Pipeline Technicals Turn Bullish

Although we rarely write about technical analysis, charts are helpful in showing visually where prices have come from. We also have a good number of clients who use charts to form investment opinions. This is especially true when it comes to changing portfolio allocations. Recently, bullish energy sector charts have come up in conversations.

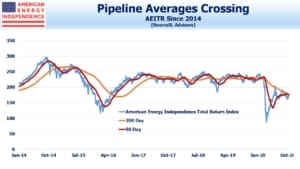

The 200-day moving average is widely used, and often gives a signal when crossed by a faster moving average, such as the 50 day. From 2016 to early this year, the pipeline sector stayed within a 20% range, and moving averages offered little of use to the technician.

Following the steep drop from January to March, the trading range for the American Energy Independence Index (AEITR) has become steadily tighter. Lower highs and higher lows will soon be resolved, as it breaks out of its current formation.

The 50-day moving average crossed the 200 day on Tuesday. Some may prefer to see it happen more decisively, with the 50-day moving sharply higher. Nonetheless, by this definition the sector has begun a new uptrend. The index itself has remained above both moving averages since Wednesday.

There’s also a downward sloping trendline, against which the index is bumping. A move up through this would confirm the bullish signal from the moving averages and chartists would interpret this as positive.

Proponents of technical analysis will tell you that it improves the timing of their trades. The fundamentals for pipelines have looked encouraging to us for several months now, with free cash flow set to double this year (see Pipeline Cash Flows Will Still Double This Year). We wrote that in mid-May, and it’s looking increasingly prescient with midstream energy infrastructure 6% higher since then. But with a yawning gap between yields on bonds and equity from investment grade issuers (see Stocks Are Still A Better Bet Than Bonds), there is substantially more upside. Fixed income markets are far more positive about big pipeline companies than are equity markets. Bond buyers have a reputation for doing more careful analysis, since their upside is receiving coupons and their downside is losing everything. They are right to be constructive.

Bullish fundamentals are now being confirmed by technical analysis.

Sentiment remains extremely cautious. Although we don’t have any numbers on this, conversations with investors often reveal interest in valuations but nervousness about buying just before a big drop. The energy sector has done that to people in the past. A lot of these people represent potential buyers – interested in committing capital but looking for some signs that they’re not alone. Waiting for the election is a common refrain. A Biden victory is priced in, and we think could be positive for pipeline stocks (see Why Exxon Mobil Investors Might Like Biden).

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.