Tariff Trauma Is Receding

/

Americans visiting Europe know that Republican presidents are generally less popular than Democrat ones, since Europe’s political center of gravity is left of ours. This is especially true of President Trump, which didn’t surprise us on a recent trip with friends to the UK and Belgium. Trade policy is largely how Europeans experience US presidential power, so Liberation Day was poorly received.

Observers on both sides of the Atlantic have been critical of how tariffs have been implemented, including this blog (see Tariffs And Mismanaging The Economy). While tariff dysfunction remains, the S&P500 has recovered its post-Liberation Day losses on hopes of trade deals. Britain was the first to reach agreement, albeit limited in scope. The UK still exerts some soft power in that an invitation to visit the King and accents that Americans find appealing hold some sway.

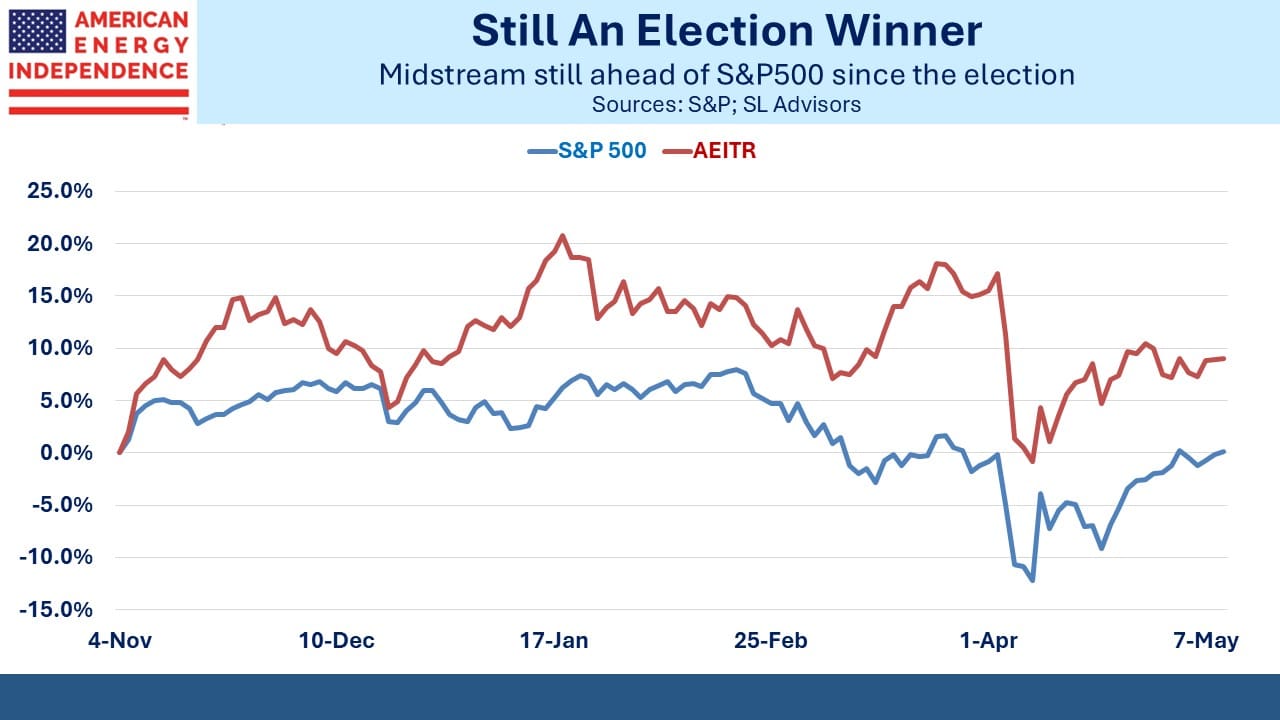

Midstream energy fell 13.5% over the two trading sessions following Liberation Day, more than the S&P 500’s 10.5% loss. There were concerns of reciprocal tariffs targeting our LNG exports although if anything countries seem more inclined to buy US energy exports than before.

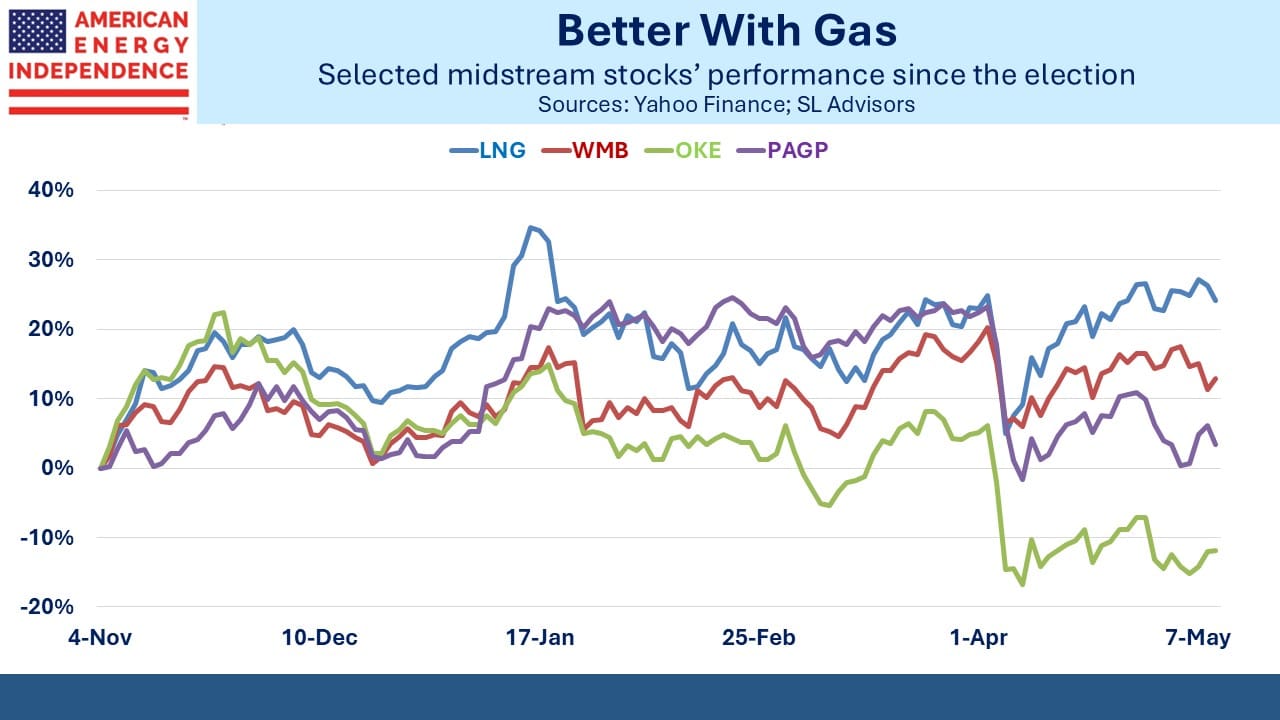

Unlike the broader market, midstream has yet to recover its Liberation day losses. That’s probably due in part to weaker crude oil, which has investors worried about volumes. Oneok (OKE) and Plains (PAGP) are both down around 12% over the past three months. Gas-exposed names such as LNG exporter Cheniere (LNG) and pipeline company Williams (WMB) are +8% and 4% respectively over the same period.

Since the election gassier names have held their gains. The weakness in crude prices has dampened some of the election excitement. But gas volumes continue to grow steadily, underpinned by LNG exports and data centers.

Earnings have been providing generally good news. Cheniere easily beat expectations, increased buybacks and is on track with its expansion plans. Energy Transfer disclosed on their earnings call that they are discussing supplying gas to 150 data centers just in Texas! Not all of these will become reality, but it is representative of the positive fundamentals for gas.

The sector’s failure to recover its Liberation Day drop reflects investor unease over the drop in crude. In our opinion this represents an opportunity.

Natural gas producers have performed well, with EQT even recouping all of its early-April tariff trauma losses.

