Pipelines Will Get a Lift From Gas

/

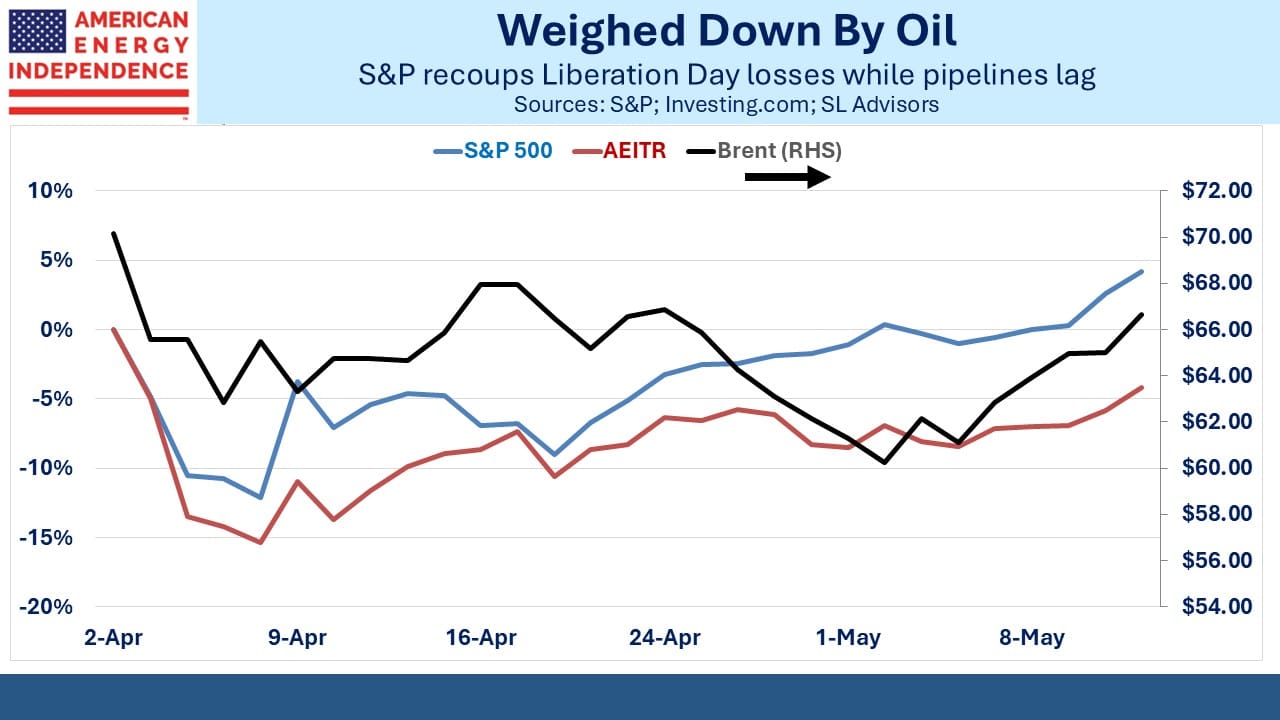

Following Sunday night’s 90-day agreement on tariffs between the US and China, the S&P500 sailed back above its pre-Liberation Day levels. All is right with the world. Sentiment seems weaker than data, so one will correct. After Liberation Day JPMorgan called for a 2H25 recession. Following the tariff news they dropped that forecast. Fed Funds futures are projecting only two rate cuts by year-end, versus four a couple of weeks ago.

Midstream has not yet recovered its tariff-trauma losses. Crude oil has been more consequential, with the May 3rd OPEC+ announcement adding downward pressure. Last year’s US oil production of 13.2 Million Barrels per Day (MMB/D) was expected to grow by 0.2-0.3 MMB/D this year, but forecasts are being modified. This will modestly impact Gathering and Processing (G&P) businesses that are sensitive to volumes from individual wells.

Some think output may even fall and at current prices at least one analyst thinks US shale has peaked. However, cheaper oil will stimulate demand. The prospect of continued delays at Newark airport through the summer will cause some to drive instead of fly.

Interestingly, Enterprise Products Partners CEO Jim Teague recently commented that even flat oil production out of the Permian basin would cause, “…rich natural gas to grow between 1.3 and 1.5 Bcf a day” and, “…a couple of hundred thousand barrels a day of natural gas liquids.” That’s because oil wells become more “gassy” as they age.

