There’s No Deficit On This Year’s Ballot

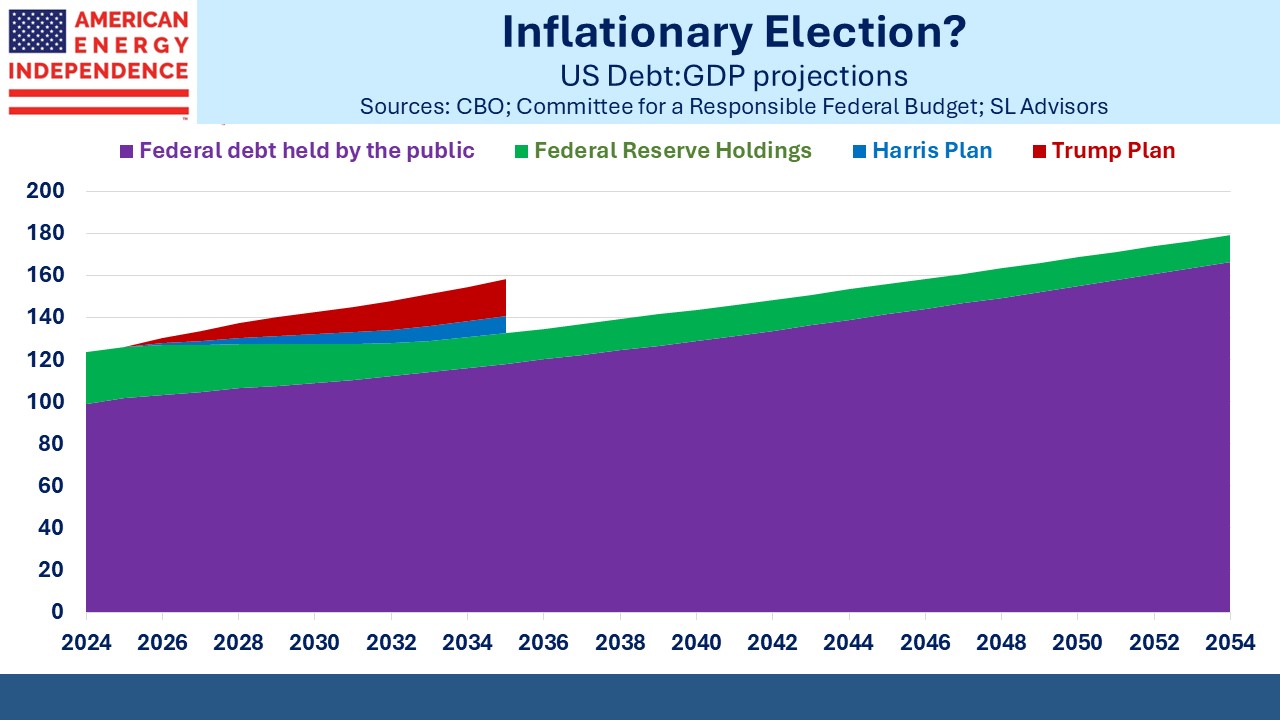

Politicians from both parties long ago learned that fiscal prudence leads to electoral oblivion. Therefore, the absence of the deficit as a topic of conversation should surprise no-one. Publicly owned Federal debt is 99% of GDP and the Congressional Budget Office (CBO) is forecasting that this will reach 166% over the next three decades.

Trump and Harris have both made promises that will add to our debt. The Committee for a Responsible Federal Budget puts its central estimate for the Harris plan at $3.5TN and the Trump plan at $7.5TN over the next decade (2026-35).

These both sound like ruinously high figures – and yet, they’re on top of total debt that’s already forecast to rise. The CBO’s forecast on current policies is that total debt, including that which is held by the Federal Reserve and in effect monetized, will grow by $18.7TN (2026-35) on present policies. In this context, the Harris plan is parsimonious and the Trump plan only somewhat less so.

The translation of those campaign promises into legislation depends on the composition of Congress. But both candidates plan to extend the Tax Cuts and Jobs Act (TCJA), provisions of which expire next year. Without Congressional action, individual income tax rates will rise (ie top rate from 37% to 39.6%) as will the $10K cap on State and Local Tax deductions (“SALT”).

Living in high-tax NJ I’m naturally in favor of retaining current tax rates and repealing the $10K SALT cap.

