The Receding Energy Crisis

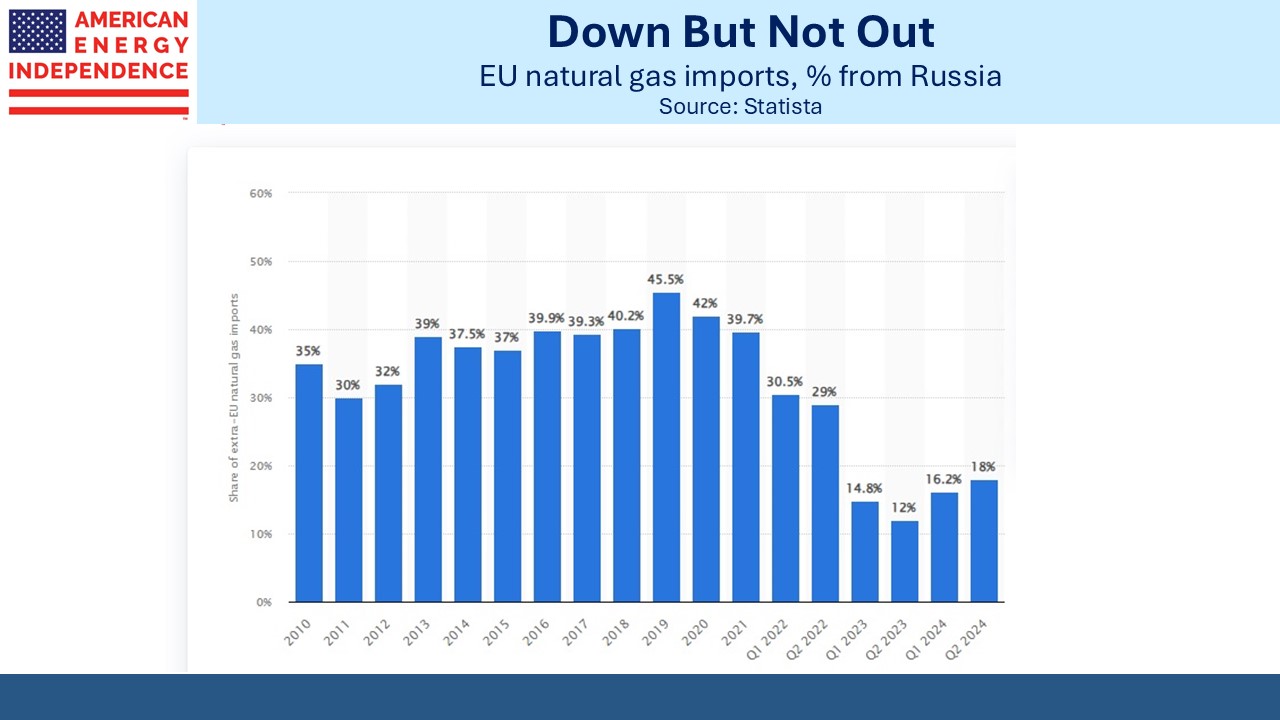

Suppose for a moment that the Sierra Club was a political party, with candidates running and elected officials in government. They might look like Germany’s Green Party, which has drawn support from idealistic German voters since the 1980s. They are politically left, view everything through the narrow prism of environmentalism and have a history of pacifism although in recent years have become less so.

In other words, they promote wholly impractical solutions to the big problems of today. For Germans worried about economic growth, cheaper energy and national security, the Greens have little useful to say.

In 2011 the Greens’ fervent desire to shut down all nuclear power became a reality when Chancellor Angela Merkel led the Bundestag to do just that, forming the cornerstone of the world’s dumbest set of energy policies.