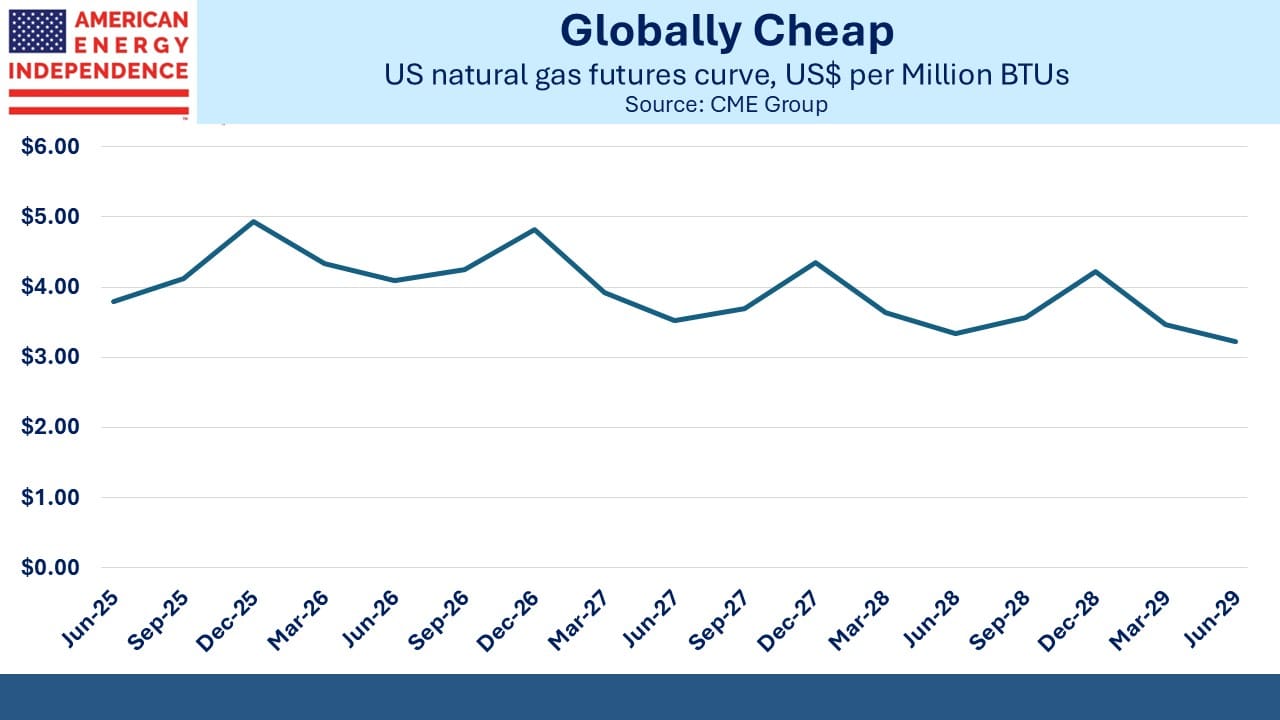

The strength in gas names aligns with the demand outlook. This is at odds with the natural gas futures curve which suggests that supply will be plentiful in the years ahead. The December 2025 futures contract trades at $5 per Million BTUs (MMBTUs), and December 2028 at only $4, projecting a modest decline.

The idea that US gas prices will be lower in the years ahead than today seems implausible given prices elsewhere. The TTF European benchmark and the JKM Asian benchmark both trade at around $12 per MMBTUs.

The result is that stock prices for gas producers have run ahead of the value of their proved reserves. A PV-10 is the net present value a company can realize from its proved reserves using current technology, and a 10% discount rate. Using JPMorgan PV-10 estimates, Range Resources (RRC) trades at almost $38 versus a PV-10 of $27. Expand Energy (EXE) is at $113 ($82) and EQT at $55 ($35).

Undeveloped/Unproved reserves could, in the upside scenario, justify current valuations if what their geologists think is there can be extracted profitably. But using the more conservative estimate they look expensive. And EXE, even if all their unproved reserves came through, has a PV-10 of $120.

That doesn’t seem to leave much room for anything to go wrong.

An alternative explanation is that the futures curve is wrong. Hedging more than two years out is impractical. For example, the May 2027 futures contract has only 5K outstanding, versus 207K for the most liquid July 2025 contract. It’s also likely that producers are keener to hedge their exposure by selling than consumers are through buying, which at the margin would depress prices.

JPMorgan calculates PV-10 values using both the futures curve and their own estimates, with the latter resulting in somewhat higher values.

Higher domestic natural gas prices seem very likely to us. As long as the huge spread exists between the US and other regional markets, companies will be looking to add LNG export capacity. The lower prices in the futures market almost assure they won’t be correct, since they’ll induce more exports. The message from the E&P names is more accurate than commodities markets.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Remember, trade with China also has major geopolitical ramifications. China imports massive amounts of hydrocarbons (oil and natural gas) from Russia and Iran. India also imports Russian oil. As a result, China is funding the Russian and Iranian militaries. The US is in major proxy wars with both Russia and Iran. Iran supplies the Houthi pirates with most of the weaponry used to attack shipping in the Red Sea. Also, Iran provides most of the weaponry to their Jihadi allies Hamas, Hezbollah and other Jihadi groups fighting US ally Israel. China has done nothing to stop the Houthi pirates. The US is spending hundreds of billions supporting the Ukrainian war effort against the Russians. China is a major economic supporter of Russia. This is a major dilemma for US foreign policy. Finally, China engages in, facilitates and profits from, a massive amount of cross border crime into the USA: dope smuggling, money laundering, illegal immigration, counterfeit goods and other contraband. China is partnering with the Mexican warlords in all these criminal activities, and also criminals in Canada. Far more involved here than just imports of consumer goods and other products. Never mind the extreme (and illegal) Chinese mercantilism: IP Theft, goods dumping, massive central command subsidies to industries in order to dominate a sector. Of course, feckless EU/UK socialist libs are wilfully ignorant of all of these geopolitical ramifications.