The Great Reversal?

Last week the Centers for Disease Control (CDC) told state health officials to prepare for vaccine distribution as soon as November 1. “My fellow Americans, our long national nightmare is over.” was first spoken by President Gerald Ford following Nixon’s resignation under threat of impeachment in 1974. But it could equally apply to Covid in 2020.

The pain has been unevenly distributed. Since March, stocks have defiantly marched higher in the face of relentlessly bad news. Hundreds of thousands of lives have been lost, and billions turned upside down. Yet people have adapted, and technology stocks such as Apple (AAPL) and Amazon (AMZN) have benefited enormously from the shift to socially distanced living. Tesla (TSLA) has shown that stock splits are bullish, even if caused by prior huge gains (see Tech Stocks Have Energy).

The market’s gains have reflected the distasteful reality that the economic impact of Covid is driven by our efforts at mitigation. Public understanding of the actual numbers reveals huge misconceptions (see Covid Exposes Innumeracy) about its lethality and who is really at risk. Recently, the CDC quietly added the following to Table 3 of its Covid website (Conditions contributing to deaths involving coronavirus disease): “For 6% of the deaths, COVID-19 was the only cause mentioned.” In other words, 94% of Covid victims had a pre-existing condition (a “co-morbidity”) which may have contributed to their outcome. It’s still tragic for each person, but as we learn more the seeming randomness of Covid becomes less so.

For an interesting perspective on mitigation efforts elsewhere, see Brazil – Not the Disaster We’ve Been Led to Believe.

Last week’s sharp market reversal around the CDC’s announcement was probably no coincidence. U.S. hospitalizations are down by a third from their recent second peak. Fatalities never reached the levels of early April, and in former hotspots like New York and New Jersey, hospitalizations are down by 95% from the peak.

A vaccine will accelerate the progress towards herd immunity that seems to be already underway. The possibility that the near future may see a modified return of our former lifestyles has hurt technology stocks but breathed new life into stocks like Carnival Corp (CCL). A resumption of cruising might be the final confirmation that we’re post-Covid, that the hospitality business no longer faces quite the same existential threat.

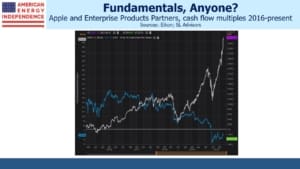

Few will be surprised that the outperformance of energy stocks caught our attention. The least liked and therefore most undervalued sector doesn’t suffer like AAPL from the loss of momentum investors, because there were none. The rubber band between liked and hated sectors is stretched taught. If the imminence of a vaccine has triggered a great unwind, pipeline stocks have substantial upside.