The Fed Can’t Afford Two Mistakes

/

Amid the more hawkish Fed and consequent sharp drop in the market, the jump in real yields has not drawn much attention. The rise in ten year yields came with inflation expectations remaining well anchored at around 2.75%. TIPs yields rose with nominal ones.

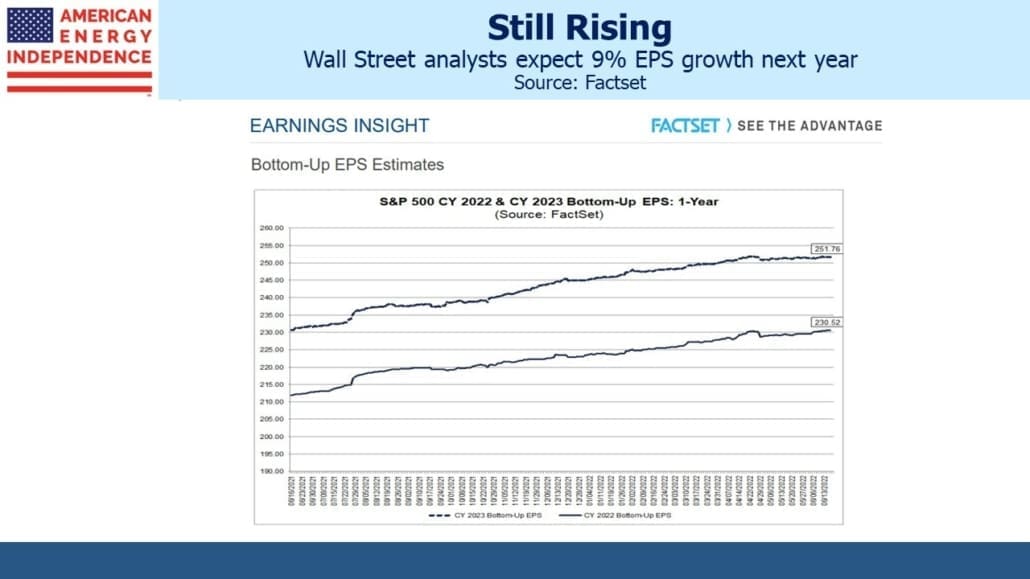

Factset earnings expectations don’t yet reflect the pessimism of public company CEOs, the majority of whom expect a recession within 12-18 months. That view relies on the expectation that the Fed will tighten excessively in their zeal to control inflation.

It’s a fascinating problem trying to predict the FOMC’s actions. Warren Buffett often responds that he never considers the economic outlook when analyzing investments, but some of these CEOs presumably do when making capital allocation decisions.

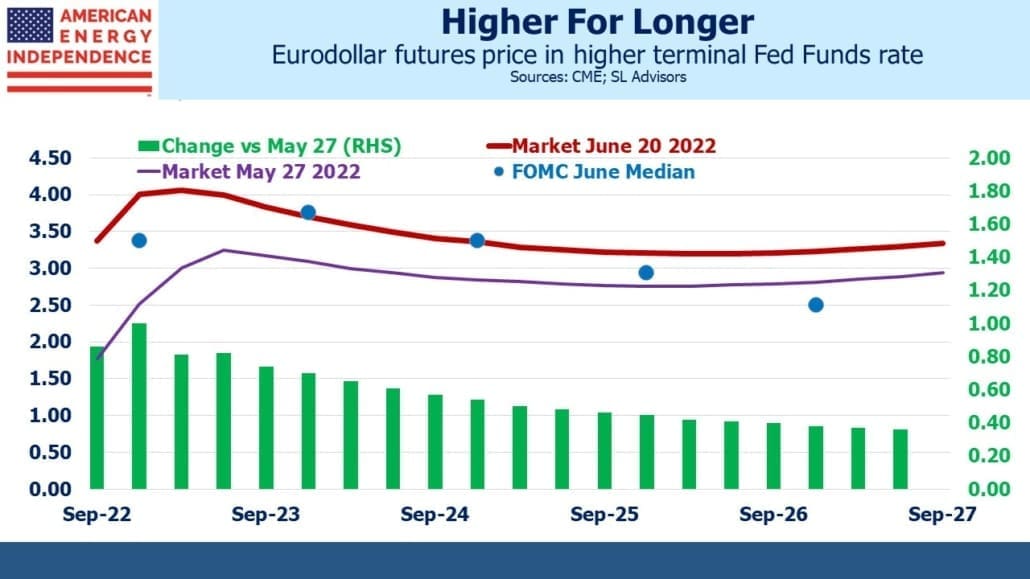

Meanwhile, the eurodollar futures curve has steepened somewhat but also has an increasing gap between yields five years out and longer compared with the FOMC’s equilibrium rate. The Fed’s latest projection materials show the median member’s forecast at 2.5% for the neutral policy rate. Futures markets have it closer to 3.25%.

It reminds of the Fed’s past poor record at forecasting (see from 2019 Bond Market Looks Past Fed). For many years after the great financial crisis of 2008-09, the bond market implied lower rates than the Fed. The bond market was right. Today circumstances have reversed, and interest rate markets are forecasting a higher neutral rate than the FOMC.

This is likely to be correct because the Fed’s reinterpreted mandate favors maximizing employment over stable prices. Therefore, inflation is likely to remain above their 2% target because they’ll be wary of the recessionary risk of extended tighter policy. Raising rates with inflation at 8% is not controversial. When unemployment is in the mid 4%s and rising while inflation is at 4% and falling is when the Fed will more clearly need to consider the employment/inflation trade-off. Even with the Fed moving at 0.75% increments, the 4% rate cycle peak represents little if any premium over then current inflation.

Today’s market prices support this view. So there’s some asymmetry every time important economic data is released, such as the employment report on the first Friday of the month. Signs of weakness will likely drive two year treasury yields lower and the market to anticipate the Fed moving to neutral or slower pace of rate hikes.

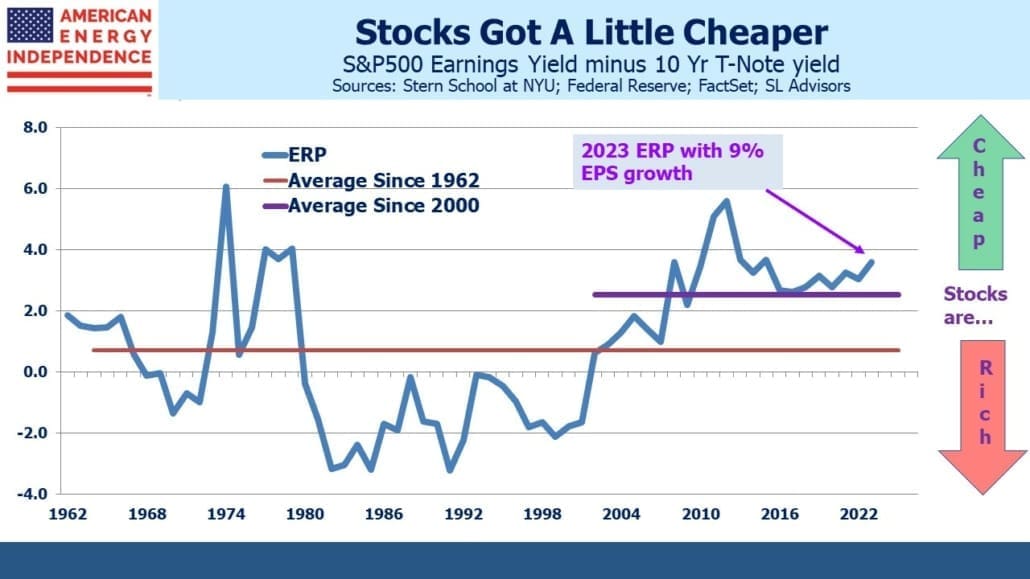

Coupled with this, the Equity Risk Premium (ERP) is starting to favor stocks again. Just two months ago we noted that the market wasn’t that attractive compared with bond yields (see Criticism Of The Fed Goes Mainstream). Since then, stocks have slumped 15%, and even though interest rates have risen stocks are more attractively priced. Bottom-up 2023 S&P500 earnings assume 9% earnings growth, which puts the ERP at 3.5, comfortably wider than its 2.5 two decade average. Even though ten year yields have been rising, bond prices seem to be permanently supported by return-insensitive holders (central banks) and rigid investment mandates (pension funds). The ERP is only likely to favor fixed income over stocks when the market is truly frothy – not its present state.

If soft economic data causes investors to price in a more moderate Fed, the equity market is poised for a strong rally.

A couple of weeks ago when I was on The Compound and Friends, Josh Brown’s weekly interview that’s published on Youtube, I suggested that we might look back at this period as the good old days. Josh and his co-presenter Mike Batnick were shocked. “There’s nothing more scary than a pessimist with a British accent” became that episode’s trailer. I explained my point, which is that although criticism of the Fed flows freely, they have achieved full employment – if anything they’ve over-achieved it.

Apart from those heavily invested in the energy sector, inflation is making many feel poorer since real incomes are falling. But at least everyone is coping with higher prices with a job. A few million people will need to lose theirs in order to reduce inflation for everyone. When that happens criticism of the Fed will take on a different form. If one policy error (a slow response to inflation) is followed by another (a recession caused by over-responding to the first), Powell’s congressional appearances will become uncomfortable.

That analysis is why it’s worth betting on the Fed claiming a premature victory over inflation. They can’t afford consecutive policy errors, so inflation is unlikely to return to their 2% target. Pipeline stocks have endured a sharp fall this month, but the strong fundamentals remain intact, and dividend yields have moved a little higher with the sell-off. In our opinion midstream energy infrastructure is attractively priced.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!