Energy Is Wall Street’s Favorite Sector

/

The revenue and earnings outlook for the energy sector has deteriorated this year. Alone among the S&P 500’s eleven sectors, FactSet shows declining revenues of –9.6% when companies report for the second quarter based on bottom-up analyst forecasts.

2025 opened with high expectations following Trump’s election victory. And while the White House has followed through on pro-energy policies, these are generally targeted at boosting output, not profits.

Tariffs have also acted as a headwind to growth. The Economist recently published a podcast titled Teflon Don: can the economy withstand a Trump shock, which expressed surprise at the resilience of the global economy to the evolving regime of import taxes.

Nonetheless, crude oil is down over 10% this year. Bombing Iran did not lead to the feared yet unlikely blocking of the Strait of Hormuz. For energy investors, Trump’s second term has continued the pattern of his first one – his love for oil and gas doesn’t boost the industry’s profits.

Energy was notably weak on Monday. The only meaningful news was that S&P once again declined to add Cheniere to their flagship index when presented with the opportunity by Chevron’s acquisition of Hess.

Had they done so, energy would have become a slightly bigger component of the S&P500, potentially benefiting many more energy names not currently in the index. Betting on a corresponding lift to the energy sector was evidently a popular idea, because unwinding it caused some startling drops. Cheniere was –7.3%, reinforcing the old adage about the market being a voting machine in the short run and a weighing machine over the long run.

Cheniere’s business prospects didn’t change at all, just their stock price.

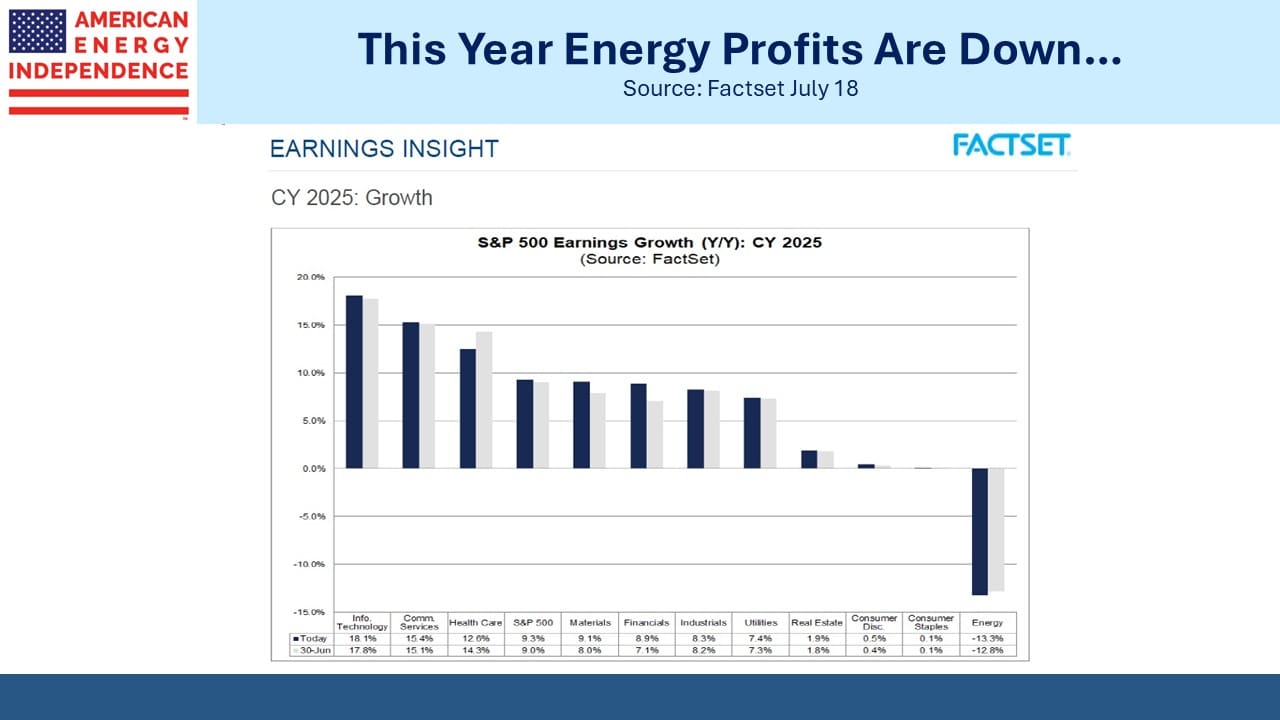

Factset expects 2025 energy profits to be down 13.3% this year, the worst of the eleven S&P500 sectors.

At the sub-sector level, four are projected to drop: Integrated Oil & Gas (-34%), Refining and Marketing (-33%), E&P (-20%) and Equipment and Services (-14%). By contrast, Oil and Gas Storage and Transportation, otherwise known as the midstream energy infrastructure sector so lovingly followed by this blog, is expected to report 2Q25 profits +14% compared with a year ago.

