Tariff Trauma Is Receding

Americans visiting Europe know that Republican presidents are generally less popular than Democrat ones, since Europe’s political center of gravity is left of ours. This is especially true of President Trump, which didn’t surprise us on a recent trip with friends to the UK and Belgium. Trade policy is largely how Europeans experience US presidential power, so Liberation Day was poorly received.

Observers on both sides of the Atlantic have been critical of how tariffs have been implemented, including this blog (see Tariffs And Mismanaging The Economy). While tariff dysfunction remains, the S&P500 has recovered its post-Liberation Day losses on hopes of trade deals. Britain was the first to reach agreement, albeit limited in scope. The UK still exerts some soft power in that an invitation to visit the King and accents that Americans find appealing hold some sway.

Midstream energy fell 13.5% over the two trading sessions following Liberation Day, more than the S&P 500’s 10.5% loss. There were concerns of reciprocal tariffs targeting our LNG exports although if anything countries seem more inclined to buy US energy exports than before.

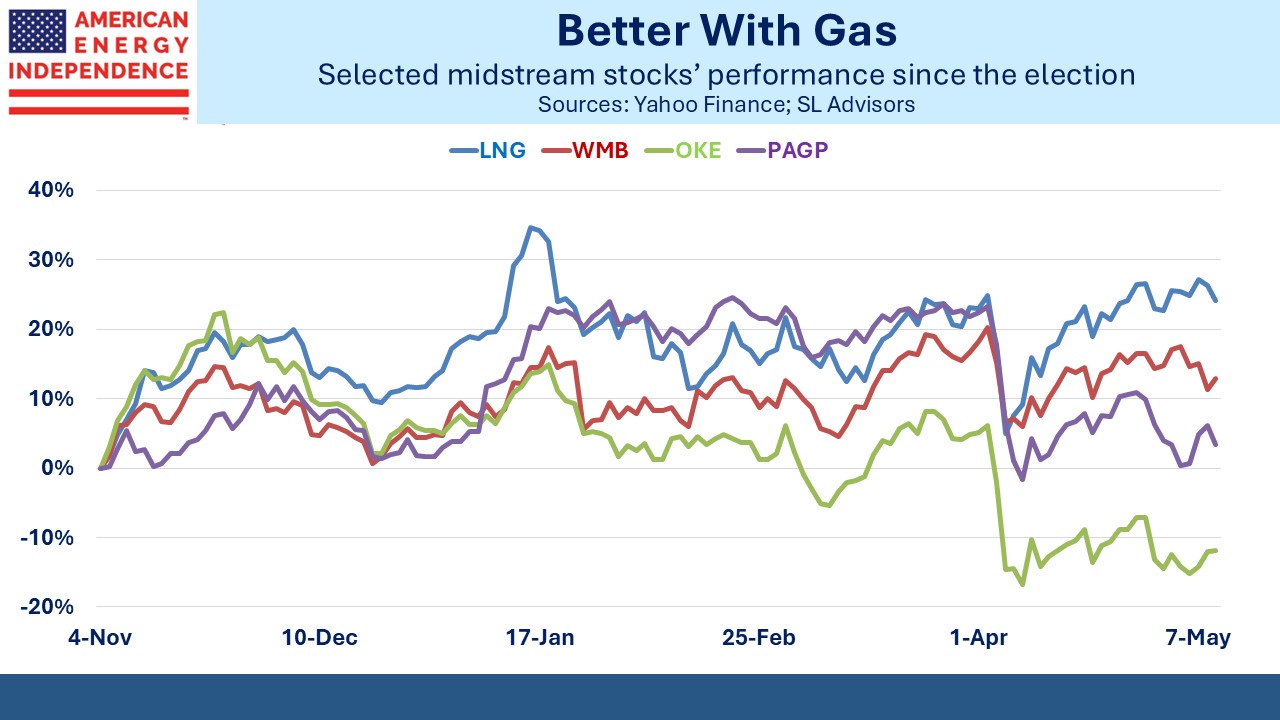

Unlike the broader market, midstream has yet to recover its Liberation day losses. That’s probably due in part to weaker crude oil, which has investors worried about volumes. Oneok (OKE) and Plains (PAGP) are both down around 12% over the past three months. Gas-exposed names such as LNG exporter Cheniere (LNG) and pipeline company Williams (WMB) are +8% and 4% respectively over the same period.

Since the election gassier names have held their gains. The weakness in crude prices has dampened some of the election excitement. But gas volumes continue to grow steadily, underpinned by LNG exports and data centers.

Earnings have been providing generally good news. Cheniere easily beat expectations, increased buybacks and is on track with its expansion plans. Energy Transfer disclosed on their earnings call that they are discussing supplying gas to 150 data centers just in Texas! Not all of these will become reality, but it is representative of the positive fundamentals for gas.

The sector’s failure to recover its Liberation Day drop reflects investor unease over the drop in crude. In our opinion this represents an opportunity.

Natural gas producers have performed well, with EQT even recouping all of its early-April tariff trauma losses.

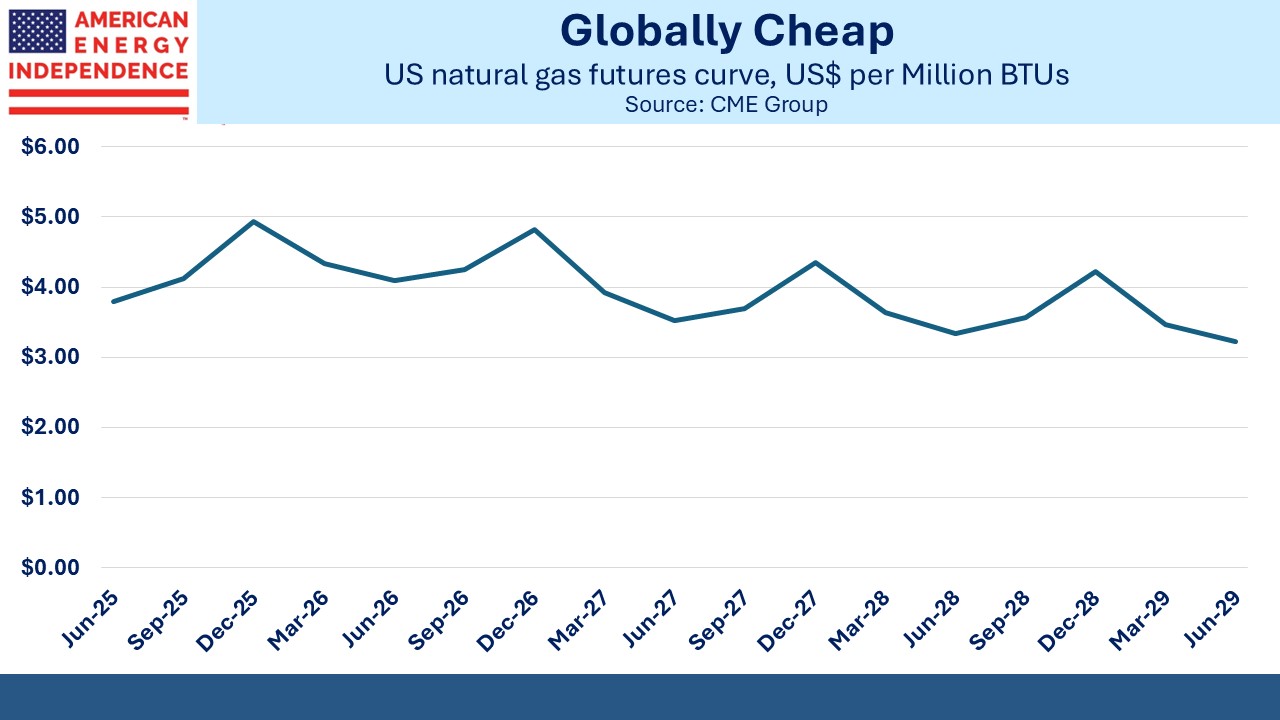

The strength in gas names aligns with the demand outlook. This is at odds with the natural gas futures curve which suggests that supply will be plentiful in the years ahead. The December 2025 futures contract trades at $5 per Million BTUs (MMBTUs), and December 2028 at only $4, projecting a modest decline.

The idea that US gas prices will be lower in the years ahead than today seems implausible given prices elsewhere. The TTF European benchmark and the JKM Asian benchmark both trade at around $12 per MMBTUs.

The result is that stock prices for gas producers have run ahead of the value of their proved reserves. A PV-10 is the net present value a company can realize from its proved reserves using current technology, and a 10% discount rate. Using JPMorgan PV-10 estimates, Range Resources (RRC) trades at almost $38 versus a PV-10 of $27. Expand Energy (EXE) is at $113 ($82) and EQT at $55 ($35).

Undeveloped/Unproved reserves could, in the upside scenario, justify current valuations if what their geologists think is there can be extracted profitably. But using the more conservative estimate they look expensive. And EXE, even if all their unproved reserves came through, has a PV-10 of $120.

That doesn’t seem to leave much room for anything to go wrong.

An alternative explanation is that the futures curve is wrong. Hedging more than two years out is impractical. For example, the May 2027 futures contract has only 5K outstanding, versus 207K for the most liquid July 2025 contract. It’s also likely that producers are keener to hedge their exposure by selling than consumers are through buying, which at the margin would depress prices.

JPMorgan calculates PV-10 values using both the futures curve and their own estimates, with the latter resulting in somewhat higher values.

Higher domestic natural gas prices seem very likely to us. As long as the huge spread exists between the US and other regional markets, companies will be looking to add LNG export capacity. The lower prices in the futures market almost assure they won’t be correct, since they’ll induce more exports. The message from the E&P names is more accurate than commodities markets.

We have two have funds that seek to profit from this environment: