The Fed’s Biggest Mistake In History

Sign up here for this Thursday’s webinar at 12 eastern. SL Advisors’ Midstream Energy and Inflation Update.

Allianz SE’s Mohamed El-Erian recently said the, “Transitory Inflation Call Likely Fed’s Worst Ever.” There is some competition for that title. Just in my career (1980-) you’d have to include Alan Greenspan’s summer 1987 tightening which was soon followed by the October 1987 Crash; Greenspan’s assessment that the internet had boosted productivity, which underpinned easy late 90s policy; and Greenspan’s laissez-faire approach to regulatory oversight which helped cause the 2008-9 Great Financial Crisis (GFC). Greenspan made a few mistakes, but he was Fed chair from 1987-2006, so he had plenty of time. And he got much more right than wrong.

But the Fed’s imminent concession that they misread inflation earlier this year exceeds those three, and probably any that came before. Today’s FOMC announcement will likely see them start to correct, but unless the Fed immediately stops buying bonds they’ll still be moving too slowly – maintaining bond market support for an economy that long ago ceased needing it.

“Worst Call Ever” is justified because Fed chair Powell’s equanimity over inflation was so obviously misplaced. Like many observers, we saw reasons to be concerned a year ago (see Deficit Spending May Yet Cause Inflation). Earlier this year, Congress passed the American Rescue Plan, $1.9TN of further stimulus not needed since vaccine distribution was already underway. Through this, the FOMC maintained its pro-cyclical monetary policy and continued to finance most of America’s mortgage origination.

Even Democrat lawmakers have begun pushing the Fed to tighten policy (see US Democrats push Fed for tougher action against inflation). Representative Jay Auchincloss (D-MA) is an example of Congressional muddled thinking – he supported the abovementioned $1.9TN profligacy but now says, “The Fed needs to start tapering immediately and then they need to raise interest rates.”

This is exactly why Modern Monetary Theory (MMT) is flawed – the notion that Congress should increase deficit spending until it’s inflationary assumes they’ll curb largesse in time, which they obviously haven’t (see Reviewing The Deficit Myth, Stephanie Kelton’s support of MMT which unwittingly reveals its flaws). When members of the party in power want the Fed to tighten to offset their fiscal mistakes, you know there isn’t much hard thinking going on. Somehow Auchincloss is a member of the House of Representatives financial services committee, which oversees monetary policy.

The sad truth is that the Federal government’s 2021 fiscal and monetary approach to Covid was dead wrong. By contrast, the government’s response to the GFC was broadly correct, and impactful. Then Fed-chair Bernanke introduced Quantitative Easing (QE), using the Fed’s balance sheet to buy $TNs of bonds. This was a bold and controversial move, but Bernanke was right in arguing it wouldn’t be inflationary. That might be the best call ever by a Fed chair. Jay Powell has simply incorporated QE into the Fed’s toolkit, but with the opposite result.

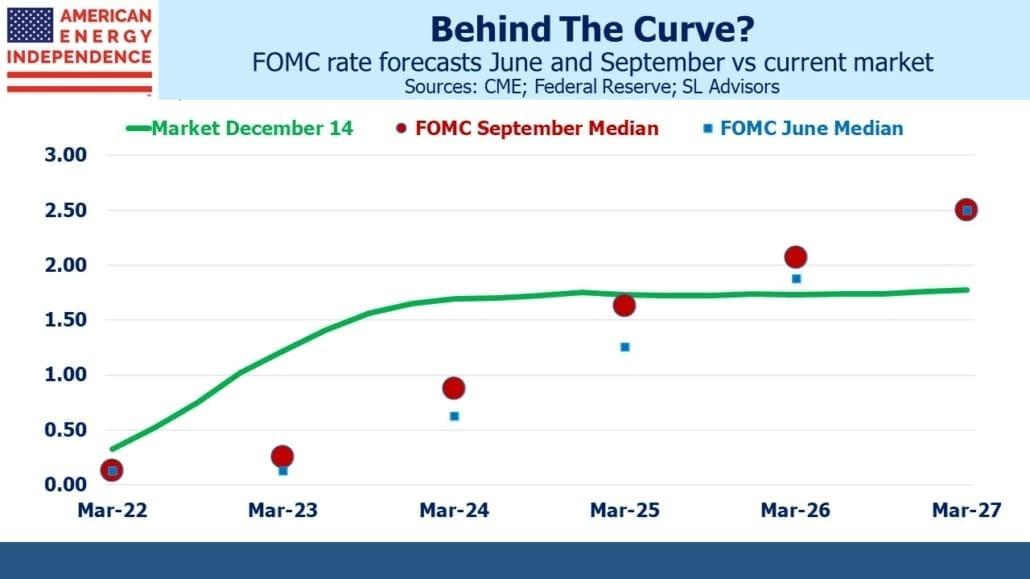

It’s likely the FOMC’s “dot plot” will move up towards eurodollar futures. The market is priced for the Fed Funds rate to reach 1.5% and by 2023 and remain there. The implication is this will be sufficient to reduce inflation back to the Fed’s desired 2%-ish level. Tightening and tapering are both reflected in ten year treasury yields, which remain below 1.5%.

The assumption is that it will not take much for the Fed to tame inflation, and ten year inflation derived from TIPs has moderated from 2.75% to 2.45% in the past month.

Another possibility is that the inflation figures are losing relevance. The deep flaw in the CPI’s measure of housing costs is receiving more attention (see U.S. Home-Price Surge Looks Much Tamer in Government CPI Report). We regularly point out the flaws in Owners Equivalent Rent (see The Subtle Inflation Pressure From Housing).

When the survey-based method of cost of shelter finally rises, expect the Fed to dismiss it as a non-cash item. If other measures of inflation are moderating then, they’ll be unlikely to act on it.

We could be entering a period of permanently higher inflation – a function of the Fed’s revised policy of greater tolerance but also an increasing gap between reported inflation and what consumers experience. Stocks and other real assets are the only investment solution.

It’s many months since we wrote about Covid – it’s often tempting, and statistics are plentiful. But it can appear self-indulgent, since there’s no shortage of literature available from better qualified writers.

However, a recent New York Times article was so egregious as to demand attention. Always in need of depressing news, they reported that 1% of older Americans have died of Covid. To further demonstrate journalistic innumeracy, they noted that 590K, or 75% of Covid deaths were the over 65s. Forget “with Covid” versus “from Covid”. The media often conflates the two, although the CDC defines “All Deaths involving Covid-19 (italics added).

Putting aside with versus from, CDC data also shows that 4.7 million over 65s died from all causes since Covid began, 73% of the 6.4 million total. In other words, older people die at roughly the same rate regardless of Covid. 1% of older Americans have died with Covid since early last year, but 8% of older Americans have died from all causes.

A New York Times non-story shouldn’t matter, except when such a widely read news outlet makes news out of something that plainly isn’t, it gets people like Representative Jay Auchincloss to mistakenly vote for unneeded fiscal stimulus.

The current inflationary environment is a result of poor analysis and policy errors. With the same cast of characters in charge, Investors should be prepared for more.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In my view the biggest mistake by the Fed was the tightening in the late 1920s whose consequences contributed to the onset of the Great Depression.

If you’re right that inflation won’t come down much and if the market is right that rates won’t rise much, then negative real rates will become a permanent feature of the investing landscape. A good topic for your next essay would discuss the implications of that for 60/40 portfolios, risk parity/CTAs. pensions, insurance companies among others. Maybe everybody will pile into EPD 🙂

Seriously tho, this is a big problem for the investor class.