The World’s Only Shale Revolution

/

In conversations with investors the Shale Revolution is acknowledged as driving US hydrocarbon production up. What is less appreciated is how much this has been a US phenomenon, with no equal anywhere else in the world.

The technologies of hydraulic fracturing (“fracking”) and horizontal drilling were developed sufficiently that they allowed access to enormous reserves that were otherwise out of reach. Although such geological formations are not unique to America, nowhere else has been able to harness all the other requirements necessary for exploitation.

Least appreciated is privately owned mineral rights. Americans take for granted that a gusher of oil on their property will make them rich. But in the rest of the world the government takes ownership – even in the UK, upon whose legal system the US is based.

This has enabled private landowners to negotiate deals with Exploration and Production (E&P) companies. The activity is regulated and taxed by the state and provides royalties to the landowner. I’ve chatted with beneficiaries of this common arrangement, and they typically report that oil or gas production takes up a tiny portion of their land. Drilling a well is noisy and disruptive but once completed there’s not much further impact.

The US has other advantages, including a highly skilled energy labor force, a culture of entrepreneurialism, technological excellence and the world’s deepest capital markets. We also have ample supplies of water. It’s estimated that fracking the typical well requires around 4 million gallons.

These are all the reasons Why the Shale Revolution Could Only Happen in America as we explained in a 2016 blog post.

It wasn’t always good for investors. The opportunities for increased production drew too much capital, and the damage from the subsequent crash hung over the sector for years. The fear of stranded assets kept many away from traditional energy. A nascent recovery in 2019 was crushed by lockdowns during the pandemic, a low point in public health policy that wrongly imprisoned everyone in their homes instead of just the most vulnerable.

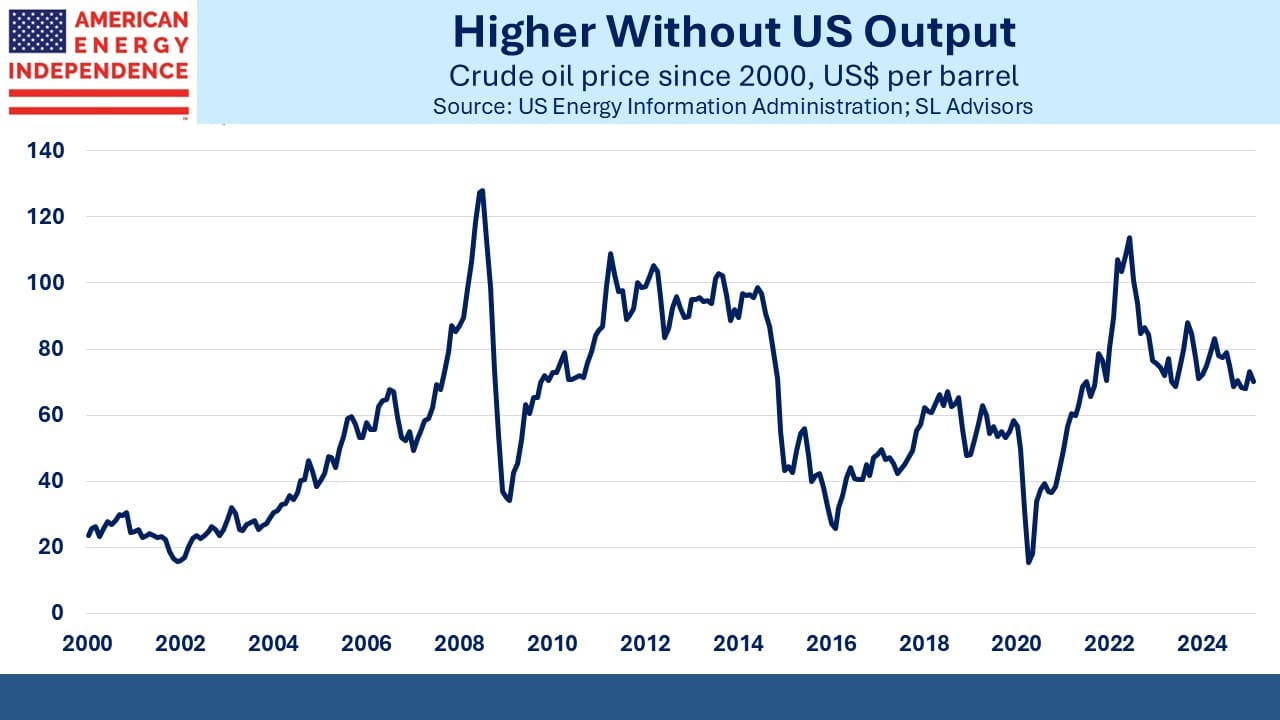

Because many investors are unaware of how uniquely American the Shale Revolution is, they also don’t appreciate how much it has impacted global energy markets. In 2014 OPEC saw the threat posed by US shale and pushed oil prices down in an effort to bankrupt these new market entrants. Within 18 months crude fell from $100 per barrel to $25.

