What Do They Know That We Don’t?

The other day a client asked if we’d looked at insider buying among management teams of pipeline companies.

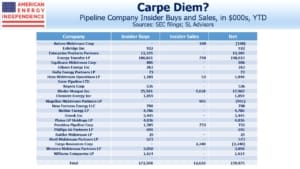

So far this year, Energy Transfer (ET) dominates with $108MM, representing 63% of all the insider buys so far. Kelcy Warren receives plenty of criticism, not least from this blog (see Energy Transfer’s Weak Governance Costs Them), but he’s certainly invested in his business. He’ll be frustrated at having made those purchases in February, because ET lost more than half its value during the March collapse. But investors appreciate his conviction.

Kinder Morgan (KMI) saw $25MM of insider buying, along with $7MM of sales. Rich Kinder is a long-time buyer of his eponymous stock. He alienated an entire class of investors in 2014, when KMI cut the dividend to finance a backlog of growth projects, and simplified their structure in a tax-adverse manner for many. He created a verb — to be “Kindered” is when faithful investors are hit with both the abrupt cancellation of promised distributions and an untimely tax bill (see Kinder Morgan: Still Paying for Broken Promises). But Kinder has bought KMI at regular intervals, including at prices much higher than today’s.

Enterprise Products Partners (EPD) saw $12MM in buying from the Duncan family. And Nustar Energy LP saw almost $5MM in buys. That three of these four are MLPs (as was Kinder Morgan years ago) shows that management teams can accumulate real wealth more easily at the helm of an MLP, with its weak corporate governance, than at a corporation.

Magellan Midstream (MMP) was an outlier among respected companies, in that it had insider sales of just under $1MM.

There was no activity at Macquarie Infrastructure (MIC), perhaps unsurprisingly since they withdrew 2020 guidance and suspended their dividend.

Plains All American (PAGP) saw $4MM of buying even as they cut their distribution by 50%, while still planning to spend half of their previously planned growth capex budget. Many investors would have preferred still less spending and a maintained distribution, but this company has lost 90% of its value since the August 2014 peak. Poor capital allocation has a long history at PAGP.

Most other names saw some insider buying, including several well-run companies. Enbridge (ENB), Cheniere (LNG), Oneok (OKE), Pembina (PPL) and Williams Companies (WMB) fall into this category. This is a very positive step by all these buyers, because the science around viruses is a key factor driving energy demand in the months ahead. Nobody has the information they’d like.

The biggest insider selling was at Targa Resources (TRGP), where Rene Joyce, a member of the Risk Committee, was forced to sell to meet a margin call. TRGP saw no insider buying either. Back in 2014 TRGP briefly touched $140 a share, when ET was rumored to be interested in an acquisition. Joyce’s forced sale at $7 reflects the same judgment that caused TRGP to spurn ET’s approach.

Given the recent leverage-induced catastrophe in MLP closed end funds (see The Virus Infecting MLPs), if Rene Joyce was to move to either Kayne Anderson or Tortoise, it seems likely both his old firm and his new one would improve their risk management.

We are invested in all the names mentioned above.