Will Fall Seasonals Cause The Market To Rise?

Students of stock market history will know that September is seasonally the worst month of the year. This month is typical. Some may think it’s October because of the crashes that month in 1929 and 1987. Only a few years into my Wall Street career, I returned home on October 19th, 1987, and solemnly warned my wife that a depression was coming. She scoffed that it was a problem for Wall Street not Main Street, and thus emboldened has ever since retained modest skepticism about my market prognostications.

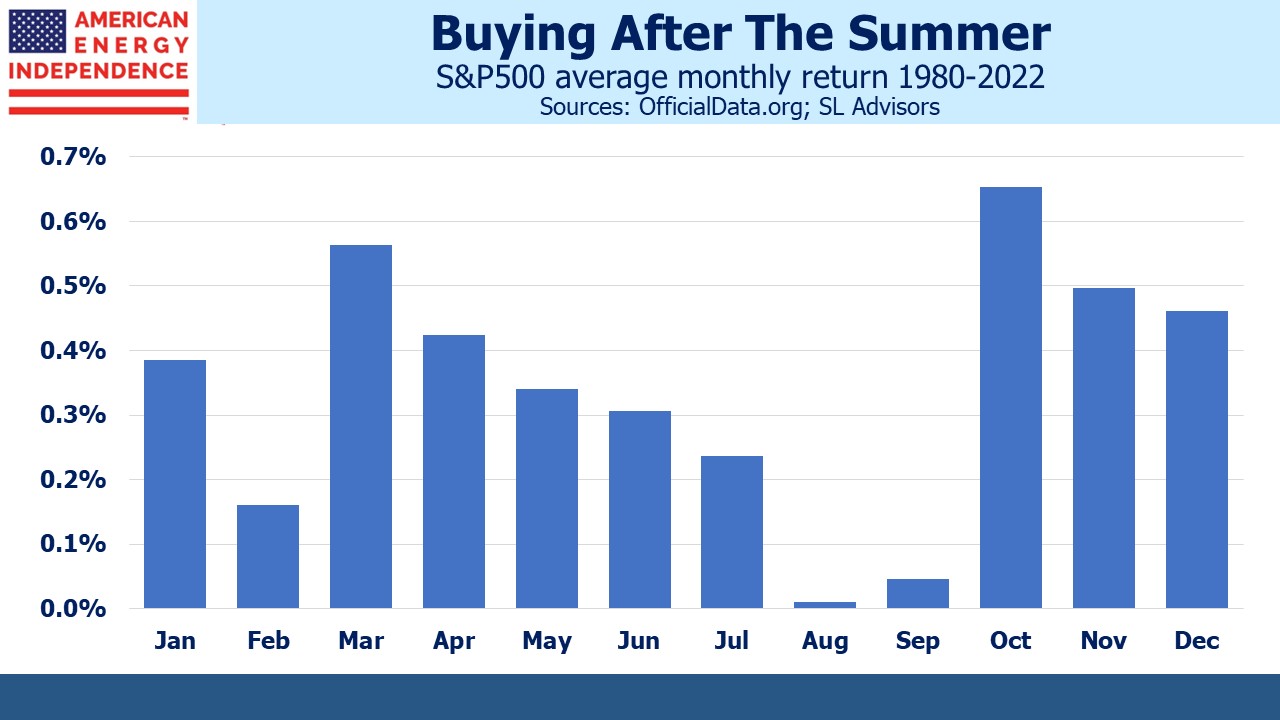

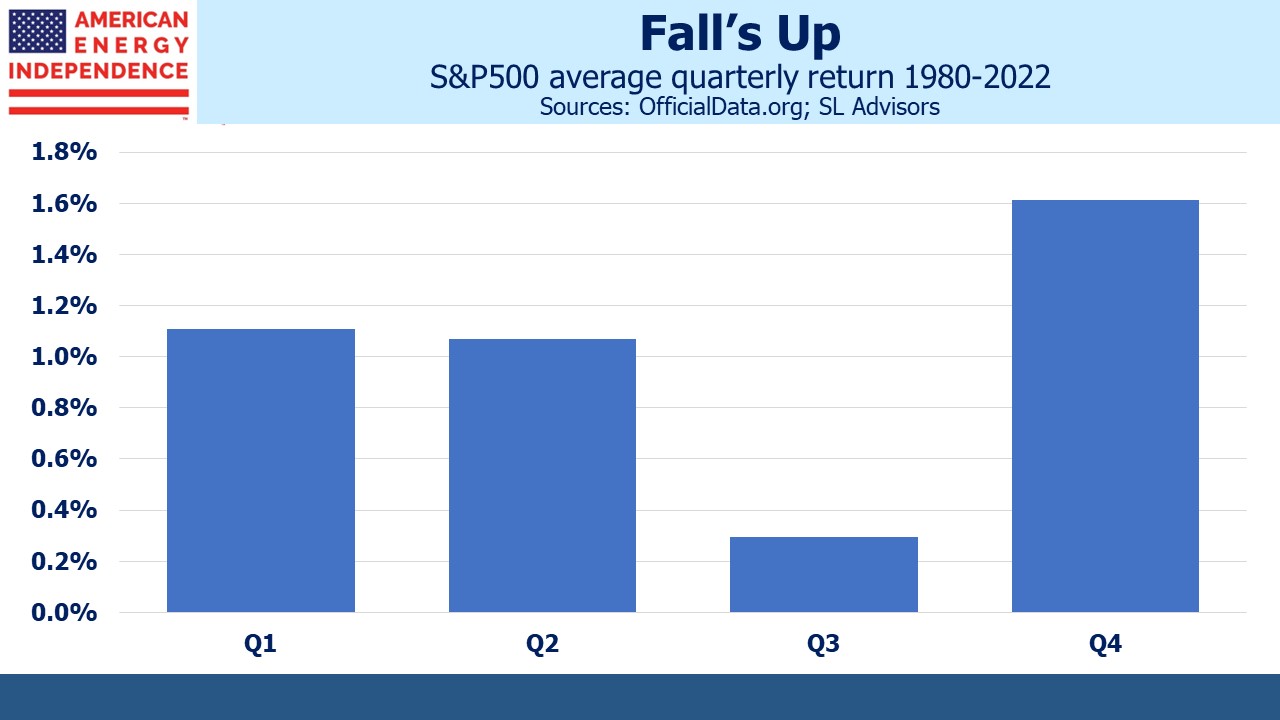

The fourth quarter historically offers the best returns. It’s easy to go down a rabbit warren of meaningless relationships with seasonal patterns. A wet weekend ten days ago didn’t mean golf would be rained out this past weekend, even though it was. One quarter of the four is going to be the best. Since 1980 the 1.6% average fourth quarter return follows the seasonally weakest third quarter of 0.3%. The relationship has persisted for over a century.

MLPs used to have a distinct quarterly seasonal pattern around distribution dates. MLP buyers are often yield-driven and like those quarterly payments. K1s also induce sales before year-end and purchases right after, in both cases to avoid a K-1 for just a few weeks of January (see Why MLPs Make a Great Christmas Present). Fewer MLPs are not just causing rebalancing challenges for Alerian-linked products (see Alerian Still Clinging On). They’re also making the seasonals less pronounced.

More interesting is whether the approaching fourth quarter will hew to the historical pattern.

Recently I switched to Bloomberg TV from CNBC as my background noise of market commentary. I chose substance over entertainment. All day long executives and market participants are discussing interest rates and crude oil. Both are responsible for September’s weak equity market performance, and the energy sector’s resurgence. The macro outlook always offers reasons to worry.

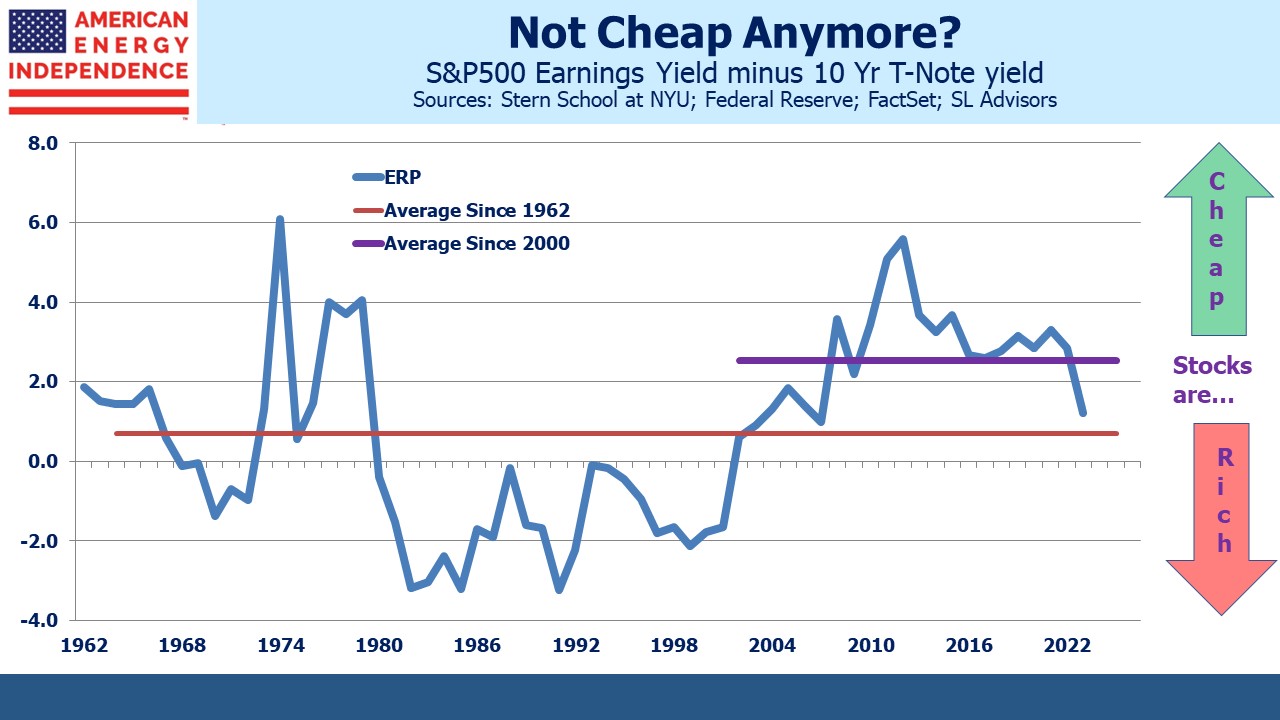

We’ve stopped worrying about the Fed causing a recession (see Jay Powell’s Victory Lap). With the economy coping well with 4.5% ten year treasury yields, there’s concern that rates will remain higher for longer. The Equity Risk Premium (ERP) shows stocks are expensive compared to the past couple of decades, and around neutral going back to 1960.

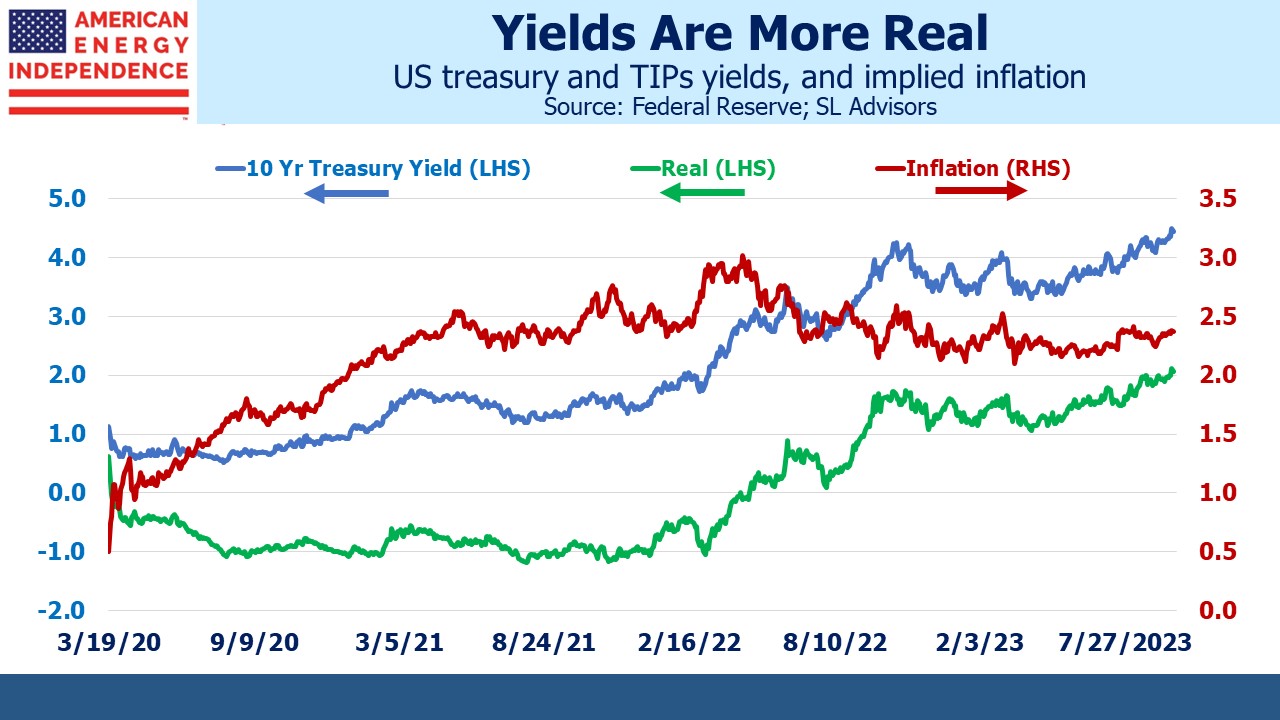

Bond yields are moving higher with inflation expectations as defined by TIPs remaining well behaved at under 2.5%. Consequently, real yields have breached 2%. Early last year they were negative. Bonds are a better investment than they’ve been for years, though to this writer still inadequate to compensate for our fiscal outlook.

Crude oil is moving steadily higher, causing some economists to worry that this will pressure consumers’ disposable income. The dismal science usually sees problems. We energy investors are not alone in liking the rally in crude (see The Super Cycle Or Peak Oil?). At the margin it should boost demand for electric vehicles. Higher oil and gas prices support a faster energy transition. Sincere climate extremists, if there are any, should rejoice.

Occidental (OXY) CEO Vicky Holub told Bloomberg TV she saw no evidence of demand destruction in response to rising oil. JPMorgan sees OXY keeping capex flat next year versus this, and overall is forecasting a 7% annual decline in E&P drilling budgets. They are better positioned than the International Energy Agency to have an informed opinion on the topic.

If the coming quarter follows the seasonal pattern of providing the year’s best return, perhaps it’ll be because the challenges caused by rising rates and oil prices will not be enough to derail the US economy. They are “known knowns” to partially quote former Defense Secretary Donald Rumsfeld. And if you find those headwinds leave you nervous about the broader market, you’ll find that midstream energy infrastructure has exhibited more robust performance in recent months.

JPMorgan, Wells Fargo and Morgan Stanley all considered the impact of the shrinking MLP universe on Alerian’s indices and the funds and products that are linked. The cost of running a non-RIC-compliant dedicated MLP fund in a RIC structure (corporate taxation) becomes increasingly difficult to justify with a smaller universe of stocks (Morgan Stanley). As more and more large-cap MLPs get eliminated from the indices, the Alerian becomes further imbalanced (Wells Fargo). We would not be surprised to see a methodology change emerge again, potentially lifting the maximum ceiling weight to 15% (JPMorgan).

We have written at length about the contradictions of owning a portfolio of 100% MLPs in a taxable, non-RIC compliant ‘40 Act fund, so have nothing new to add. Holders of such funds will eventually conclude they shouldn’t have been.

We three have funds that seek to profit from this environment: