What Energy Transition?

/

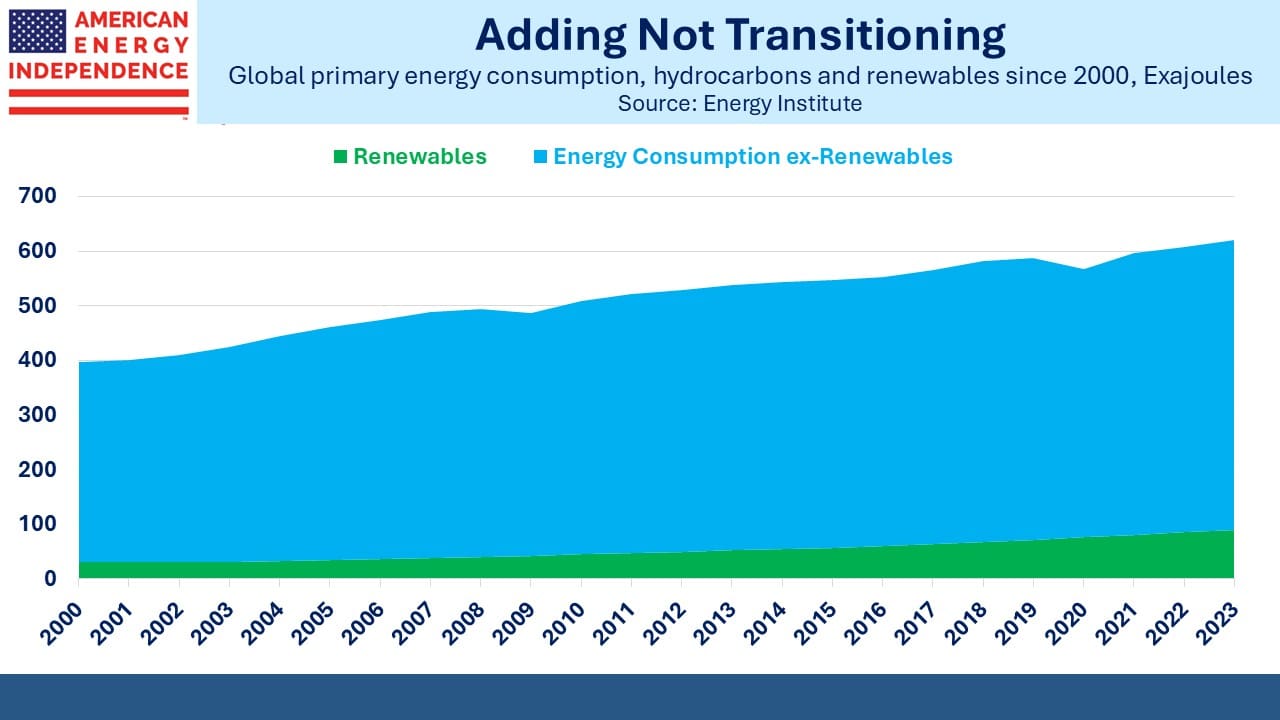

Daniel Yergin is right to call it the Energy Addition. In an essay in Foreign Affairs called The Troubled Energy Transition, he notes that since 1990 hydrocarbons have dropped from 85% of primary energy to around 80% today. That can hardly be called a transition. Since 2000 global energy consumption has increased from 397 Exajoules (EJs) to 620 EJs.

Renewables, including hydropower, have met only 27% of this increase. They’ve gone from a 7% to 15% share, but Greenhouse Gas Emissions (GHGs) have gone from 24 to 35 Gigatonnes.

Climate extremists will argue that without the growth in solar and wind it might have been worse, but the numbers show that the strategy of relying fully on these intermittent sources has been a huge failure. And yet renewables promoters continue to assert that solar and wind are the cheapest form of power generation.

The Biden administration sought a 50% market share for EVs by 2030. It’s currently stuck at 10% and no longer an objective of the Federal government. Every EV owner I know keeps a second car for long journeys. This is hardly a transportation strategy for the masses.

Offshore windpower targeted at 30 Gigawatts by 2030 will be missed by at least half.

As Yergin points out, past energy transitions have never seen the displacement of the old by the new (ie wood for coal). The developing world’s six billion citizens want to use more energy. They’re not going to readily swap coal for wind turbines, and the $TNs in subsidies necessary from rich countries to pay for this aren’t forthcoming.

Promises of abundant cheap renewable energy with well-paid union jobs were an empty promise. Perhaps Biden’s dementia was already affecting his judgment when he spoke those words.

Critics argue that prolonging the use of natural gas risks embedding its use and GHG emissions in our energy systems for decades to come. Bill Gates made this flawed argument in his otherwise thoughtful book, How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need.

But to reject natural gas is to embrace the fantasy that solar and wind will fully replace them. This has led to an enormous misallocation of resources and subsidies to promote energy sources simply inadequate to the task.