Although there was widespread financial pain, the move was too late. Over time giants like Exxon and Chevron moved in, bringing financial heft and technological expertise that lowered costs. US shale was here to stay.

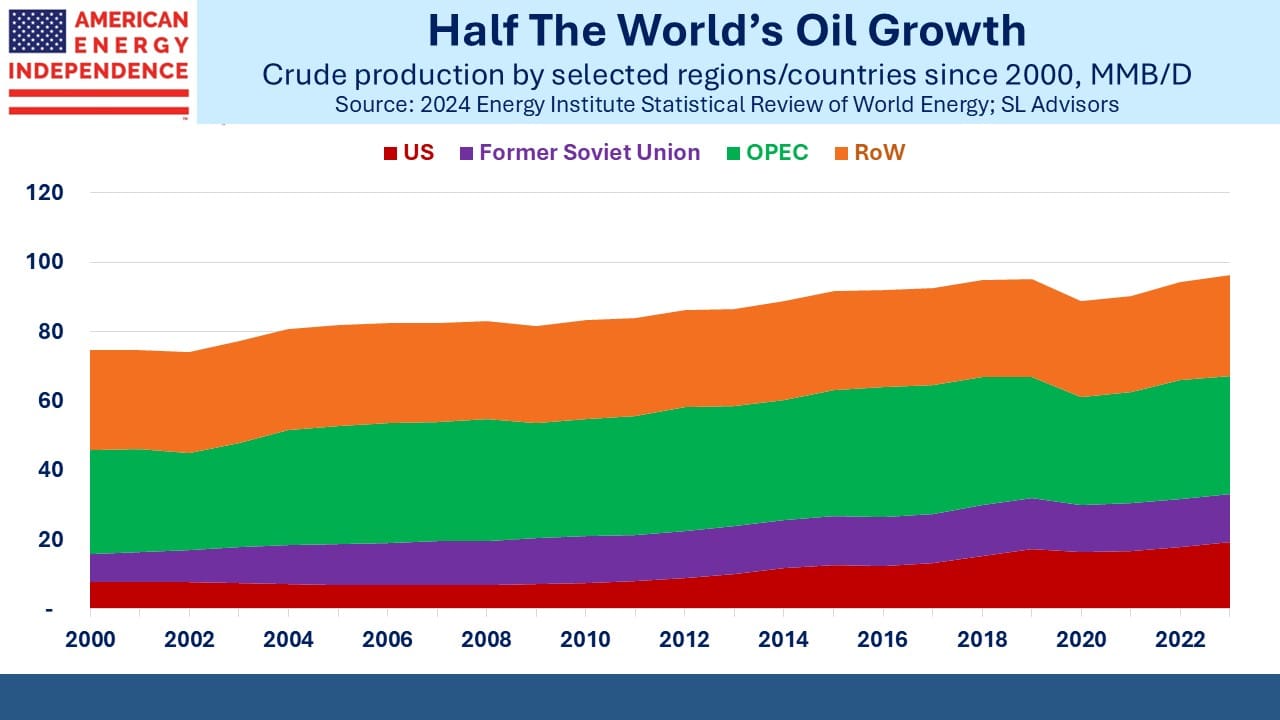

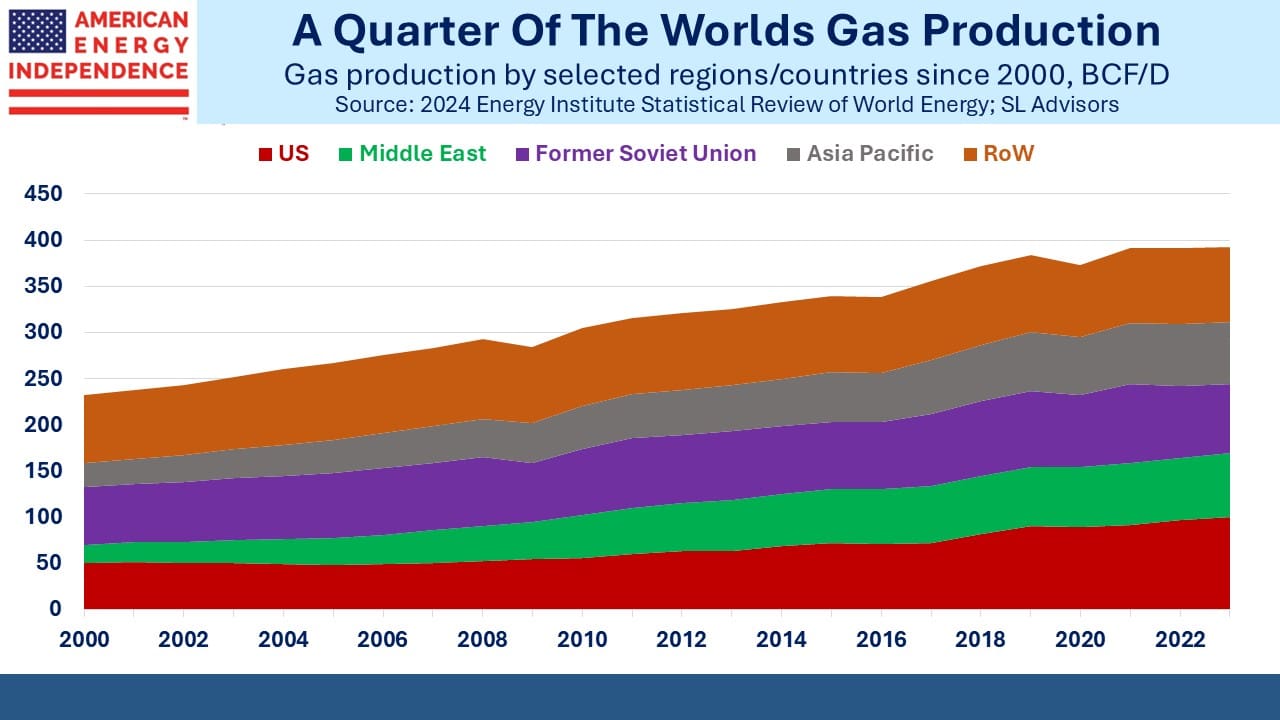

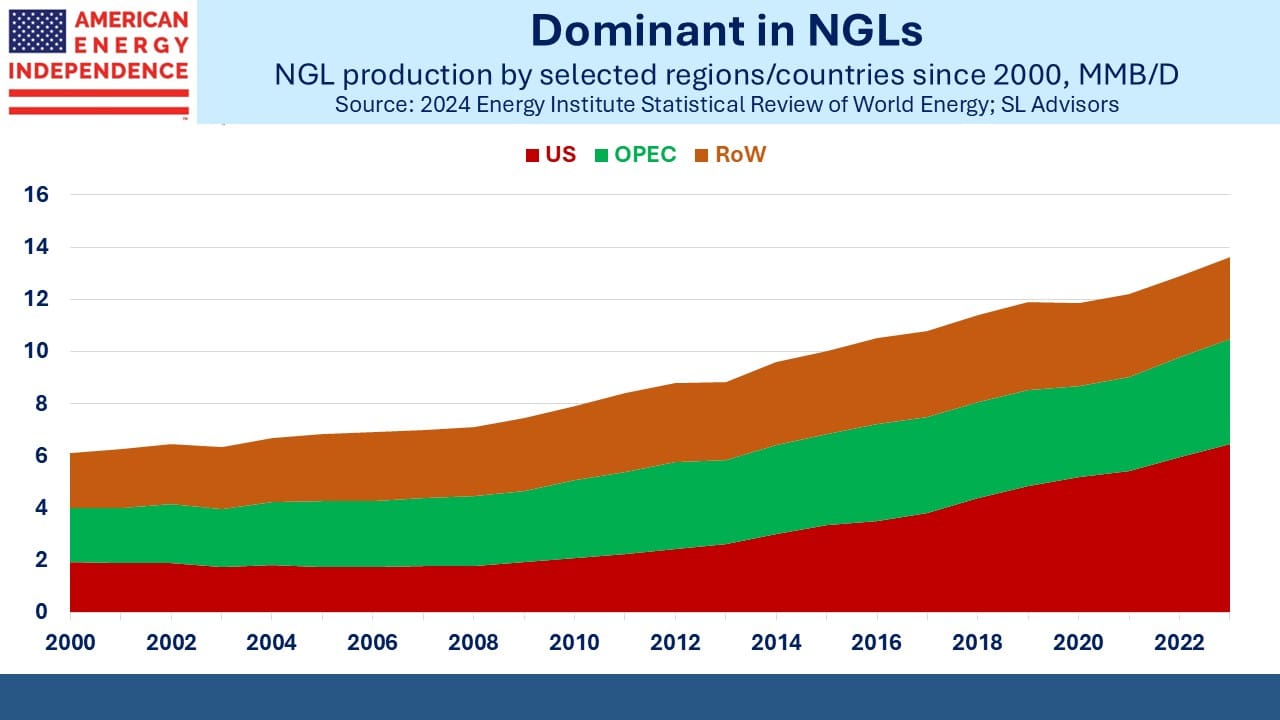

The global impact shows up on production charts covering the last quarter century.

