Williams Companies Promotes the Little Blue Flame

Last Thursday Williams Companies (WMB) held their investor day in New York. WMB owns and operates an extensive natural gas network, and is a top ten U.S. midstream energy infrastructure company. Like most big pipeline companies, it’s omitted from the Alerian MLP indices because it’s not an MLP. CEO Alan Armstrong conceded that the company had in recent years become too closely identified with the oil business and fracking. He said they need to refocus attention on the little blue flame in every kitchen’s stovetop, emphasizing a cleaner, more positive message.

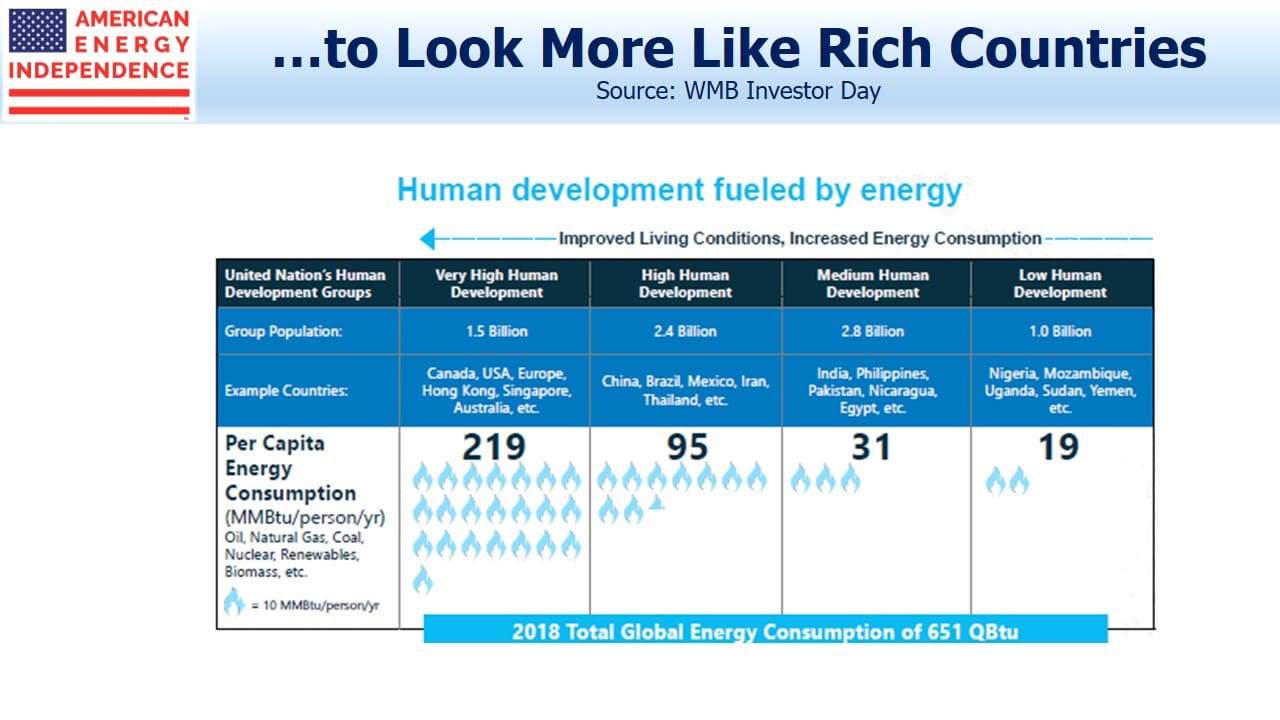

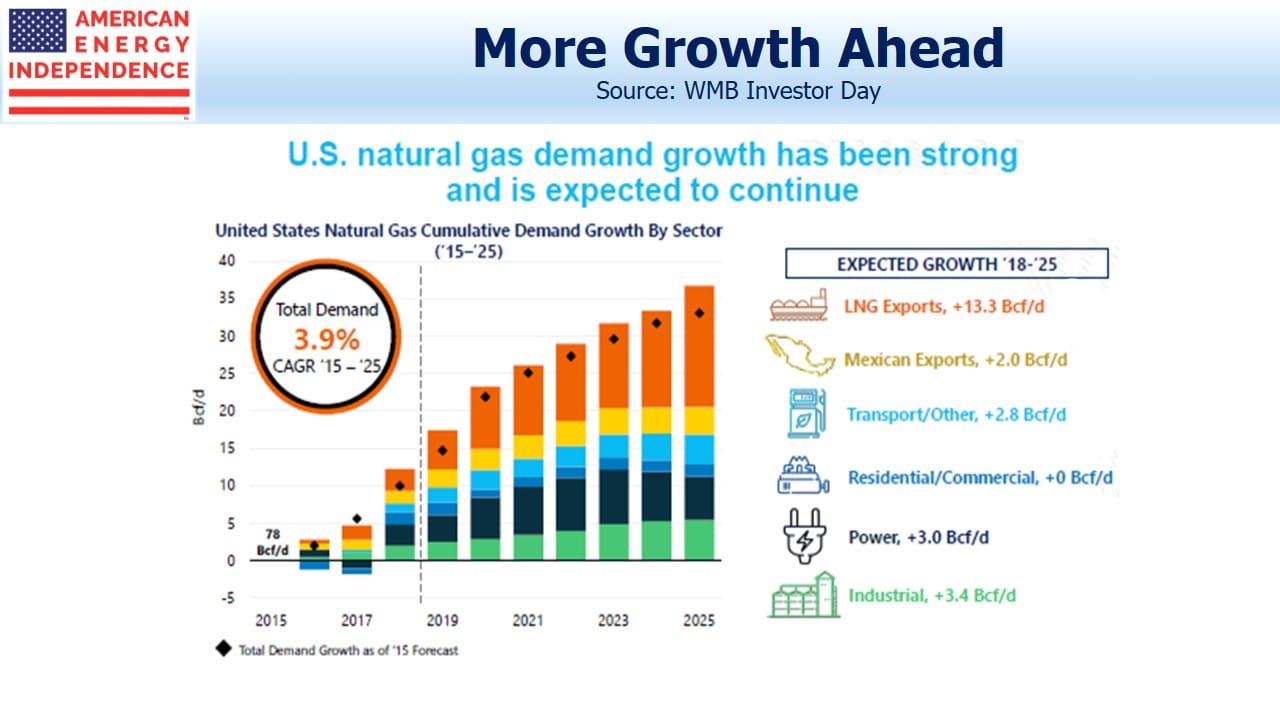

Their presentation opened with some useful slides on the long term, global outlook for natural gas. Although most investors in this sector follow crude oil prices because they drive sentiment among energy investors, our investments are more focused on natural gas because it’s the cleanest burning fossil fuel and we believe has a clearer growth path over the next several decades.

