Williams Companies Promotes the Little Blue Flame

Last Thursday Williams Companies (WMB) held their investor day in New York. WMB owns and operates an extensive natural gas network, and is a top ten U.S. midstream energy infrastructure company. Like most big pipeline companies, it’s omitted from the Alerian MLP indices because it’s not an MLP. CEO Alan Armstrong conceded that the company had in recent years become too closely identified with the oil business and fracking. He said they need to refocus attention on the little blue flame in every kitchen’s stovetop, emphasizing a cleaner, more positive message.

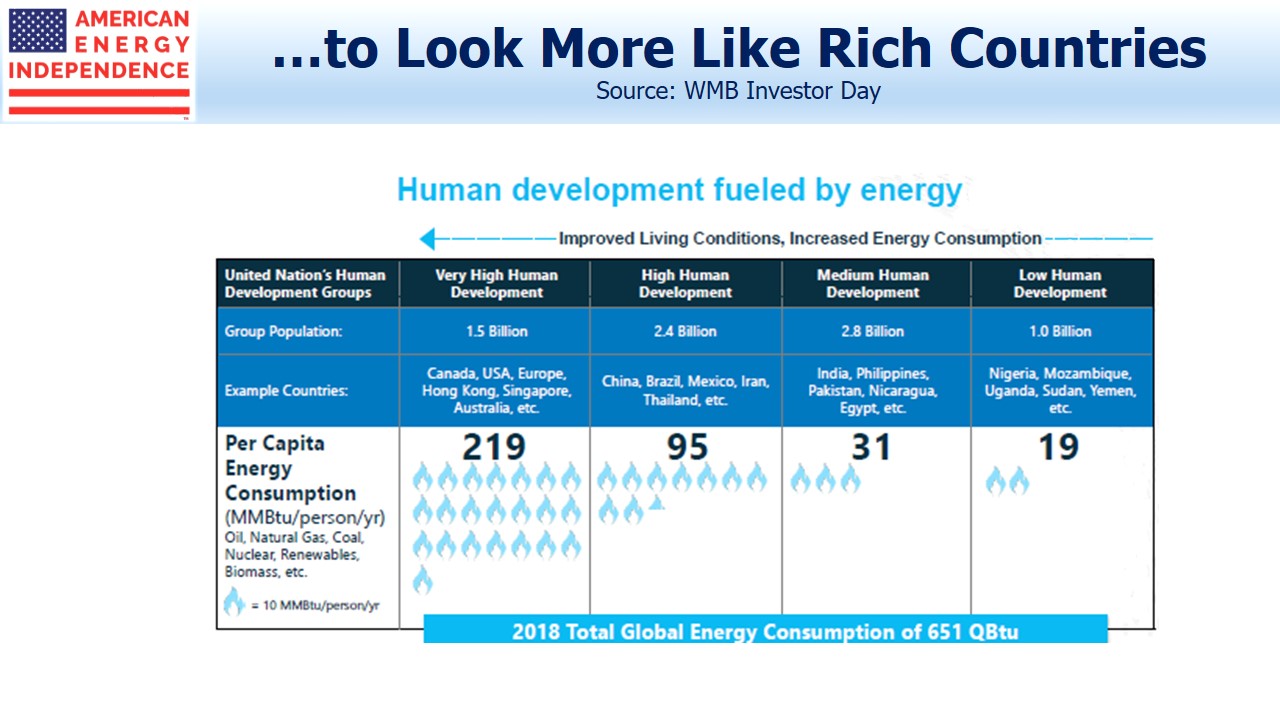

Their presentation opened with some useful slides on the long term, global outlook for natural gas. Although most investors in this sector follow crude oil prices because they drive sentiment among energy investors, our investments are more focused on natural gas because it’s the cleanest burning fossil fuel and we believe has a clearer growth path over the next several decades.

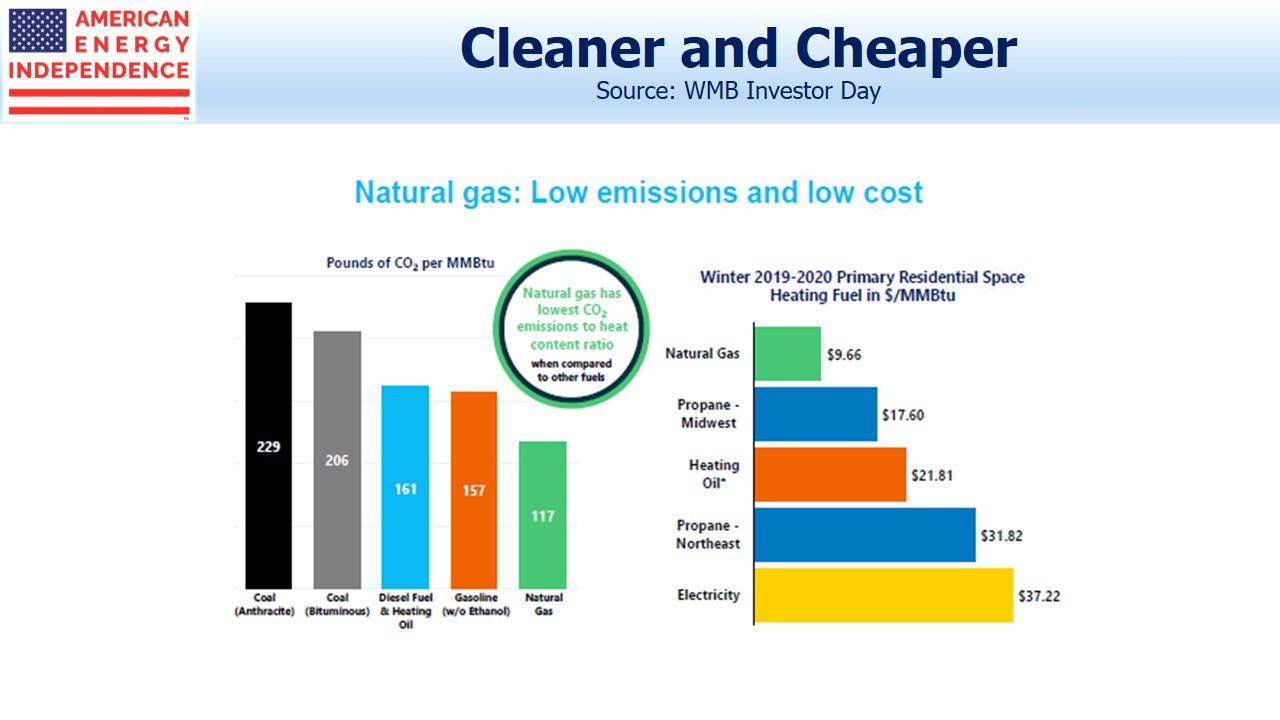

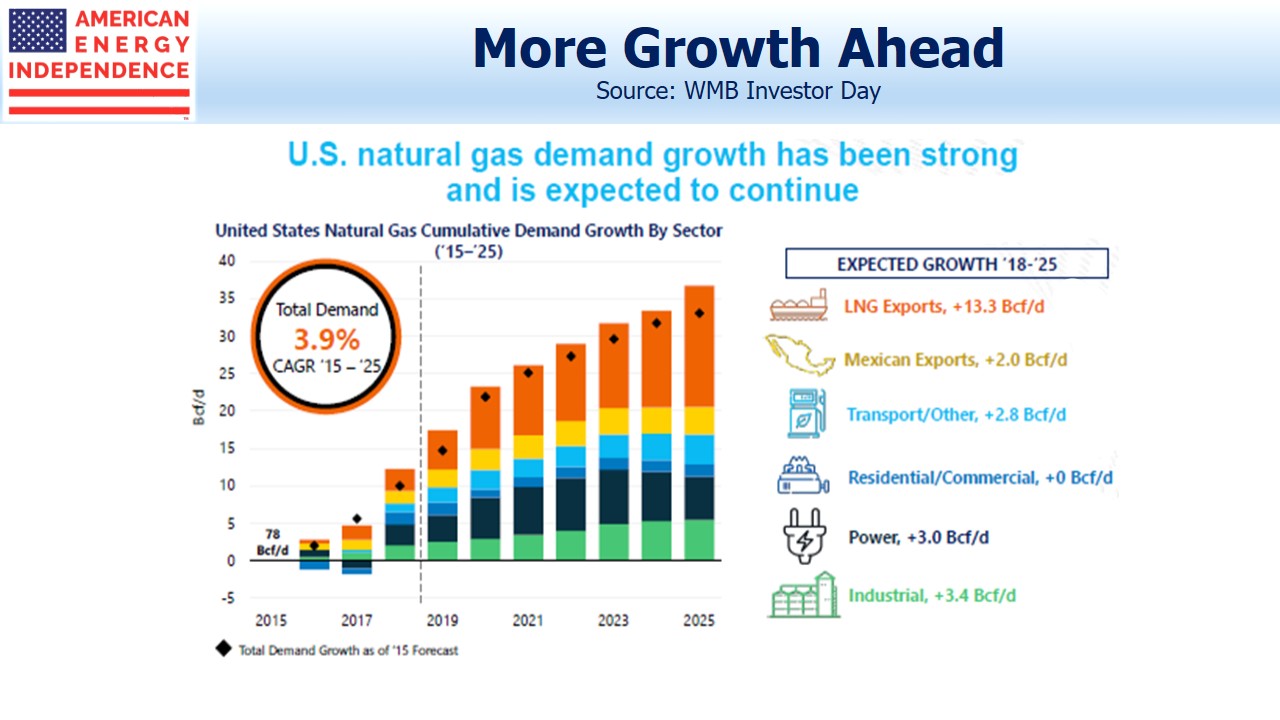

The Shale Revolution has produced an abundance of natural gas in America, which means that it’s not only cleaner than other fossil fuels but also the cheapest form of residential heating. So far, the benefits of this abundance have flowed to the consumers of cheap energy and not the producers, as energy investors know well. Figuring out how to better monetize America’s energy renaissance consumes management teams and investors.

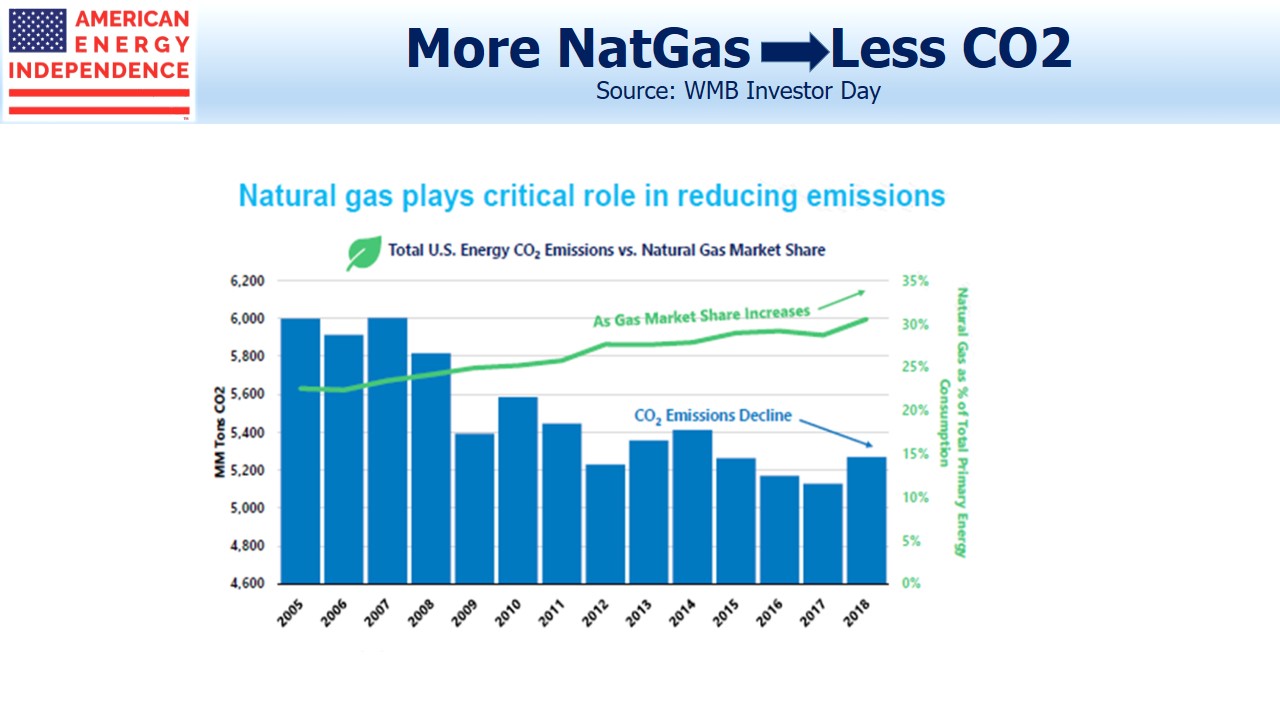

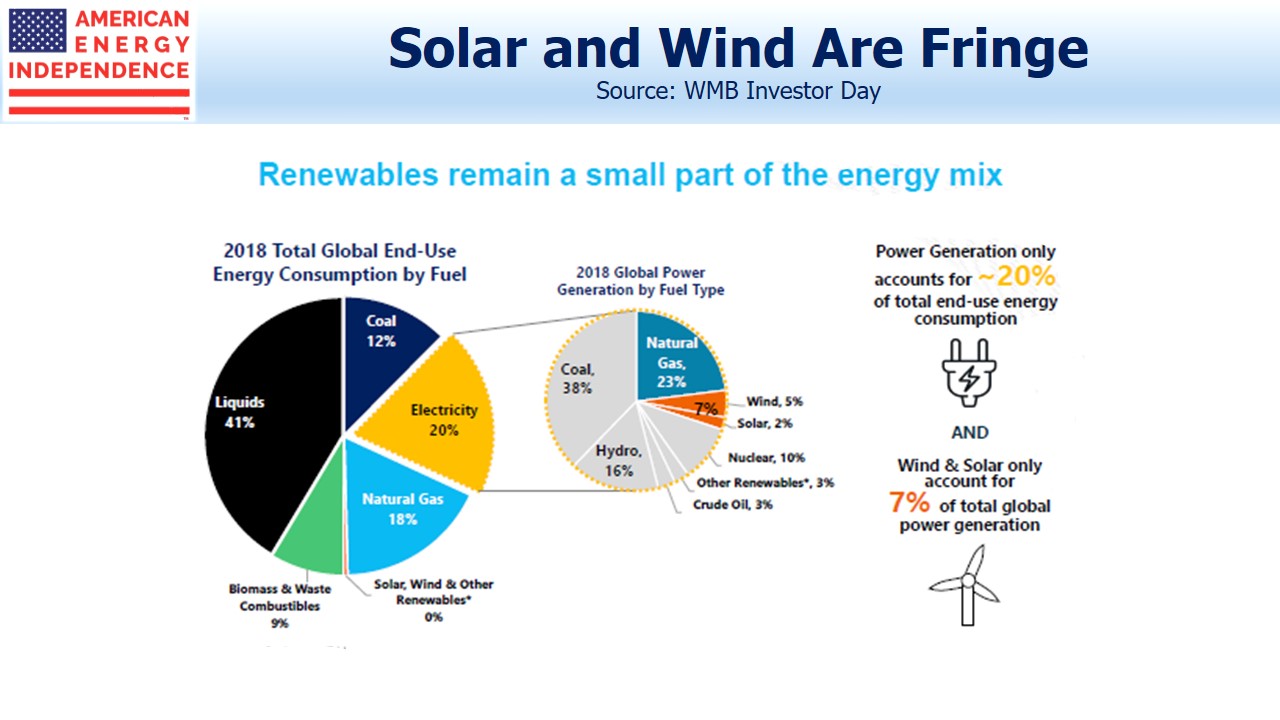

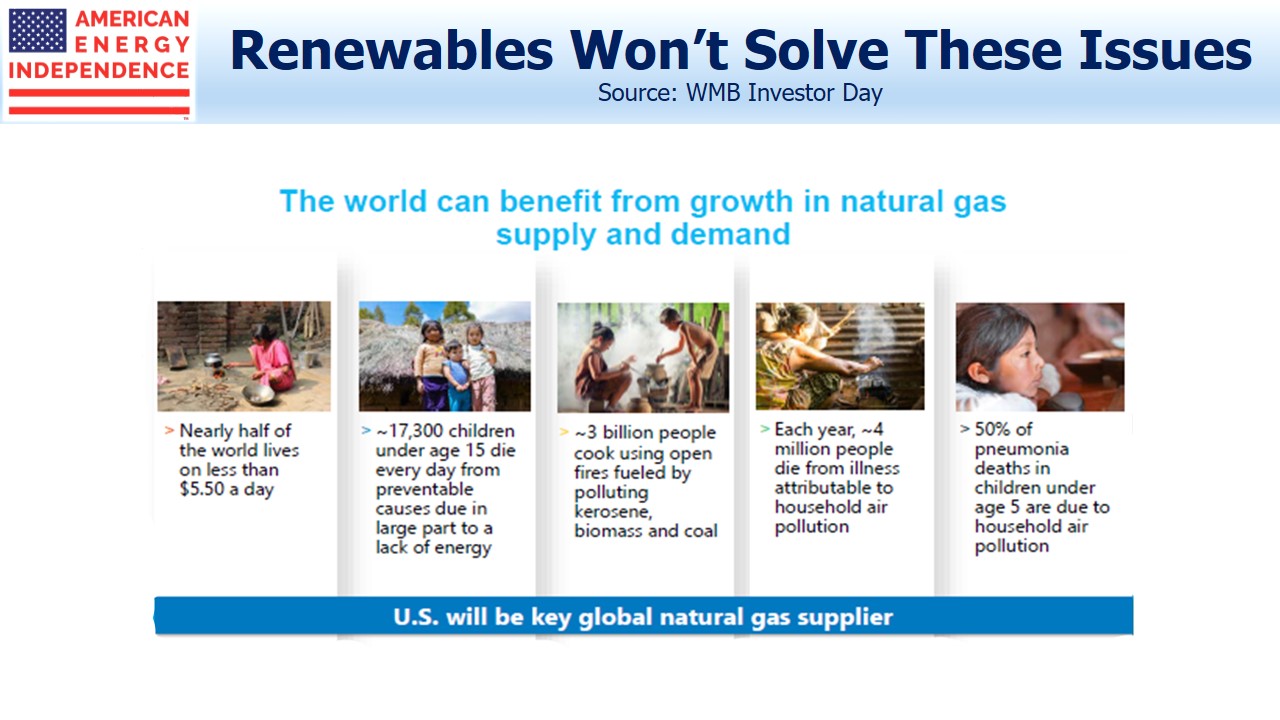

Substantial press coverage is focused on climate change and the opportunity of renewables to impede global warming. Solar and wind remain fringe sources of overall energy, a statement often regarded as incendiary by climate extremists but easily supported in the above chart. Electricity