Another Power Auction Hikes Electricity Prices

/

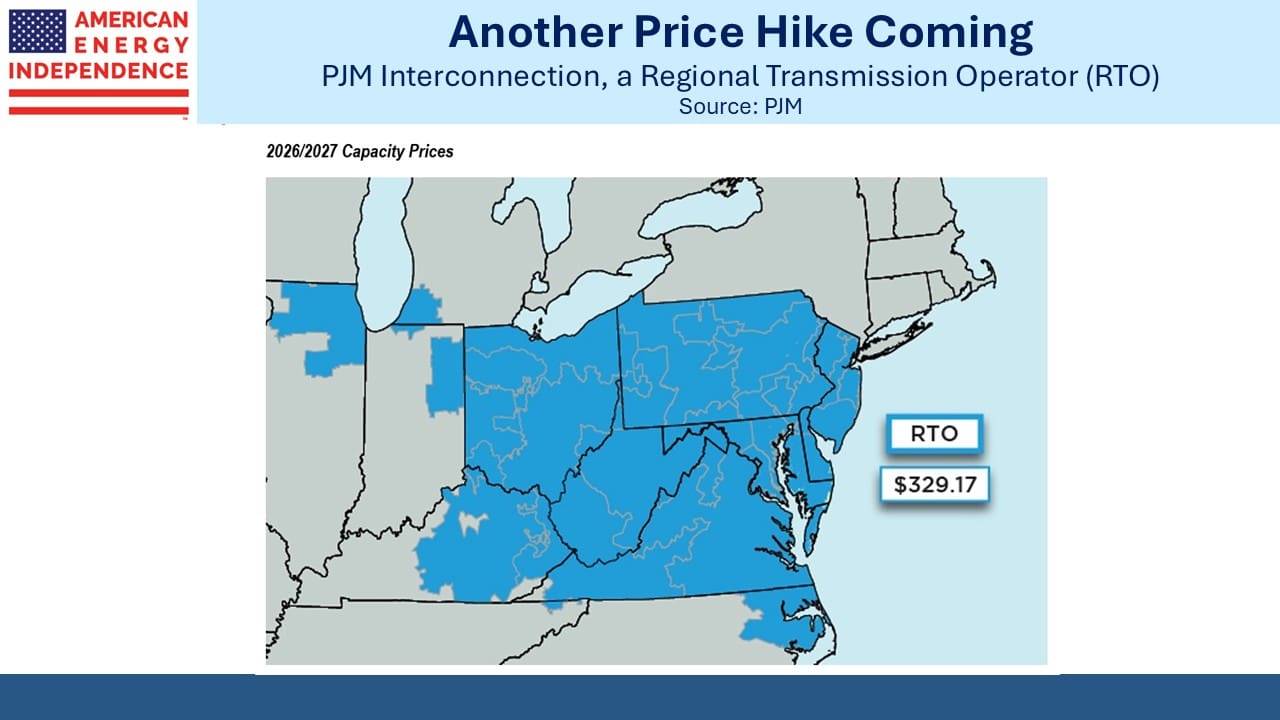

PJM Interconnection announced the results of their capacity auction last week. This is where suppliers of electricity quote prices to provide surge capacity for periods of high demand (typically hot summer days). It used to be uneventful until last year, when the clearing price was 9X higher than before. This led to the price hikes now rolling across PJM’s region, which saw your blogger’s bill rise 35% (see Power Auctions Are Getting Interesting).

The clearing price of $329.17 per MegaWatt Day was +22% from last year, and would have been higher except for the price cap imposed by FERC. Without the cap, PJM indicated the cleared price would have been $388.57, +44%. PJM expects this to translate into 1.5-5% price increase for consumers.

PJM also noted that this only covers about half the new power demand they expect to see, because of growing data centers.

JPMorgan wrote a cheery research note on the auction (“PJM Paranoia proves perilous”). I was initially confused by this, wondering why higher electricity prices could be good. It soon became clear that power providers such as Talen Energy and Constellation Energy were the auction beneficiaries. Talen reported that this would add $805 million to capacity revenues. Its stock rose 8% on the news.

This is capitalism at work, ensuring that electricity will be available when needed by discovering the price necessary for that to happen. The mix of this guaranteed surge capacity is: 45% natural gas, 21% nuclear, 22% coal, 4% hydro, 3% wind and 1% solar.

Over three quarters of this power is from dispatchable sources (gas and coal) that can be ramped up when needed. 4% is weather-dependent. Demand from data centers is rising. Supply isn’t keeping up and state policies are increasing the share of intermittent power that’s available.

The usual crowd of apologists for renewables complains that much more solar and wind could be connected to the grid if only PJM would move faster. The impact of each new source needs to be evaluated in terms of the impact of intermittent supply, since conventional power is available when needed rather than weather permitting.

PJM also noted that many projects applying to be connected have yet to be built and have run into problems outside PJM’s scope, such as with, “permitting, supply chain constraints and evolving project economics.”

Grid operators need to consider factors such as the Effective Load Carrying Capacity (ELCC). This contrasts with Unforced Capacity (UCAP). ELCC is typically lower than UCAP, especially for renewables. Moreover, as more intermittent power supplies are added to a grid, their low ELCC drags down the system’s overall ELCC. It means that ever more excess capacity is required as intermittent power gains market share.

This is why it’s so disingenuous for renewables advocates to claim that their solution is the cheapest. As the results of this auction and last year’s show, adding renewables to a grid increases the cost of spare capacity that must be available for when it’s not sunny or windy.

Ironically, offshore wind has been found to have a high ELCC, sometimes even as good as gas combined cycle power plants. But the US has very little offshore wind, and numerous projects have been canceled due to rising costs, supply chain issues and the new Administration’s general hostility to wind.

Surveys show that consumers value reliability and price. Climate change has been receding as a concern, as was apparent in November’s election. But left-wing climate policies continue to have a deleterious impact.

Solar and wind can work in certain situations though. Enbridge is building a 600MW solar farm near San Antonio, TX which will be fully dedicated to supporting Meta data centers.

Puerto Rico is laboring under an impractical zero carbon mandate. The electricity supply is notoriously unreliable, and many homes have generators to compensate for regular power cuts. Consequently, a law requiring 40% of the island’s electricity to come from renewables this year is (a) not addressing their most important problem, and (b) hopelessly out of reach. Last year 62% of its power came from petroleum products, meaning diesel, 24% natural gas and 7% renewables.

New Fortress Energy (NFE) has been negotiating with Puerto Rico over a $20BN LNG contract, although those discussions have recently been broken off by the PR government. They have few good alternatives and have begun negotiations for 30-day emergency LNG supply contracts. NFE’s stock rose on the news, perhaps reflecting the market’s view that PR will ultimately have to return to negotiations.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!