Year-End Roundup

Heading into year’s end, a number of interesting stories caught my attention. Energy Transfer (ET) rarely avoids conflict and is embroiled in a dispute with three pipeline developers in Louisiana who sought crossings over Gulf Run Pipeline, owned by ET. Momentum Midstream, one of the developers with a $1.6BN project, accused ET of unfair trade practices. ET has also sought temporary restraining orders against Williams Companies and DT Midstream.

Pipelines routinely have to cross over or under each other as they crisscross the country. Momentum argues that without competition, ET could control up to 80% of the pipeline capacity supplying LNG exports in Louisiana. ET argued that the crossings sought were numerous, threatened pipeline safety and disregard ET’s exclusive ownership over certain stretches of land.

A court ruling is awaited. ET’s well-earned bare-knuckle approach to business hasn’t hurt the stock, +27% this year.

Morgan Stanley continues to report attention around the Alerian MLP Infrastructure Index (AMZI), which AMLP tracks (albeit not very well). The shrinking pool of MLPs is causing AMZI to be more concentrated and even to move beyond midstream infrastructure by incorporating USA Compression Partners, LP. At their recent rebalancing, AMZI publisher Vettafi retained the 12% position cap. Morgan Stanley continues to warn that AMZI might eventually relax its 12% cap or, more radically, AMLP might adopt a RIC-compliant index which would limit its MLP holdings to 25% (versus 100% now).

Such changes could create turmoil in MLP names. But Vettafi could also do nothing, reasoning that if investors didn’t like the fund’s current structure they wouldn’t own it.

Kinder Morgan’s (KMI) prescient sale of the TransMountain (TMX) pipeline project to Canada’s federal government in 2018 (see Canada’s Failing Energy Strategy) looks better every month. Facing unexpectedly hard rock, TMX recently asked the regulator for permission to drill a smaller-diameter pipe through a 1.4 mile section. The regulator turned them down, causing TMX to warn of a further two year delay if they are forced to proceed with the wider diameter. Canadian Natural, the country’s biggest oil producer, has urged the regulator to give its approval. Meanwhile the Trudeau administration approved another C$2BN in loan guarantees for a project quickly exceeding triple the cost anticipated when KMI made its well-timed exit.

A drought in Panama has impeded ship traffic through the canal in recent weeks. This is because the locks rely on supplies of inland fresh water to operate. As a result, Chile and some Asian buyers have reduced their imports of US gasoline from the gulf coast, depressing prices. The alternative route around the tip of South America is more costly and slower. Interestingly though, an LNG executive recently told us that Panama sets the canal tarrif close to the break-even point for ships considering the alternative. For US LNG exports to Asia, this suggests that the long route takes longer but doesn’t cost that much more.

In Oklahoma, fans of David Grann’s Killers of the Flower Moon will have been fascinated to see the Osage Nation win a victory against a wind farm built by Italian energy company Enel. A decade-long legal fight was settled when U.S. Court of International Trade Judge Jennifer Choe-Groves ruled eighty wind turbines had been illegally built. They have to be removed. You can find a more complete telling of this unusual tale here.