is 20% of global end-use energy consumption, with solar and wind providing 2% and 5% respectively. So at 7% of power generation, which is itself 20% of global energy use, they’re 1.4% of the total. Natural gas substitution for coal has been far more effective in lowering emissions, and attracts thoughtful advocates for cleaner energy.

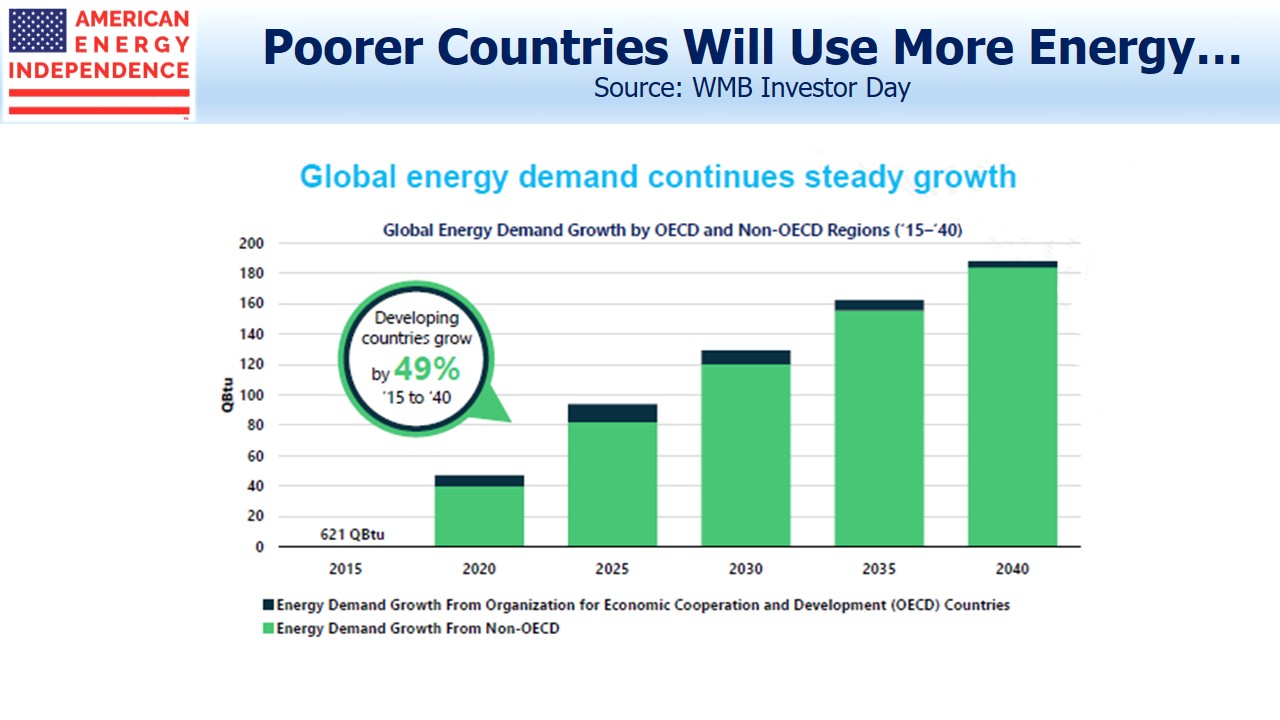

An estimated 17,300 children younger than 15 die every day because of insufficient access to energy, according to UNICEF (the United Nations Children’s Fund). The moral high ground is solidly occupied by those engaged in providing more energy to poor countries, including investors in WMB. Climate extremists impede this progress, and offer no solutions. Their warped, Malthusian philosophy cares little for today’s human suffering.