With both candidates pledging to modify the TCJA, and taxes set to rise with no action, it’s likely something will get done. The Harris plan allows tax rates to rise on households making over $400K, and her TCJA modifications are 85% of her plan’s ten year impact on our debt. Trump’s plan adds more than twice as much debt as the Harris one, and TCJA modifications are 71% of it.

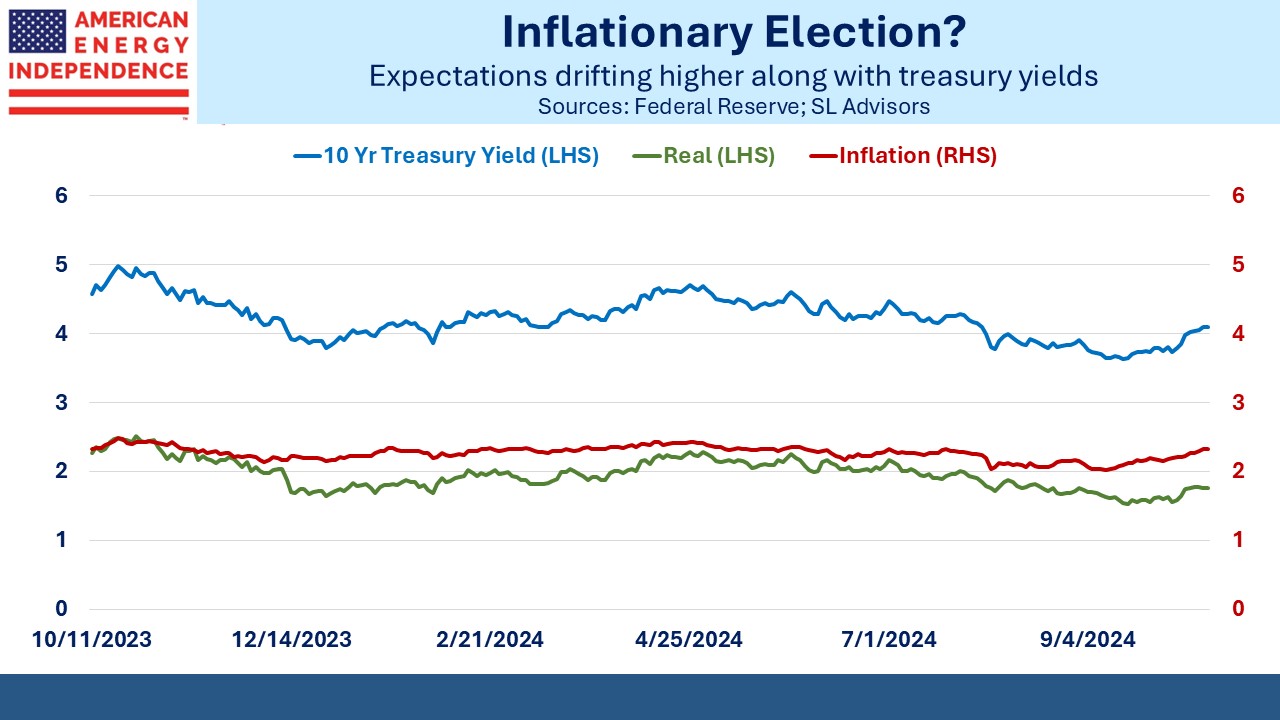

Meanwhile bond yields are drifting higher. It’s partly a steepening of the curve caused by the Fed’s 0.5% cut and a result of the strong September jobs report which made another big cut unlikely.

Inflation expectations (derived by subtracting the yield on TIPs from nominal treasuries) have moved 0.30% higher in the past month and near the highest levels of the year. It’s far from indicating a return of the bond vigilantes, but bears watching. Political concern about our fiscal outlook, never much in evidence, is completely absent.

A Hemingway character explained his bankruptcy as occurring, “Gradually, then suddenly”) in The Sun Also Rises. The US won’t go bankrupt. But if a fiscal debt crisis suddenly occurs, it’ll be because it was getting gradually worse in plain sight for decades.

In our opinion, inflation-sensitive assets such as midstream energy infrastructure offer good protection against the subsequent rise in inflation that would follow.

In energy news, we noted that China’s coal imports hit a record high in September, +13% on a year ago. Meanwhile the Sierra Club continues to oppose the supply of reliable energy. They recently persuaded a court to delay a 32-mile natural gas pipeline planned by Tennessee Gas Pipeline, a subsidiary of Kinder Morgan.