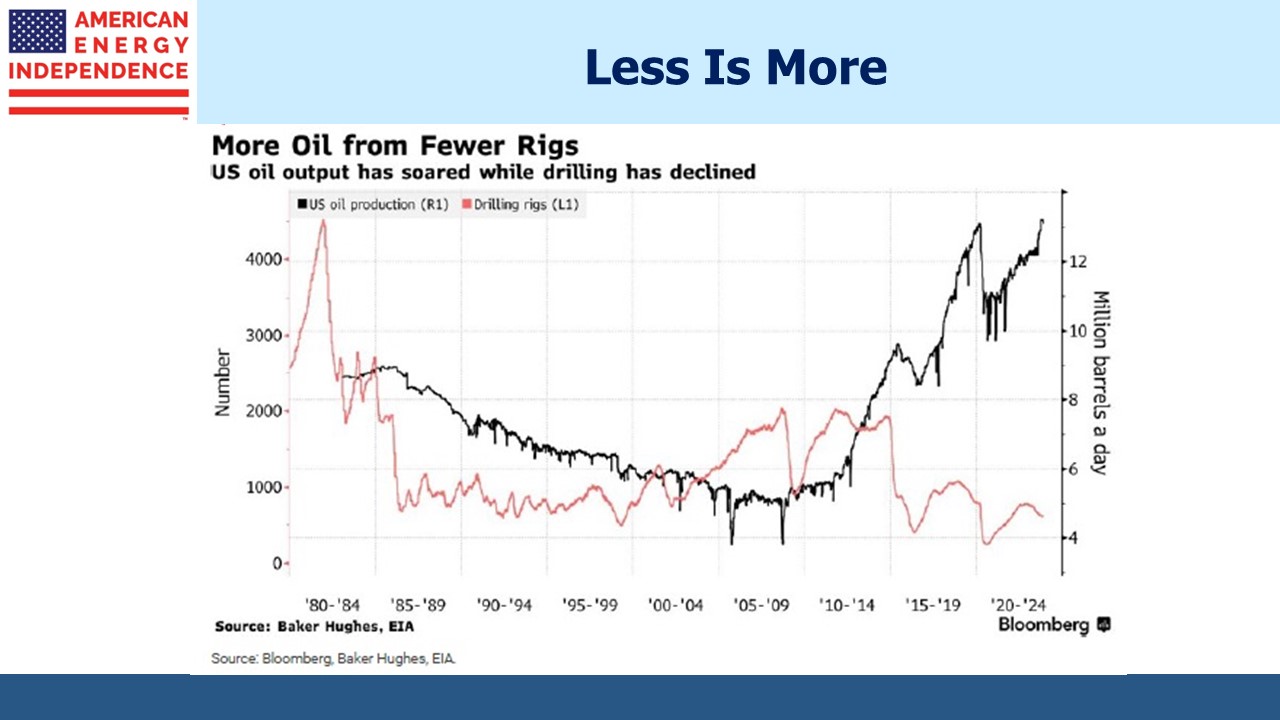

We know oil production has become more efficient over the years, but this chart of rigs versus production back to 1980 is a compelling visual. Few forecasters saw US oil production reaching a new high this year. But it did.

Finally, the slowdown in US EV sales continues to draw unwelcome news coverage. They’re still growing, but at a declining rate. EVs are also taking dealers about three weeks longer to sell than conventional cars. Sales tend to be concentrated in blue counties and states. Across the US EVs have an 8% market share, but in California it’s 24%. In Michigan it’s 3%.

The Administration wants to require that EVs represent 2/3rds of all automobile sales by 2032. Canada is planning to require all auto sales be zero emission by 2035.

The EPA estimates that the typical passenger car emits about 4.6 Metric Tonnes (MT) of CO2 per year. The Inflation Reduction Act values CO2 pulled out of the ambient air and permanently buried via Direct Air Capture (DAC) at up to $180 per MT in tax credits. This is enough to have encouraged Occidental to build the world’s biggest DAC plant and CEO Vicki Hollub is bullish on the technology.

It looks as if public policy is to force EV adoption by making conventional cars scarce. But if you’d prefer to own just one car, not two like most EV owners I know (a regular one for long journeys), a carbon tax based on 2X the DAC credit would impose a $1,656 annual cost on the owner of a gas-powered car. Some would willingly pay that for the convenience of easy refuelling and assurance that inadequate charging infrastructure wouldn’t force them to have their EV transported back home on a truck.

I would be one of those people willing to pay the $1,656 annually. It’s why a carbon tax would be better than the current method of subsidies, tax credits and regulation. It gives people a choice.

We have three have funds that seek to profit from this environment: