There’s No Deficit On This Year’s Ballot

/

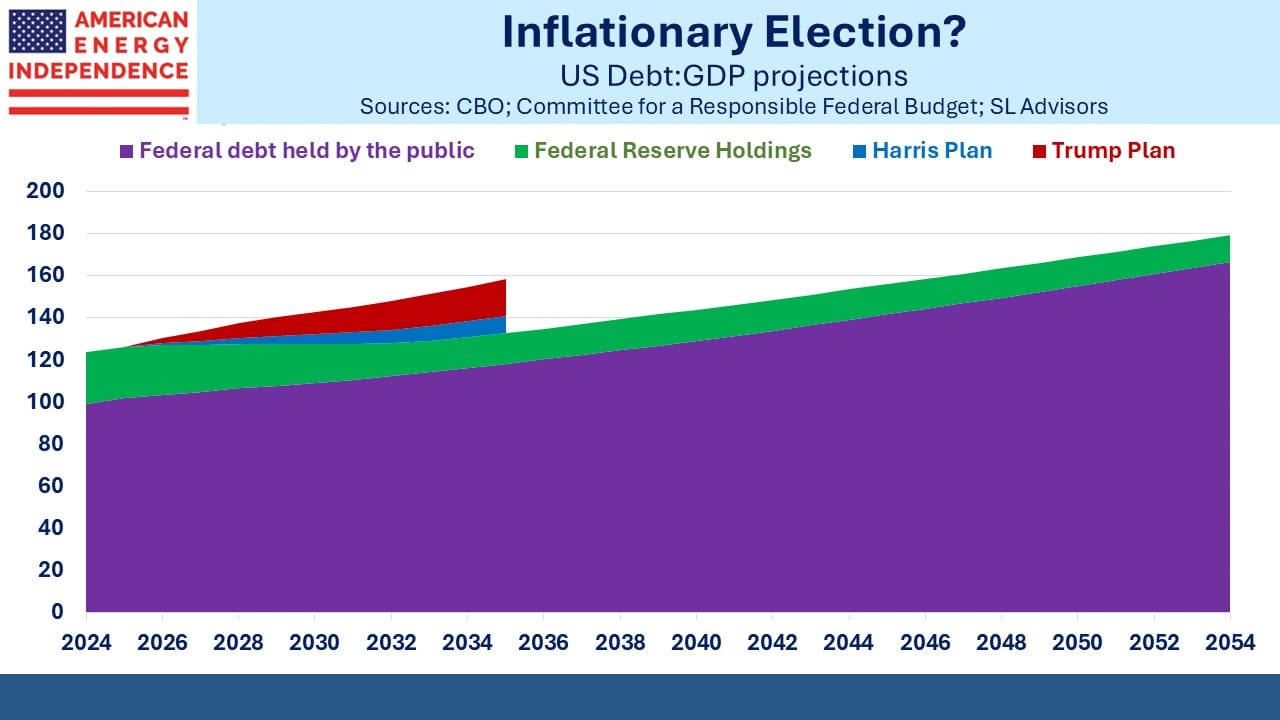

Politicians from both parties long ago learned that fiscal prudence leads to electoral oblivion. Therefore, the absence of the deficit as a topic of conversation should surprise no-one. Publicly owned Federal debt is 99% of GDP and the Congressional Budget Office (CBO) is forecasting that this will reach 166% over the next three decades.

Trump and Harris have both made promises that will add to our debt. The Committee for a Responsible Federal Budget puts its central estimate for the Harris plan at $3.5TN and the Trump plan at $7.5TN over the next decade (2026-35).

These both sound like ruinously high figures – and yet, they’re on top of total debt that’s already forecast to rise. The CBO’s forecast on current policies is that total debt, including that which is held by the Federal Reserve and in effect monetized, will grow by $18.7TN (2026-35) on present policies. In this context, the Harris plan is parsimonious and the Trump plan only somewhat less so.

The translation of those campaign promises into legislation depends on the composition of Congress. But both candidates plan to extend the Tax Cuts and Jobs Act (TCJA), provisions of which expire next year. Without Congressional action, individual income tax rates will rise (ie top rate from 37% to 39.6%) as will the $10K cap on State and Local Tax deductions (“SALT”).

Living in high-tax NJ I’m naturally in favor of retaining current tax rates and repealing the $10K SALT cap.

With both candidates pledging to modify the TCJA, and taxes set to rise with no action, it’s likely something will get done. The Harris plan allows tax rates to rise on households making over $400K, and her TCJA modifications are 85% of her plan’s ten year impact on our debt. Trump’s plan adds more than twice as much debt as the Harris one, and TCJA modifications are 71% of it.

