Trade Deals Boost LNG Stocks

/

European Commission president Ursula von der Leyen described the US-EU trade agreement as “huge”, demonstrating a helpful grasp of President’s Trump’s lexicon. The imposition of tariffs and the threat of punitive ones has gone remarkably smoothly. That may not always be so, but for now markets are buoyant and inflation only modestly higher.

The White House is linking trade with defense, at least implicitly. Reports suggested that von der Leyen had to consider the continued security umbrella via NATO that the US provides as well as ongoing support of Ukraine. With a trade surplus of almost €200BN in goods last year, she conceded that, “We have to rebalance it.”

Weakness in the Euro FX rate, down 2% in the subsequent two days, confirmed the view of many observers that the EU got the worse end of the deal.

Analysts were quick to point out that the EU will struggle to buy $750BN of US energy exports (mostly oil and gas) over the next three years, even though that is part of the agreement. US total exports of oil and LNG are around $150BN, with about half of that going to the EU, so we will also find it challenging to provide that much. But we can expect US-EU trade to expand in that direction. This will pressure Europeans to source less gas from Russia, which is surely in their best interests as well as ours.

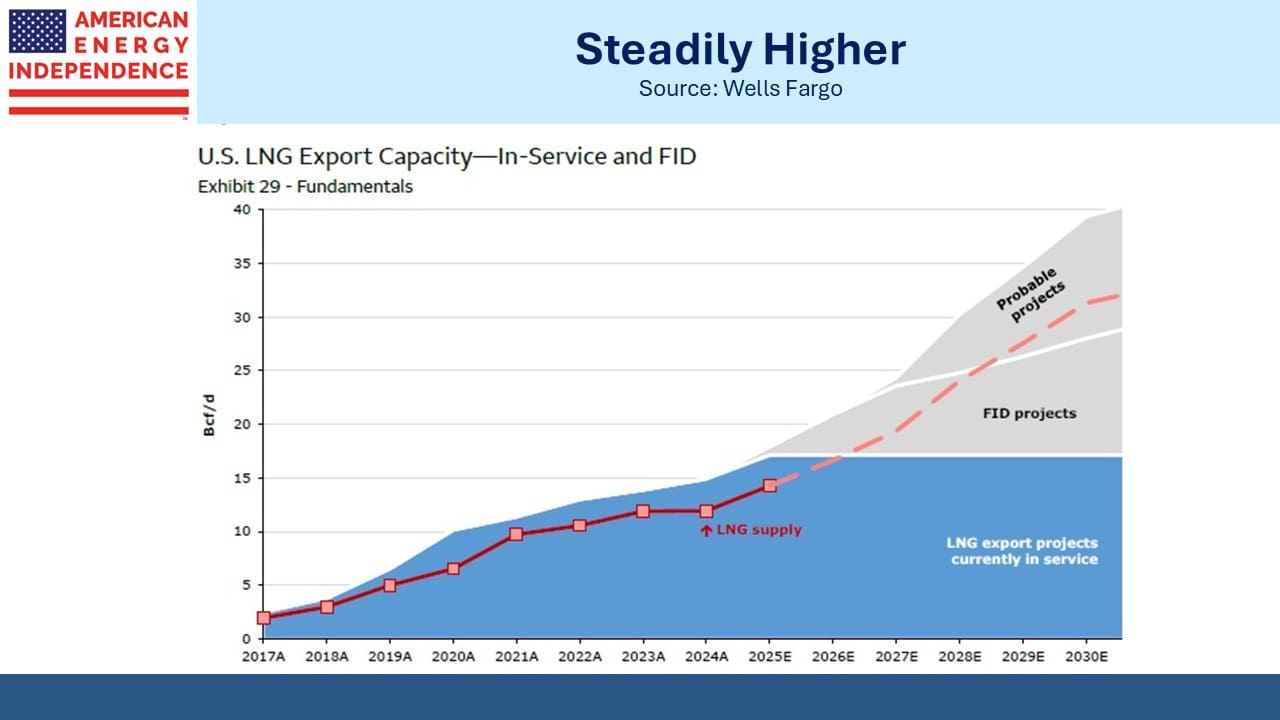

LNG stocks initially reacted strongly to the trade news but then slipped as traders contemplated that the path to increased gas exports is pretty much set for the next few years based on projects already under construction. Price differentials are already sufficient to induce flows from the US to Asia and Europe.

