The Great Reversal?

Last week the Centers for Disease Control (CDC) told state health officials to prepare for vaccine distribution as soon as November 1. “My fellow Americans, our long national nightmare is over.” was first spoken by President Gerald Ford following Nixon’s resignation under threat of impeachment in 1974. But it could equally apply to Covid in 2020.

The pain has been unevenly distributed. Since March, stocks have defiantly marched higher in the face of relentlessly bad news. Hundreds of thousands of lives have been lost, and billions turned upside down. Yet people have adapted, and technology stocks such as Apple (AAPL) and Amazon (AMZN) have benefited enormously from the shift to socially distanced living. Tesla (TSLA) has shown that stock splits are bullish, even if caused by prior huge gains (see Tech Stocks Have Energy).

The market’s gains have reflected the distasteful reality that the economic impact of Covid is driven by our efforts at mitigation. Public understanding of the actual numbers reveals huge misconceptions (see Covid Exposes Innumeracy) about its lethality and who is really at risk. Recently, the CDC quietly added the following to Table 3 of its Covid website (Conditions contributing to deaths involving coronavirus disease): “For 6% of the deaths, COVID-19 was the only cause mentioned.” In other words, 94% of Covid victims had a pre-existing condition (a “co-morbidity”) which may have contributed to their outcome. It’s still tragic for each person, but as we learn more the seeming randomness of Covid becomes less so.

For an interesting perspective on mitigation efforts elsewhere, see Brazil – Not the Disaster We’ve Been Led to Believe.

Last week’s sharp market reversal around the CDC’s announcement was probably no coincidence. U.S. hospitalizations are down by a third from their recent second peak. Fatalities never reached the levels of early April, and in former hotspots like New York and New Jersey, hospitalizations are down by 95% from the peak.

A vaccine will accelerate the progress towards herd immunity that seems to be already underway. The possibility that the near future may see a modified return of our former lifestyles has hurt technology stocks but breathed new life into stocks like Carnival Corp (CCL). A resumption of cruising might be the final confirmation that we’re post-Covid, that the hospitality business no longer faces quite the same existential threat.

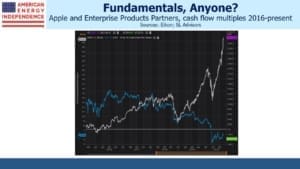

Few will be surprised that the outperformance of energy stocks caught our attention. The least liked and therefore most undervalued sector doesn’t suffer like AAPL from the loss of momentum investors, because there were none. The rubber band between liked and hated sectors is stretched taught. If the imminence of a vaccine has triggered a great unwind, pipeline stocks have substantial upside.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

“The least liked and therefore most undervalued sector doesn’t suffer like AAPL from the loss of momentum investors, because there were none.”

I like this observation.

Even if the imminence of a vaccine does trigger “a great unwind” I don’t look for midstream infrastructure investments to bounce back until (a) after the election and (b) after tax loss selling abates at the end of December.