In crude oil, the US is responsible for 53% of the growth in production since 2000. In natural gas we’re 31%. In Natural Gas Liquids (NGLs, which include ethane, propane and butane) the US is 47% of global production and 60% of the growth over this time.

We produce a quarter of the world’s natural gas and are the biggest exporter of Liquefied Natural Gas (LNG).

The result is that increased US production of hydrocarbons is the biggest energy story in the world. Without it, most manufactured goods would be more expensive because transportation (oil), plastics (ethane or crude oil) and power (electricity from natural gas) would all cost more. Lower prices have boosted living standards everywhere.

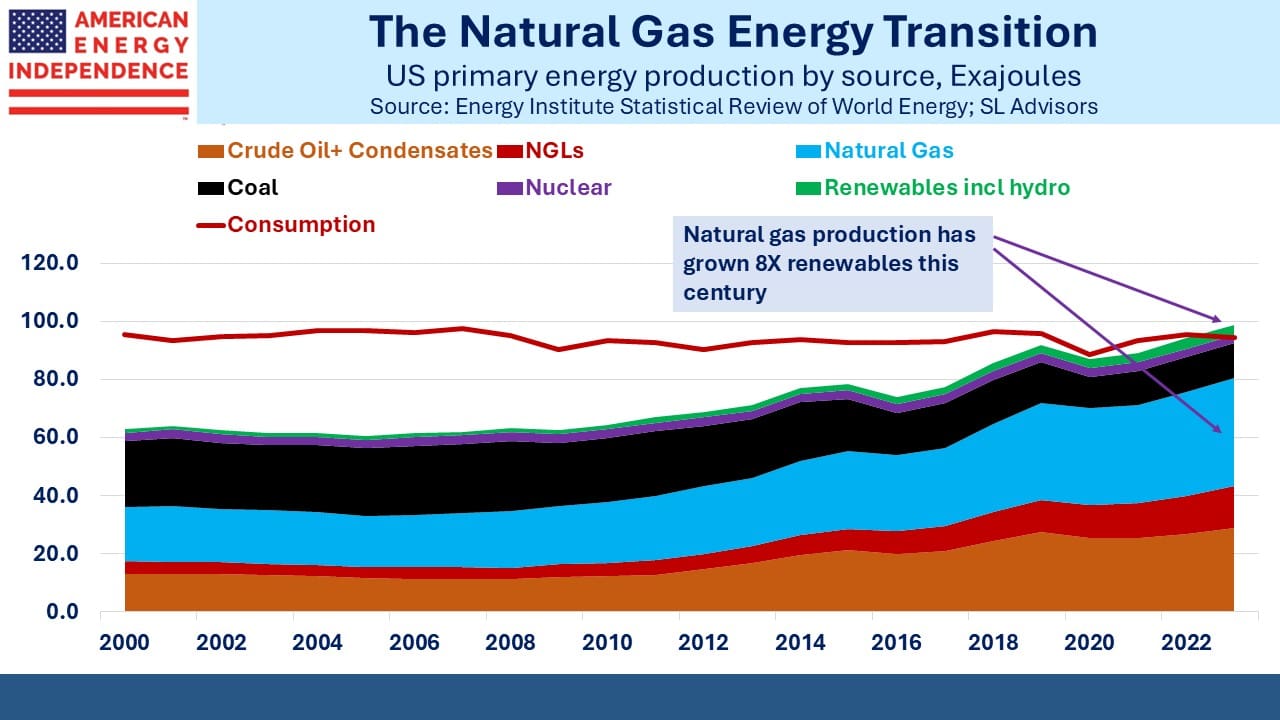

While America is the world’s biggest energy story, natural gas is the biggest energy story in America. US media relentlessly covers the energy transition towards renewables, ignoring the fact that natural gas production has increased at eight times the rate of solar and wind over multiple time periods extending back 25 years.

The Natural Gas Energy Transition, as we explained last year, is the only energy transition of any consequence going on in the US. It’s protected us from the disastrous energy policies of Europe (see Germany’s Costly Climate Leadership).

Which naturally brings us to midstream energy infrastructure, the enabler of the world’s biggest energy story. Gas demand from power hungry data centers and LNG export terminals underpin growth. Valuations are not as cheap as two years ago but by no means expensive. And energy is the president’s favorite sector, with many countries advised to avoid high tariffs on their US exports through buying more of our oil and gas.

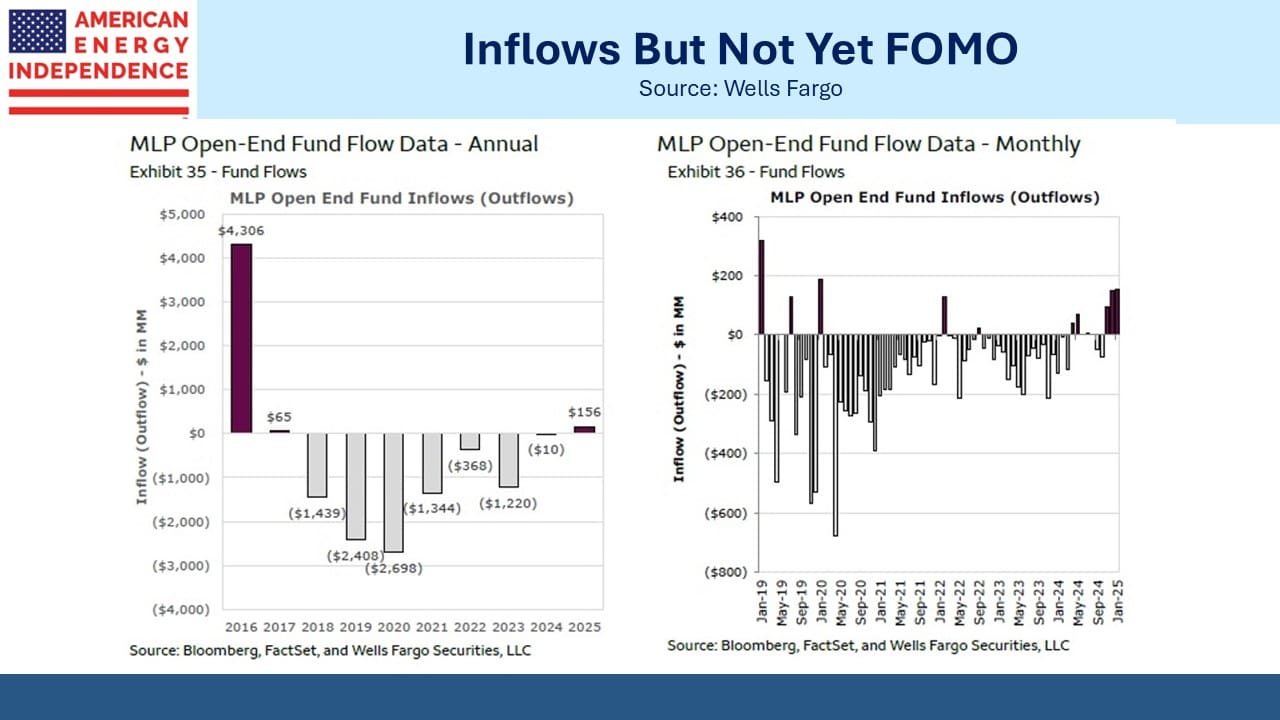

Fund flows show that retail investors have only recently become net buyers of the sector, which should comfort those wary of being late to follow the crowd.

Explaining to investors why America is the world’s biggest energy story invariably grabs their interest.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Confusingly, the abbreviation “fracking” is also sometimes used for fractionation, that is separating liquid natural gas into ethane, butane and propane.