There’s much more to midstream than crude oil.

To us the pessimistic view overlooks the sector’s huge tailwind, which is gas demand from data centers. I listened to Liz Reid, head of Google Search, on a recent Economist podcast. AI is regarded by some as a direct threat to Google’s business model, since as Reid explains the Google AI search result taps into multiple websites, reducing the opportunity for advertising revenue. I’m not too worried about Google, but users are learning to ask more complicated questions.

For example, in response to “Which midstream companies mentioned data centers on their earnings calls”, I was presented with a list of names and summaries from their call transcripts. Previously I would have laboriously found each transcript online and done a word search (Ctr-F “data centers”) to find the relevant dialogue. But the AI-aided search is more efficient.

Results included:

Williams Companies (WMB) discussed their ability to bring around a gigawatt worth of power online for data center use by the end of 2027 on an earnings call.

Kinder Morgan (KMI) highlighted how AI-driven energy needs are boosting their business on recent earnings calls.

Energy Transfer (ET) during its earnings call on May 6, said it has roughly 200 data center opportunities in 14 states across its footprint.

Enbridge (ENB) noted the company is well-positioned to fuel escalating AI and data center needs.

Gas demand for data centers is the midstream story.

When asked on the podcast if Google search users were being “retrained” to use AI, Liz Reid cleverly responded that they were trying to “untrain” users from prior habits and encourage them to raise their expectations of search results by asking more complex questions. I’m doing that myself with narrower queries that generate AI-driven complex results drawing on numerous individual websites.

Your blogger’s narrow experience doesn’t settle whether AI will add sufficient value to justify all the investment in data centers and associated supporting infrastructure, including power. But it’s working for me.

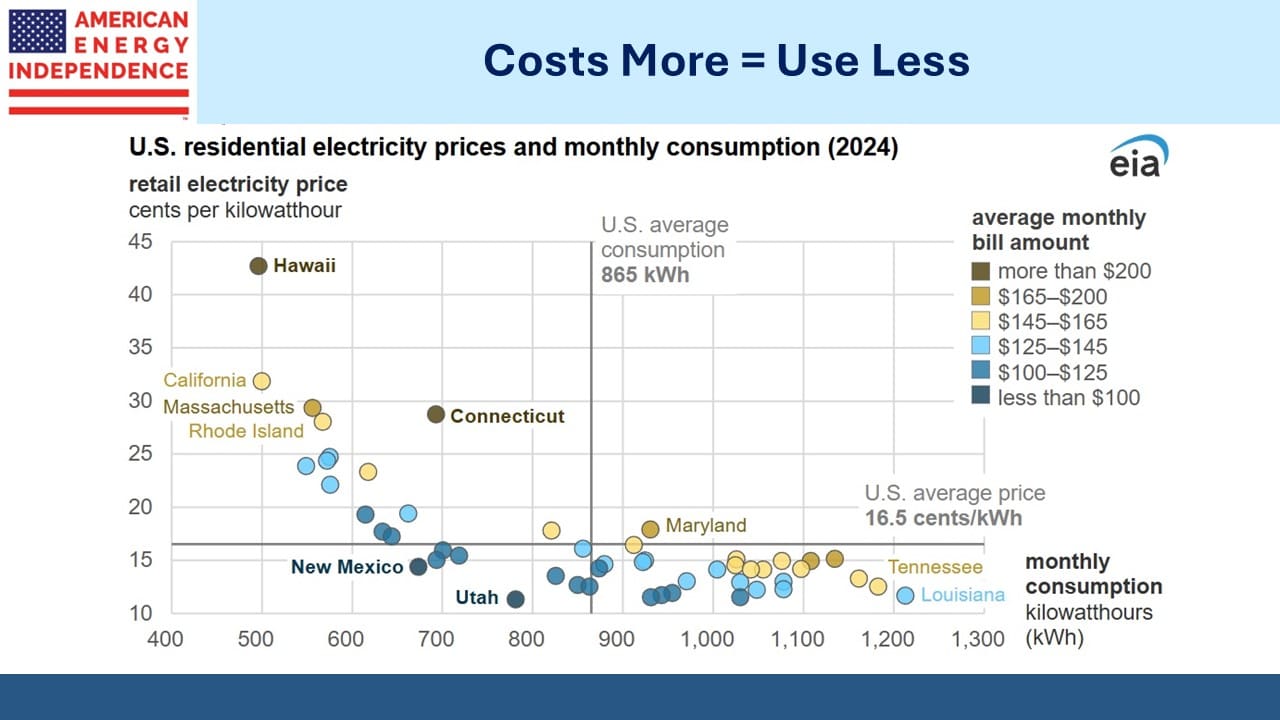

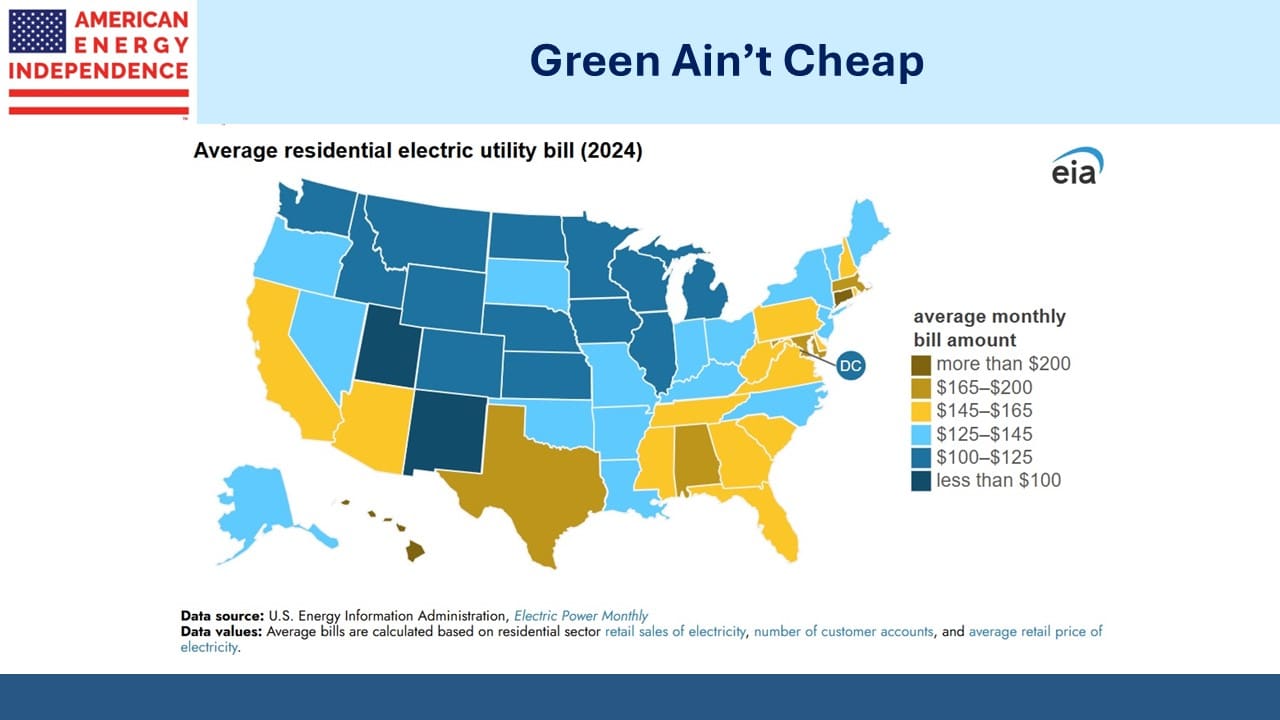

Retail electricity prices vary widely across the US. Generally, more renewables penetration correlates with higher prices. This must mystify left-wing advocates of solar and wind.

New York State faces an interesting challenge. They’ve passed legislation requiring 70% of their power to come from renewables’ sources by 2030. It’s currently 29%, or 50% if you include nuclear.

Today New York state sensibly relies on natural gas for 46% of its electricity, slightly above the US average of 43%. It’s why New Yorkers enjoy relatively low prices. Unfortunately, public policy is to reduce gas in favor of renewables. To this end, new building construction in New York City can no longer include a gas connection.

The 800 MW Empire Wind Offshore wind farm being built by Norway’s Equinor is expected to power up to 500K homes in Brooklyn. But construction has stopped, because the US Interior Department thinks the Biden administration approved the project without an adequate environmental assessment. Equinor has said the delay is costing them $50million a week and unless it’s resolved within days they’ll pull the plug.

Electricity customers in the Empire state may soon find themselves squeezed between an aspirational policy on renewables unable to deliver and self-imposed constraints on using cheap natural gas. It is democratic, if poorly conceived.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!