The Fed Pivots To Financial Stability

/

Commercial banks have long benefited from depositor lethargy regarding rates. Although we now have a de facto guarantee of all commercial banking deposits, not just those up to the $250K threshold, customers are likely to pay a little more attention to return and risk, which will force banks to be more competitive.

On the asset side, capital rules that favor riskless US treasuries have encouraged banks to load up on longer maturities. Although a return of interest and principal is guaranteed, a profit is not when funded with floating rate debt. Regulatory scrutiny of banks’ duration risk will follow given the hit to capital ratios since the Fed started their belated, and therefore hurried, tightening a year ago. Bond purchases will be less eager, although the drop in rates caused by Silicon Valley Bank’s collapse has boosted bank portfolios.

The combination of having to pay more for deposits while being more cautious in taking risk represents the tightening of financial conditions long sought by the Fed. The consequences won’t be clear for months – under the circumstances a hike next week must seem imprudent. The path of monetary policy has correctly repriced to peak lower, and perhaps immediately.

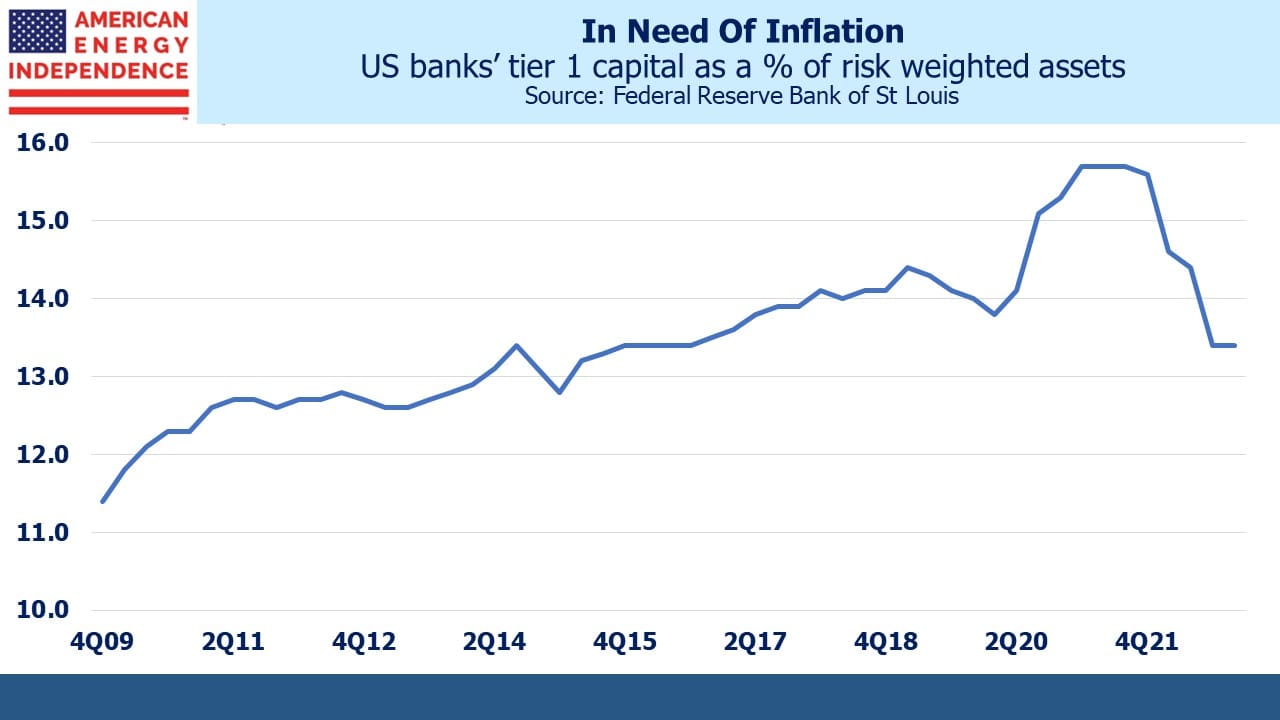

The unwitting creation of tighter financial conditions the Fed’s rapid hikes caused now needs time to percolate. Monetary policy is best implemented slowly with few surprises. We’re seeing why. Tier 1 capital ratios for the US banking system fell by an unprecedented 2.6% last year.

The Fed interprets its twin mandate of achieving maximum employment consistent with stable prices as addressing whichever of the two metrics is farthest from target. The 2019 Jackson Hole symposium sought greater employment at the tolerance of higher near-term inflation because this was stubbornly low.

Last year’s pivot was late because of their disbelief that elevated inflation was entrenched.

But sitting atop the Fed’s twin mandate is an overarching responsibility for financial stability. Assuring that now takes priority.

What’s unfolding is a significant regulatory failure – the Fed leads banking oversight and failed to make the connection between countering inflation and the financial system it oversees. As a result, they’re relying for now on suddenly lost confidence in regional banks to slow inflation since the previously communicated rate path is untenable. Not for the first time, the blue dots on the FOMC’s Summary of Economic Projections (SEP) will need to be revised towards market forecasts.

All it would have taken was a speech by Jay Powell eighteen months ago warning that banks’ increased duration risk was going to receive greater scrutiny from regulators. Under Powell’s leadership the Fed can claim credit for low unemployment but little else. It’s often said that tightening cycles continue until the Fed breaks something. They have.

What this means for investors is that inflation risk has risen because it’s no longer the Fed’s primary concern. The rising share of Federal expenditures taken up by interest on our debt (see How Tightening Impacts Our Fiscal Outlook) will, over time, impact the conduct of monetary policy.

But the banking system’s exposure to interest rate risk presents a more immediate consideration. Industry Tier 1 Capital as a percentage of risk-weighted assets fell from 15.6% to 13.4% last year, arresting a steady trend towards a better capitalized industry begun after the 2008 Great Financial Crisis (GFC). Not every bank has JPMorgan’s fortress balance sheet, and markets have quickly identified the weak ones.

Capital ratios are now a consideration for monetary policy. The rate path indicated by the blue dots in the last SEP would likely hurt capital ratios further, so that’s no longer an option. The months ahead will determine whether the Fed’s done enough. FOMC members routinely make speeches about awaiting actual evidence of moderating inflation before slowing tightening. Circumstances now dictate that they must pause and await developments.

Yesterday’s CPI report exposed the Fed’s dilemma. Even though it showed that inflation remains elevated, tightening next week is hard to justify given recent events. Shelter was also a significant factor and this element provides a flawed reading of the housing market that lags behind actual developments by at least a year (see The Fed Is Misreading Housing Inflation). The FOMC might be relieved to explain this away as not indicative of underlying trends.

For now inflation expectations remain sanguine. Ten year TIPs imply 2.3% CPI over the next decade, not much changed since last summer. For those unconvinced that price stability will return so easily, energy infrastructure offers 5-6% yields from companies whose cashflows are linked to inflation via tariff price escalators.

The case for infrastructure, particularly in the energy sector, remains as strong as ever.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!