Banking Crisis Means More Inflation Risk

/

Investors have reacted to the aftermath of Silicon Valley Bank’s (SVB) failure by assuming tighter credit conditions. This makes sense over the near term. The US banking system has been increasing duration risk, and while SVB was more reckless than most they were not alone.

Piling into long term government bonds and mortgage-backed securities required minimal amounts of capital because interest and principal are guaranteed. In perusing the Fed’s most recent stress tests, it’s clear a sharp jump in interest rates wasn’t given much consideration. Guided by the 2008 financial crisis, regulators focused on a sharp drop in equity markets, real estate and employment along with widening credit spreads.

In the interest rate stress test scenario, US interest rates are modeled to increase from 0.12% to 0.52% out along the yield curve. Regulators clearly focused on a slump in economic activity. The worst they could conceive of the bond market was a steepening of the curve led by falling prices on longer maturities. Stress scenarios largely assume an event is followed by accommodative policy.

There is no stress test remotely like the past year. An upside inflation surprise doesn’t appear anywhere.

Consistent with fighting the last war, an inflation stress test scenario will be added, designed along the lines of what we’ve just experienced. When implemented, it will force banks to reduce their tolerance for funding long term bonds with short term liabilities. It doesn’t matter whether those deposits are guaranteed by the FDIC or not – the rates banks pay will have to be more competitive than in the past.

The Fed is still in crisis mode, but a post-mortem is bound to expose the absence of co-ordination between the Fed’s setting of monetary policy and its impact on the banking system it regulates. The most recent FOMC minutes note that, “Vulnerabilities associated with funding risks were characterized as moderate.”

Elsewhere the minutes say, “Several participants discussed the value of the Federal Reserve taking additional steps to understand the potential risks associated with climate change.” It looks as if this was more important to them than the drop in Tier 1 capital ratios across the US banking system from 15.6% to 13.4% during 2022.

Silicon Valley Bank still has no buyer, and its parent Silicon Valley Bank Group filed for Chapter 11 bankruptcy protection on Friday. We’re unlikely to see a repeat of the Great Financial Crisis (GFC) of 2008-09 when the strong bought the weak – such as JPMorgan buying Bear Stearns and Washington Mutual, and Bank of America buying Countrywide.

By 2018 the banking industry had paid $243BN in fines related to the GFC. Bank of America paid $76BN, and JPMorgan $44BN, largely related to actions by the companies they had acquired in the lead up to the GFC.

For these two and other “too big to fail” banks, placing several $BN on deposit with Republic National Bank is much less risky than buying them. It’s doubtful any bank in distress could find a commercial banking buyer because the Fed isn’t empowered to issue immunity from subsequent lawsuits.

I was working at JPMorgan in 2008 at the time of the Bear Stearns acquisition. CEO Jamie Dimon described it as doing the right thing for America, because JPMorgan was in a position to help. His sentiments were not reflected in subsequent regulatory actions or litigation. He’s been very clear that he would not do the same thing again.

Testifying on recent events before Congress will be uncomfortable for Fed chair Powell. If there isn’t a pause in the cycle of rate hikes it’ll just confirm how out of touch they are. Banks need some time to rebuild their capital. Further tightening of monetary policy won’t help. With the focus shifted from inflation and the Fed forced to adopt more cautious changes in monetary policy, medium term inflation risk has gone up. Blackstone’s Larry Fink wrote in his recent annual letter that inflation is, “more likely to stay closer to 3.5% or 4% in the next few years.”

Infrastructure, especially in the energy sector, offers the potential to protect investors since around half the sector’s EBITDA is derived from inflation-linked contracts, according to research last year from Wells Fargo.