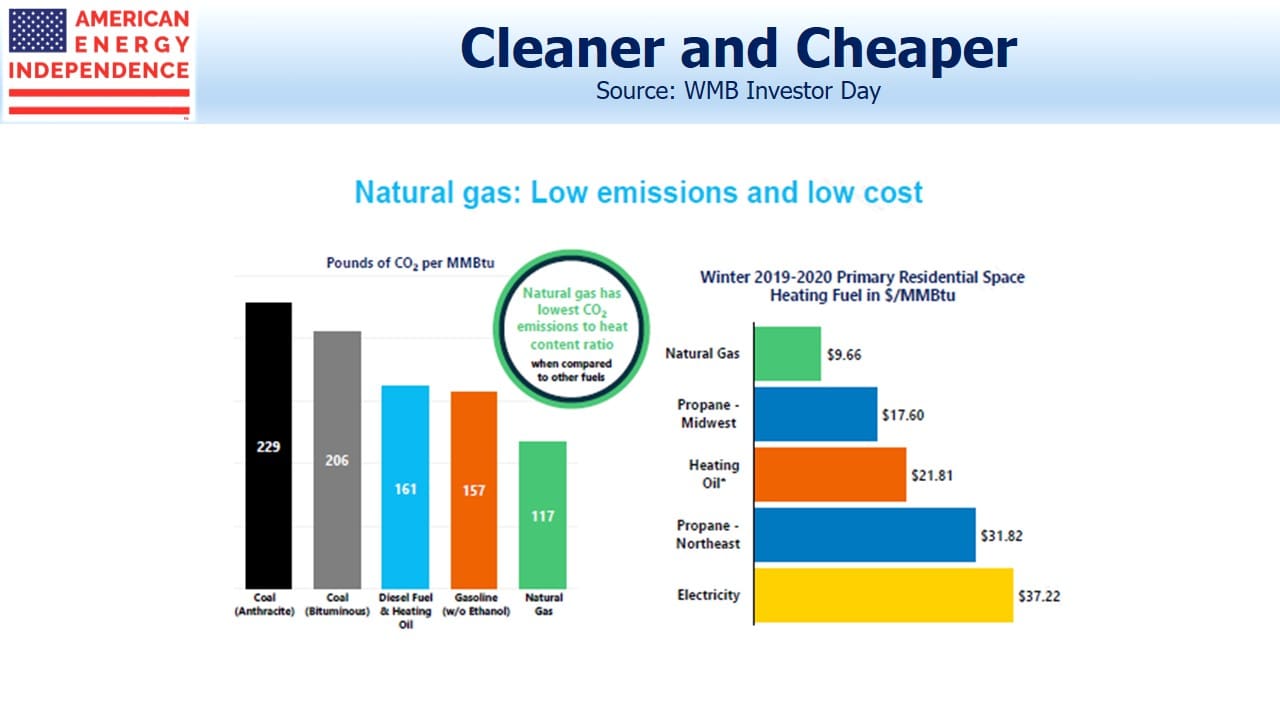

The Shale Revolution has produced an abundance of natural gas in America, which means that it’s not only cleaner than other fossil fuels but also the cheapest form of residential heating. So far, the benefits of this abundance have flowed to the consumers of cheap energy and not the producers, as energy investors know well. Figuring out how to better monetize America’s energy renaissance consumes management teams and investors.

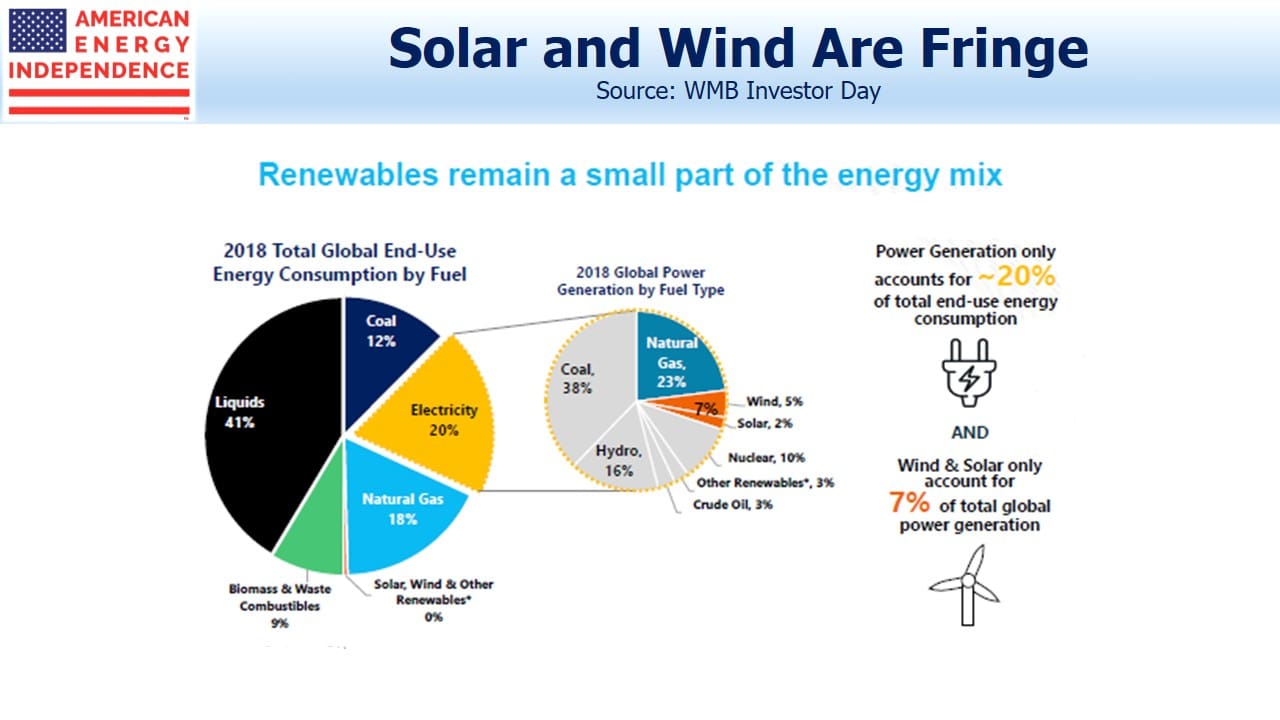

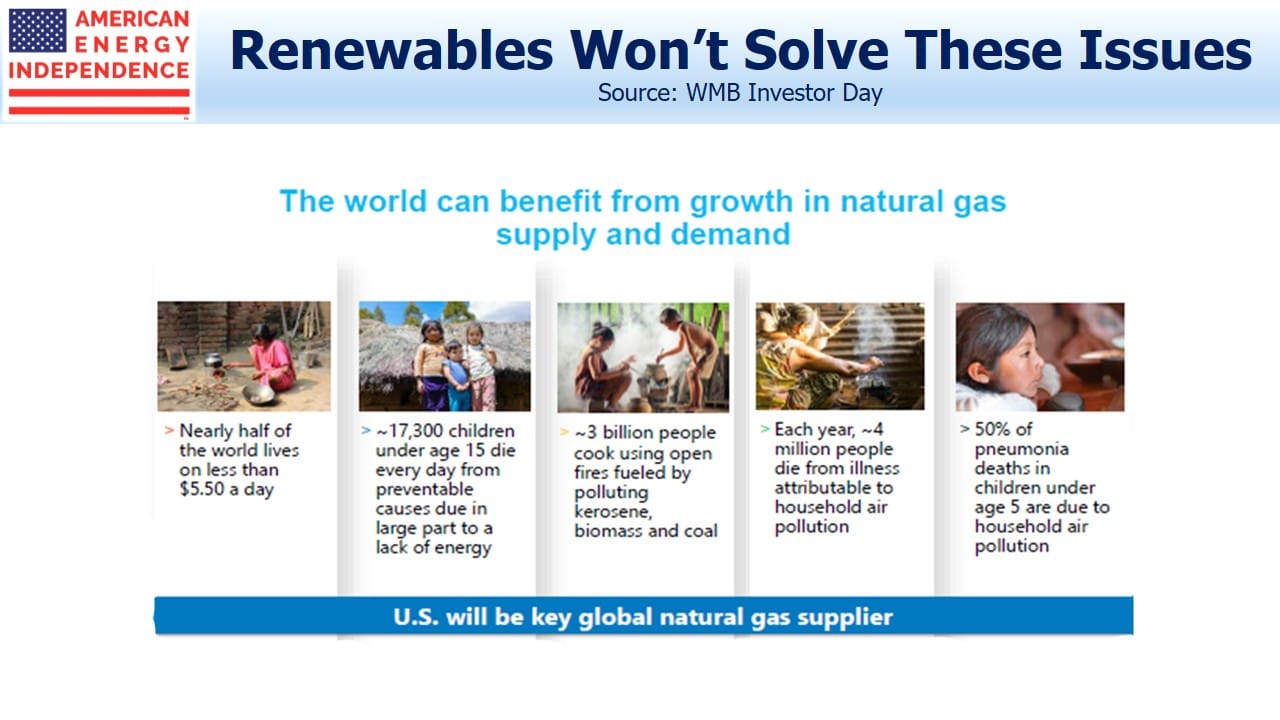

Substantial press coverage is focused on climate change and the opportunity of renewables to impede global warming. Solar and wind remain fringe sources of overall energy, a statement often regarded as incendiary by climate extremists but easily supported in the above chart. Electricity is 20% of global end-use energy consumption, with solar and wind providing 2% and 5% respectively. So at 7% of power generation, which is itself 20% of global energy use, they’re 1.4% of the total. Natural gas substitution for coal has been far more effective in lowering emissions, and attracts thoughtful advocates for cleaner energy.

