The Coming Squeeze On Bank Deposit Rates

/

An Op-Ed in the Washington Post last week suggested that unrealized losses on fixed income investments are likely much higher than the $640BN on held to maturity MBS. It was written by Sebastian Mallaby, who wrote about hedge funds in More Money Than God and has published several other finance books.

Mallaby relies on two recent academic papers which add interest rate exposure on loans to the MBS unrealized losses. Not much data is publicly available on duration risk in bank loan portfolios. Based on the reasonable assumption that loans have an average duration of 3.9 years, the academic papers Mallaby cites estimate US banking system mark-to-market losses of $1.7TN-$2TN, against a capital base of $2.2TN.

These staggeringly big numbers are theoretical and unrealized. Banks are not going to recognize losses anything like that. That’s not to say this isn’t going to be a problem.

It’s worth remembering how we got here. Since Quantitative Easing (QE) was first unleashed in the 2008 Great Financial Crisis (GFC), the Fed has generally found it easier to grow its balance sheet than shrink it. Their huge bond portfolio has depressed government bond yields, which are the benchmark from which all other fixed income securities are priced. The MBS and loans on bank balance sheets mostly originated within the last few years. From mid 2019 until early last year, the ten year yield was below 2%.

Bankrate.com calculates the average rate paid on savings accounts is 0.23%. The Federal Reserve Bank of St Louis calculates 0.35%. Depositors are normally a lethargic bunch but have been galvanized into action by Silicon Valley. Flight from shaky institutions is the current fear, most vividly represented in First Republic’s collapsing stock price. But this problem will likely be solved with a system-wide guarantee on all deposits, not just those under the FDIC $250K threshold. That is de facto government policy today having found Silicon Valley Bank to be systemically important. As the “too big to fail” tent gets bigger, the moniker no bank will want is “small enough to fail”. This is why Treasury Secretary Janet Yellen announced more support for small regional banks.

QE didn’t just help cause a housing bubble, it’s also weakened the banking system. Applied on a sustained basis, QE left them with little choice but to buy bonds and make loans at rates that only prevailed because of the Fed’s enormous portfolio.

Today’s inverted yield curve shows that the problem still exists. Ten year treasury yields are 1% below the Fed Funds rate.

That makes this week’s Fed announcement more important than most, because it’ll reveal how well they understand the banking system’s sensitivity to the funding costs of their vast portfolios of bonds and fixed rate loans that are theoretically underwater. If they regard the depositor run as localized and temporary it’ll mean higher rates to quell inflation remains their primary objective. This will put further pressure on net interest margins.

Held To Maturity (HTM) accounting has once again come in for criticism. The CFA Institute (I sit on the board of the Naples, FL chapter) thinks “hide to maturity” accounting should be abolished because it obscures information investors need. This was considered after the GFC but rejected in 2010 as adding unnecessary volatility to bank financial statements. The information is there if investors choose to look. The problem is that depositors rarely feel the need to consider creditworthiness.

Depositor inertia is what’s under threat. Last year Charles Schwab changed their sweep feature on brokerage accounts to make Charles Schwab Bank the default choice for cash rather than money market funds. Banks routinely pay paltry deposit rates, and this quiet change boosted Schwab’s profitability. We duly adjusted client accounts to hold treasury securities.

This is the real threat facing the banking business model, not depositor runs which are solved relatively easily with a blanket guarantee.

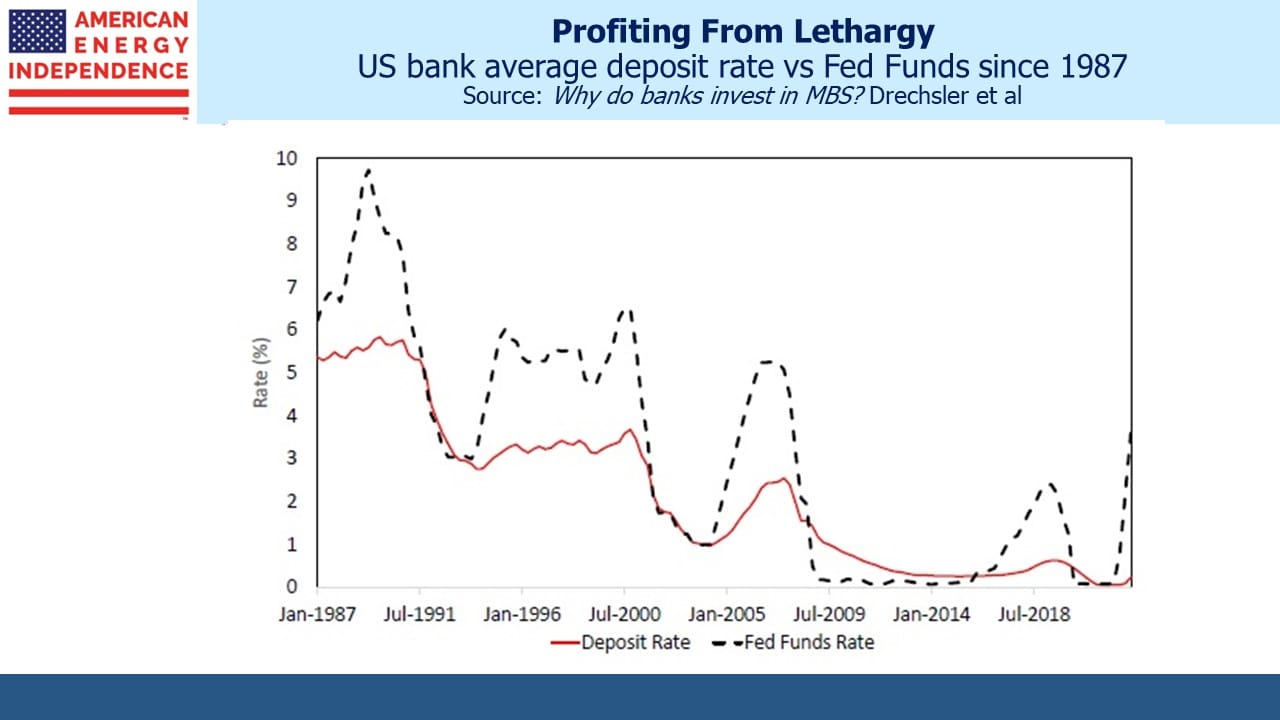

Three academics recently asked Why do banks invest in MBS? in a paper published earlier this month. They include a chart showing how inadequately deposit rates rise during tightening cycles. This captures the banking system’s vulnerability. Deposit rates lag because of inertia among savers. There’s nothing like a banking crisis to make you pay attention to where your money is. Depositors are likely to become more sensitive to savings rates.

Notwithstanding turbulent markets, the case for higher commodity prices remains intact. Goldman’s Jeff Currie believes the commodities supercycle will take oil prices higher by June. Hedge fund manager Pierre Andurand expects oil to reach $140 by year’s end. Citadel’s head of commodities Sebastian Barrack doesn’t expect any long-lasting pressure on commodities.

Inflation risks haven’t meaningfully fallen, but the Fed’s flexibility to confront them has to be balanced with the poor interest rate decisions made across much of the US banking system.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!