Natural gas has been the biggest cause of reduced US CO2 emissions by displacing coal. Globally, demand continues to grow. Even the International Energy Agency (IEA), whose forecasts are increasingly designed to cheerlead for renewables, is warning that insufficient investment in new gas production risks a supply shortage.

Along with rising construction costs and regulatory challenges in building LNG export terminals, this is impeding the shift from coal to gas that China and other developing countries must make.

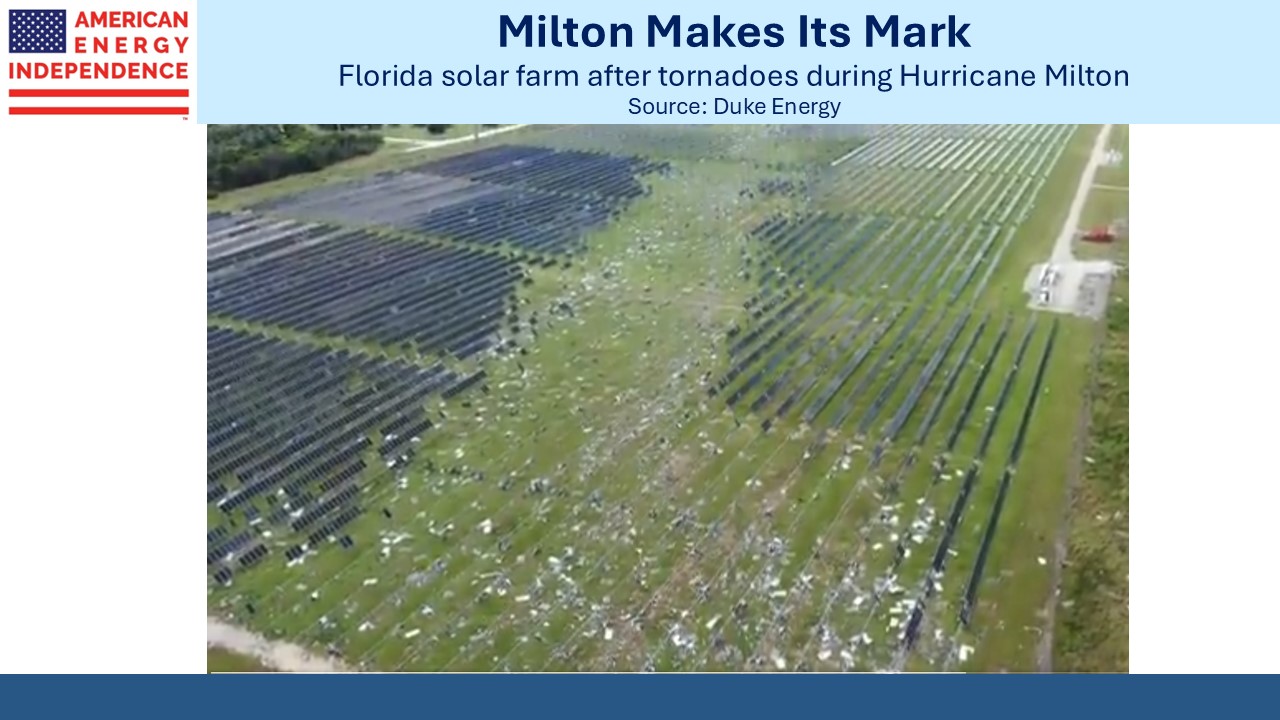

Lastly, a photo showing the damage a tornado can inflict on a solar farm. Duke Energy’s Lake Placid facility was the target. As a Florida homeowner on the Gulf of Mexico I can attest that weather damage is becoming more frequent. Hiring workers to shift sand off our property and back onto the beach at exorbitant prices is a cost of being there if admittedly a first world problem.

Florida Power and Light restored electricity within a few days, but it reminds why gasoline-powered trucks and other equipment will be irreplaceable at such times.

EVs are especially vulnerable to flooding and storm surge. With a conventional car your worst case is it’s totaled, but saltwater entering an EV lithium-ion battery creates a fire risk in addition to leaving it undriveable. One fire marshall advised moving a water-disabled EV out of its garage, “so that you can worry about fixing your home instead of rebuilding it due to fire”

Internal migration to the south and south west is increasing the population in hurricane-prone areas like Florida. Sun and no left-wing politics will do that.

We have two have funds that seek to profit from this environment: