Energy Lifts Poor Countries Up

/

The International Energy Agency (IEA) released their 2024 World Energy Outlook last week. The IEA has become a renewables cheerleader in recent years, issuing projections of energy consumption that are frequently implausible. However, they still produce a Stated Policies Scenario (“STEPS”) which omits their more fanciful projections.

Electricity demand from data centers has been a regular topic of discussion with investors as US grids have increased ten-year demand projections from 1% to around 5% pa over the past year or so. The IEA concedes that it’s hard to precisely forecast the growth in global data center demand, but generally expects demand from air conditioning to be substantially higher.

Like almost all growth in energy consumption, this is driven by developing economies. An extended heat wave in India this summer resulted in a doubling of sales of air conditioning units. One homeowner said, “I’ve endured the worst summers under just a fan. But this year, my children suffered so much that I had to buy our family’s first air conditioner.” His monthly electricity bill increased 7X.

40% of the world population (around 3 billion people) live in the tropics, where ChatGPT estimates only 8-10% have access to air conditioning. The IEA believes a/c penetration in emerging economies will rise from 0.6 per household to almost 1.0 by 2035, close to the US.

The natural response of people that are sweating profusely is not to blame CO2 emissions but to get cool. You can’t fight climate change if you’re too hot, don’t have access to electricity or cook dinner on a fire of animal dung.

This is why energy demand will keep going up.

The IEA provides figures on energy poverty. 750 million people (world population is around 8.2 billion) don’t have access to electricity. More than 2 billion don’t have access to clean cooking, meaning they use open fires of either wood or animal dung. To quote the IEA, “This results in over 4.5 million premature deaths worldwide each year due to ambient (outdoor) air pollution, and nearly 3 million deaths from household air pollution.”

The moral response of OECD countries, especially the US, should be to help provide these people with access to electricity and clean cooking, by exporting natural gas. Democrat policies that impede such US exports betray a philosophy that is deeply anti-humanity. We believe such pragmatic solutions will continue to gain traction, just as nuclear power is enjoying a US renaissance.

Energy exports are in the great US tradition of helping less fortunate countries prosper. They are ethically correct and in the interests of our national security.

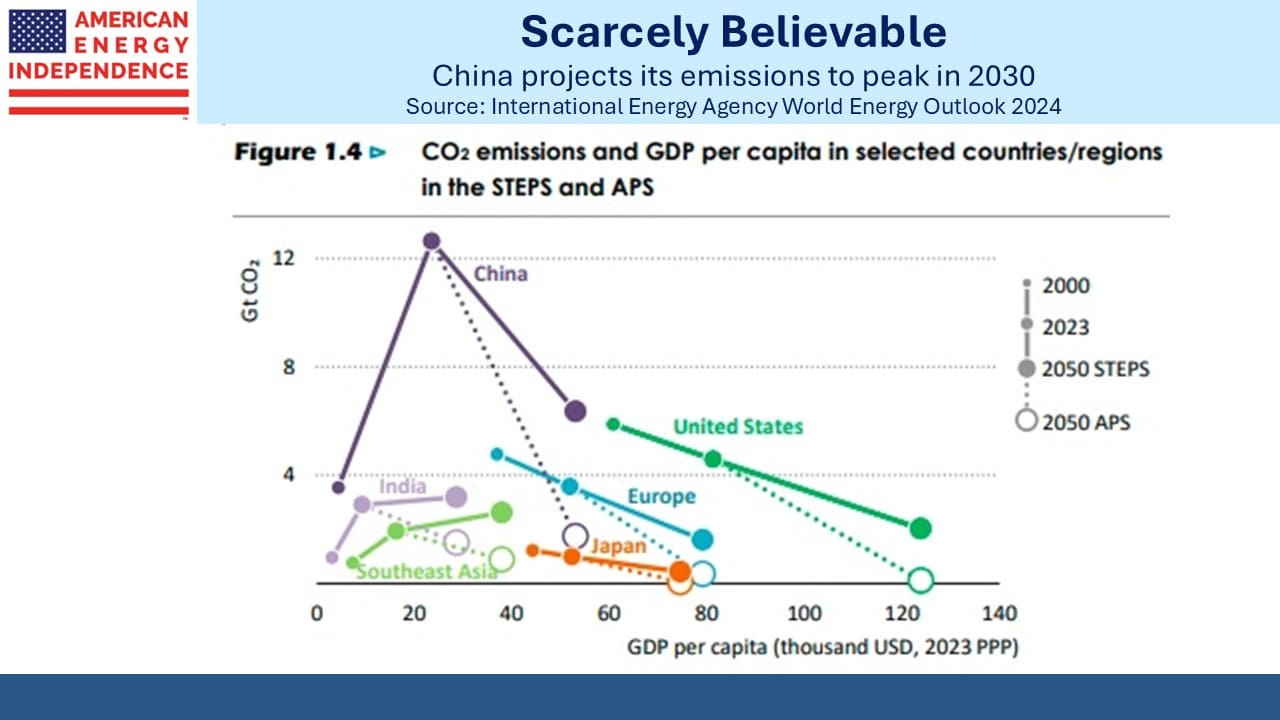

Current policies assume China will begin reducing emissions in 2030, reaching zero by 2060, a decade later than the UN IPCC goal. China burns over half the world’s coal and a “show me” attitude is appropriate towards the country that generates 31% of global emissions. It’s not at all obvious that their emissions will peak as planned. New York City’s policy that forbids natural gas hookups to new buildings is a virtue-signaling, self-inflicted irrelevance.

I spent last week visiting clients in South Carolina, Georgia and New Orleans. I always enjoy such encounters, but they’re especially convivial when an advisor can report that 100% of his clients invested with us are profitable. This happened more than once, and I credit the advisor’s propitious timing. Nonetheless it is a great pleasure to be tangentially associated with such success.

Our investors tend to favor Republicans, and as a registered Republican myself I enjoy their company. But I often note that midstream energy infrastructure should appeal to moderate Democrats too since natural gas is the main driver of reduced US CO2 emissions. If climate extremists would get out of the way the benefit could extend to other countries.

Discussion topics usually included the election. It’s often believed that the “permit pause” on new Liquefied Natural Gas (LNG) export terminals announced by the Department of Energy in January to try and excite progressive climate extremists means current LNG exports are capped.

This is not the case.

LNG export terminals take years to build, and the pause did not impact already issued permits. Therefore, LNG exports will double from 12 to around 24 Billion Cubic Feet per Day (BCF/D) over the next few years as new capacity is completed. The US will be doing its part to provide electricity and clean cooking to developing countries in Asia as well as natural gas to friends and allies such as Ukraine.

From the moral high ground, the Sierra Club is an insignificant speck in the ditch.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!