The Fed’s Biggest Mistake In History

Sign up here for this Thursday’s webinar at 12 eastern. SL Advisors’ Midstream Energy and Inflation Update.

Allianz SE’s Mohamed El-Erian recently said the, “Transitory Inflation Call Likely Fed’s Worst Ever.” There is some competition for that title. Just in my career (1980-) you’d have to include Alan Greenspan’s summer 1987 tightening which was soon followed by the October 1987 Crash; Greenspan’s assessment that the internet had boosted productivity, which underpinned easy late 90s policy; and Greenspan’s laissez-faire approach to regulatory oversight which helped cause the 2008-9 Great Financial Crisis (GFC). Greenspan made a few mistakes, but he was Fed chair from 1987-2006, so he had plenty of time. And he got much more right than wrong.

But the Fed’s imminent concession that they misread inflation earlier this year exceeds those three, and probably any that came before. Today’s FOMC announcement will likely see them start to correct, but unless the Fed immediately stops buying bonds they’ll still be moving too slowly – maintaining bond market support for an economy that long ago ceased needing it.

“Worst Call Ever” is justified because Fed chair Powell’s equanimity over inflation was so obviously misplaced. Like many observers, we saw reasons to be concerned a year ago (see Deficit Spending May Yet Cause Inflation). Earlier this year, Congress passed the American Rescue Plan, $1.9TN of further stimulus not needed since vaccine distribution was already underway. Through this, the FOMC maintained its pro-cyclical monetary policy and continued to finance most of America’s mortgage origination.

Even Democrat lawmakers have begun pushing the Fed to tighten policy (see US Democrats push Fed for tougher action against inflation). Representative Jay Auchincloss (D-MA) is an example of Congressional muddled thinking – he supported the abovementioned $1.9TN profligacy but now says, “The Fed needs to start tapering immediately and then they need to raise interest rates.”

This is exactly why Modern Monetary Theory (MMT) is flawed – the notion that Congress should increase deficit spending until it’s inflationary assumes they’ll curb largesse in time, which they obviously haven’t (see Reviewing The Deficit Myth, Stephanie Kelton’s support of MMT which unwittingly reveals its flaws). When members of the party in power want the Fed to tighten to offset their fiscal mistakes, you know there isn’t much hard thinking going on. Somehow Auchincloss is a member of the House of Representatives financial services committee, which oversees monetary policy.

The sad truth is that the Federal government’s 2021 fiscal and monetary approach to Covid was dead wrong. By contrast, the government’s response to the GFC was broadly correct, and impactful. Then Fed-chair Bernanke introduced Quantitative Easing (QE), using the Fed’s balance sheet to buy $TNs of bonds. This was a bold and controversial move, but Bernanke was right in arguing it wouldn’t be inflationary. That might be the best call ever by a Fed chair. Jay Powell has simply incorporated QE into the Fed’s toolkit, but with the opposite result.

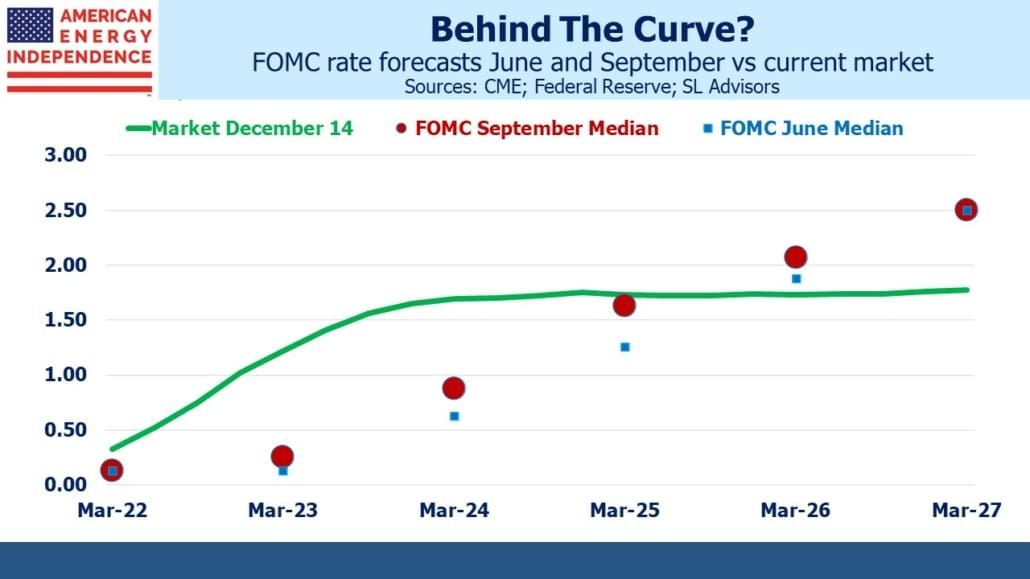

It’s likely the FOMC’s “dot plot” will move up towards eurodollar futures. The market is priced for the Fed Funds rate to reach 1.5% and by 2023 and remain there. The implication is this will be sufficient to reduce inflation back to the Fed’s desired 2%-ish level. Tightening and tapering are both reflected in ten year treasury yields, which remain below 1.5%.

The assumption is that it will not take much for the Fed to tame inflation, and ten year inflation derived from TIPs has moderated from 2.75% to 2.45% in the past month.

Another possibility is that the inflation figures are losing relevance. The deep flaw in the CPI’s measure of housing costs is receiving more attention (see U.S. Home-Price Surge Looks Much Tamer in Government CPI Report). We regularly point out the flaws in Owners Equivalent Rent (see The Subtle Inflation Pressure From Housing).

When the survey-based method of cost of shelter finally rises, expect the Fed to dismiss it as a non-cash item. If other measures of inflation are moderating then, they’ll be unlikely to act on it.

We could be entering a period of permanently higher inflation – a function of the Fed’s revised policy of greater tolerance but also an increasing gap between reported inflation and what consumers experience. Stocks and other real assets are the only investment solution.

It’s many months since we wrote about Covid – it’s often tempting, and statistics are plentiful. But it can appear self-indulgent, since there’s no shortage of literature available from better qualified writers.

However, a recent New York Times article was so egregious as to demand attention. Always in need of depressing news, they reported that 1% of older Americans have died of Covid. To further demonstrate journalistic innumeracy, they noted that 590K, or 75% of Covid deaths were the over 65s. Forget “with Covid” versus “from Covid”. The media often conflates the two, although the CDC defines “All Deaths involving Covid-19 (italics added).

Putting aside with versus from, CDC data also shows that 4.7 million over 65s died from all causes since Covid began, 73% of the 6.4 million total. In other words, older people die at roughly the same rate regardless of Covid. 1% of older Americans have died with Covid since early last year, but 8% of older Americans have died from all causes.

A New York Times non-story shouldn’t matter, except when such a widely read news outlet makes news out of something that plainly isn’t, it gets people like Representative Jay Auchincloss to mistakenly vote for unneeded fiscal stimulus.

The current inflationary environment is a result of poor analysis and policy errors. With the same cast of characters in charge, Investors should be prepared for more.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.