What Do They Know That We Don’t?

The other day a client asked if we’d looked at insider buying among management teams of pipeline companies.

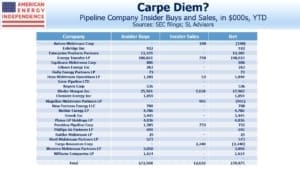

So far this year, Energy Transfer (ET) dominates with $108MM, representing 63% of all the insider buys so far. Kelcy Warren receives plenty of criticism, not least from this blog (see Energy Transfer’s Weak Governance Costs Them), but he’s certainly invested in his business. He’ll be frustrated at having made those purchases in February, because ET lost more than half its value during the March collapse. But investors appreciate his conviction.

Kinder Morgan (KMI) saw $25MM of insider buying, along with $7MM of sales. Rich Kinder is a long-time buyer of his eponymous stock. He alienated an entire class of investors in 2014, when KMI cut the dividend to finance a backlog of growth projects, and simplified their structure in a tax-adverse manner for many. He created a verb — to be “Kindered” is when faithful investors are hit with both the abrupt cancellation of promised distributions and an untimely tax bill (see Kinder Morgan: Still Paying for Broken Promises). But Kinder has bought KMI at regular intervals, including at prices much higher than today’s.

Enterprise Products Partners (EPD) saw $12MM in buying from the Duncan family. And Nustar Energy LP saw almost $5MM in buys. That three of these four are MLPs (as was Kinder Morgan years ago) shows that management teams can accumulate real wealth more easily at the helm of an MLP, with its weak corporate governance, than at a corporation.

Magellan Midstream (MMP) was an outlier among respected companies, in that it had insider sales of just under $1MM.

There was no activity at Macquarie Infrastructure (MIC), perhaps unsurprisingly since they withdrew 2020 guidance and suspended their dividend.

Plains All American (PAGP) saw $4MM of buying even as they cut their distribution by 50%, while still planning to spend half of their previously planned growth capex budget. Many investors would have preferred still less spending and a maintained distribution, but this company has lost 90% of its value since the August 2014 peak. Poor capital allocation has a long history at PAGP.

Most other names saw some insider buying, including several well-run companies. Enbridge (ENB), Cheniere (LNG), Oneok (OKE), Pembina (PPL) and Williams Companies (WMB) fall into this category. This is a very positive step by all these buyers, because the science around viruses is a key factor driving energy demand in the months ahead. Nobody has the information they’d like.

The biggest insider selling was at Targa Resources (TRGP), where Rene Joyce, a member of the Risk Committee, was forced to sell to meet a margin call. TRGP saw no insider buying either. Back in 2014 TRGP briefly touched $140 a share, when ET was rumored to be interested in an acquisition. Joyce’s forced sale at $7 reflects the same judgment that caused TRGP to spurn ET’s approach.

Given the recent leverage-induced catastrophe in MLP closed end funds (see The Virus Infecting MLPs), if Rene Joyce was to move to either Kayne Anderson or Tortoise, it seems likely both his old firm and his new one would improve their risk management.

We are invested in all the names mentioned above.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Nice work. Keep strong

Nice work

The same insider buying rules govern MLPs as C corporations. Insider buying rules have nothing to do with corporate governance comparisons of the two entities.

And there has been more buying in 2020 by insiders at EPD (and by management as well as by Duncans) than the $12 million noted.