Why The Energy Transition Is Hard

The media is not short of simple solutions for climate change. Solar panels and windmills have been cheaper than natural gas for so long in the popular narrative that you’d think utilities are willfully pursuing lower profits by not blanketing the country with them. The industry that provides over 80% of our energy is often demonized by extremists who drive to protest pipelines.

There are some whose concern is more thoughtful. Bill Gates recently laid out the many economic and technological challenges to reducing Global Greenhouse Gases (GHGs), and avoided the politics which is bigger than the other two (see Not Just Another Billionaire With A Plan). Recently Mike Cembalest, Chairman of Market and Investment Strategy at JPMorgan Asset Management, published Future Shock: Our 11th Annual Energy Paper. As in the past, Cembalest partnered with Vaclav Smil, author of numerous excellent books on energy stuffed with facts and figures.

The sober analyses by Gates and Cembalest are much more useful than shrill soundbites from the Sierra Club. Cembalest notes that, “Absent decarbonization shock treatment, humans will be wedded to petroleum and other fossil fuels for longer than they would like.” Gates (albeit unintentionally) and Cembalest are bullish about the long term future of oil and gas, a point not lost at JPMorgan which remains overweight energy stocks.

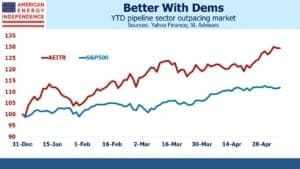

Right on cue, 1Q21 pipeline earnings reaffirmed the continued growth in free cash flow and stability of the sector. Williams Companies (WMB) beat expected EBITDA by 7%, and raised its full year guidance by 2%. Its stock yields 6.5% and its payout is covered almost 2X by distributable cash flow. Enterprise Products Partners (EPD) beat estimates by 14%. It yields 7.7%, 1.7X covered. Cheniere Energy (LNG) beat estimates by 43% and raised full year guidance by a conservative 5%. Energy Transfer (ET) enjoyed a one-time gain of $2.4 BN from the Texas power outages, beating EBITDA expectations by 88%. This helped them reduce debt by $3.5BN.

The energy transition is slow, for all the reasons regularly cited in this blog. Mike Cembalest provides further insight. Decarbonizing the transportation sector by switching to Electric Vehicles (EVs) is a goal in most developed countries. Its apparent imminence has damaged many reputations for forecasting acuity. Norway is a special case with 62% penetration of EVs in light vehicle sales. Taxes and subsidies heavily favor EVs; Norway’s electricity (97% hydropower) is 40-70% the cost of their European neighbors, and if Norwegians only bought EVs their subsidies would be the second biggest government expenditure.

U.S. EV penetration is low at 2%. Americans drive farther, enjoy cheaper gasoline and use less public transport than other countries. and trucks/SUVs are 75% of light vehicle sales. All the Tesla owners I know love them, but my small group of friends isn’t representative. Comparing the EV with its equivalent internal combustion engine counterpart (i.e. Ford F150 with the F150EV etc) shows EVs to be almost twice as expensive.

The energy transition comes with a substantial increase in power consumption, which is intended to be supplied with solar and wind. Sunny and windy places are often not where electricity consumers live – on top of which solar and windmill farms require substantially more land than conventional power plants. A report last year from Princeton University estimated that U.S. annual transmission investment would need to triple over the next three decades.

Massachusetts is trying to import hydropower from Quebec, but it first has to travel through New Hampshire where environmentalists recently persuaded authorities to deny construction of the necessary transmission lines. In Russell Gold’s Superpower (see our review here), he chronicled the challenges faced by Clean Line in getting windpower from Oklahoma to Tennessee. The book ended with the assets being sold to NextEra Energy, and after continued delays and expensive court battles the project was abandoned.

Widespread battery storage is a critical supplement to the intermittency of solar and wind, where 20-30% capacity utilization is common versus 85% for natural gas power plants. Batteries are getting cheaper to be sure, but Mike Cembalest illustrates the daunting economics by comparing the cost of building an oil storage tank ($15-$18 per barrel of capacity) with the $510,000 cost of a Tesla Megapack holding the same 17 kWh of energy.

The stark truth is that combating climate change will require enormous public investments, substantially higher energy prices and altered daily lives for many. This shouldn’t be surprising – if it was easy we’d have done it already. The biggest failure of climate extremists has been to misunderstand the cost and to avoid talking about it. It’s why Joe Biden promises well-paying green jobs. Higher electricity prices and Federal eminent domain to build inter-state transmission networks isn’t so appealing.

Climate Czar John Kerry’s discussions with China acknowledge where much of the future growth in GHGs will come from. The 2001 entry of China into the World Trade Organization brought enormous access to cheap goods as production of what the west consumes moved east. Today, China’s industrial sector uses more energy than America’s and Europe’s combined. More than half comes from coal.

Gates and Cembalest are both deeply concerned about climate change. Their work on the subject examines the substantial changes required for the world to reach its stated goals on reduced GHGs and global warming. Few who care about the issue seek to build public support for the costs involved, which is why progress is slow.

Our conclusion from reading both is that the world will be reliant on fossil fuels for many decades to come. Migrating away from coal to natural gas remains well within reach, and has led to most of America’s reduction in emissions. The pipeline sector isn’t just recovering from the Covid collapse of last year, but is beginning to reflect a more realistic outlook.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!