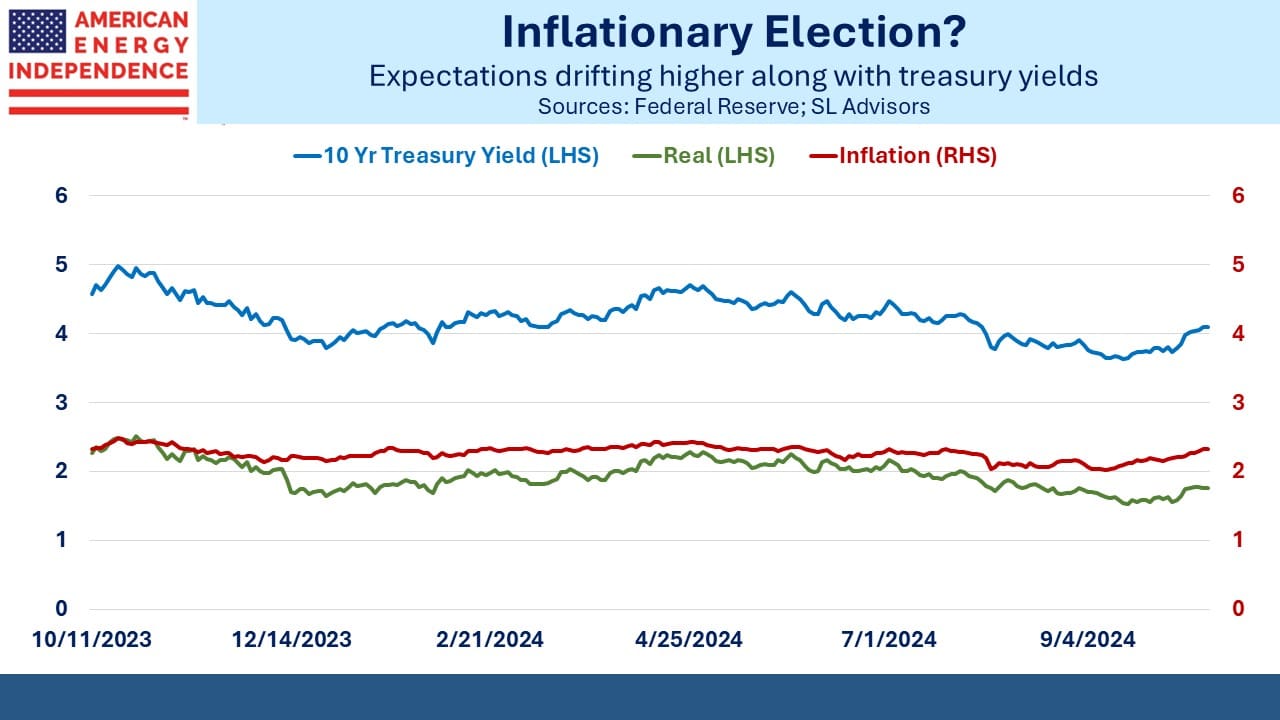

Meanwhile bond yields are drifting higher. It’s partly a steepening of the curve caused by the Fed’s 0.5% cut and a result of the strong September jobs report which made another big cut unlikely.

Inflation expectations (derived by subtracting the yield on TIPs from nominal treasuries) have moved 0.30% higher in the past month and near the highest levels of the year. It’s far from indicating a return of the bond vigilantes, but bears watching. Political concern about our fiscal outlook, never much in evidence, is completely absent.

A Hemingway character explained his bankruptcy as occurring, “Gradually, then suddenly”) in The Sun Also Rises. The US won’t go bankrupt. But if a fiscal debt crisis suddenly occurs, it’ll be because it was getting gradually worse in plain sight for decades.

In our opinion, inflation-sensitive assets such as midstream energy infrastructure offer good protection against the subsequent rise in inflation that would follow.

In energy news, we noted that China’s coal imports hit a record high in September, +13% on a year ago. Meanwhile the Sierra Club continues to oppose the supply of reliable energy. They recently persuaded a court to delay a 32-mile natural gas pipeline planned by Tennessee Gas Pipeline, a subsidiary of Kinder Morgan.

Natural gas has been the biggest cause of reduced US CO2 emissions by displacing coal. Globally, demand continues to grow. Even the International Energy Agency (IEA), whose forecasts are increasingly designed to cheerlead for renewables, is warning that insufficient investment in new gas production risks a supply shortage.

Along with rising construction costs and regulatory challenges in building LNG export terminals, this is impeding the shift from coal to gas that China and other developing countries must make.

Lastly, a photo showing the damage a tornado can inflict on a solar farm. Duke Energy’s Lake Placid facility was the target. As a Florida homeowner on the Gulf of Mexico I can attest that weather damage is becoming more frequent. Hiring workers to shift sand off our property and back onto the beach at exorbitant prices is a cost of being there if admittedly a first world problem.

Florida Power and Light restored electricity within a few days, but it reminds why gasoline-powered trucks and other equipment will be irreplaceable at such times.

EVs are especially vulnerable to flooding and storm surge. With a conventional car your worst case is it’s totaled, but saltwater entering an EV lithium-ion battery creates a fire risk in addition to leaving it undriveable. One fire marshall advised moving a water-disabled EV out of its garage, “so that you can worry about fixing your home instead of rebuilding it due to fire”

Internal migration to the south and south west is increasing the population in hurricane-prone areas like Florida. Sun and no left-wing politics will do that.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!