Falling Taxes and Valuations Boost Energy Infrastructure Outlook

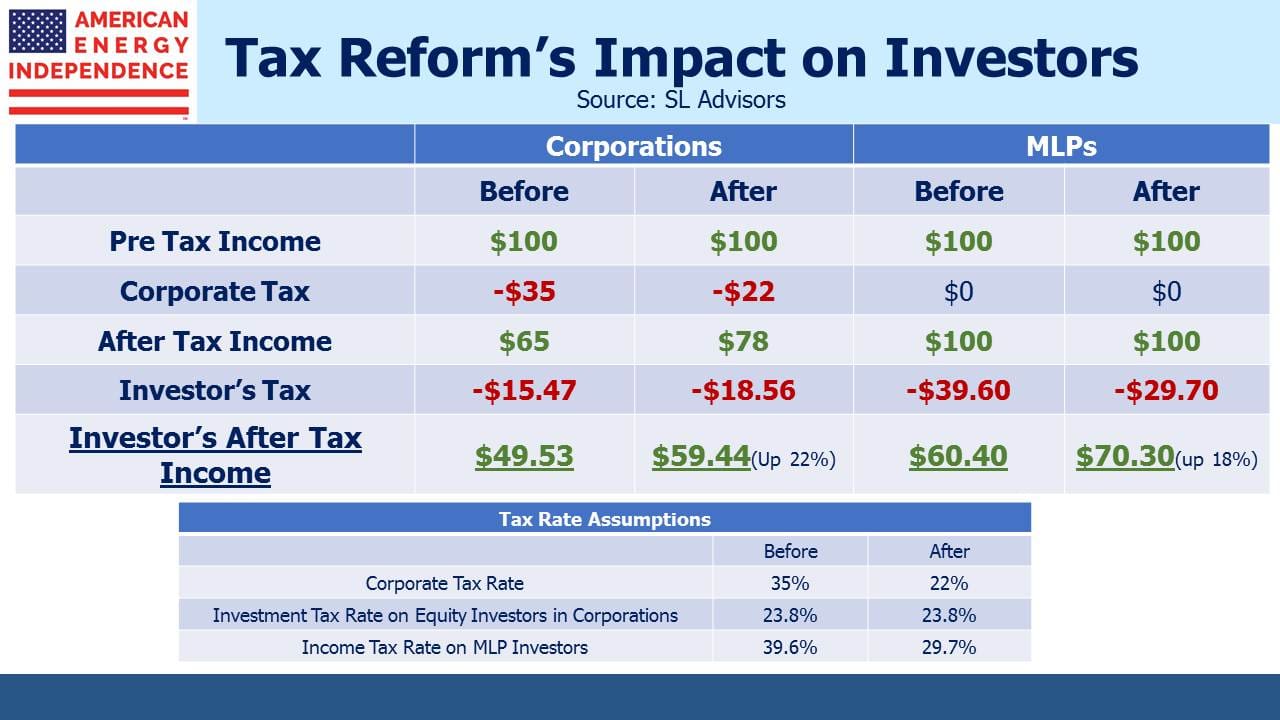

Tax reform removed the uncertainty surrounding treatment of MLPs, in that both House and Senate plans provide some additional benefit. Although the final bill will require negotiations to reconcile the different Senate and House versions, we’ve updated the table below to reflect a 22% corporate tax rate and the Senate treatment of pass-through income for MLP investors, which is less attractive than the House. Investors in both C-corps and MLPs will be better off, and if the House’s pass-through treatment prevails MLP investors will benefit further.