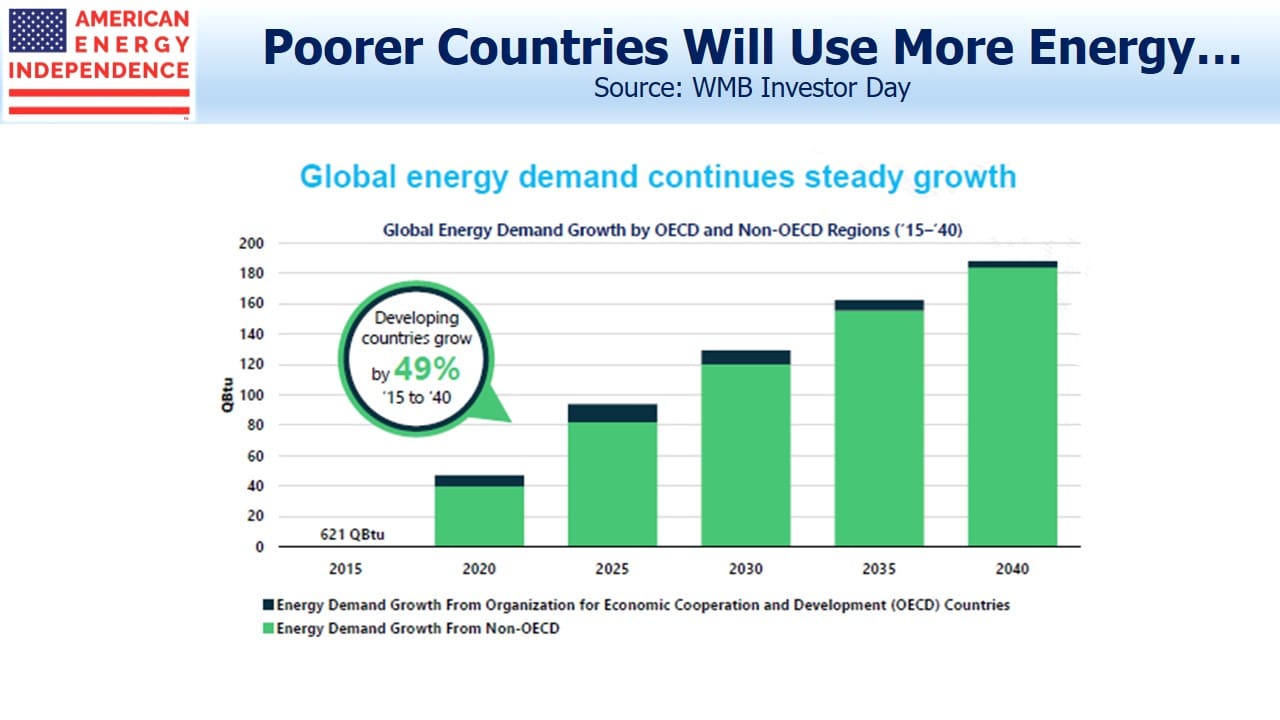

An estimated 17,300 children younger than 15 die every day because of insufficient access to energy, according to UNICEF (the United Nations Children’s Fund). The moral high ground is solidly occupied by those engaged in providing more energy to poor countries, including investors in WMB. Climate extremists impede this progress, and offer no solutions. Their warped, Malthusian philosophy cares little for today’s human suffering.