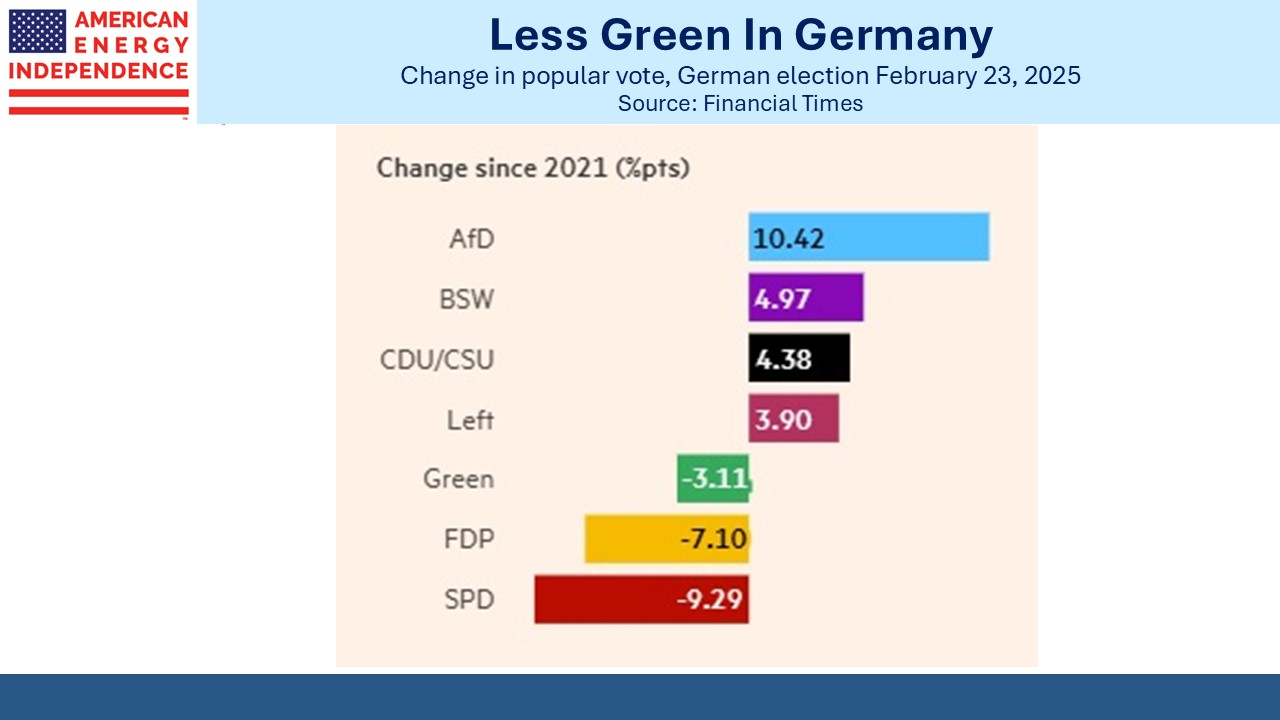

In this weekend’s election their share of the vote slipped by 3.1% to 11.6% compared with 2021. Few other countries are so burdened (see Germany’s Costly Climate Leadership).