Venture Global (VG) announced Final Investment Decision (FID) on Phase 1 of CP2 LNG. They estimate the project will cost $15.1BN to complete and will make them the #1 LNG exporter in the US. VG has developed a reputation for relatively fast construction of LNG terminals, aided by their modular design. Along with Cheniere they dominate LNG exports, with each leapfrogging the other to be the biggest as they announce new projects.

The prospects for export volumes to double within five years are good, and it’s possible they could increase further still. Export terminals take several years to build, so we have good visibility over that time frame.

The continued promotion of oil and gas exports as a way for foreign countries to reduce their trade surpluses with us is consistent. It means we should expect ongoing regulatory support for increasing our LNG export capacity.

Growing even faster than LNG export capacity is that for Floating LNG (FLNG). Shell’s Prelude FLNG vessel off the coast of NW Australia gave the sector a bad name because of construction delays and downtime which led to enormous cost overruns.

But technology has improved, with former LNG tankers in some cases being converted into liquefaction vessels. The large spherical storage tanks they come with make the conversion relatively straightforward.

Rystad Energy estimates that global FLNG capacity will triple over the next five years.

Enterprise Products Partners (EPD) reported earnings that came in as expected. They spent $170MM repurchasing stock in 1H25 compared with a full year range of $200-300MM. They raised their dividend by 4% year-on-year. At $0.545 per quarter it yields 7%.

A couple of weeks ago I asked my accountant to estimate my tax bill if I was to sell any EPD. As an MLP, the portion of my past EPD distributions that were defined as Return Of Capital (ROC) would be “recaptured” or taxed upon sale. This large tax bill is often a painful experience for the investor.

Oneok’s (OKE) 2023 acquisition of Magellan Midstream (MMP) was treated as if MMP unitholders (which included me) had sold their units. This was one of the reasons we were unhappy about the transaction (see Oneok Does A Deal Nobody Needs). I did get a big tax bill, but OKE’s deft integration of their target has more than compensated.

The taxes owed and tax benefits of MLPs are impenetrable to all but a very few highly skilled tax experts. My friend Elliot Miller is one and he may add a comment to this post when he reads it.

I have owned EPD for close to twenty years and it’s almost tripled since my first purchase. My cost basis has gone negative due to years of the ROC portion of distributions. Nonetheless, I was surprised to learn that for each $100 of EPD I might sell, I’d owe the Federal government $16 which was less than I expected. New Jersey was more than I expected, at $10, so a 26% total tax hit.

The Garden State’s tax code is ruinously high, illogical in ways that always favor the state and doesn’t allow tax-loss carryforwards which is why you should never come to NJ to start a business.

EPD’s yield of 7% is high because of the MLP discount – most investors don’t want a K-1. Even though those distributions are now taxed as ordinary income, it still looks like an attractive yield to me so why sell it?

I’m currently reading Jon Meacham’s American Lion, a Pulitzer Prize winning biography of President Andrew Jackson. His absence of links to the establishment, rejection of constitutional norms and desire for political fights which he invariably won are all reasons he’s compared with Trump, not least by the President himself.

For those who fear the country can’t survive a second four years of Trump (and among this blog readership you are few), draw some comfort from the fact that America survived Andrew Jackson’s two terms (1829-37).

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Perhaps investors figured out the only promise that will be fulfilled was the favorable headline for Trump.

I’m happy receiving 20-25% higher dividend knowing some tax will be paid in the future. I buy and sell MLPs so my cost basis changes. I really don’t think the IRS can figure out my Income from MLPs and I’m not 100% sure ET or WES can either.

If you buy ET at 12 and sell at 18 earing 4 dividends in the process and then starting over and getting lucky because the stock has dropped again, I think my bond alternative is working and everything is fine in the PIPE world!

Simon:

I appreciate your notation, especially since I find your articles very insightful and valuable to my investing.

Personally, I don’t buy my MLP investments as trading vehicles. I buy them to hold, likely until my death, at which point my estate will receive a stepped up basis and likely no depreciation recapture if the estate does sell the units. I own many of these partnerships long enough to have a zero basis due to basis reductions over the years. Normally that would result in capital gains taxes currently, but I am applying my carried over long ago incurred material capital losses retained by me. I can always change my future MLP purchases from new to long held existing partnerships if I do consume those carry overs..

Thanks again for your gracious comment.

Elliot