Democrats Will Test The Limits On Spending

Modern Monetary Theory (MMT) is taking hold. Relying on the insight that a government can never go bankrupt in its own currency, it posits that deficits don’t matter until they cause inflation (see our review of The Deficit Myth by Stephanie Kelton).

On a week that incoming President Biden unveiled a $1.9TN package to fight Covid and the economic downturn, ten year treasury yields fell. This was helped by Fed Chair Powell, who said, “When the time comes to raise interest rates, we’ll certainly do that, and that time, by the way, is no time soon,”

Meanwhile, JPMorgan, Citi and Wells Fargo released $5BN from their loan loss reserves because of the improving economic outlook.

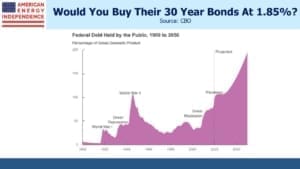

Empirically, deficits don’t seem to matter. The Congressional Budget Office (CBO) projects that Federal Debt:GDP will reach 107% in two years, eclipsing the past high that followed World War II. After a brief pause, it is projected to move stratospherically towards 200% and beyond. This projection was made last September, so omitted the $1.9TN that Biden proposes to add.

Meanwhile, thirty year bonds, which encompass the period during which Debt:GDP will soar, yield under 2%.

MMT remains a fringe theory among mainstream economists. Paul Krugman, liberal credentials burnished by his regular NYTimes op-ed slot, is a critic. Far across the political divide, Larry Summers describes it as a “recipe for disaster.” It’s not political orthodoxy for either party, although progressive Democrats see in it a way to finance their liberal agenda. But you could also envisage Republicans relying on MMT to justify tax cuts.

While economists like Paul Krugman and Larry Summers are debating the merits of MMT, practically speaking the debate is over. In Kelton’s book, she doesn’t argue that deficits never matter – if government spending exceeds the economy’s non-inflationary productive capacity, inflation will rise. That’s how you find out where the limit is.

As the bond market shows, we’re not there yet.

What isn’t receiving enough attention is that our fiscal policy is steadily adopting the MMT framework. Persistently low interest rates have removed the last remaining bulwark against fiscal profligacy. Spending hawks have gradually retired from Congress or been voted out. Holding such views is a thankless task. You don’t need to be an MMT advocate to ask why we don’t borrow huge sums at such low rates. The deficit was already growing under Trump because of tax cuts, before Covid relief took it higher still.

Last March, Trump tweeted, “With interest rates for the United States being at ZERO, this is the time to do our decades long awaited Infrastructure Bill. It should be VERY BIG & BOLD, Two Trillion Dollars, and be focused solely on jobs and rebuilding the once great infrastructure of our Country! Phase 4”

Biden’s $1.9TN package is to be financed fully with debt as opposed to taxes – for now anyway. And it doesn’t include anything from the Green New Deal (see The Bovine Green Dream). Or for infrastructure.

Big spending is a bi-partisan strategy.

What seems increasingly likely is that we’ll keep pushing our deficit higher until we generate inflation. To fail to do so is to needlessly leave people worse off. The government should spend, and provide jobs for all, because as Kelton writes in her book, “…poverty strips people of the opportunities to flourish and to participate in the American dream.”

Bernie Sanders, who will chair the Senate Budget Committee once the Democrats take control of the Senate next week, has Stephanie Kelton as an adviser. His platform during his run for the presidency last year included $30TN for Medicare for All, $16TN for the Green New Deal and $7.5TN in Federal job guarantees. Any complaints he may have on Biden’s spending plans are likely to criticize their lack of ambition.

Worrying about the deficit has been a fool’s errand for decades. Betting on higher inflation has been a losing trade for the entirety of most investors’ careers. That could remain the case this year too, although there are signs of price pressure. Hot rolled steel has doubled in price since October. Money supply (M2) is growing at 26%, faster than even the inflationary 1970s and 80s.

Protecting against inflation is incredibly cheap. December 2022 eurodollar futures yield 0.29%, only 0.06% more than today’s three month Libor, with almost two years to go. Pipeline stocks, which often have inflation escalators embedded in their tariffs, yield over 8%.

Inflation may stay quiescent, but the cost of protection is very low.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

We are short December 2022 eurodollar futures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The only disagreement I have with this excellent analysis is that I don’t think that Paul Krugman has much of a reputation to begin with and, if he did, I can’t imagine how his association with The NY Times could enhance it (or anything else).

There are no atheists in foxholes and there are no fiscal conservatives in power. The Republicans have shown this time and time again by their reckless spending using borrowed money. At least Biden has plans to use the money to invest, that ought to provide some return.