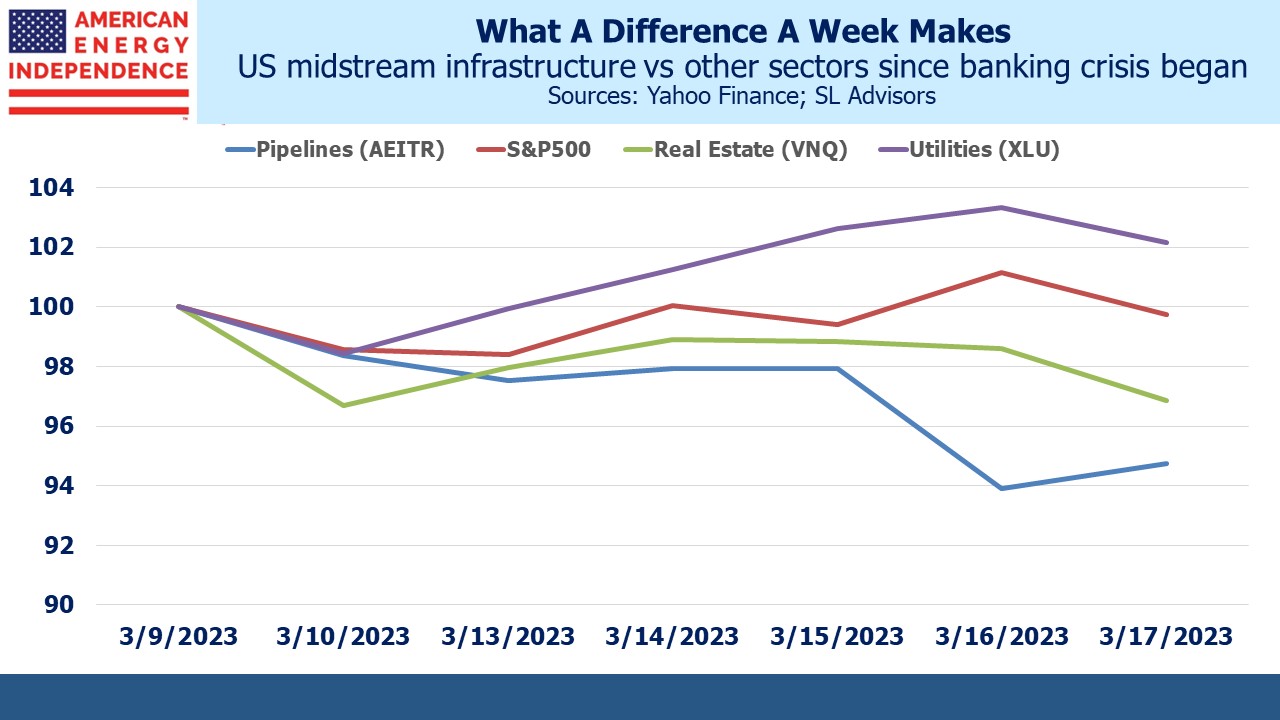

The sector has dropped too far in response to recent events. At a time when bond yields are declining the dividend stability of pipeline companies looks more appealing to us.

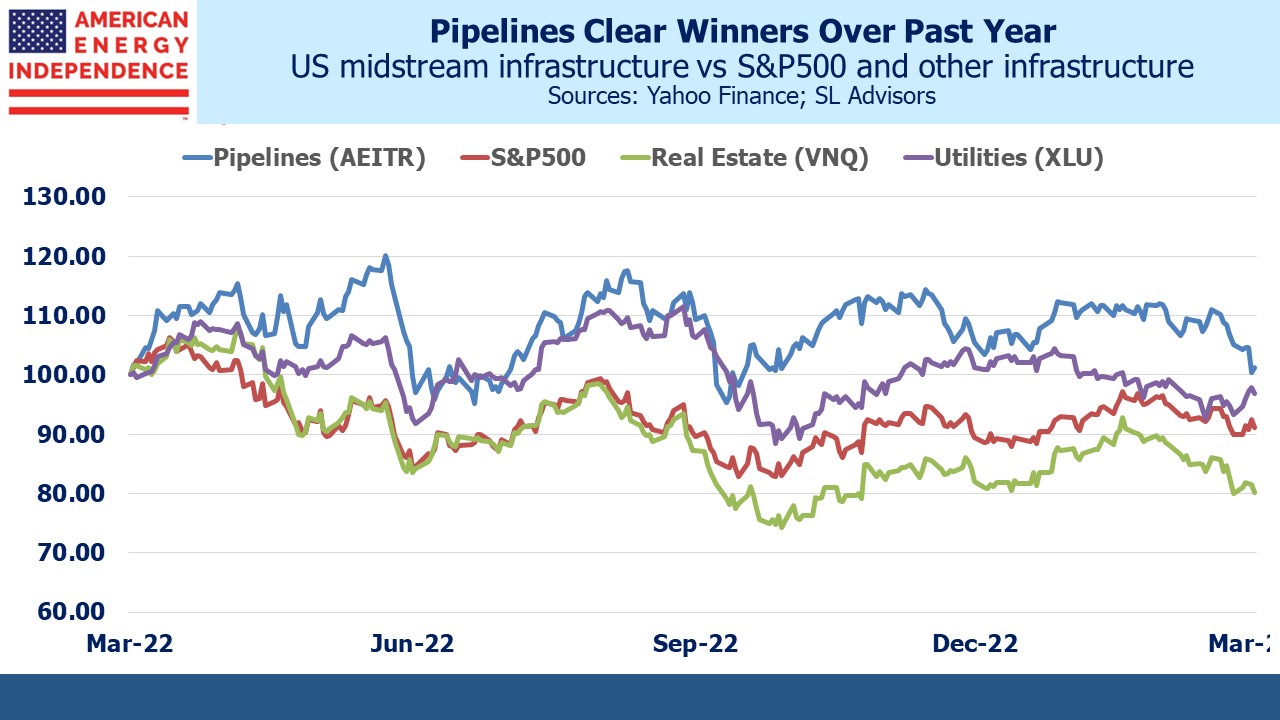

Over the past year pipelines have easily beat the S&P500 and other infrastructure such as real estate and utilities. The past week has seen a minor reversal. And yet, the case for inflation protection has never been stronger in the past 40 years.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It is horrifying that some Fed members raised climate change in the current economic environment–or in any economic environment for that matter.