Pipeline Technicals Turn Bullish

Although we rarely write about technical analysis, charts are helpful in showing visually where prices have come from. We also have a good number of clients who use charts to form investment opinions. This is especially true when it comes to changing portfolio allocations. Recently, bullish energy sector charts have come up in conversations.

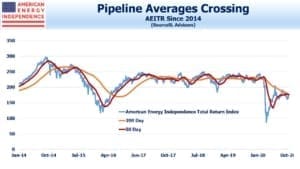

The 200-day moving average is widely used, and often gives a signal when crossed by a faster moving average, such as the 50 day. From 2016 to early this year, the pipeline sector stayed within a 20% range, and moving averages offered little of use to the technician.

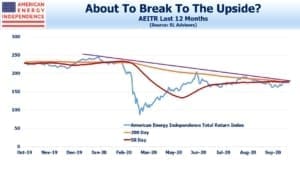

Following the steep drop from January to March, the trading range for the American Energy Independence Index (AEITR) has become steadily tighter. Lower highs and higher lows will soon be resolved, as it breaks out of its current formation.

The 50-day moving average crossed the 200 day on Tuesday. Some may prefer to see it happen more decisively, with the 50-day moving sharply higher. Nonetheless, by this definition the sector has begun a new uptrend. The index itself has remained above both moving averages since Wednesday.

There’s also a downward sloping trendline, against which the index is bumping. A move up through this would confirm the bullish signal from the moving averages and chartists would interpret this as positive.

Proponents of technical analysis will tell you that it improves the timing of their trades. The fundamentals for pipelines have looked encouraging to us for several months now, with free cash flow set to double this year (see Pipeline Cash Flows Will Still Double This Year). We wrote that in mid-May, and it’s looking increasingly prescient with midstream energy infrastructure 6% higher since then. But with a yawning gap between yields on bonds and equity from investment grade issuers (see Stocks Are Still A Better Bet Than Bonds), there is substantially more upside. Fixed income markets are far more positive about big pipeline companies than are equity markets. Bond buyers have a reputation for doing more careful analysis, since their upside is receiving coupons and their downside is losing everything. They are right to be constructive.

Bullish fundamentals are now being confirmed by technical analysis.

Sentiment remains extremely cautious. Although we don’t have any numbers on this, conversations with investors often reveal interest in valuations but nervousness about buying just before a big drop. The energy sector has done that to people in the past. A lot of these people represent potential buyers – interested in committing capital but looking for some signs that they’re not alone. Waiting for the election is a common refrain. A Biden victory is priced in, and we think could be positive for pipeline stocks (see Why Exxon Mobil Investors Might Like Biden).

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I thought the Dems. we’re going to stop all fracking, so how can that be positive for fracking?