Global energy consumption is going to continue increasing, because it drives higher living standards which are desired by at least half the world’s population. Non-OECD countries are forecast to increase their energy demand by half over the next twenty five years. Any serious impact on emissions will turn on the form in which this increased energy is delivered. China is the world’s biggest polluter and consumes half the world’s coal. If natural gas replaced all the world’s coal, it would lower CO2 emissions by 17%, an enormous change. The world isn’t about to make such a bold move, but because natural gas is expected to fulfill 45% of global demand growth through 2040, its gain in market share is contributing to a cleaner planet.

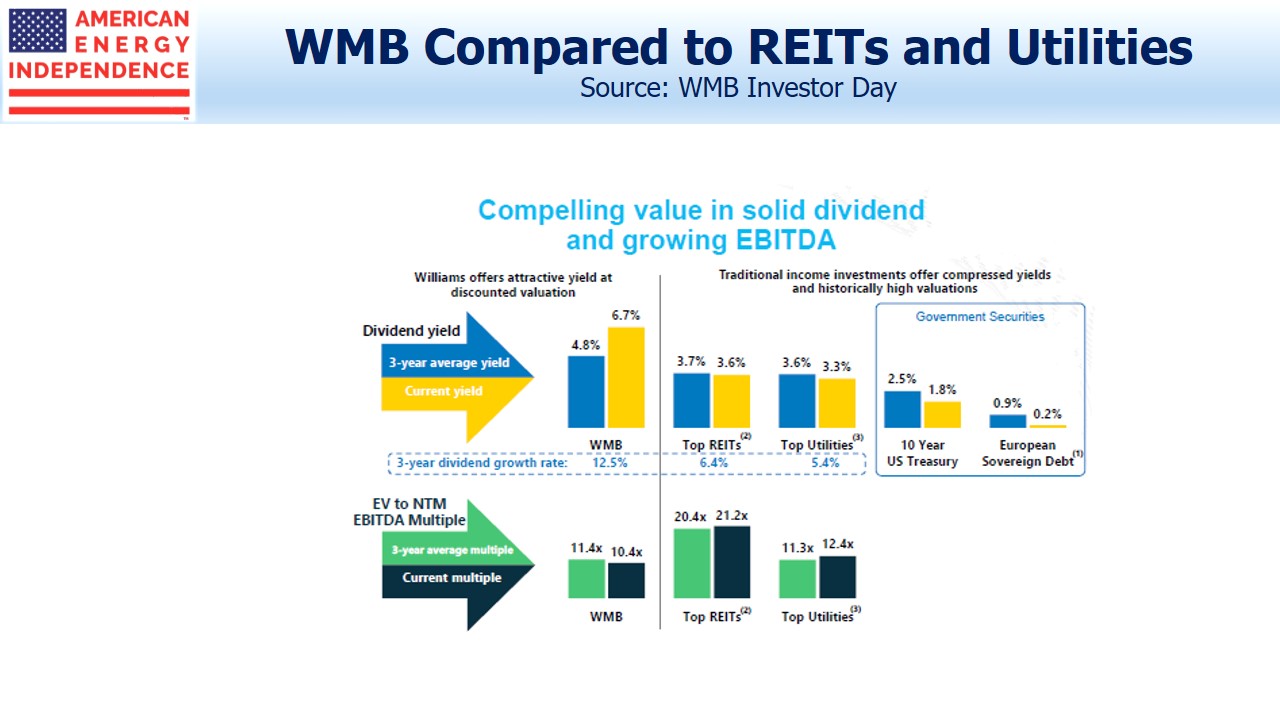

Finally, we show a slide on valuation. Valuation metrics such as Enterprise Value/EBITDA and yield have become less attractive for REITs and utilities in recent years, while they’ve moved in the opposite direction for midstream energy infrastructure. Investors know this well, but the macro outlook for natural gas must surely mean that a company such as WMB, positioned as well as anyone to profit, is cheap and should be substantially higher.

We are invested in WMB.