The U.S. Borrowing Pandemic

Ever since the 2008 financial crisis ushered in permanently low interest rates, perhaps the biggest question in finance has been why long term rates remain so low (see Real Returns On Bonds Are Gone). On Monday, the U.S. Treasury announced plans to issue $2.99 trillion in marketable debt this quarter, and $4.5 trillion this fiscal year. The second quarter sum alone is more than double what we borrowed last year.

Given the sharp drop in yields, there’s evidently no shortage of buyers. Corporations have been eager to borrow money too. Apple had $94BN in cash and marketable securities as of the end of March – and yet they borrowed $8.5BN in the bond market on Monday. Liquidity is king. At Saturday’s virtual annual meeting, Warren Buffet mused that the $137BN in cash held by Berkshire, “…isn’t all that huge when you think about worst-case possibilities.”

The most fundamental responsibility of a corporate treasurer is to ensure adequate liquidity for any plausible scenario.

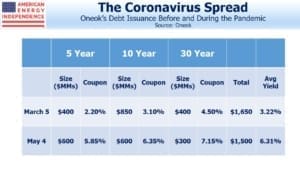

Oneok (OKE) offers an interesting example, because they tapped the bond market for $1.65BN in early March, and just returned for $1.5BN this week. Like most pipeline companies, cuts to spending on new projects exceed their estimated drop in EBITDA. This cash is going to be held, and hopefully not needed. It’ll sit in treasury bills, partially answering the question of who’s going to buy all this new debt the U.S. is issuing.

The negative spread between OKE’s 6.31% blended cost and the 0.10% yield on treasury bills will cost $93MM annually. The $8.5BN Apple raised will also sit in treasury bills alongside the $94BN they already have. These are both small components of the cost of uncertainty.

The Federal government’s fiscal and monetary response has been appropriately massive. They’ve been so effective that Berkshire Hathaway was unable to negotiate any expensive, emergency investments.

The cost is rapidly mounting. Excessive caution was justified in the early days of the pandemic. Hospitals in New York faced the real threat of being overwhelmed, so shutting the economy down to “flatten the curve” was expedient. This has transitioned to a strategy of suppression, with a less clear exit but an increasingly visible and staggeringly big cost.

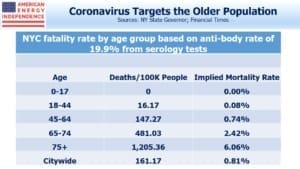

Fatality rates based on known cases reflect the 2% of the population that’s been tested, and people are often infectious without showing symptoms. Data increasingly shows Coronavirus to be highly contagious but with a fatality rate in the ballpark of the flu for those that are young and otherwise healthy. For those between 18-49 years of age, the flu has a mortality rate around 0.02%. Coronavirus anti-body tests are revealing substantial portions of the population to have been already infected. New York City estimates a 19.9% citywide rate. Combined with the city’s fatality rate of 161.17 per 100,000 population, this suggests the fatality rate may be close to 0.81%, skewed towards the elderly.

The vulnerable are well known; 96% of New York City patients hospitalized for Coronavirus had additional health issues, often obesity, diabetes or a heart condition. Dr. Scott Gottlieb, a former FDA commissioner regularly on CNBC, said mitigation hasn’t worked, “as well as we expected.” The virus isn’t going away anytime soon.

Suppression can only go so far. We’re going to have to adapt to the virus. The data suggests people under 44 have extremely low risk, but lockdown strategies rarely differentiate based on risk factors. Targeted stay at home orders for older people and those with health vulnerabilities would allow a return to more normal economic activity, arresting the spiraling debt with little increased health risk. We accept 38,000 road fatalities annually, which could be reduced with lower speed limits. Society already makes these tradeoffs.

Few of us are epidemiologists, and deferring to the experts was correct at the outset. But given the huge economic impact and $TNs in Federal spending, we’d all better do our best to become better informed. It’s correctly becoming a political issue.

We are invested in OKE

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!