we’ll be hosting a post-election webinar to discuss the outlook for the energy sector. Click here to sign up.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!