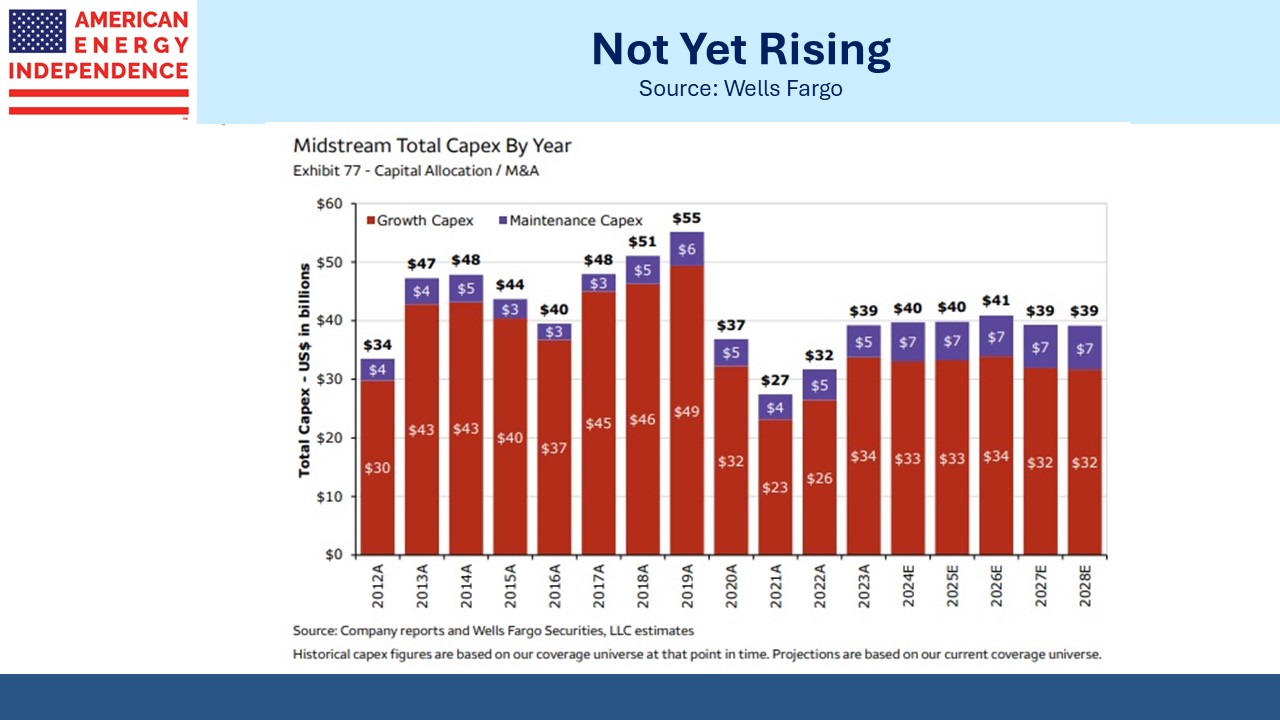

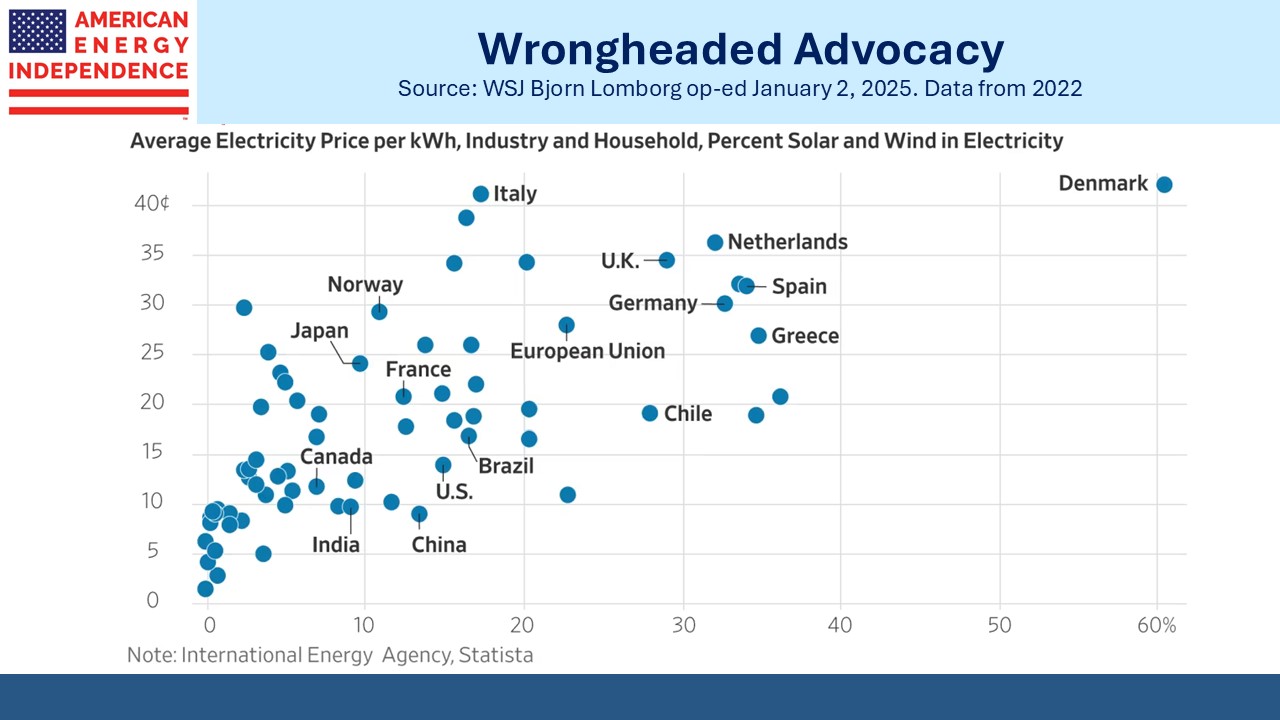

European energy companies have adopted more aggressive renewables targets than their US counterparts, which has hurt operating performance and caused their stock prices to lag. BP recently abandoned their target to increase renewables generation 20X by 2030. Despite the claims by many environmental extremists that solar and wind are cheap, profits are elusive in this area and electricity prices where renewables dominate are high.

