The Virus Infecting MLPs

Closed end fund investors are passionate about the product. Because they generally own a portfolio of publicly traded securities, their NAV per share is easily calculated. The fixed share count means their share price can deviate from the NAV, and this attracts investors keen to buy something for less than it’s worth.

MLP closed end funds have been around for years. They’re a low-octane version of levered ETFs. If you’re good at market-timing, a skill claimed by far more than actually possess it, you can navigate the ups and downs. Leverage magnifies your exposure, and strategies with fixed leverage have to rebalance in the direction the market has moved (i.e. buy high and sell low).

We have warned investors about this before (see Lose Money Fast with Levered ETFs).

In 2015 we pointed out how the Cushing MLP Total Return Fund (SRV) had persistently destroyed value, because of leverage (see An Apocalyptic Fund Story).

MLP closed end funds use leverage. Because they are more than 25% invested in MLPs, they are non-RIC compliant and therefore their profits are subject to corporate income tax. The interest expense on their borrowings can be deducted against taxable income, thereby reducing or even offsetting the tax obligation that few holders realize exists.

But adding leverage to a single sector fund is a dumb idea. Investment grade midstream energy infrastructure companies generally operate at around 4.0X Debt:EBITDA. Non-investment grade are a little higher. The manager of a sector-specific leveraged fund is essentially rejecting this leverage as too conservative, even though such a fund has little diversification in a sharp fall in the market.

This is an expression of arrogance, that the managers of these funds have some insight superior to the collective opinion of CFOs and rating agencies. They don’t. They are just willing to gamble other people’s money that they do.

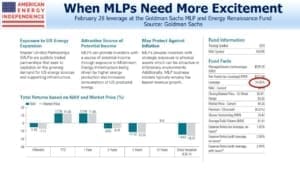

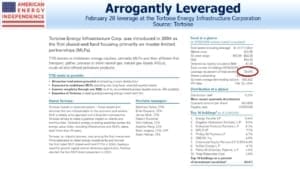

An investor pointed out to me leverage at some of these funds, from fact sheets recently published at the end of February. Goldman was running a fund with 35% leverage. Tortoise had one with 40%. YTD these funds were down 85% and 95% respectively as of 2pm today.

Given the collapse in March, these funds have all been forced sellers. As long-only investors we are down a lot. But the delevering of MLP CEFs has exacerbated the drop for everyone. Leveraged MLP closed end funds are a financial virus that is infecting the rest of the sector, by driving prices even lower. They harm all investors, but most especially the poor souls who sadly bought them. Fortunately, most of these funds are nearly dead, with little capital remaining to protect.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Well, for a break, we can all enjoy the “Pipeline Blues” album by E Frank Murphy.

Goldman’s overleveraged MLP fund has caused chaos, likely because of margin calls. Goldman’s fund owned 5,000,000 units of CEQP and once the selling started it caused a reduction in the unit price which meant that it had to keep selling, which caused more negative cycles. The fund is probably down by 2 or 3 million CEQP units now and it may be finished with that company, but as a result CEQP units, which I bought a few weeks ago at $21 today were $3.55 when I bought some additional units.

And ENBL, which has investment grade credit metrics and is 79% owned by two major utilities for which it transports natural gas, has units trading at $1.70. Since its distribution is $1.32, the units yield 78% at their current cost.

Incompetence of Midstream CEF fund managers in 2020 is the stuff of legends. Perhaps an idea for your next book. Even as of 3/17/20, with AMZ (7.4)% and AMNA (5.6)% on the day, some of these fund NAVs were down dramatically more, suggesting they were STILL highly leveraged. For example, CEM (21)%, DSE (32)%, EMO (23)%, NTG (22)% and TYG (21)%. Can’t wait to see damage done today to those NAV.

Callers are letting these clowns off much too easy on their conference calls. As if this all just unavoidably happened to them and they had no responsibility to prepare for this eventuality.