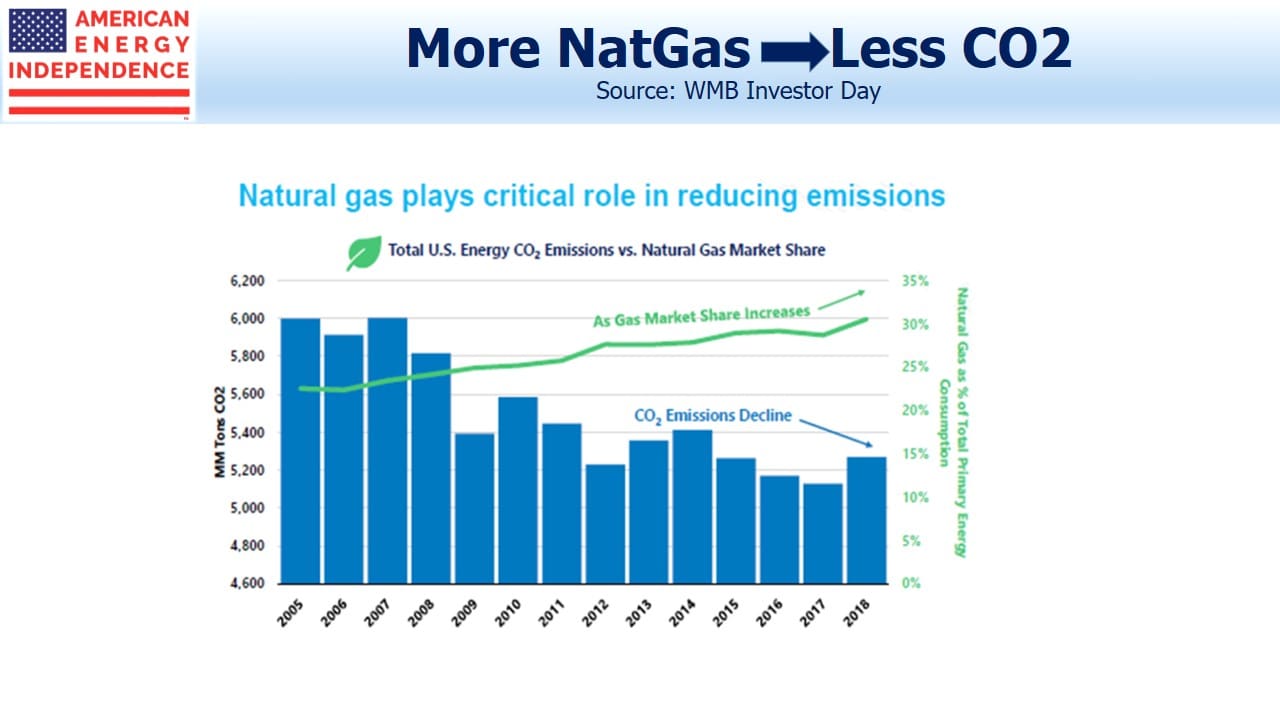

Global energy consumption is going to continue increasing, because it drives higher living standards which are desired by at least half the world’s population. Non-OECD countries are forecast to increase their energy demand by half over the next twenty five years. Any serious impact on emissions will turn on the form in which this increased energy is delivered. China is the world’s biggest polluter and consumes half the world’s coal. If natural gas replaced all the world’s coal, it would lower CO2 emissions by 17%, an enormous change. The world isn’t about to make such a bold move, but because natural gas is expected to fulfill 45% of global demand growth through 2040, its gain in market share is contributing to a cleaner planet.