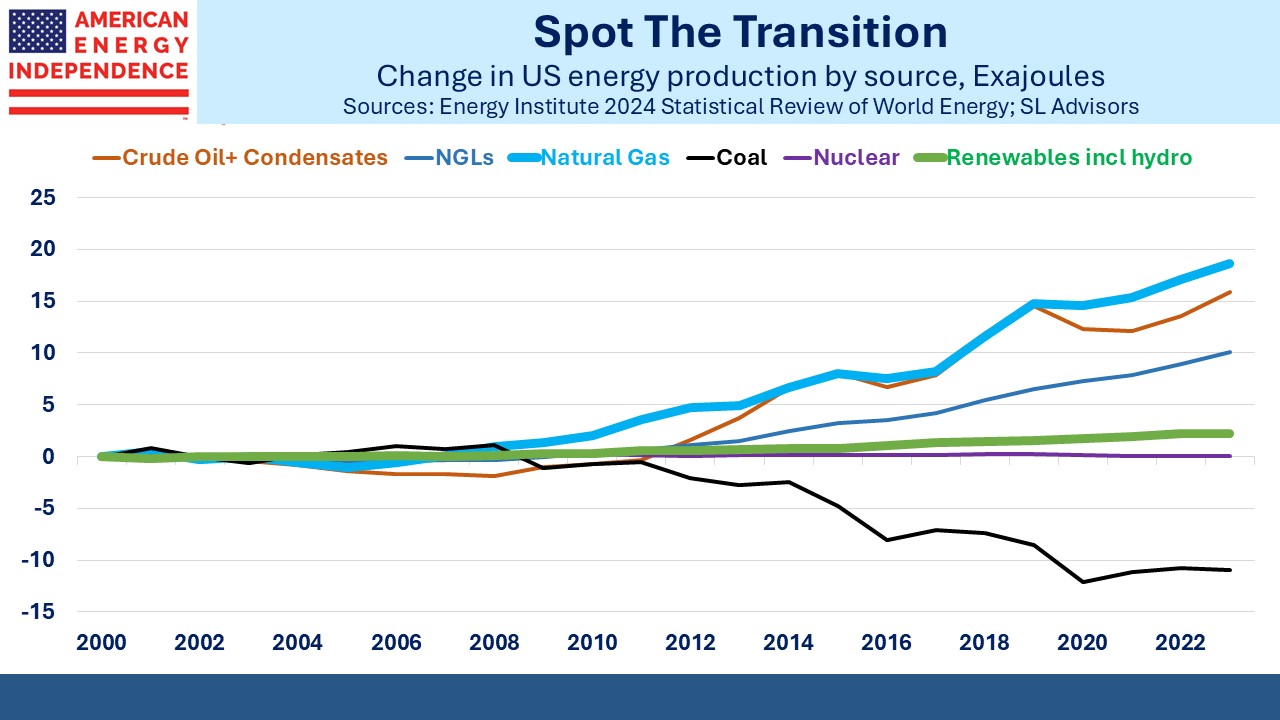

The only energy transition of any consequence in the US is the one from coal to gas (see The Natural Gas Energy Transition). One of my favorite charts shows the increase in energy output from natural gas consistently running 8X higher than renewables over the past couple of decades.

Many commentators are distracted by % growth rates which always appear impressive from a low starting point, creating the impression of dramatic change. They mistakenly think the country is rapidly shifting to solar and wind, which wasn’t happening even before the election.