Next year energy sector profits are forecast to rebound, +20.5%. In spite of recent weakness, 74% of stocks carry a “Buy” rating from Wall Street analysts, the most of any sector.

Midstream businesses will perform with less drama, demonstrating the low correlation with commodity prices that is once again proving valuable to pipeline investors.

LNG exports continue to take an increasing share of total US gas production. RBN Energy reports that feedgas demand to lower 48 LNG export terminals is running at 15.6 Billion Cubic Feet per day (BCF/D), with Sempra’s Cameron LNG facility and consortium owned Freeport both back up after brief disruptions earlier in the month.

The Philippines saw its first decline in coal use for 17 years due to increased LNG imports.

Spain, which suffered a nationwide blackout three months ago because of its over-reliance on renewables, is now using more natural gas to stabilize its grid.

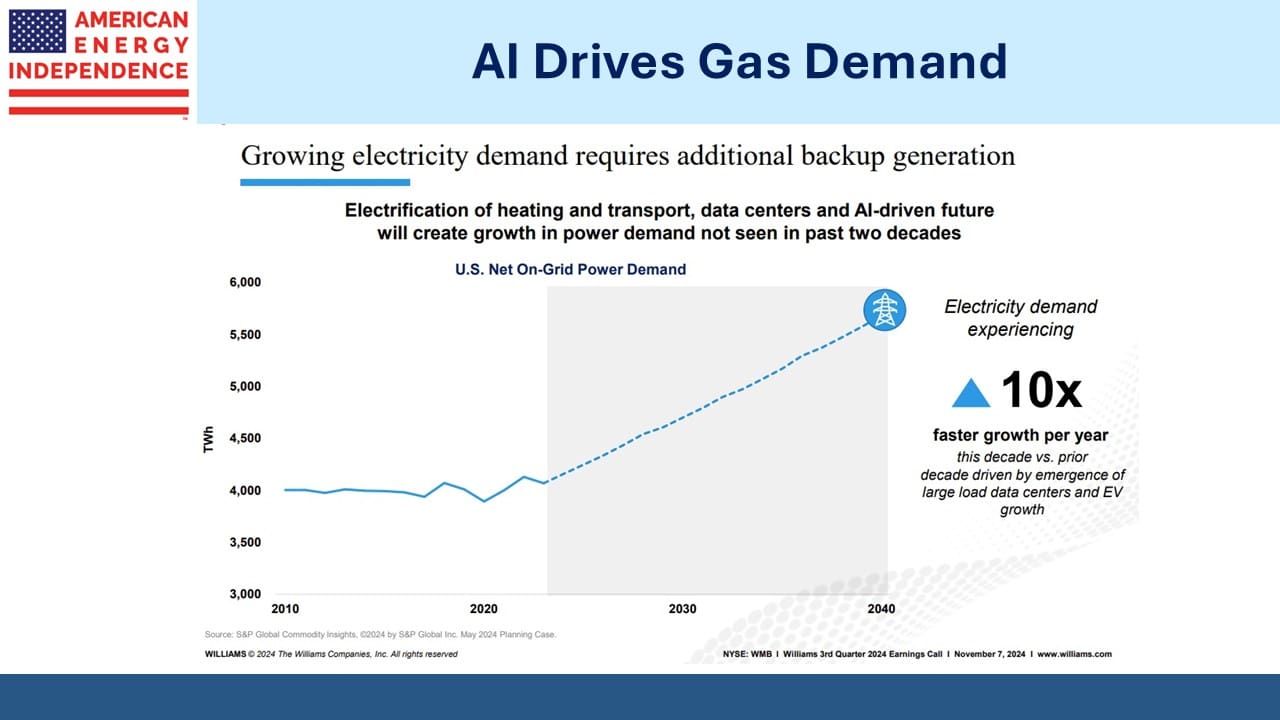

Later this week the White House is expected to release their AI Action Plan, which should support the rapid construction of data centers and their need for reliable power. As New Jersey residents have found, demand from data centers can drive up residential electricity prices.

The Garden State’s mandate that 100% of electricity be zero-carbon by 2035 hasn’t helped (watch Progressive Energy Policies Are Costing New Jersey). The independent watchdog for the region’s grid operator PJM says there’s no capacity available for any more data centers.

Some expect that the opening of public lands for more gas extraction will be part of the solution. Around 90% of oil and gas production takes place on private land, usually regulated by states. Trump is for energy dominance, but the Federal government doesn’t have many ways to influence output. Allowing more drilling on Federal land is one of the few.

Electrical grids are struggling to adapt to a surge in demand for electricity. Business models that spread the cost of new infrastructure across all customers are designed for annual growth of 0.1-0.3% or so. When demand grows 10X as much as in the past, spreading the costs of growth widely is more noticeable and unfair. Data centers create few jobs – indeed, some think AI may eliminate vast swathes of employment across the country.

Placing them in lightly populated regions with their own dedicated supply of energy (known as “Behind The Meter” or BTM) may be a necessary political expedient to avoid an upswell of popular opposition.

Natural gas demand will keep rising.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!