Will Fall Seasonals Cause The Market To Rise?

/

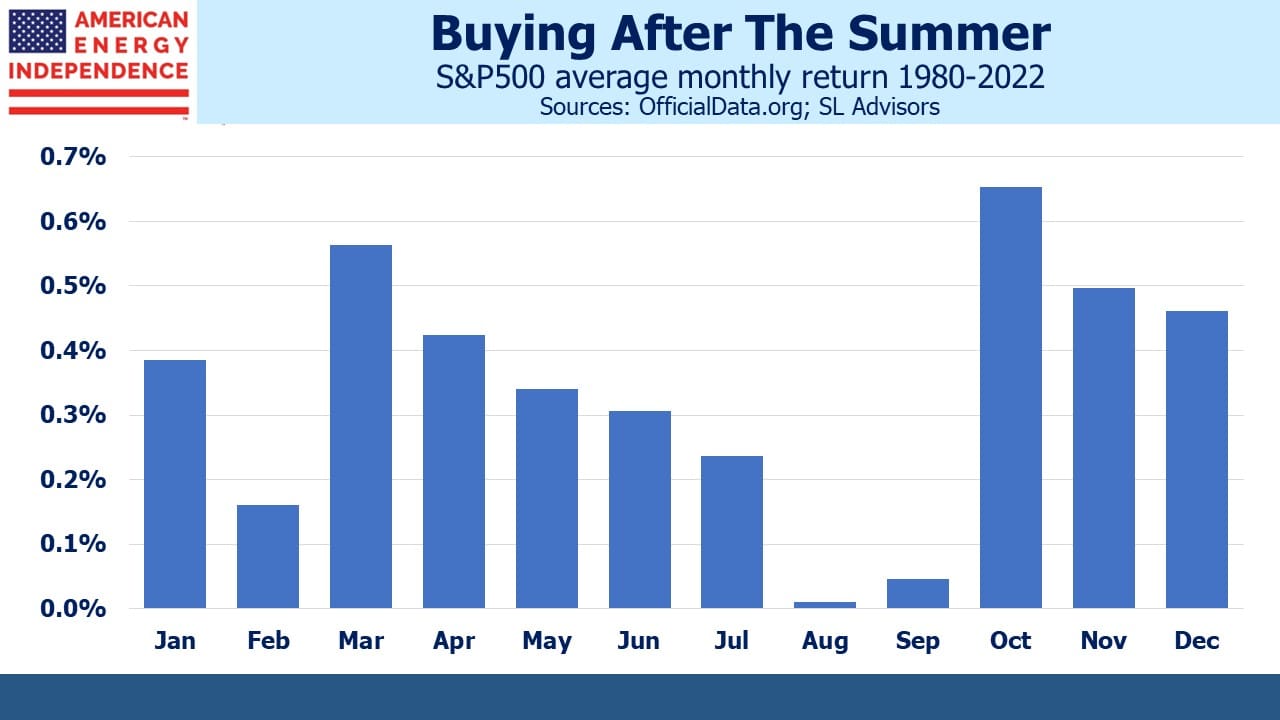

Students of stock market history will know that September is seasonally the worst month of the year. This month is typical. Some may think it’s October because of the crashes that month in 1929 and 1987. Only a few years into my Wall Street career, I returned home on October 19th, 1987, and solemnly warned my wife that a depression was coming. She scoffed that it was a problem for Wall Street not Main Street, and thus emboldened has ever since retained modest skepticism about my market prognostications.

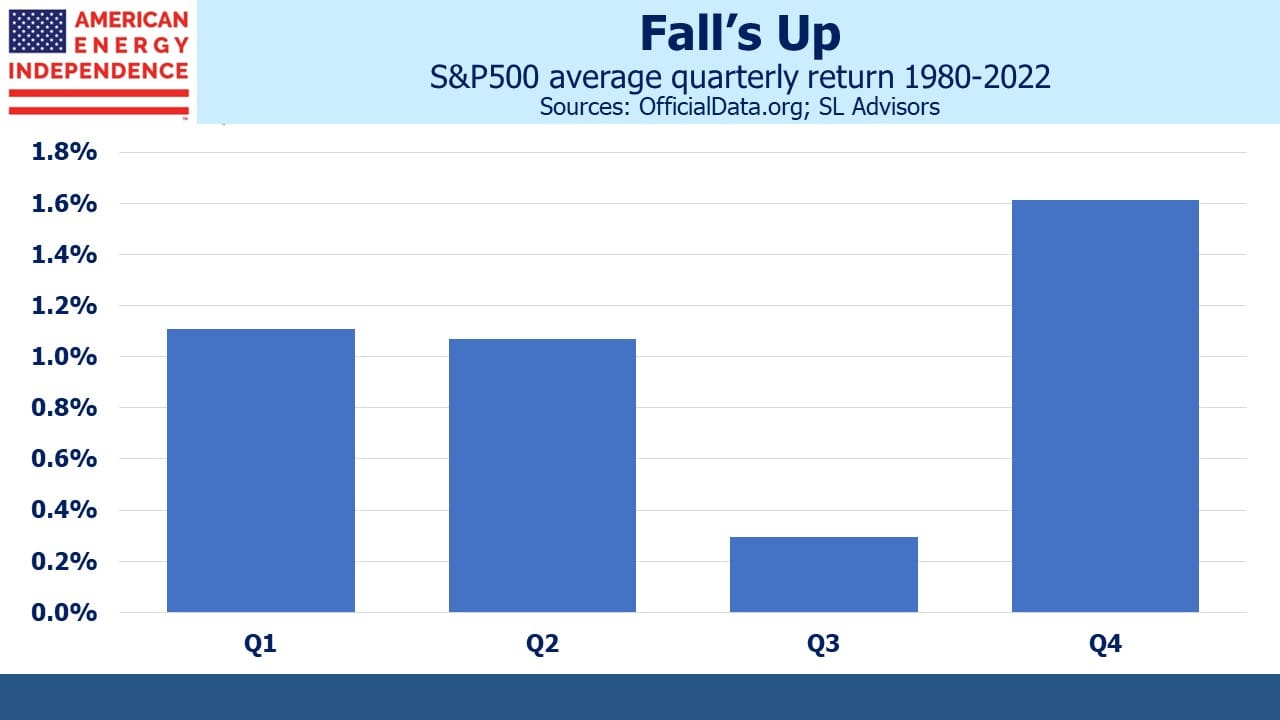

The fourth quarter historically offers the best returns. It’s easy to go down a rabbit warren of meaningless relationships with seasonal patterns. A wet weekend ten days ago didn’t mean golf would be rained out this past weekend, even though it was. One quarter of the four is going to be the best. Since 1980 the 1.6% average fourth quarter return follows the seasonally weakest third quarter of 0.3%. The relationship has persisted for over a century.

MLPs used to have a distinct quarterly seasonal pattern around distribution dates. MLP buyers are often yield-driven and like those quarterly payments. K1s also induce sales before year-end and purchases right after, in both cases to avoid a K-1 for just a few weeks of January (see Why MLPs Make a Great Christmas Present). Fewer MLPs are not just causing rebalancing challenges for Alerian-linked products (see Alerian Still Clinging On). They’re also making the seasonals less pronounced.

More interesting is whether the approaching fourth quarter will hew to the historical pattern.

Recently I switched to Bloomberg TV from CNBC as my background noise of market commentary. I chose substance over entertainment. All day long executives and market participants are discussing interest rates and crude oil. Both are responsible for September’s weak equity market performance, and the energy sector’s resurgence. The macro outlook always offers reasons to worry.

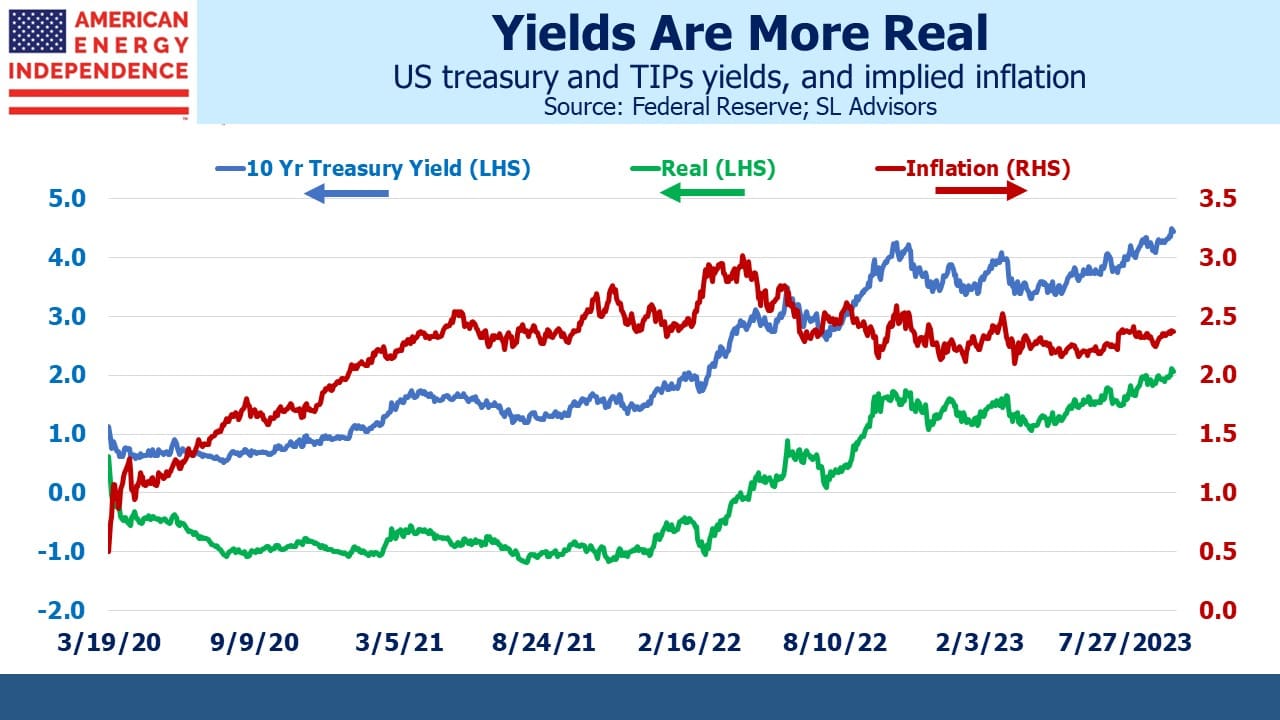

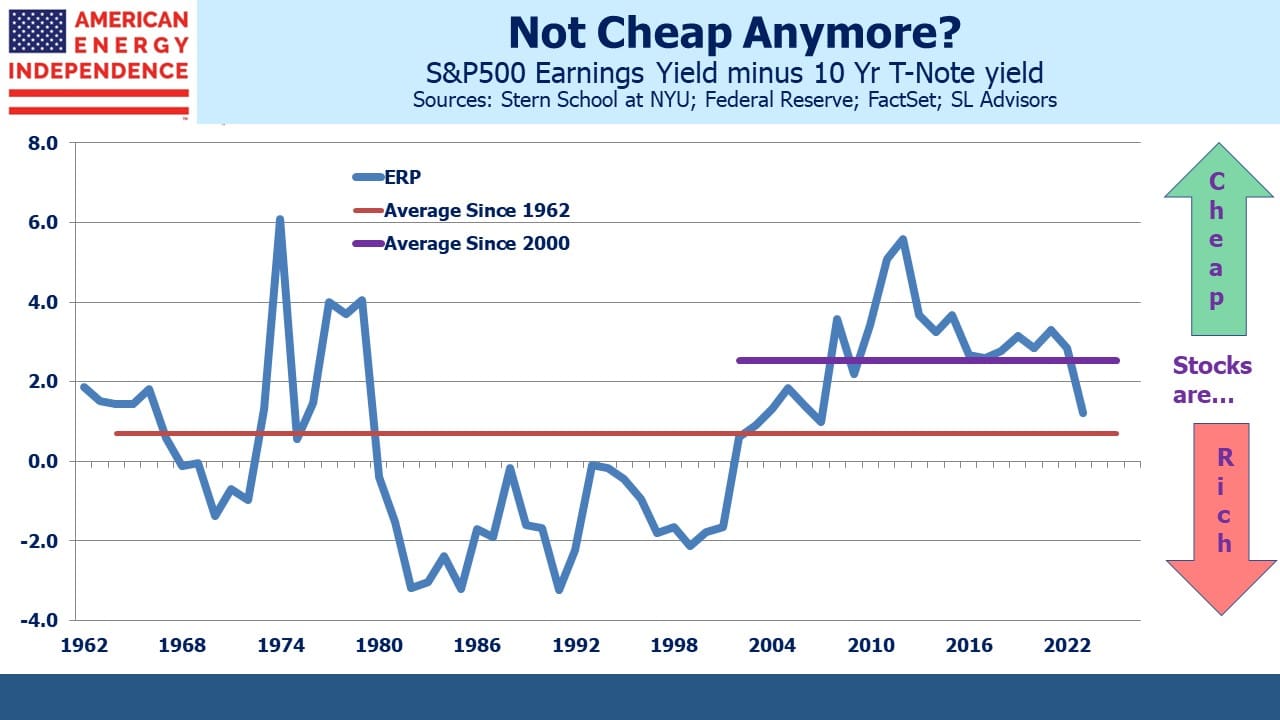

We’ve stopped worrying about the Fed causing a recession (see Jay Powell’s Victory Lap). With the economy coping well with 4.5% ten year treasury yields, there’s concern that rates will remain higher for longer. The Equity Risk Premium (ERP) shows stocks are expensive compared to the past couple of decades, and around neutral going back to 1960.

Bond yields are moving higher with inflation expectations as defined by TIPs remaining well behaved at under 2.5%. Consequently, real yields have breached 2%. Early last year they were negative. Bonds are a better investment than they’ve been for years, though to this writer still inadequate to compensate for our fiscal outlook.

Crude oil is moving steadily higher, causing some economists to worry that this will pressure consumers’ disposable income. The dismal science usually sees problems. We energy investors are not alone in liking the rally in crude (see The Super Cycle Or Peak Oil?). At the margin it should boost demand for electric vehicles. Higher oil and gas prices support a faster energy transition. Sincere climate extremists, if there are any, should rejoice.

Occidental (OXY) CEO Vicky Holub told Bloomberg TV she saw no evidence of demand destruction in response to rising oil. JPMorgan sees OXY keeping capex flat next year versus this, and overall is forecasting a 7% annual decline in E&P drilling budgets. They are better positioned than the International Energy Agency to have an informed opinion on the topic.

If the coming quarter follows the seasonal pattern of providing the year’s best return, perhaps it’ll be because the challenges caused by rising rates and oil prices will not be enough to derail the US economy. They are “known knowns” to partially quote former Defense Secretary Donald Rumsfeld. And if you find those headwinds leave you nervous about the broader market, you’ll find that midstream energy infrastructure has exhibited more robust performance in recent months.

JPMorgan, Wells Fargo and Morgan Stanley all considered the impact of the shrinking MLP universe on Alerian’s indices and the funds and products that are linked. The cost of running a non-RIC-compliant dedicated MLP fund in a RIC structure (corporate taxation) becomes increasingly difficult to justify with a smaller universe of stocks (Morgan Stanley). As more and more large-cap MLPs get eliminated from the indices, the Alerian becomes further imbalanced (Wells Fargo). We would not be surprised to see a methodology change emerge again, potentially lifting the maximum ceiling weight to 15% (JPMorgan).

We have written at length about the contradictions of owning a portfolio of 100% MLPs in a taxable, non-RIC compliant ‘40 Act fund, so have nothing new to add. Holders of such funds will eventually conclude they shouldn’t have been.

We three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I note that Morgan Stanley referred to MLP equities as stock, not units.