Renewables: More Capacity, Less Utilization

The U.S. Energy Information Administration (EIA) is generally apolitical – they’re not championing any single energy source. That may change under the new Administration, and they may become a shrill for renewables, but so far, they largely report data.

Yesterday their website carried Renewables account for most new U.S. electricity generating capacity in 2021, highlighting that 70% of the 39.7 Gigawatts (GW) of new capacity to be added is solar and wind.

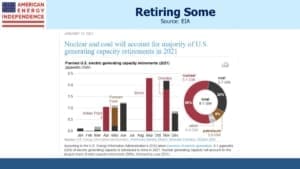

Recently they also ran with Nuclear and coal will account for majority of U.S. generating capacity retirements in 2021. The continued drop in coal is good news – its elimination is the fastest route to reduced emissions globally. This trend is unfortunately moving in the opposite direction in China and India, but at least in the U.S. we’re getting it right.

The drop in nuclear is not helpful in terms of lowering emissions, since it produces none. A realistic path towards fighting climate change includes using more nuclear, rather than relying fully on solar panels and windmills.

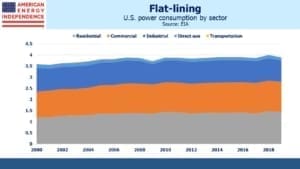

What’s notable is that we’re adding 39.7GW of generating capacity while retiring 9.1GW, for a net gain of 30.6GW. Total U.S. power generating capacity is 1,100 GW, so we’re adding around 3%. But U.S. power consumption for the past decade is flat. Energy intensity, the amount of energy consumed per $ of GDP, has been falling for decades in developed countries, reflecting ongoing energy efficiencies and the steady decline of manufacturing’s share of economic output.

So why is the U.S. increasing its energy capacity?

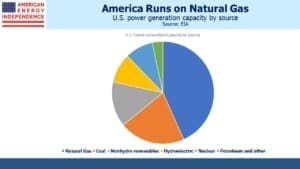

The 39.7GW being added is certainly expected to be used – otherwise the capital wouldn’t have been invested. Most likely, it reflects the lower utilization of renewables, which typically runs 20-30%. By contrast, baseload natural gas power plants run at 90% of capacity, with nuclear higher still.

The dismal truth that, for all the excitement about solar and wind, it takes more than 1 GW of solar capacity to decommission 1GW of coal power. This lower utilization is beginning to show up in the figures. The U.S. is net adding capacity while consumption is flat. Maybe enormous growth in electric vehicles will shift energy consumption from petroleum to electricity, but it’s likely we will gradually utilize less of our power generating capacity as the mix shifts.

Comparing the cost per GW of different power sources doesn’t account for differences in utilization, which therefore flatters renewables. The need for back-up power to offset their intermittency is also normally overlooked.

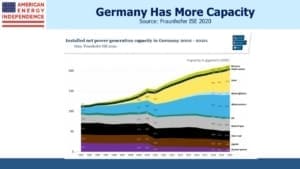

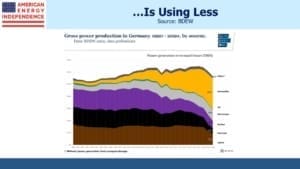

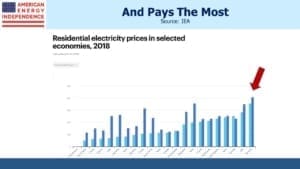

Germany has pursued renewables aggressively, adding capacity even while demand has been falling. Because of this, they also have among the highest electricity prices in the world. More of their power generation sits idle than in the past, because the windpower they’ve been adding has lower utilization. Watching the “Energiewend” (Energy Transition) has been instructive for the rest of us (see It’s Not Easy Being Green).

At least they’re not as bad as California, the state with America’s most expensive and least reliable electricity (see California’s Altruistic Carbon Policy).

Outside of California, electricity is cheap in the U.S. Some may believe there is plenty of room for prices to rise. If we are serious about climate change, prices should rise. Germany’s example shows where this can go. It’s not yet part of the climate change debate in America. It should be.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Your point about back-up generation requirements for green energy is critical to a true assessment of costs. It is frustrating to see the marginal cost estimates for wind and solar energy that do not take into account their 20-30% utilization and the costs of batteries and backups that must accompany them. Not sure if you have done a piece on “full cost” & “full cycle” energy production comparison but I for one would enjoy seeing it.

So, we are spending extra to get added renewable capacity for 1/3 the utilization. And, the benefits are probably being mismeasured because they don’t accurately reflect neither the costs of building solar panels or wind turbines nor the excessive costs of disposing of them (which happens more frequently because they don’t last as long. And, a nat gas plant to serve 100k homes takes up about 2.5 acres whereas a comparable solar farm requires 6400 acres (10 square miles). Yeah, this should work out well.

That’s a compelling analysis that is not understood and will be ignored by the “Green New Deal” advocates. Mike Somers, the CEO of the API, gave a presentation at today’s virtual annual conference along the same lines.