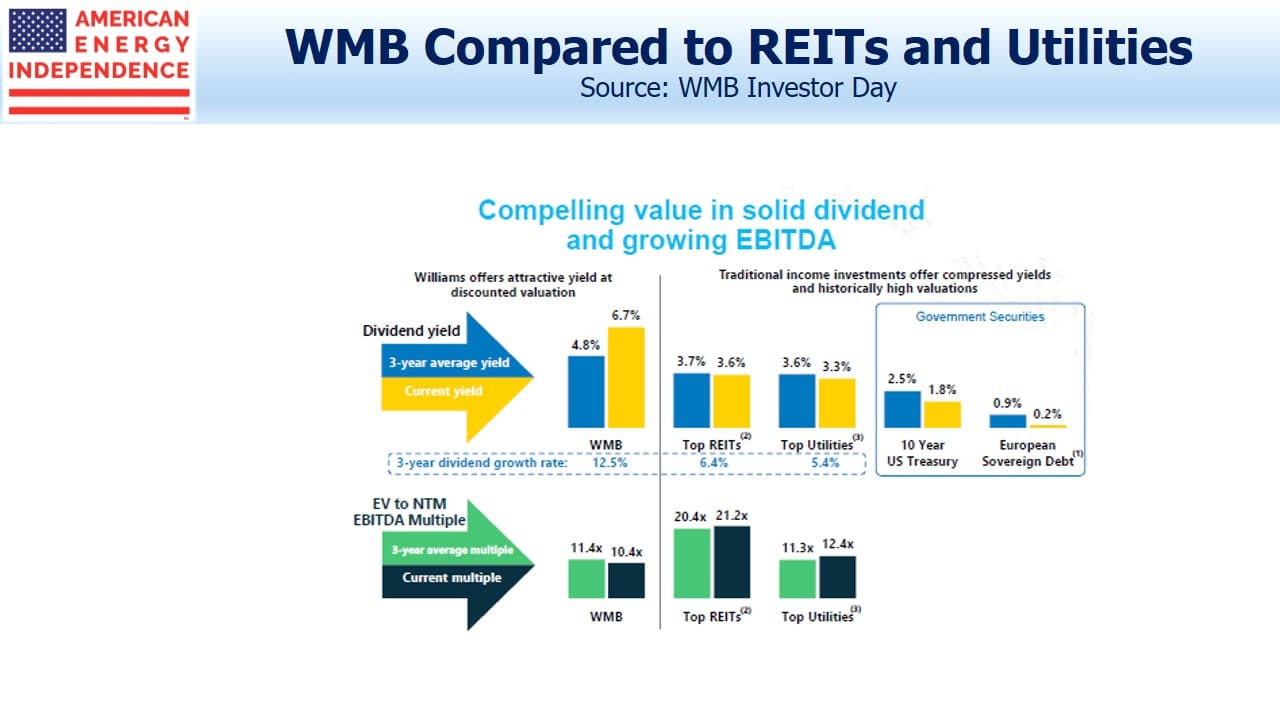

Finally, we show a slide on valuation. Valuation metrics such as Enterprise Value/EBITDA and yield have become less attractive for REITs and utilities in recent years, while they’ve moved in the opposite direction for midstream energy infrastructure. Investors know this well, but the macro outlook for natural gas must surely mean that a company such as WMB, positioned as well as anyone to profit, is cheap and should be substantially higher.

We are invested in WMB.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Thank you for the comments on Williams investor day. Were there any company comments or do you have any insights on their financial sensitivity to continued low nat. gas prices; especially exposure to Chesapeake ? If I remember correctly the two firms renegotiated terms a couple of years ago, WMB got some upfront cash in return for taking more commodity price risk. Now nat. gas prices seem stuck in mid $2’s/mcf and CHK share price is <$1/share with going concern risk.

It seems to me that many WMB slides are all about growing natural gas volumes and demand without key details about commodity price sensitivity of the WMB business model. That is something that I think the company should calculate and communicate. Peer Kinder Morgan does this for investors. Right or wrong, I have in mind WMB exposure to CHK as a key risk over last couple of years and the travails of CHK have kept me away. (Though I own WMB though sector funds)

I am also concerned and find it very misleading that the company seems to proudly tout recent asset sale multiples and recent capex rates of return while ignoring the massive writedowns in recent years on some acquired and older assets. The company and investors need to look at returns on capital across the portfolio. I think those ROIC returns are around a middling 6%. And with all the moving parts, I cannot tell if ROIC will be getting better or worse.

Mike, on natgas price sensitivity, they did comment that NT weakness can affect volumes somewhat, but that also stimulates demand. They didn’t offer much detail beyond that. KMI’s oil sensitivity related to their EOR business which does have direct price sensitivity, so somewhat different. No question WMB has overpaid for assets in the past, including Access Midstream. CHK is 8% of their business. They noted that many CHK wells are JV’d with PE, so in cases where CHK wishes to spend less on production the JV partner can take disproportionate share and adjust split of remaining reserves as a ppropriate.

In regard to CHK, on the Q&A section of the presentation beginning at about 3:10:00, CHK was discussed. Managment was confident that they would be paid because they provided the gathering and no gathering implies no gas to sell. To paraphrase management, WMB has be stiffed on NGL pipes, etc, but never in gathering.

Unmentioned, I think, is expected revenues from off-shore tie-ins with the natural gas from the GOM. I think revenues are expected in 2011. There will be very little cap ex for the tie in.

klee12

Simon….it appears that the moral high ground claimed by the climate extremists may be flawed as they conveniently step over the bodies of those that need engery to survive. Ron Guggemos

Nice comment!

“environmental extremists”, “looney left”. The blatant pandering to AGW denialists and ecocidal Trumptards was brilliantly displayed in your talk about natural gas flaring. Your comments provide strong anecdotal evidence for the near-perfect negative correlation between intelligence and Republican identification. Well done.

>RE: Renewables won’t solve these issues

The issue of people cooking with wood or biomass is currently being addressed by the use of solar ovens. There are workshops being done in certain countries to show people how to build solar ovens with cheap materials.

Thanks for the informative article on this new promotion. We appreciate up-to-date and reliable information. Keep up the great work!