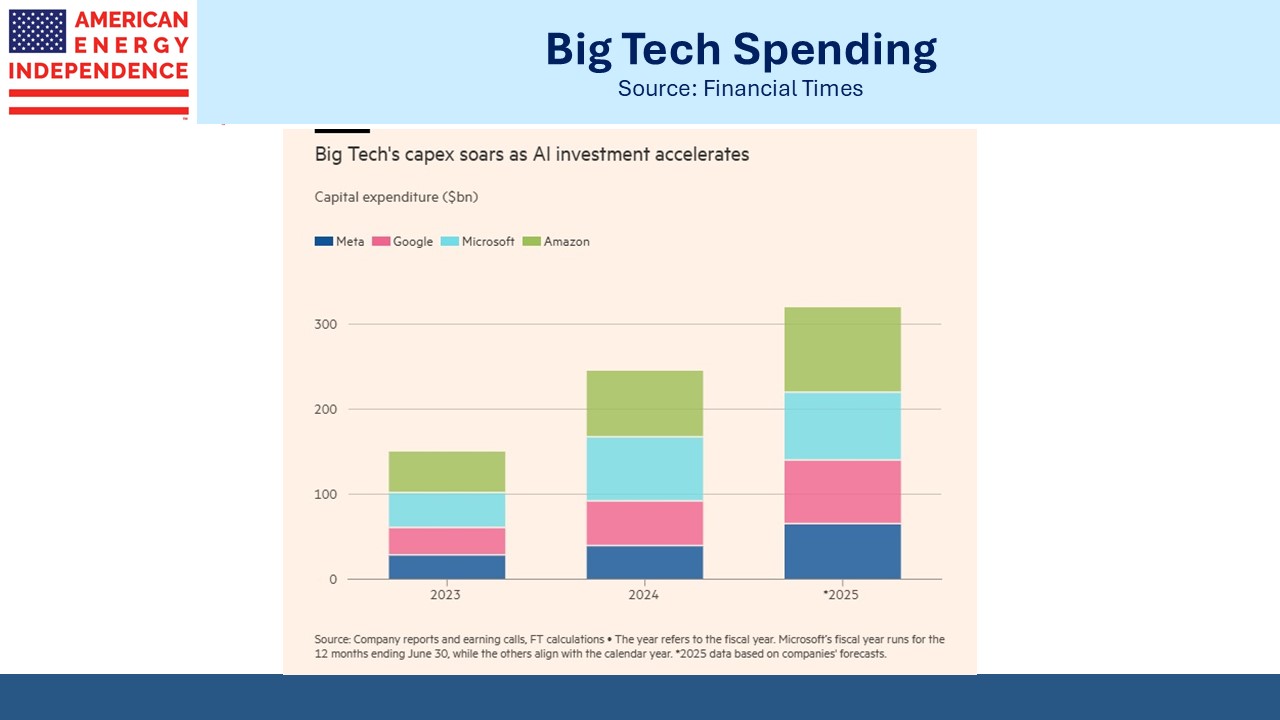

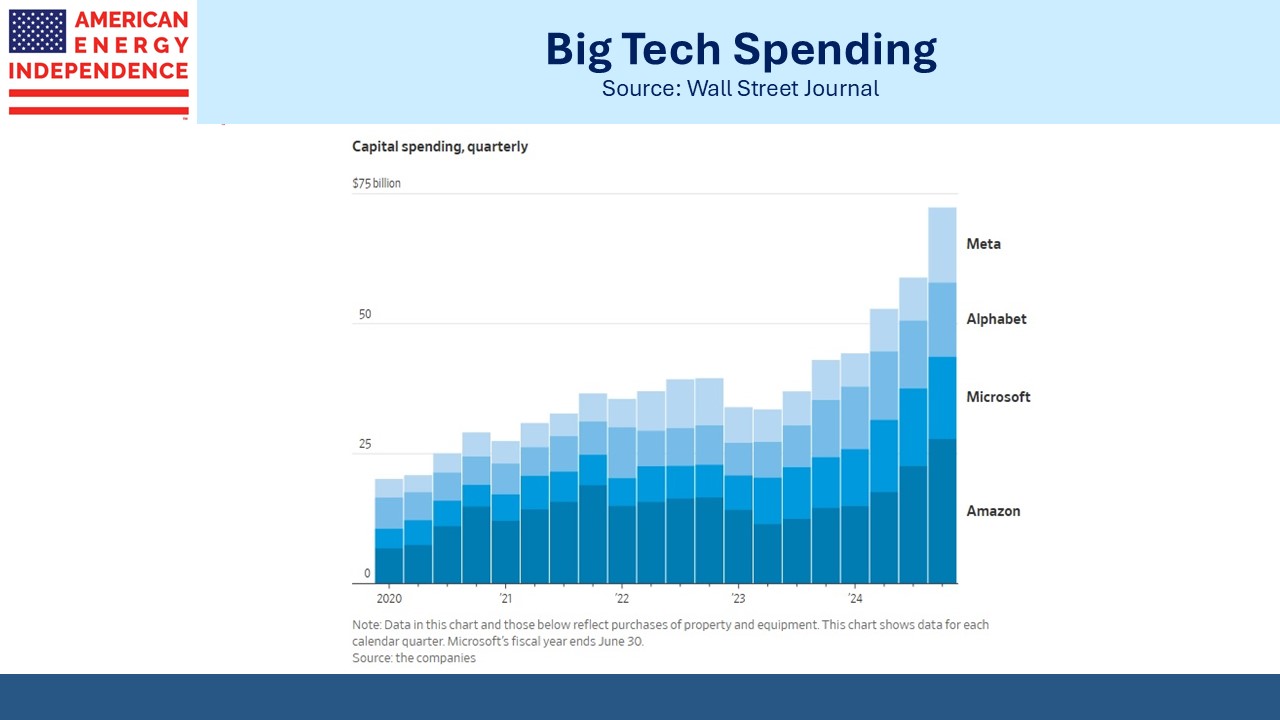

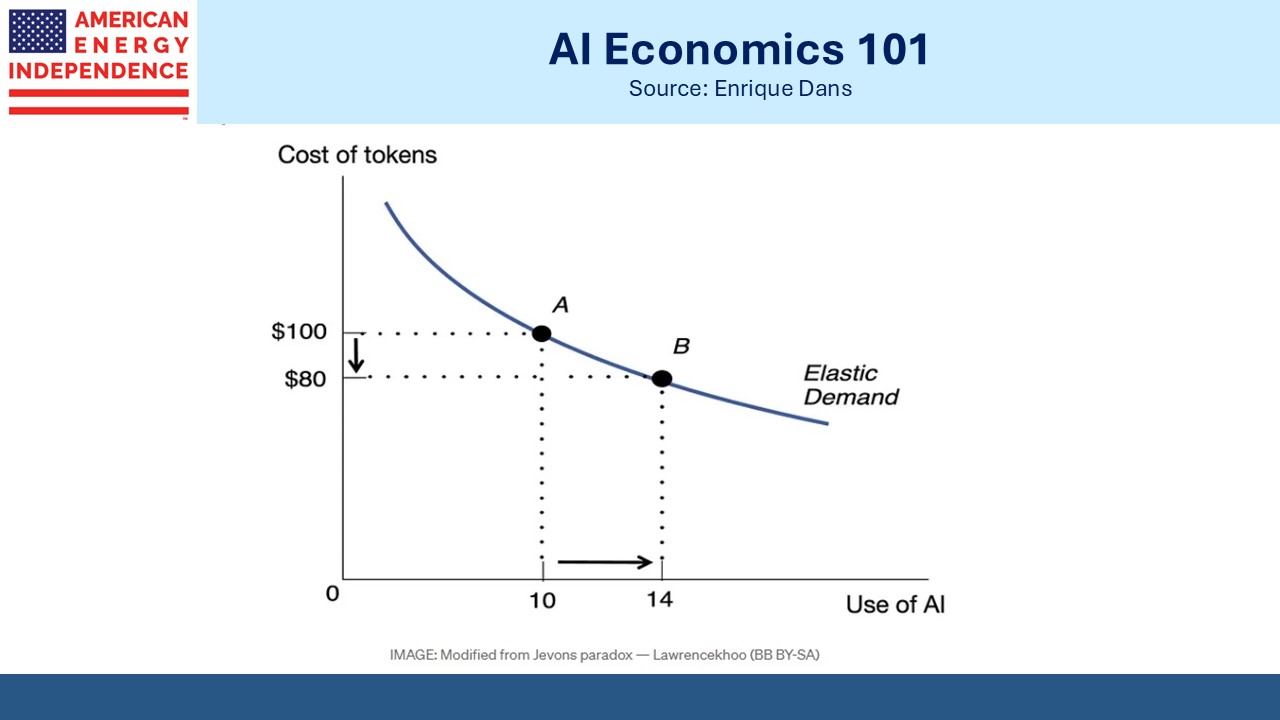

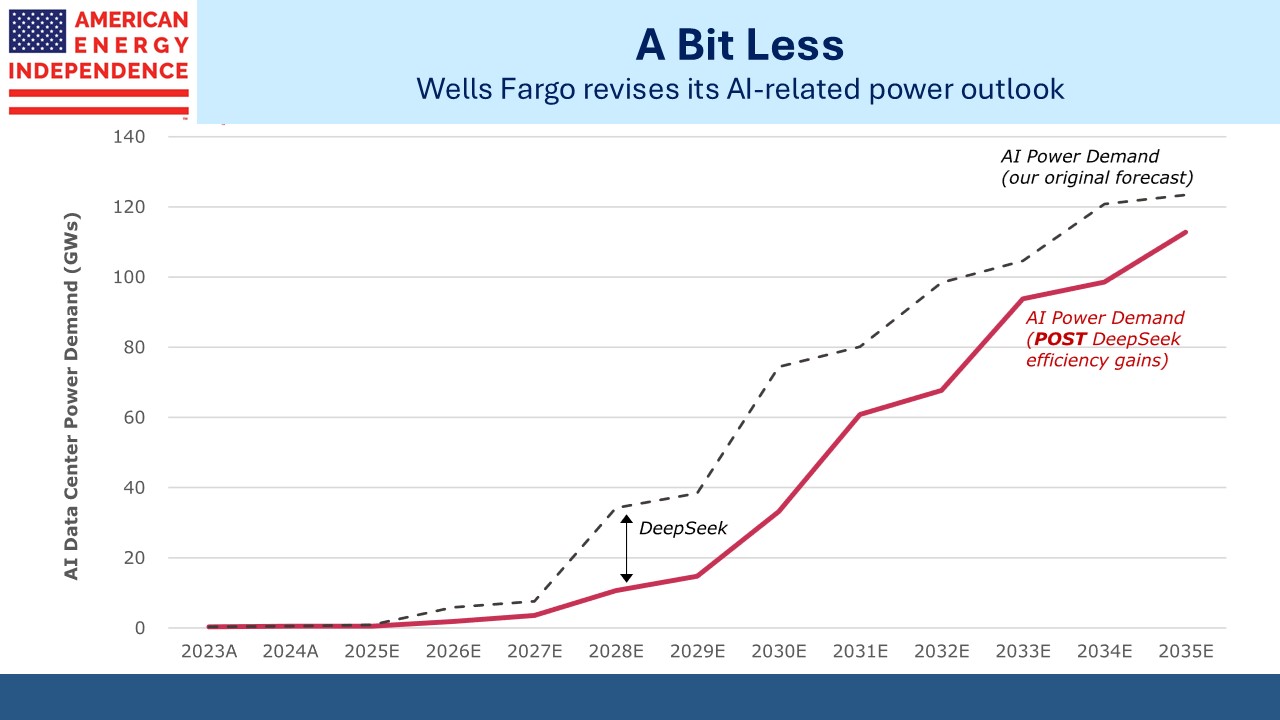

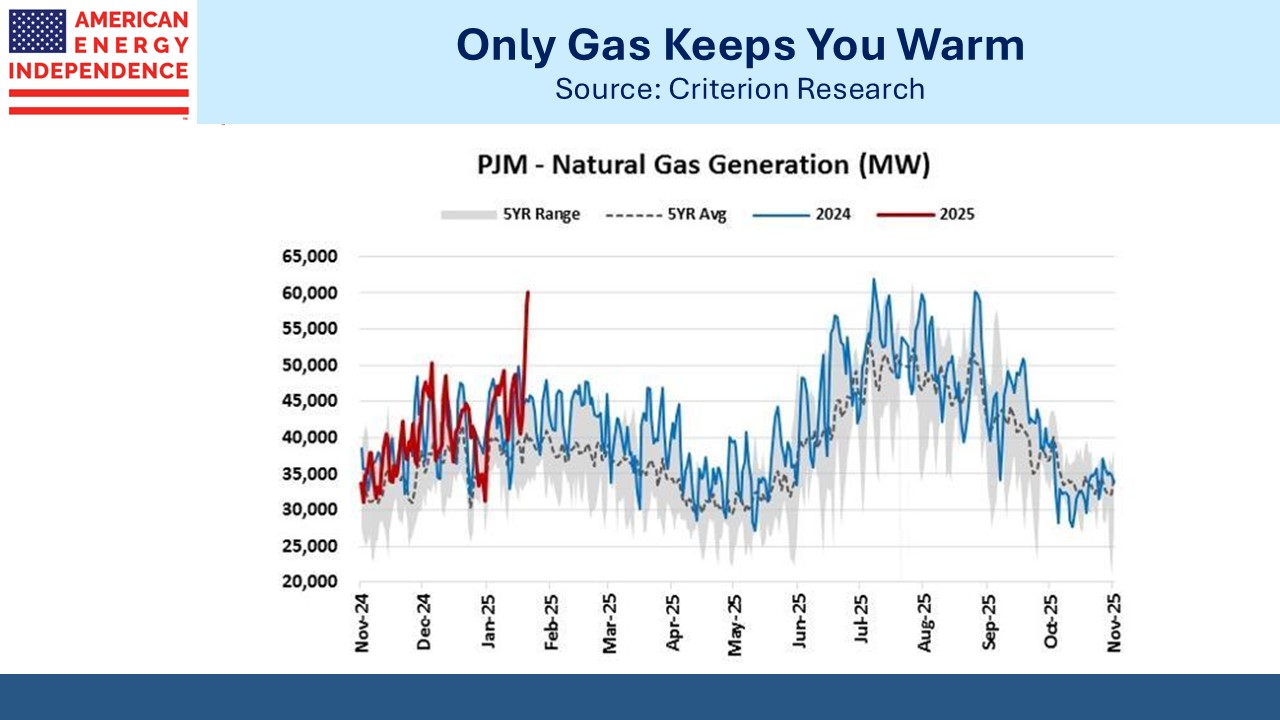

Wood Mackenzie offers an interesting perspective on the drivers of natural gas demand in different regions of the world. In the US its