Of Red Crypto And Black Pipelines

/

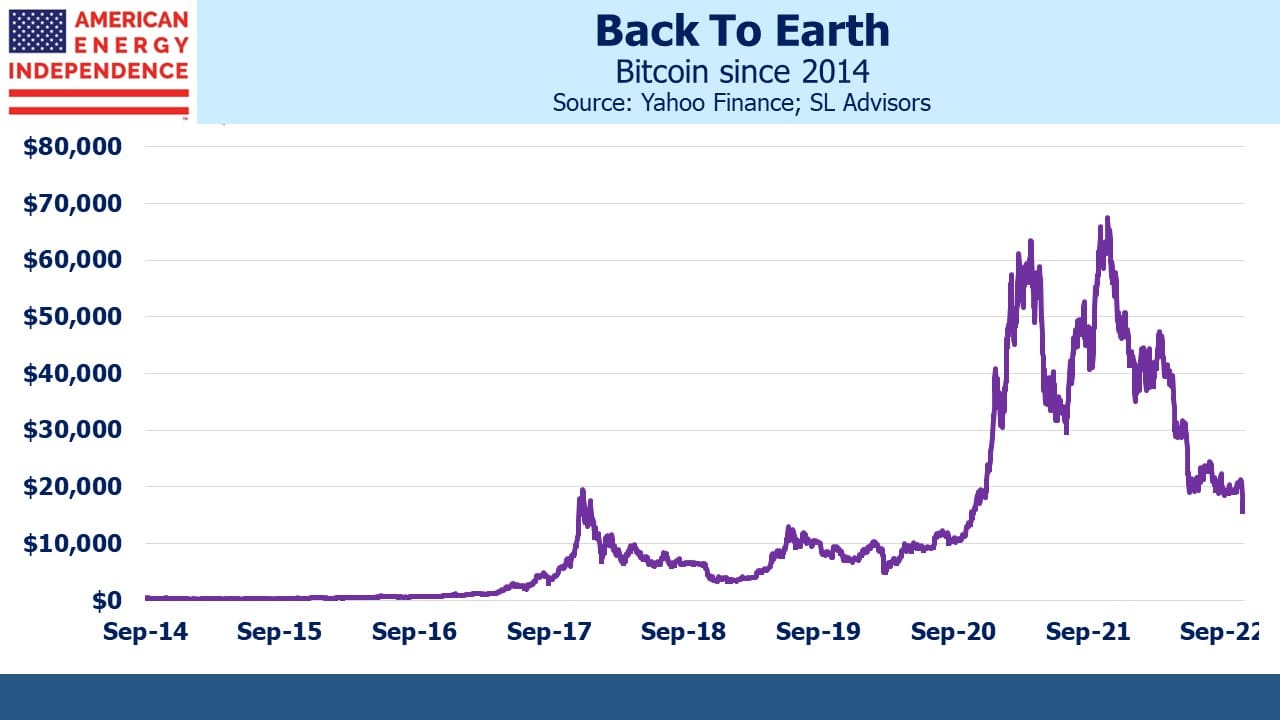

Bitcoin could be poised for another ascent. Bulls will be encouraged that Jim Cramer advised holders to sell following the collapse of FTX. Few readers would have been surprised when this blog first expressed crypto-skepticism in December 2017. Its return since then is 1.7% pa, substantially behind the market and, naturally, midstream energy infrastructure.

But annualized returns are too pedestrian to be the metric of choice for crypto-traders. They prefer “X”, as in “I made 3X on crypto so far this year.” For them, red is the new black.

Bitcoin is too volatile to be a store of value. Exchanges are routinely hacked. And the government can seize it. So what’s the point of it? You don’t have to short bitcoin to be unconvinced – avoiding it is sufficient. It has always looked like a modern Dutch tulip bulb craze. Not everything that changes in value is an investment or needs to be traded. Many investors in FTX were proponents of decentralized finance (“defi”), valuing the freedom to operate outside existing regulatory structures. Now as many as a million creditors are relying on regulators and national justice systems to salvage value for them.

The long term bull case for bitcoin sees it assuming the role of a widely-held currency, with a yield curve reflecting interest rate expectations set in the absence of a central bank. For now the US$ is not threatened with a loss of dominance. Fed funds futures project a cycle peak of just under 5%, sooner and higher than a few weeks ago. Like the FOMC, the market expects rates to begin decreasing a few months later. Fed chair Jay Powell did suggest rates could peak at a higher level than previously expected, but that was before the benign CPI number.

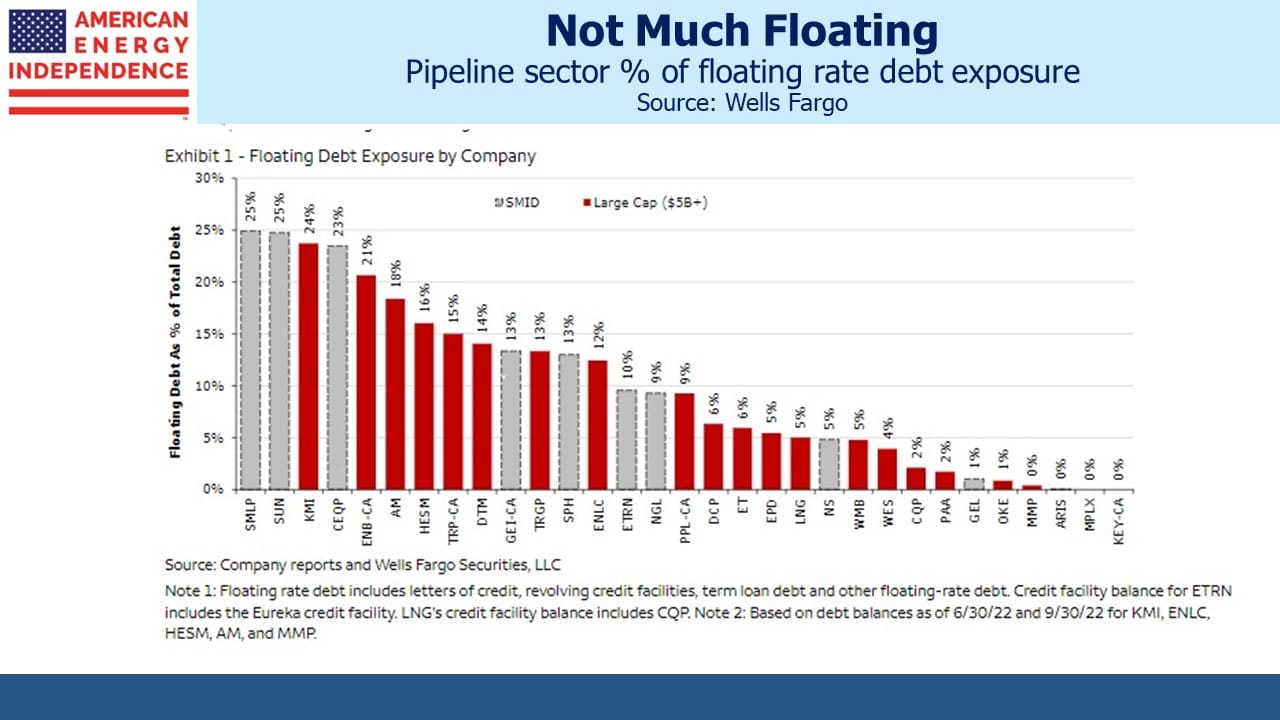

Investors sometimes ask us about the exposure of pipeline companies to rising interest rates. The chart from Wells Fargo is informative and shows the preponderance of fixed rate debt across the sector. Wells Fargo estimates that a 1% increase in short term rates would reduce free cash flow by a similar percentage. With around half the industry’s EBITDA subject to inflation-linked tariffs, elevated PPI and interest rates is preferable short of causing a recession.

The COP27 is notable for more realism (see Energy Pragmatism Is Beating Extremism) and the presence of traditional energy companies. EQT is the biggest producer of natural gas in the US. Their CEO Toby Rice has been vocal in making the case for natural gas as a substitute for coal. “The most important thing is for people to see America’s largest natural gas producer here at COP27 as a symbol that we’re going to be a leader in energy transition,” said Rice on the sidelines of the conference.