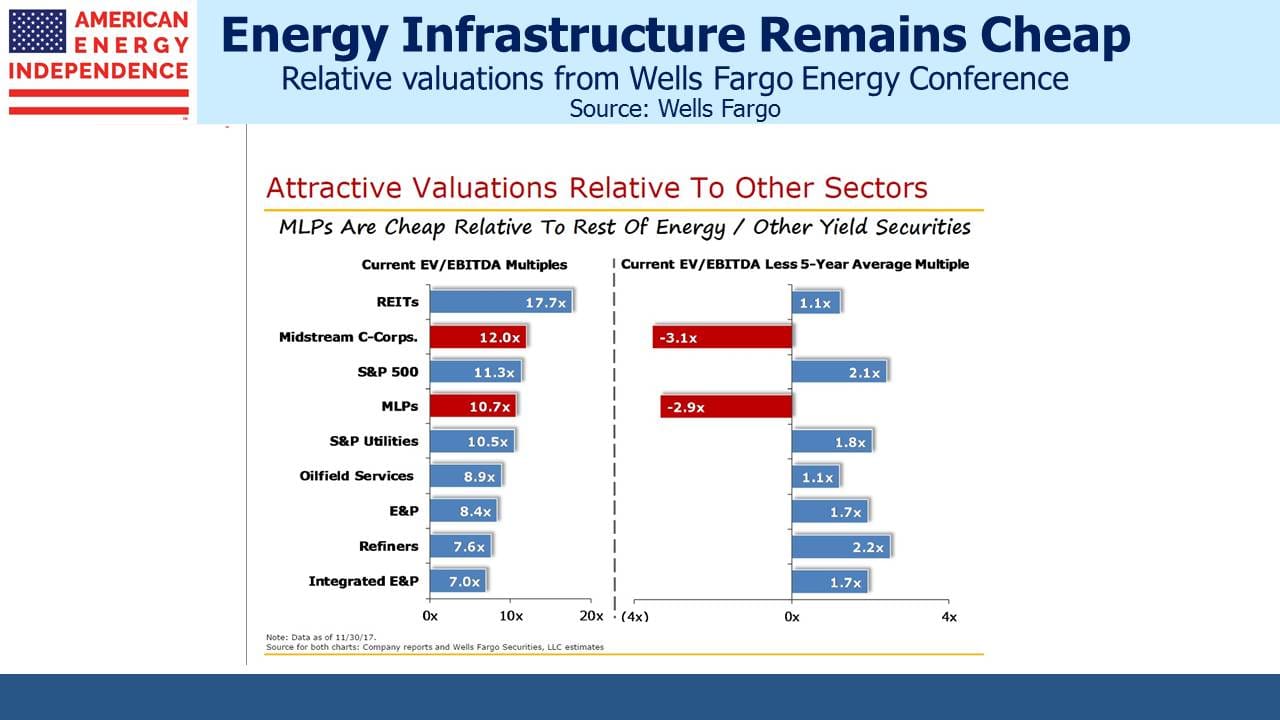

The 2017 Wells Fargo Pipeline and Utility Symposium held last week included the slide below. Energy infrastructure investors need little reminder – 2017 is turning out to be a forgettable year, which has reduced valuations to the levels shown in the chart. Tax loss selling continues, since most investors have substantial investment gains and unloading some energy losers mitigates the tax bill. There’s little other justification for such moves.

People often associate breakthroughs in energy research with electric vehicles (EVs) and use of renewables to provide power. But traditional energy businesses are also the subject of considerable research and development. NET Power, based in Houston, TX, has built a pilot power plant that uses natural gas but captures the resulting CO2. They claim to have built a zero-emission natural gas power plant. Investors have provided $150MM to develop the business. It’s obviously early, but if the technology turns out to be successful on a large scale, given the abundance of natural gas in the U.S., it could be a significant solution to fossil-fuel based carbon emissions. It could even provide a legitimate clean energy alternative to windmills and solar panels. It would represent yet another dimension to the benefits to America of the Shale Revolution. New technology is often exciting, and interesting energy research isn’t limited to wind and solar.

