Every Issue Is Linked To Trade

/

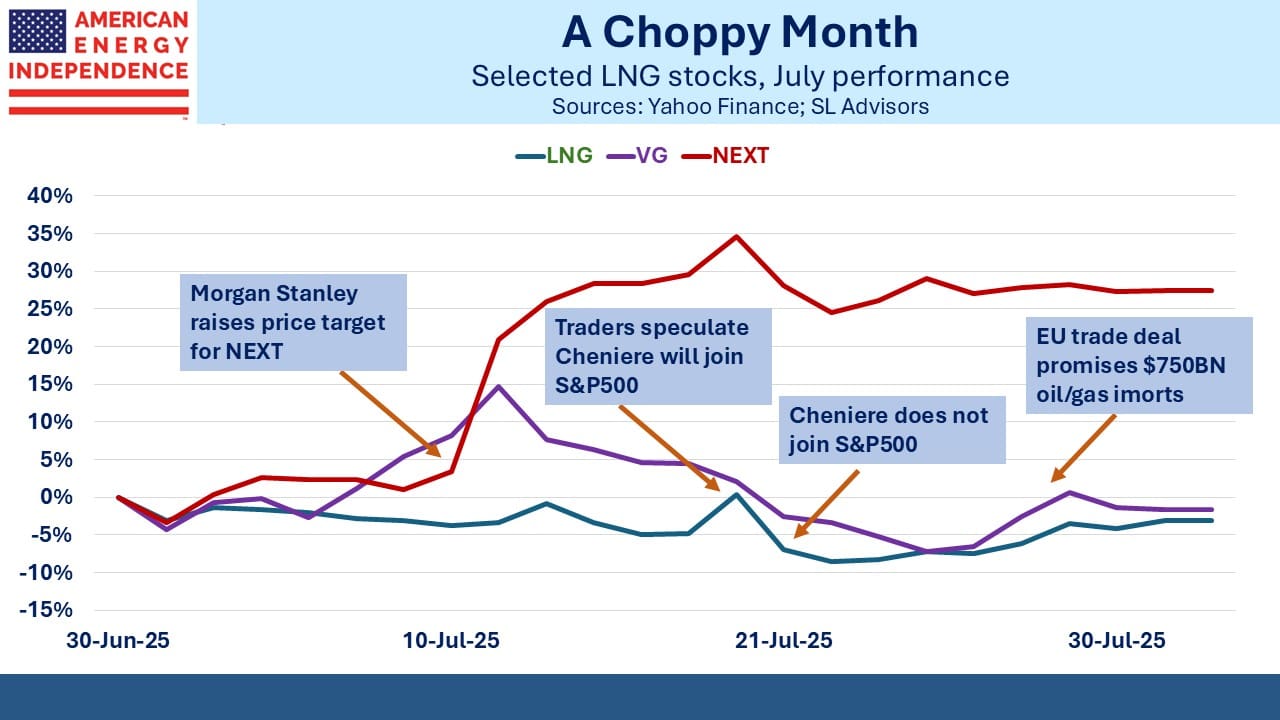

July was action-packed for LNG names. On July 11 Morgan Stanley raised their price target on NextDecade (NEXT) to $15, having last moved it to $10 in October 2022. The stock rose 18% to $10.77 on the news and added further gains during the month. Morgan Stanley’s upgrade was the only news of note, but their more bullish view on the company led the market to reprice.

Venture Global (VG) traded up in sympathy with NEXT, but since it wasn’t mentioned in the Morgan Stanley report, its gains slipped away.

Cheniere’s price target was left unchanged at $255. But following the International Court of Arbitration’s July 18th ruling that Chevron’s acquisition of Hess could proceed, Cheniere rose as traders bet it would finally be added to the S&P500 by replacing Hess. It fell when Block was chosen instead.

The US-EU trade agreement boosted LNG stocks because of the commitment by Europeans to buy $750BN of US oil and gas over three years. This was quickly derided by analysts. Criticisms included (1) the EU doesn’t buy oil and gas, private companies do, so it’s unclear what mechanism they would use to meet this commitment (2) no written agreement was released, so there are no visible consequences for failure, and (3) US oil and gas exports in total are currently around $150BN.

Reaction to the trade deal across the EU has been negative. Europe’s Summer of Humiliation in the Financial Times Op-Ed section reflected widely-held sentiments.

The deal exposed Europe’s negotiating weakness. With no one in charge, their decision-making process is necessarily slow and defensive, which dilutes the heft their economy might otherwise wield. They’re scrambling to develop a military capability to confront their aggressive eastern neighbor.

These issues clearly played a role, which is why the Euro sank 3% in the days following the deal. The White House linked trade and national security to exploit these weaknesses to America’s advantage. It’s hard to think of a previous Administration that took such a stance.

How investors think about the prospects for increased US energy exports to Europe has been a hotly debated topic among your blogger’s investment team. It’s easy to conclude the numbers are implausible.

The EU commitments on oil and gas purchases can be dismissed as aspirational given the figures outlined above. But the trade deal showed who holds the cards. Trump is likely to abruptly rescind any agreement with little warning.

When Cheniere or VG are negotiating a long-term LNG supply contract with a big European buyer, they’re likely to complain to the White House if unable to reach a conclusion. If EU rules rather than commercial terms are the sticking point, “temporary punitive tariffs” may be needed to induce a more co-operative EU regulatory structure. If European buyers don’t sign some additional long-term LNG contracts in the months ahead, there are likely to be consequences.

