Pipelines Close In On A Milestone

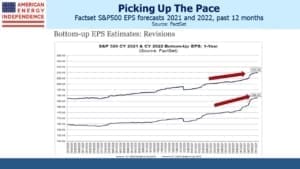

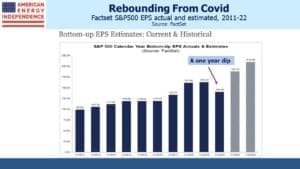

The S&P500 is up 11% so far this year. 2021 EPS estimates from Factset are up by close to the same amount. The rise in ten-year treasury yields means the Equity Risk Premium (ERP) doesn’t show the market to be quite as cheap as it was, but not by much. Covid has been less traumatic to the market than to people. Earnings forecasts have been rising steadily for the past six months. First quarter announcements led to a surge in upward revisions.

2021 S&P earnings are now expected to be 15% higher than pre-Covid 2019, a 7.3% compound annual growth rate over the two years. Enormous fiscal stimulus in the U.S., which continued even while vaccine distribution was letting life return to normal, helped. 2022 earnings growth of 12% confirms the strong recovery.

Stocks offer some protection against inflation. But rising bond yields could negate that. The Federal government is on a well-orchestrated mission to drive stocks higher. More $TNs in spending are coming, for investment in infrastructure followed by the American Families Plan. The Federal Reserve’s bond buying is muting the message from investors worried about such fiscal profligacy. Donald Trump, who often took credit for strong stock market performance, must grudgingly admire the government’s synchronized and powerful boosting of equity markets.

Larry Summers continued his criticism of the Fed, warning yesterday of the Fed’s “dangerous complacency” regarding inflation. He continued, “It is not tenable to assert today in the contemporary American economy that labor market slack is a dominant problem. Walk outside: labor shortage is the pervasive phenomenon.” That view fits the facts as we see them better than the Fed’s outlook.

Although the market has continued its upward momentum, there’s been a clear rotation away from growth and towards value. Rising bond yields has contributed to this – growth stocks in effect have a longer duration, increasing their sensitivity to higher rates. The IWM/QQQ ratio compares small cap value with technology stocks. The trend for value to outperform began with the vaccine announcement in November.

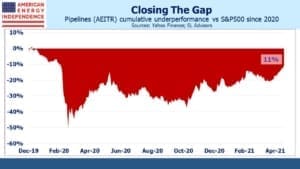

The perennially unloved energy sector has been inexorably recovering too. North American pipelines, as measured by the American Energy Independence Index (AEITR), have been gradually closing the performance gap with the overall market. It’s increasingly clear that the brief collapse in March 2020 was partly due to the forced liquidation of leveraged closed end funds (see MLP Closed End Funds – Masters Of Value Destruction). The biggest pipeline corporations delivered 2020 financial results that weren’t far from pre-Covid guidance. Reduced spending on new projects helped, and operating cashflow for the sector offers unappreciated resilience.

A handful of natural gas pipeline operators then benefitted from the Texas power cuts in February, when prices spiked over 100X. The sector even rallied when the Colonial pipeline suffered a temporary service interruption, causing gasoline shortages in parts of the eastern U.S. (see Hackers Highlight Pipelines’ Value).

The International Energy Agency published a report on what the world needs to do in order to reach zero emissions by 2050. Their recommendation is that no new supplies of oil, gas or coal be developed. This is implausible – China, India and other emerging economies aren’t going to abandon their plans to raise living standards and energy consumption (see Why The Energy Transition Is Hard).

Investors are coming to terms with a more realistic assessment of the energy transition – one recently articulated in an excellent paper by JPMorgan’s Mike Cembalest. Solar panels and windmills can’t meet all the world’s energy needs, which are likely to keep growing as emerging countreies seek higher living standards for their populations.

The pipeline sector has continued its post-Covid bounce and is within 11% of matching the return of the S&P500 from the beginning of last year, when few knew what a coronavirus was. Inflation fears, which continue to percolate, have helped push commodity prices higher. This, combined with the strong recovery, is also boosting oil and gas prices. If current trends continue, the AEITR will close its 2020-21 performance gap with the overall market, which would represent another milestone in its recovery.

Sentiment, based on our many client conversations, is turning cautiously optimistic. The past several years of disappointing returns dissuade many generalists. Energy buyers haven’t been accused of irrational exuberance for a long time.

Free cash flow yields that should exceed 10%, 2X the S&P500, by year’s end, should continue to drive strong returns.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Interesting. Look at a map of USA and pipelines. Look at a the arteries in the human body. Both are essential. Only one pays a cash dividend.

The IEA–and the naïve Biden loving environmentalists– idiotically ignore the fact that trillions of dollars of necessary industrial and commercial products world wide are manufactured based on petrochemicals, such as polypropylene, polyethylene, isobutane and other derivatives of natural gas, as described in detail in the marvelous Investor Presentation issued yesterday by EPD in connection with its conferences at the EIC (which I attended by Zoom).

At another such Zoom conference, Mike Hennigan, Chairman, President and CEO of MPLX emphatically stated his strongly felt belief in a very positive future for natural gas.

The IEA is bowing to the irrational wokeness of the environmentalists and ignoring reality.