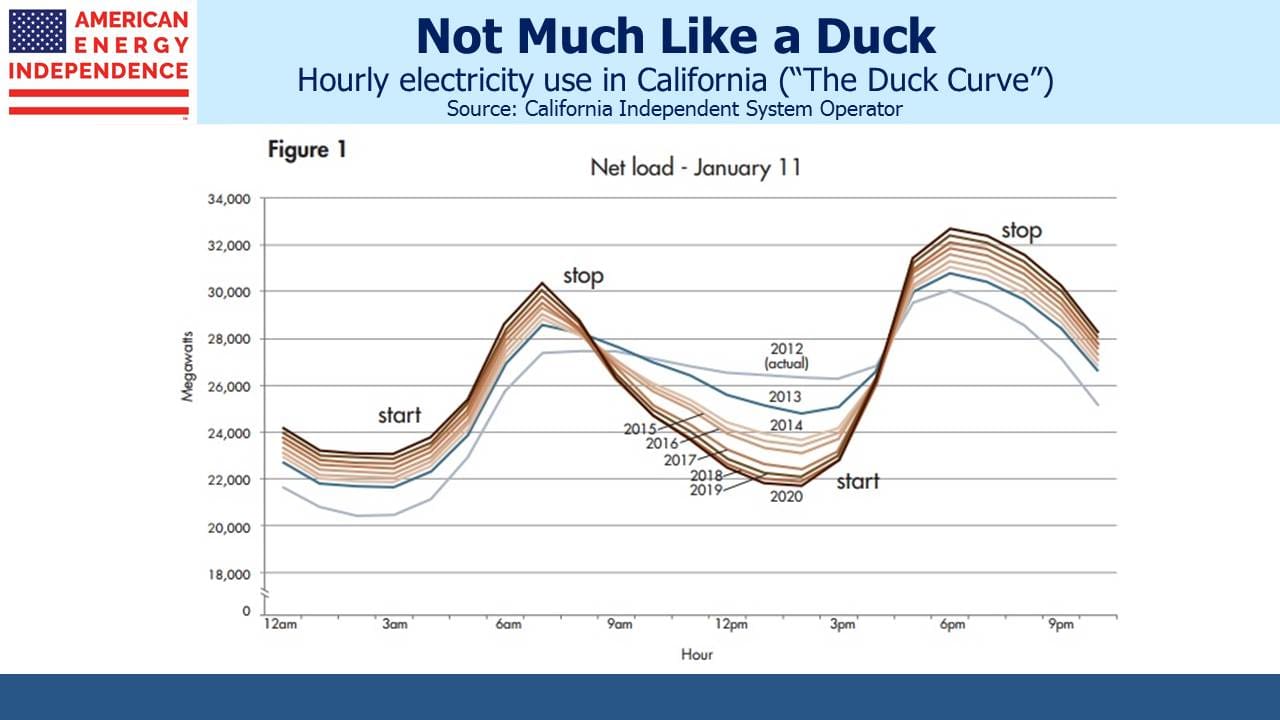

The “Duck Curve” represents the demand for electricity during a typical day. The version from California’s Independent System Operator (ISO) highlights that peak electricity demand occurs at breakfast time when people are getting ready for work or school, and at dinner time when they return home. Although solar-generated electricity is growing, it’s worth noting that demand is highest when the sun is low in the sky or it’s dark. Therefore, traditional power plants such as natural gas are critical to providing power when it’s most needed. A speaker at a recent conference organized by R.W. Baird noted the potential problem this presents for the green credentials of EV owners, in that the obvious time to charge them is in the evening when renewables are less likely to be the source of electricity.

Regular readers will not expect us to be bullish on Bitcoin. Its recent take-off has been spectacular to watch, rather like a rocket that will inevitably crash even while its ascent is riveting. We’re reaching the stage where comparative valuations are startling: on Wednesday aggregate crypto-currency valuation exceeded the market capitalization of JPMorgan for example. CEO Jamie Dimon has called Bitcoin a fraud. You could own all the bitcoins that exist, or approximately half the publicly held energy infrastructure in the U.S. The correct choice isn’t obvious to everyone. The CME and CBOE’s proposed Bitcoin futures contracts must be the strongest evidence yet that parts of the U.S. finance industry have completely lost the plot, oblivious to their ostensible role of helping savers fund retirement in favor of creating gambling products.

What receives less attention than Bitcoin’s price is the energy consumed to “mine” new units. The computing power required to solve the increasingly complex algorithms that allow cryptocurrency units to be manufactured now consumes 29 Terrawatt Hours of electricity annually. This is more than the consumption of 159 countries. One analyst estimates that this costs $1.5BN, based on using cheap electricity in places such as China. Using recent growth rates, by next Summer crypto-currency production will consume the equivalent of America’s electricity output, and by 2020 the entire world’s. Somewhere, something will give. We’ll be spectators.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!