Enlink’s Growth Plans Need Better Justification

Energy investors would still like to see less spending on growth projects than company executives are pursuing. Whenever a CEO announces new spending, there’s a palpable lack of enthusiasm. Given valuations, many companies could easily justify buying back stock as a higher return use of capital than building new infrastructure. The message is getting through, but not quickly enough in the opinion of many.

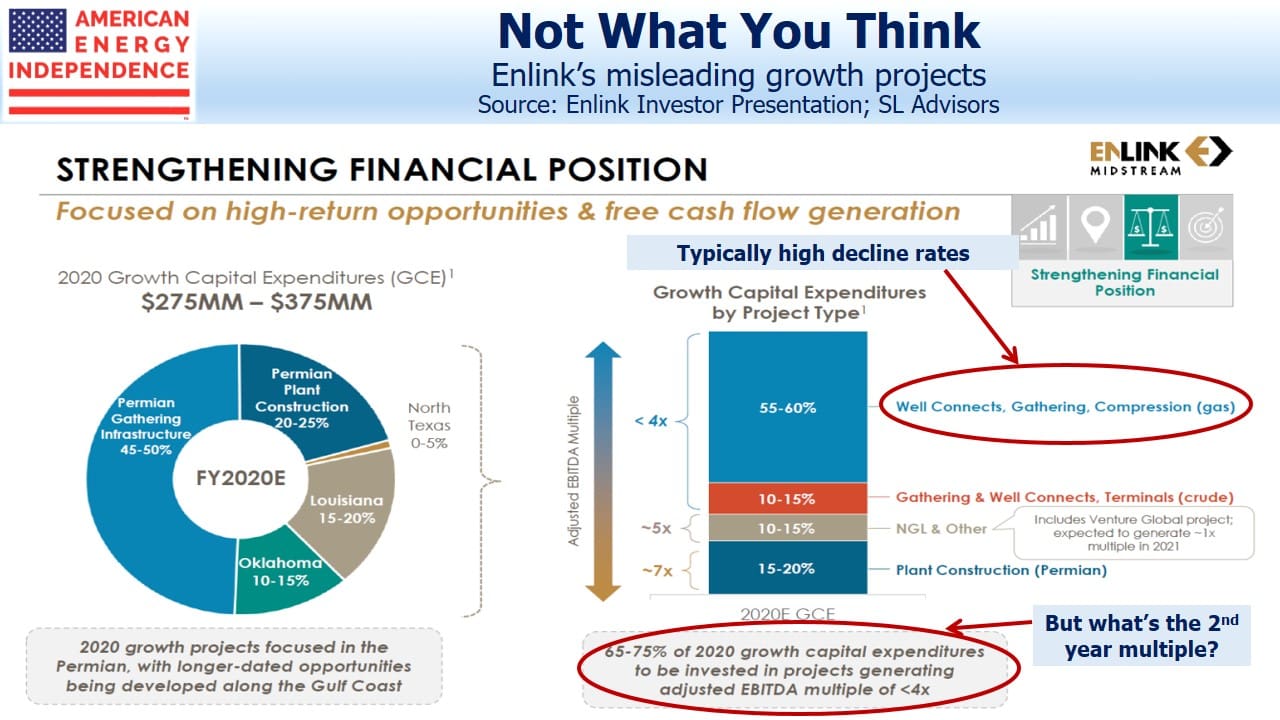

Part of the problem is the way companies present their growth plans. A recent investor presentation from Enlink (ENLC) illustrates the problem. Their 2020 Growth Capital Expenditures (“capex”) are listed as $275-375MM. The collapse in ENLC’s stock price this year has driven their dividend yield up to 25%, a lofty level they plan to maintain. Since stock repurchased would therefore generate a 25% return as they claim DCF coverage >1X, it’s hard to believe they carried out a rigorous analysis on where they plan to invest cash that clearly won’t be used to buy back stock. Theoretically, their capex plans will yield a higher return that their stock, the implausibility of which casts further doubt on their capital allocation.

However, the problem with the presentation is the focus on EBITDA multiples to illustrate the attractiveness of their capital program. Over two thirds of their projects will generate an adjusted EBITDA multiple of <4X. In other words, $100 invested will generate better than $25 of EBITDA.

By coincidence, ENLC’s projects offer a return similar to their dividend yield, perhaps justifying them as a better use of scarce funds rather than buybacks. But over half the projects are for natural gas well connects, gathering and compression. These are not long distance transportation pipelines, but narrow lines running to individual wells. Their volumes will begin strongly and deplete as output from the wells they’re servicing depletes.