reliability in power generation is seen as key to developing the most sophisticated AI models. Data centers are wholly avoiding weather-dependent power, which is useless to them and prohibitively expensive with or without costly back-up for when it’s dunkelflaute (German for calm and cloudy).

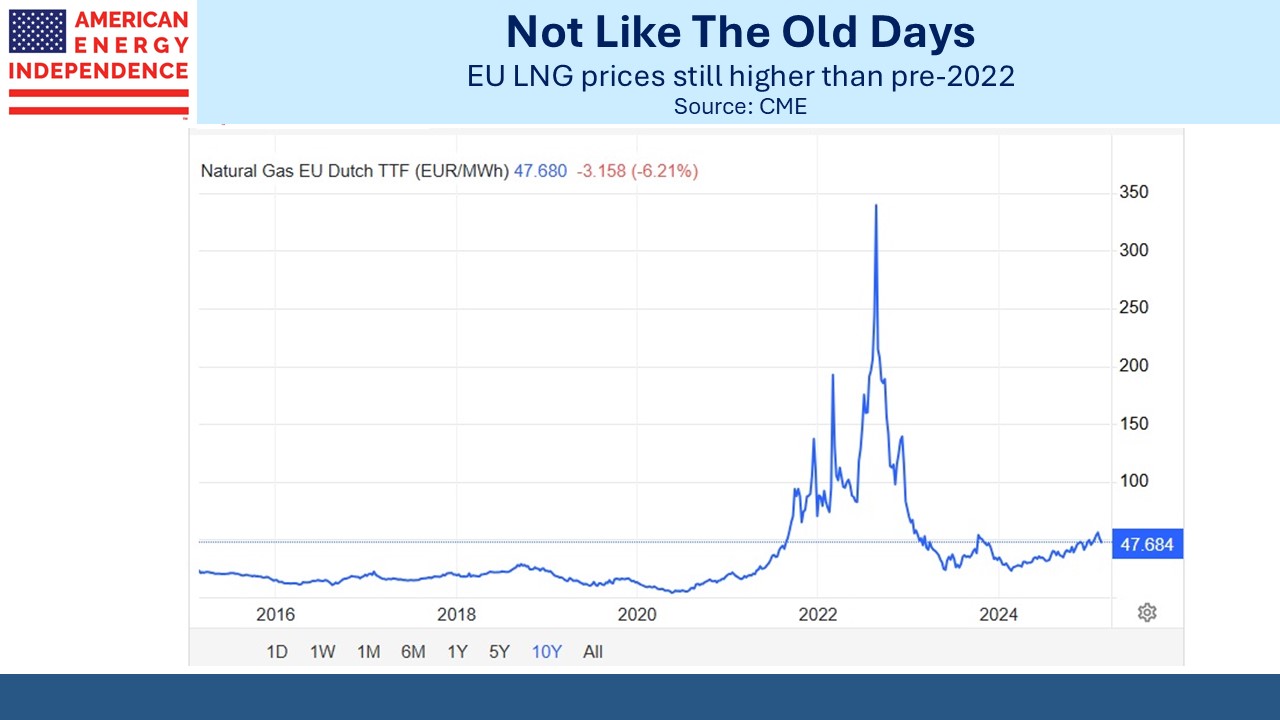

In Europe, Wood Mackenzie finds gas-fired power is gaining support to compensate for renewables’ intermittency and seasonal needs. This is where the world’s most expensive power is found. In this blog post, Robert Bryce listens to a London cab driver complaining that his energy bill has more than tripled in four years. The UK is “hurtling toward net-zero oblivion.”