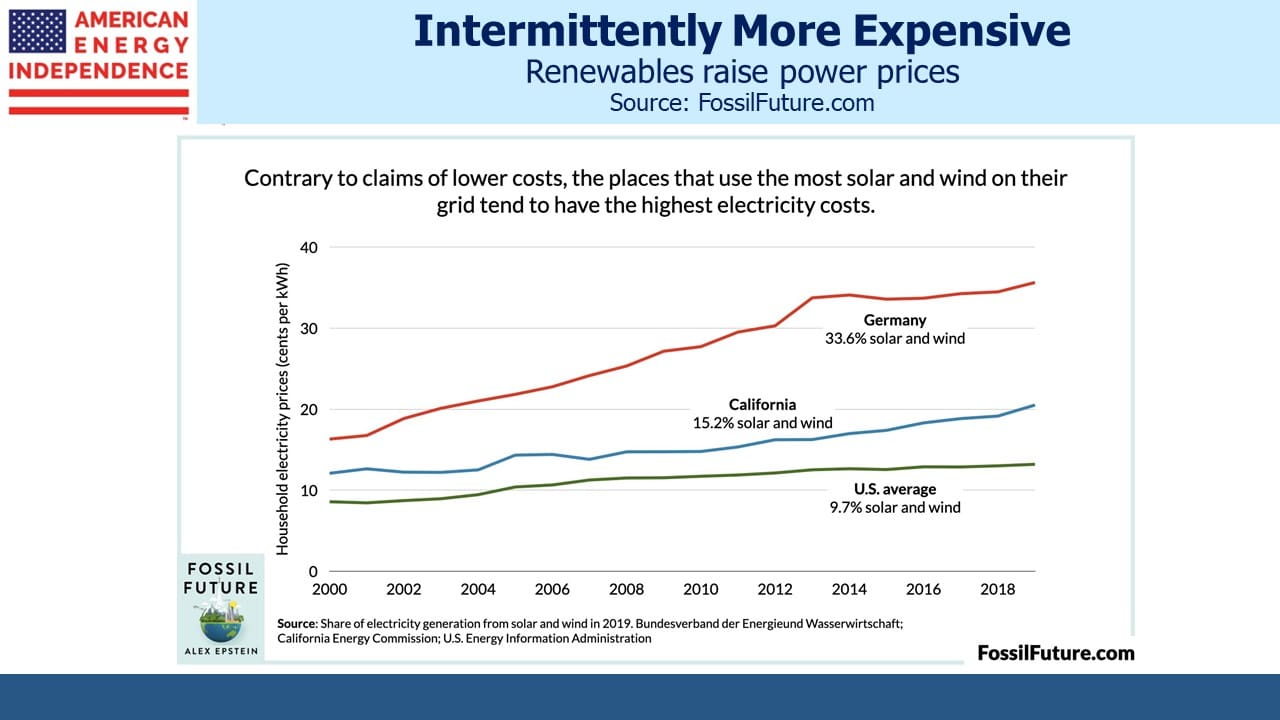

Coal power plants produced a fifth of global greenhouse gas emissions in 2021, more than any other single source, according to the International Energy Agency. China consumes half the world’s coal. Their representatives at COP27 offered the novel argument that Russia’s invasion of Ukraine justifies this. China is building coal burning power plants roughly equal to what the US has operating, but this is apparently to improve energy security and does not represent a shift in emissions policies. Do residents of California or Germany, where expensive electricity comes with high renewables penetration, grasp this? Should we believe it?

The White House has been frustrated that US E&P companies haven’t responded to higher prices by increasing drilling. Few are surprised given the hostile posture the Administration has towards the energy industry. It’s imperceptible on the chart but Drilled Uncompleted wells (“DUCs”) increased for the first time in over two years. The steady decline in DUCs has long frustrated Joe Biden, who has excoriated companies for not producing more oil in between promising no more fracking.

Meanwhile, natural gas production continues to move higher. The US Energy Information Administration noted that natural gas is providing 38% of US electricity, up from 37% last year. In recent months the power sector has taken record amounts, consuming about a third of total US output. The EIA projects a slight drop next year, although that was once their 2022 forecast as well. Along with renewables, growth is at the expense of coal.

The industrial sector and exports of Liquefied Natural Gas (LNG) have both been growing in recent years. There’s little doubt that LNG will continue to rise, providing energy security and a cleaner alternative to coal for its buyers. Crypto investors probably regard pipelines as boring, but tangible assets have their place too.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Author Lyn Alden does an outstanding job on the reasons why Bitcoin is useful, mostly in countries other than the US. In my view, you only see the replacement currency case of the fanatics. That is not the point; financial privacy and security is. In some contexts it is worth tolerating the volatility.