The point is that projects should be evaluated on an NPV basis, taking account of all the future cashflows. An EBITDA multiple is a shorthand way of comparing projects, and only makes sense when that EBITDA is stable or growing. ENLC’s CFO presumably doesn’t assess projects that way.

The types of project ENLC is planning have declining EBITDA. Including them in their presentation the way ENLC does creates a misleading impression of highly attractive investments. When we asked ENLC about the absence of any decline assumption in their own capex guidance, they referred us to Devon Energy’s (DVN) comments on the issue. DVN is the big customer whose production ENLC’s capex are intended to service. DVN has forecast production declines rates from “high 20% to high 30%”. DVN isn’t claiming that production will be stable. So why is ENLC using the first year’s cash flow to justify the capex in its presentation?

ENLC must know that presenting an investment based on the first year’s cashflow doesn’t fairly present the longer term outlook. They should either model the EBITDA over several years to show the decline rate they expect, or present the NPV analysis that they’ve presumably done internally before committing capital. A cynic might believe ENLC is doing projects with a negative NPV because the first year’s EBITDA flatters their leverage ratio, temporarily boosting EBITDA and thereby lowering Debt:EBITDA.

Energy companies are being criticized for poor capital allocation – a more transparent and rigorous explanation of spending would help ease investor concerns.

ENLC has plenty of room for improvement in this area. We hope they do. We are invested in ENLC and believe it’s cheap. The market is not giving energy management teams the benefit of the doubt and their stock would benefit from our suggested improvements in their presentation.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Great argument, hope they listen.

Back in April, you said “It’s cheap, with good growth prospects and we like the management. Dinner reaffirmed our conviction.” Must have been some good wine.

First, I want to say that I’ve always enjoyed your blog. You guys are spot on in all your analysis. I read everything you guys print, going back a couple of years now. For anybody who wants to understand this space, your blog is a must read.

Getting to the subject of Enlink, I would say modeling Enlink is not an easy task. The first thing that you quickly realize as you pointed out is that a significant amount of Growth CAPEX is required just to keep their net EBITDA flat. (To the novice investor, this is very misleading!)

It’s a question that comes up routinely on their earnings call: “how much Growth CAPEX is required to keep your EBITDA flat.” Their answers are vague, in part because this turns out to be a very difficult thing to define and answer. Minimum volume commitments, commodity prices, operating and G&A savings, which basin the GCAPEX is spent – all these things make a difference. Do you excluded the impact of commodity prices? How about payments for MVC shortfalls?

In 2020, they will spend about $190 million in Growth CAPEX and yet their natural gas and processing volumes and their net EBITDA declined – both will be down 3-4%. Crude will be down 20% by volume but this is a relatively small portion of their business and their NGL business was up slightly. So you could say that $190 million is not enough spent to keep the volume flat from the end of 2019 to the end of 2020. Net EBITDA was affected by several impacts: shuts-ins, commodity impacts to their POP, POL, processing margin contracts and other variable pay opportunities, saving in G&A and operating costs, volume drops in crude running through their ORV assets and a host of other impacts. I’ve made many attempts to model the cost of how much Growth CAPEX it takes to maintain net EBITDA and the back of the envelope answer appears to be 25% of net EBITDA (per year on average) is required to be spent to maintain net EBITDA but even this is greatly affected by where and how the money is spent. Well connects in Oklahoma have come down significantly (payback is less than 1 year according to Ben Lamb) but the long pipe they laid to connect their Tiger plant in the Permian didn’t come cheap. One thing is very clear, it is very expensive to lose volume in one basin like their Barnett shale position and build new plants and assets in a new basin like the Permian. This is one reason why the cost to maintain EBITDA is high. An analyst on the latest call asked if they could chop up a plant in a declining basin and move it to another basin.

Modeling the returns on Growth CAPEX is also challenging and involves a series of calculations that remove things like Joint Venture contributions, divestitures, the Tall Oaks purchase in 2015 and its net EBITDA impacts in subsequent years, MVC shortfall payments…..but the figure over the past 5 years appears to be 7.6 times net EBITDA across all growth CAPEX inclusive of declines – this includes new plants, plant upgrades, headers, compression, well connects, etc.. It doesn’t include the future decline that will occur to those assets beyond those five years.

The less than 4 times net EBITDA figure for well connects is a multi-year return across all basins and it is inclusive of the decline rates. I calculated this basin by basin and was surprised that their EBITDA figures are inclusive of declines over a period of say 3-5 years.

Again, I really appreciate the great content! Keep up the great work.