Instead developing countries should be encouraged to prioritize gas, which emits around half the GHGs as coal and is a ready substitute for power generation, heating, cooking and many industrial uses. Emissions will fall, which under current policies they’re not.

There are encouraging signs that commercial choices around the world are pre-empting enlightened policymaking by already moving in this direction. Forecasts for exports of Liquefied Natural Gas (LNG) continue higher. This is aided in part by Trump’s sensible removal of the LNG export pause imposed by Joe Biden in a desperate move to excite progressives about his re-election. The US is leading The Natural Gas Energy Transition.

The US and Qatar are planning increased LNG export capacity. Russia may even manage to export more following peace with Ukraine, although surely the Europeans will have the good sense to shun such a fickle supplier.

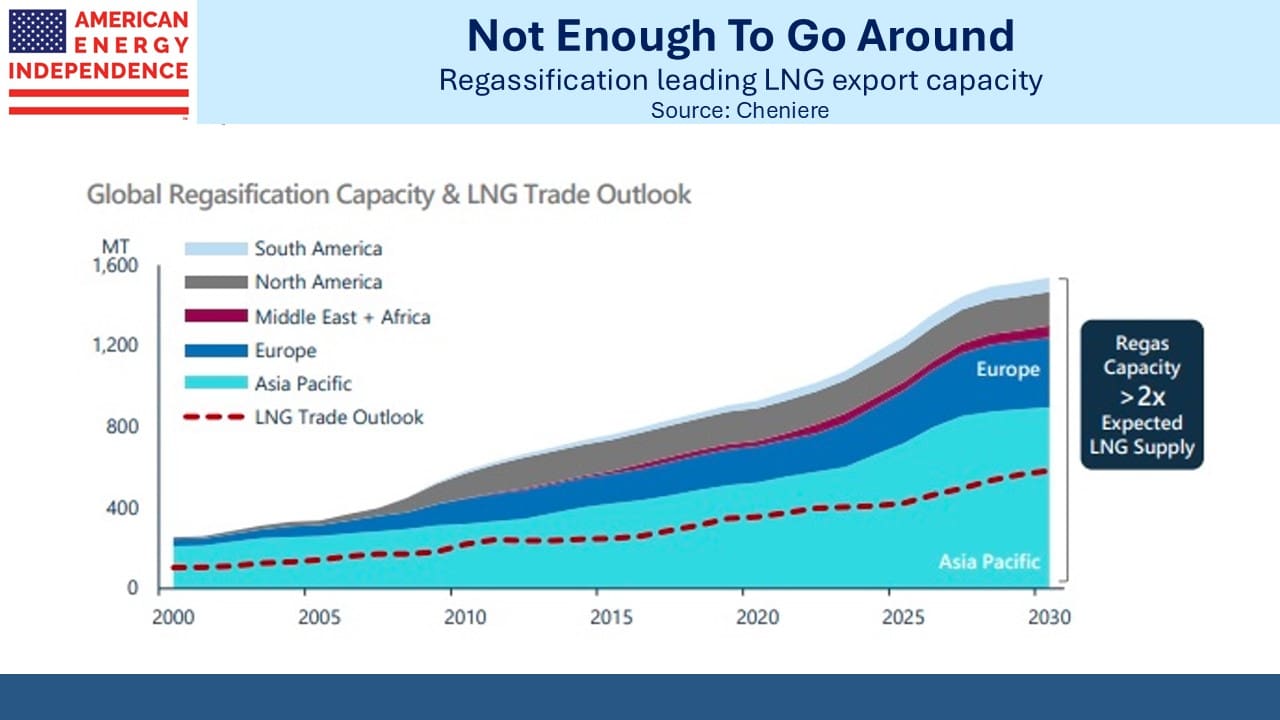

What receives less attention is the growth in import terminals to receive LNG. Natural gas is liquefied to 1/600th of its volume before being loaded onto an LNG tanker. At the other end a regassification terminal restores it to its gaseous form for use by customers.

There are often articles projecting a surplus of LNG in years to come, warning that export terminals will struggle to use all that capacity. Less is written about regassification capacity, which is on track to be twice as big. In other words, if every LNG export terminal projected to be operational by 2030 runs at 100% capacity, only half the regassification availability would be needed. It seems more likely that future LNG exports may yet be inadequate to the demand.

For example, India’s LNG imports from the US reached another all time high last year.

The US has reduced emissions by over 15% in the past fifteen years, mostly by coal to gas switching for power generation. The growth in LNG exports will at least keep emissions below where they would otherwise be and may even reduce them if developing countries take advantage of the opportunity to reduce coal use.

In a few years once Energy Secretary Chris Wright gets his hands on the numbers, don’t be shocked to see President Trump lay claim to being the most consequential climate change president in history. Progressives will be left in stupified silence by such a claim, but it’ll be based on promoting what works, which is natural gas.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!