The US has already introduced tariffs into relations with Brazil to halt the prosecution of right-wing former President Jair Bolsonaro. The 35% tariff on Canadian goods announced Friday is in part because PM Mark Carney showed he is “tone deaf” by recognizing Palestinian statehood, according to Commerce Secretary Howard Lutnick.

Trade issues are being linked like never before to promote US interests.

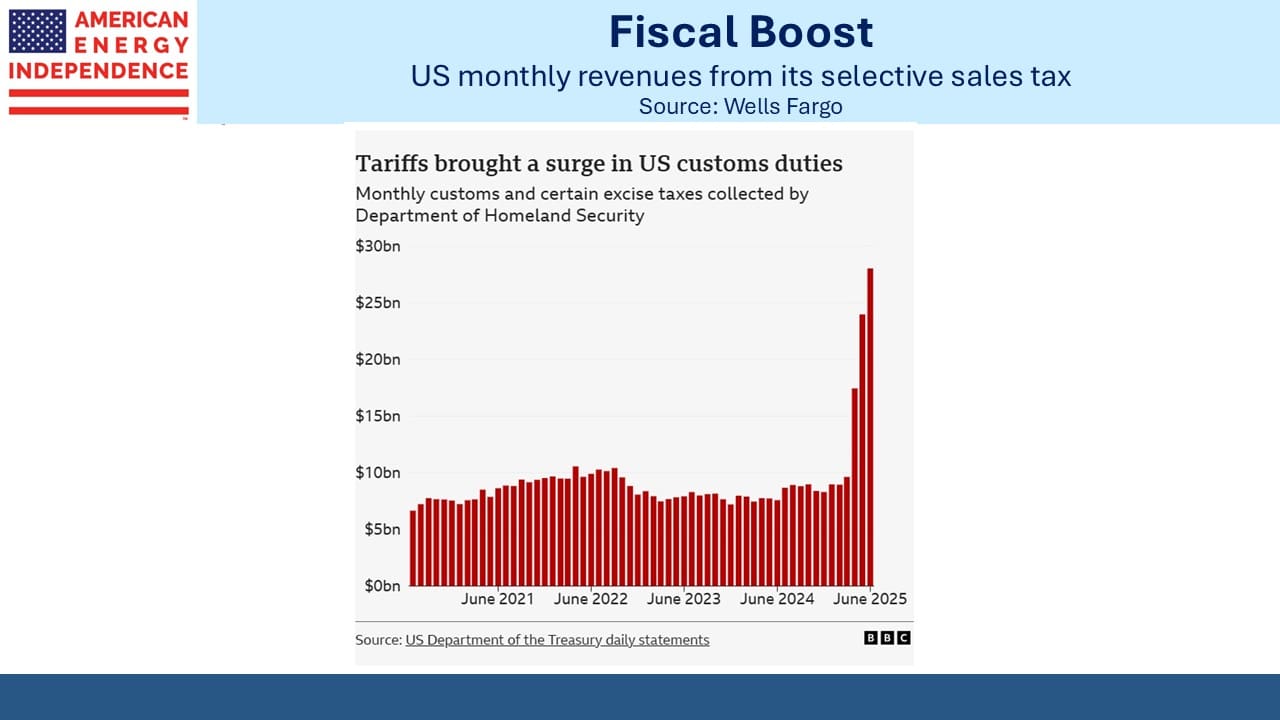

So far, tariffs have been less disruptive than many expected. One might even say that those who understand economics forecast a dire outcome, while those who don’t just went ahead and implemented them. The net result looks like a Federal sales tax applied to imports. It’s running close to $30BN per month. Even for the US-sized budget deficit this is real money – equal to more than a third of our defense spending.

State-level sales taxes are uncontroversial, and most states have one. We now have a Federal sales tax applied selectively on foreign goods. Implementation has been capricious, inducing equity market volatility. Some industries such as autos with their cross-border supply chains have absorbed big losses. There may yet be an uptick in prices, although few would worry that a sales tax is inflationary.

The world hates the re-ordered trade system. Swiss lawmakers were left “in shock” at the abrupt imposition of a 39% tariff on Friday.

America, objectively, seems to be doing fine. The outlook for growth in US LNG exports continues to improve.

We’re modifying the current Sunday/Wednesday twice-weekly blog schedule to be weekly, on Sundays, with opportunistic updates during the week as market events dictate. We think this will improve the quality and relevance of this blog’s output.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Thank you for recognizing the reality that tariffs are a tax on the consumer, namely the American people. The more taxes we pay, the less we will have to circulate in the economy. And as you have often reported, money paid to the government is generally less efficiently spent than that in the private economy. Perhaps the public reaction to tarriffs will be different when the public takes to heart who is actually paying them. By the way, I strongly suspect your assertion that “everything is well in spite of Trumps actions” will soon be belied by reality. I hope you’re right, and I’m wrong, but I doubt it.

Of course “the world” hates the re – ordered trade system: other countries will now be less able to use the US market as a dumpnig ground for their excess production. Other countries using the US market to protect and maintain their employment and their basic industries, to the detriment of the US economy. A re -balance in the US international trade is long overdue. Also, a more developed US industrial base is required. For example, all of the many metals, minerals and RE’s required for industry and national defense. RE’s are a prime example. It’s appalling that US has let this lack of mining, refining and processing of RE’s into the final products in the US to occur. The Trump administration has at least started to rectify this glaring shortfall with the DOD 10 year investment in MP Materials. No surprise that AAPL soon followed. Unfortunately, due to the bloated bureaucaratic US permitting system and burdensome environmental laws and NIMBY, who knows how long this process will take. No surprise that MP is building its refining and processing facilities in TX.