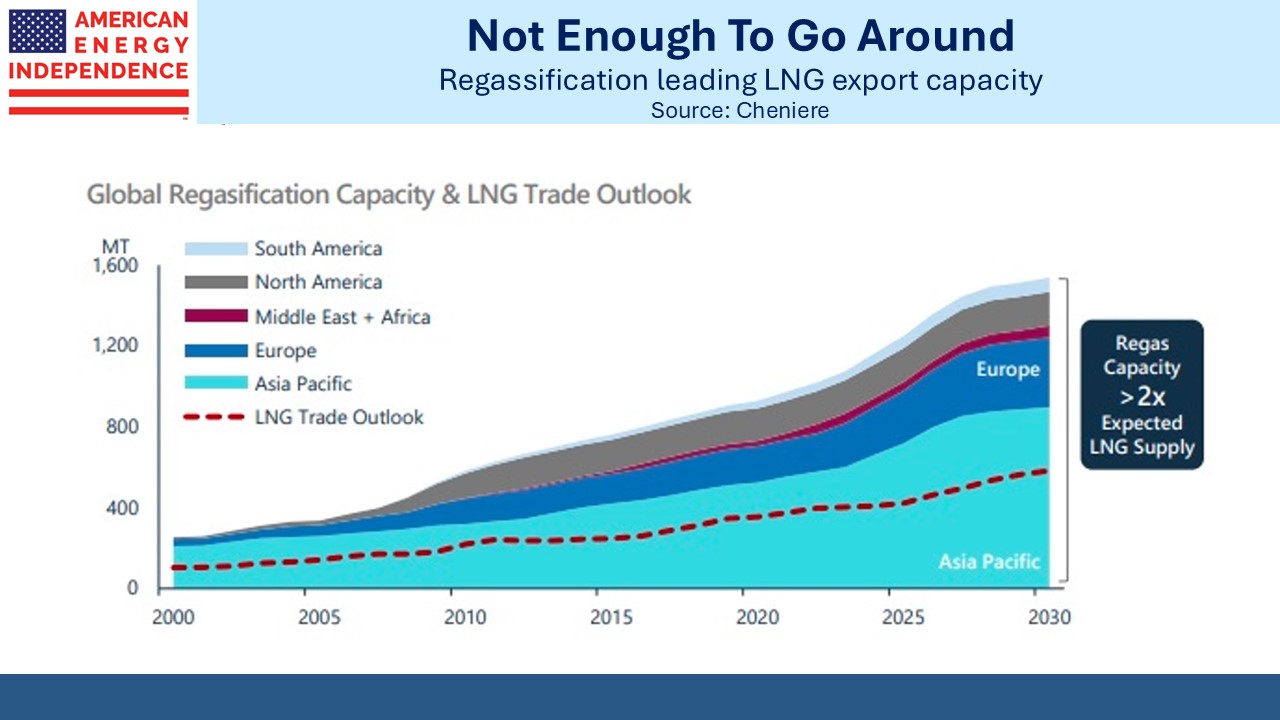

Wood Mackenzie adds that in SE Asia gas is a vital source of baseload power to reduce their reliance on coal, which pollutes and generates as much as 2X the greenhouse gas emissions as natural gas. The US can help lower emissions with LNG exports that displace coal, allowing the region to emulate our success in cutting CO2.

Chris Wright, our new energy secretary and former CEO of Liberty Energy, has a view that’s shared by vast numbers of voters. Human-induced rising CO2 levels are real. But it’s just one of several major global challenges including energy poverty, malnutrition and endemic diseases. In spite of billions of words spilled in the media, our lives haven’t been much affected. It’s hard to maintain a permanent crisis that lasts for generations.

The International Energy Agency (IEA) has morphed into a cheerleader for renewables in recent years. Their annual forecasts omit the most plausible scenarios in favor of absurdly unrealistic ones. Perhaps in response to criticism, the IEA is contemplating restoring the Current Policies Scenario in their next publication. This is the only one remotely worth consideration and restoring it may bring back an element of credibility.

EVs are undergoing a reality check. German automaker Porsche is spending over $800 million this year on traditional engines and hybrids as their EV sales continue to plummet. The most successful EV market is China where a new EV costs under $10K. This seems the right approach. At that price in the US range anxiety wouldn’t matter because households could make 95% of their trips on an overnight charge and still keep a regular car for longer journeys.

The rollout of US charging stations under the Inflation Reduction Act NEVI program has been painfully slow. Politico Energy reports that only 56 new stations were added last year, and now the Administration has ordered states to pause any such spending. With the outlook for EVs uncertain, I can’t see the point in buying much more than the road-worthy golf carts that glide around places like Naples, FL.

We have two have funds that seek to profit from this environment: