Why MLP Fund Investors Should Care When They Change

MLPs have been losing relevance to the midstream energy infrastructure sector for years. The Shale Revolution caused them to evolve from reliable generators of income to growth-seeking enterprises. As upstream companies plowed money into drilling, pipeline companies felt compelled to add new infrastructure to service them. The capital spending spigot had already been ratcheted down since 2018, with investors rebelling against the culture of always building. The hit to demand from Covid accelerated a trend already in pace.

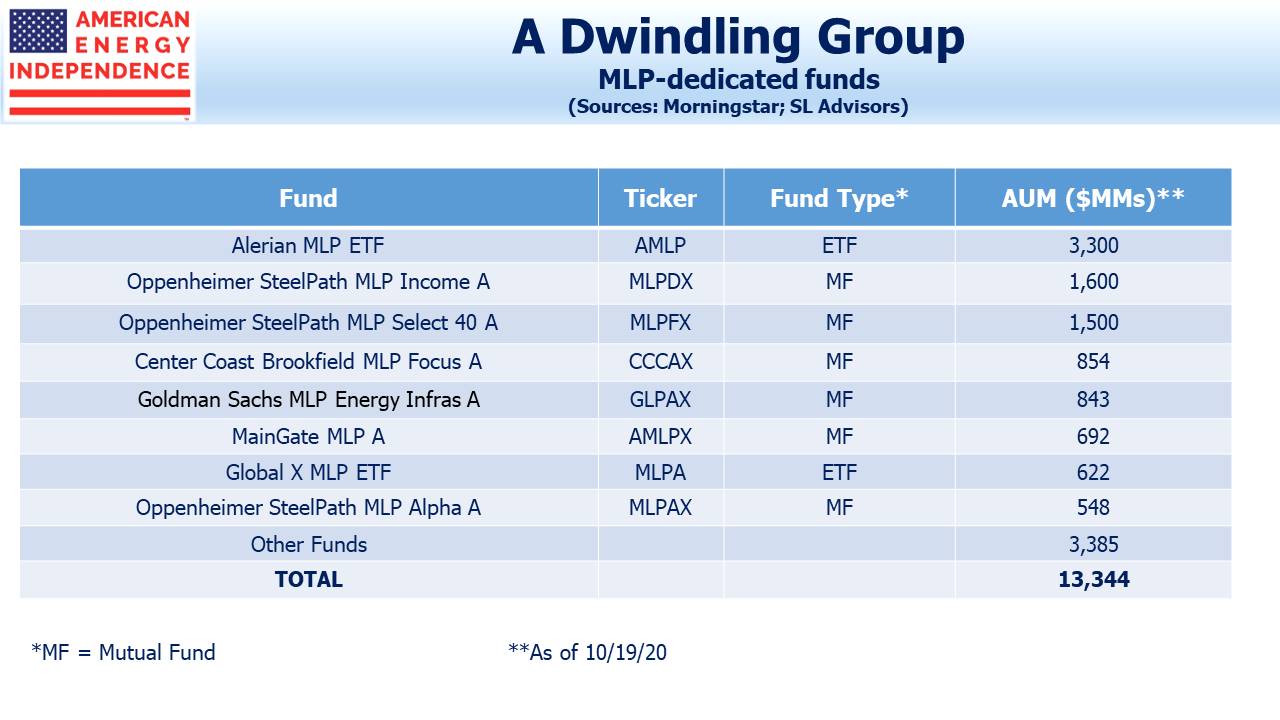

MLPs represent around a third of the pipeline business. This has left MLP-dedicated funds increasingly challenged to find enough names to build out a portfolio. It’s a dilemma we’ve forecast for a long time (see The Uncertain Future of MLP-Dedicated Funds, April 2018). Such funds, most notably the Alerian MLP ETF (AMLP), were already burdened with an inefficient structure (see Uncle Sam Helps You Short AMLP, July 2018).

The MainStay Cushing MLP Premier Fund (CSHAX) has decided to bite the bullet and abandon their anachronistic structure. In recent weeks they’ve been quietly informing clients that they plan to limit MLPs to 25%, because of the “significant contraction” of MLPs. It’s taken them longer than it should, but they’ve accepted that the MLP business has changed. Serial distribution cuts imposed on income seeking investors have lost those investors to the sector for good.

CSHAX is around $500MM in AUM. Bringing their MLP holdings below 25% will require them to shed 75% of their portfolio, around $375MM, over period of months. MLP funds have seen around $6BN of outflows in the past year, and this has weighed on prices. Even so, the CSHAX repositioning should be manageable.

But what if other MLP funds reach the same conclusion? The Invesco Steelpath family of MLP funds is over $3.5BN. Center Coast and Goldman each have another $800MM. And AMLP is $3.3BN. There’s over $13BN invested in flawed, MLP-dedicated funds.

MainStay Cushing’s move is logical, but nobody will want to be the last one jumping. They’re not the first either. Some smaller closed end funds have combined and become RIC-compliant by limiting MLPs to 25%. The Kayne Anderson MLP/Midstream Investment Company recently became the Kayne Anderson Energy Infrastructure Fund (still KYN). Dropping MLPs is a developing trend.

It should induce investors in all MLP-dedicated funds to ponder their fund’s future. If bigger funds follow MainStay Cushing, the MLP sector could find itself having to absorb an indigestible amount of sales. Alerian calculates the market cap of MLPs at $139BN, but it’s only $72BN when adjusted for float. For example, the Duncan family’s 32% ownership of Enterprise Products Partners (EPD) doesn’t provide any liquidity. The remaining MLP-dedicated funds are almost 20% of the market.

MLPs are cheap by any reasonable measure. We’ve noted the yawning gap between EPD’s debt and equity yields (see Stocks Are Still A Better Bet Than Bonds). Bond and stock investors are poles apart in their assessment of the sector. But the risk investors in MLP-dedicated funds face is that portfolio shifts by competitor funds depress MLP prices, driving down their own fund’s NAV.

The near–term future of MLP-dedicated funds is unclear. But the time for such vehicles has passed, and it seems inevitable that funds invested in midstream infrastructure will limit MLPs to 25%. You just don’t want to be in the last fund to decide to make the shift.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.